Click on “Download PDF” to read the full document

Summary

The programme of reforms and austerity measures has set Spain on a path of accelerating growth, but the legacy from the crisis is such that unemployment will remain very high for several years yet. The budget deficit is gradually coming down, though not public debt in GDP terms; exports continue to grow, but less so than in the last couple of years; the banking system is more solvent; foreign direct investment in Spain is rising; net migration is outward and not inward and the political map is changing.

Background to the crisis

Spain was hard hit by the bursting of its property bubble in 2008, whose creation was fuelled by very low interest rates and a staggering number of housing starts (762,214 in 2006 alone, reportedly more than Germany, France and Italy combined). The collapse of this sector, which forged a lopsided economy, followed the subprime mortgage crisis in the US and the downfall of Lehman Brothers, events that intensified the global credit squeeze and triggered the deepest downturn in the global economy since the Great Depression in the 1930s. Until its crash the Spanish economy had roared along at an annual average of 3.5% between 1995 and 2007, the highest and longest growth period since the 1970s. Between 2008 and 2013, the Spanish economy shrank by 6%.

When the bubble burst jobs, many of them temporary, were destroyed almost as quickly as they had been created and Spain was plunged into a five-year on-off recession. Between 2002 and 2007 the total number of jobholders rose by 4.1 million, a much steeper increase than in any other EU country and more than three times higher than the number created in the preceding 16 years. Since 2008, more than 3 million jobs have been lost, over half of them in the construction and related sectors, and the ranks of the unemployed have also been swelled by those coming onto the labour market and actively looking for work. The total number of unemployed, as measured by the latest quarterly labour force survey, stands at 5.6 million (a jobless rate of 25.9%).

The current account deficit ballooned to 10% of GDP in 2007, underscoring the extent to which the economy had become overheated and uncompetitive and the degree to which Spaniards, in general, and some companies, in particular, were living way beyond their means and on borrowed money.

Banks, particularly the 47 cajas de ahorro (regionally-based savings banks), were massively over exposed to the property sector and some of them had to be bailed out by the EU, most notably Bankia, Spain’s fourth-largest bank, which was nationalised in 2012. The depth of the banking crisis was such that Miguel Ángel Fernández Ordóñez, the former Governor of the Bank of Spain, feared that it could force Spain out of the euro zone.

The rapid deterioration of the budget deficit (it reached 9.1% of GDP in 2011 as a result of plummeting tax revenues and rising spending) and the perception of the dangers inherent in a growing feedback loop between sovereign risk and banking risk pushed up Spain’s sovereign debt yields to 7.5% on the 10-year bond at the end of July 2012. This was the level in Greece, Portugal and Ireland that triggered their sovereign bailouts by the EU. The risk premium on government bonds –the difference between Spain’s 10-year bond yields and those of low-risk Germany– rose briefly to more than 650 basis points, from an average of 8 basis points in 2007. Public debt soared from 36% of GDP in 2007 to 70% to 94% in 2013 and continues to rise. The net international investment position reached almost 100% of GDP in 2013, one of the most negative in the euro zone.

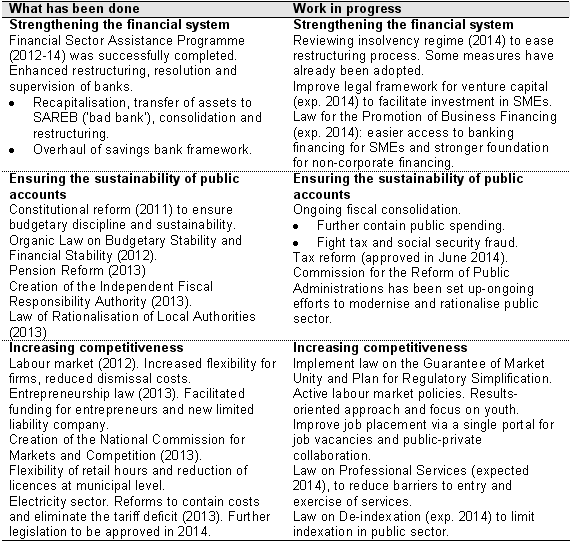

The Popular Party swept the board in the November 2011 election, ejecting the Socialists from their eight years in office, and began a major programme of reforms and austerity measures that are beginning to bear fruit (see Figure 1).

Figure 1. A summary of Spain’s structural reforms

Source: IMF Spain country report No. 14/192, July 2014.

The export-led economy began to grow again in the second half of 2013. The recovery is accelerating; growth this year is forecast at close to 1.5% and up to 2% in 2015. The better macroeconomic picture includes:

- The current account was in surplus last year (1% of GDP, a remarkable improvement since 2007) for the first time since 1986.

- Domestic demand is finally starting to rebound, as shown by the spurt in imports this year and a loss of steam in exports.

- Direct inward foreign investment has risen, and Spanish companies are investing abroad again.

- Sovereign yields are at pre-crisis lows. The interest rate on the 10-year bond fell below 2.5% in July for the first time ever.

- The government exited the bailout programme for banks in January.

- The budget deficit is coming down, albeit more slowly than desired.

- Modest net job creation is underway.

The legacy from the crisis, however, persists and will be with Spain for a long time.

William Chislett

Associate Analyst at the Elcano Royal Institute, author of ‘Spain: What Everyone Needs to Know’, published by Oxford University Press (2013). wwww.williamchislett.com.