Abstract

How can internationalisation help Spain overcome its recession? This paper first looks at the benefits of internationalisation from a theoretical standpoint. It then reviews the Spanish economy’s internationalisation process, pointing out its strengths and weaknesses. Finally, it presents lessons and recommendations on the basis of both international and Spanish evidence.

Introduction

There are different growth models in the global economy. Some countries, like the US, the UK and Spain, tend to grow on the basis of strong domestic demand backed by economic policies that encourage lending, investment and consumption. Other models, such as those of Japan, China and Germany, rely more heavily on the foreign sector, thus recording significant current-account surpluses, which means that they are financing other countries with their savings.

However, no one model is inherently better than another as there are different ways of making an economy successful. It is precisely the diversity of voters’ preferences that leads to some models moving in a particular direction and not in another.

Nevertheless, at times of economic crisis and low growth, such as at present in Spain and in most of the advanced economies, it is evident that countries with a dynamic foreign sector and with competitive, international companies as well as foreign surpluses have a clear advantage as there is no ongoing need for external financing at times of credit shortage. This is because the global economy continues to have significant poles of growth (particularly in the emerging economies), so foreign demand appears to be the key to generating growth and employment in a context where domestic demand has collapsed owing to high debt levels, bottlenecks in the financial sector and the procyclical cuts that many countries are forced to implement in exchange for external financial support.

Above and beyond the advantages of more export-oriented countries to overcome their difficulties, it is also true that even the countries that rely more on domestic demand have a great deal to gain if they manage to go global with their companies. While it is true that not all countries can become net exporters (for this to occur the world would have to trade, and have a surplus, with other planets), there is significant room for manoeuvre for countries to improve their exports. In fact, when a country internationalises its economy, it tends to increase both its imports and exports, while simultaneously increasing its foreign investments and productive capital inflows. And this dynamic, which is a win-win situation, stimulates the growth of all countries involved in the process, not just those that export more and invest more abroad.

That is why, beyond the fact that in Spain’s current recession exports seems the best recipe for growth in the short term, it is also advisable to make the most of this necessity and to use the crisis to transform part of Spain’s manufacturing structure so that, in the future, it can have a sounder, more stable growth model. And for that to come about, it is necessary to significantly enhance the foreign sector and the internationalisation of Spanish companies.

As shown in the pages that follow, Spanish companies are well equipped to compete in the international markets. Spain has first-class multinational companies in many sectors, Spanish exports have recorded the highest growth in the euro area since the start of the crisis and the market share of Spanish companies in world markets has remained stable when those of the most advanced countries have dropped owing to increased competition from emerging countries. However, only a few Spanish companies export, both because their average size is too small to allow them to conquer foreign markets and because they are so used to strong domestic demand that there has not been any need for them to go global. Therefore, the challenge is to make more companies export.

Spain also faces challenges in the field of international investment. The most important is to remain an attractive destination for foreign companies in a context of increased competition and a weak domestic market in which transnational value chains are increasingly important and determine, in turn, the role of each country in world trade flows. So Spain has to offer more than just low wages, political stability and legal certainty (its ways of attracting capital in the 80s and 90s). It has to change its model of international integration.

These are the issues addressed by this paper. First, it analyses from a theoretical and general point of view the benefits of the internationalisation of the economy. Then it analyses the profile of Spain’s internationalisation, with a special emphasis on the weaknesses of the international integration model in recent decades. Finally, it presents lessons and recommendations on the basis of both international and Spanish empirical evidence.

The advantages of internationalisation

At a macroeconomic level, there is no conclusive empirical evidence to show that more open economies attain higher levels of income and welfare. This is because the determinants of economic growth are basically all internal factors (good institutions, accumulation of physical and human capital, macroeconomic stability, etc).[2] However, it has been proved that in the long term a gradual and orderly opening-up of trade, combined with other factors, favours development. Furthermore, direct investments accelerate growth when they transfer technology to the host country, pay taxes and create jobs, that is, when there are no enclaves isolated from the rest of the domestic economy –which tends to occur in primary sectors and in countries with weak governance–. Beyond these ambiguous, macroeconomic results, recent studies of businesses clearly confirm the advantages for a country of having highly internationalised companies. Additionally, it is clear that the high level of current economic interdependence offers many more opportunities or niches for growth for outward-oriented companies than those that existed in the pre-globalisation 50s and 60s of the 20th century. And, as mentioned above, these opportunities are particularly interesting for countries like Spain, where domestic demand has collapsed.

What does internationalisation add?

In recent years, academic research in international economics has begun to look at how the heterogeneity of companies within a country explains their different behaviour.[3] The conclusions of these studies clearly show that most international companies have important advantages over non-international companies and that there are benefits for shareholders, employees and the countries where they are located (whether the country of origin or of a subsidiary).

First, international companies are larger and produce more goods and services than those operating exclusively in the domestic market. Being bigger they can make better use of economies of scale and they have greater financial capacity, which in turn allows them to invest more. They devote more resources to R&D, they are more innovative and are more used to operating in highly competitive markets, making them more efficient and leading them to achieve productivity levels that are significantly higher than those of non-international companies. Likewise, these companies also tend to create more jobs, attract more skilled workers by paying higher wages, have more and better training programmes for their employees, recycle their employees more effectively and have a global mindset for easy adaptation to new environments. They empower creativity and the development of their employees’ skills, making them more competitive in their domestic markets.

Therefore, exporting and international companies better resist economic downturns, both in terms of production and employment. Having higher levels of productivity and the ability to diversify their risks, offsetting falling sales in one market with higher sales in others, they have a much lower ‘mortality rate’ than companies that only operate in the domestic market (as in the case of Spanish companies in the current macroeconomic situation: the more international companies have survived thanks to exports).

Finally, international activity generates a large number of positive externalities both for the companies and the country as a whole (what is known in economics as a spillover). Thus, the technological innovations that these companies produce tend to infiltrate (sometimes slowly due to the protection afforded by patents) into other sectors, fuelling demand for other companies to which they outsource intermediate inputs and, in general, paying more taxes than smaller and less outward-oriented companies.

Although in terms of commercial internationalisation (exports) there are virtually no drawbacks, assessing openness to international investment flows is a bit more controversial, however. When considering the impact of international capital flows, economists use a medical analogy and speak of good cholesterol (FDI) versus bad cholesterol (portfolio investment, sometimes called ‘hot money’). In principle, there is consensus that FDI inflows are essentially good for the growth of the receiving country, while the inflow of portfolio investment can be risky because hot money is liable to panic and to being suddenly pulled out from a country owing to destabilising events, which can lead to financial crises. Still, as the phenomenon of FDI is closely linked to industrial relocation and the outsourcing of services, its advantages are sometimes open to debate.

In any case, as regards the inflow of FDI in developed countries with solid institutions, such as Spain –where abuse by foreign companies is uncommon–, there is consensus on its benefits for the economy. FDI transfers technology and know-how, creates jobs, attracts talent and physically contributes to sustainable public accounts. In the case of a country’s FDI abroad, although relocation causes the loss of domestic jobs, many of them can be offset by new (but different) jobs that are created domestically as a result of the company’s expanding sales upon extending its field of activity to new international markets. In fact, both theoretical models and empirical evidence show that the internationalisation of developed economies is associated in the long term with creating highly-skilled jobs and high productivity, which more than offsets the job losses that result from the phenomena of relocation and outsourcing (AFI, 2010; Kohler & Wrona, 2010). Furthermore, as illustrated by AFI (2010, p. 18), companies follow a more multi-location model than a relocation model, allowing them to create more jobs in most cases. Still, it should be noted that some relocations are net job destroyers, although it should also be highlighted that these jobs may not be sustainable in the long term in the local market once the countries have opened up to international trade. Thus, sometimes the relocation of a part of production is the only option so that a company does not disappear.

A look at the Spanish economy’s commercial and financial internationalisation

Over the past decade, the Spanish economy’s degree of internationalisation has greatly improved. The trade openness rate (exports plus imports over GDP), which at the beginning of the 2000s stood at around 40%, exceeded 60% in 2012. While still below the levels attained by Italy (72%), France and the UK (75%), it exceeds those of the US (30%) and Japan (40%). The growing internationalisation of current transactions has been accompanied by the full freedom of capital movement, meaning that the Spanish economy’s internationalisation has also intensified in the area of investments.

Thus, in late 2011 Spain had a larger stock of direct investment abroad than FDI at home. The stock of Spanish portfolio investments accounted for just over 25% of foreign portfolio investment in Spain and the stock of other Spanish investment abroad was 50% of that accumulated for other foreign investments in Spain. The Spanish economy has been at the forefront of an intense integration process in the global economy mainly owing to its inclusion in the euro zone. However, the dynamics of its growth model have, unfortunately, led to an unbalanced external integration. The new funding opportunities opened up by the creation of the euro intensified capital inflows, generating growth in non-tradable sectors (especially real estate) which, ultimately, proved to be counterproductive.

As a result, financial integration has encouraged significant changes in the competitive conditions of companies, causing an intense and ongoing imbalance in the current account. The current financial crisis has highlighted the urgent need for a change in the form of international integration. It is necessary to promote exports of both goods and services and to attract new foreign direct investment to increase the participation of Spanish activities in global value chains.

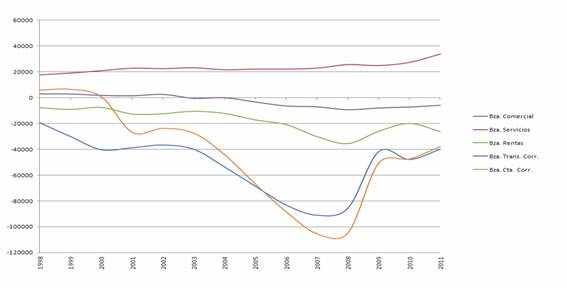

To date, the external imbalance (reflected in the current account deficit) is mainly attributable to oil imports, which still accounted for 86% of the trade deficit in 2011 (Bonet, 2012). And it is also owing to the deficit in the balance of payments and current transfers (see Graph 2). Only the service trade balance, with a high prevalence of tourism, helps to reduce the current account deficit, but its insufficient diversification to other services, including knowledge-intensive services, does not offset the balance of goods deficit.

Graph 1. Spain: evolution of the current account balance and its sub-balances, 1998-2011 (€ million)

Source: compiled from Bank of Spain data.

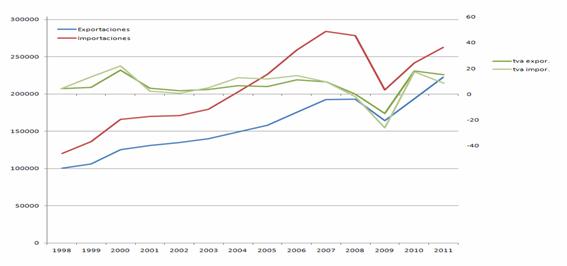

Nevertheless, exports of goods performed well since joining the euro until the crisis in 2008 and, after a sharp drop in 2009, they have exceeded the pre-crisis level in both 2010 and 2011 with an outstanding cumulative growth rate of 30% (see Graph 2). However, it is still surprising that exports of Spanish goods and services have retained their relative importance in world trade over the last decade and their share has remained at around 1.6% and 3.3% respectively up until 2010 (see Table 1). This indicates that Spanish exported products do not necessarily compete on price, but on quality, making them more resistant to competition from low-wage emerging countries.

Table 1. Main exporters and importers in the world trade of goods and services, 2010 (%)

| Goods | Services | ||||||||||

| Rank | Exporters | Share | Rank | Importers | Share | Rank | Exporters | Share | Rank | Importers | Share |

| 1 | China | 10.4 | 1 | US | 12.8 | 1 | US | 14.1 | 1 | US | 10.2 |

| 2 | US | 8.4 | 2 | China | 9.1 | 2 | Germany | 6.3 | 2 | Germany | 7.3 |

| 3 | Germany | 8.3 | 3 | Germany | 6.9 | 3 | UK | 6.2 | 3 | China | 5.5 |

| 4 | Japan | 5.1 | 4 | Japan | 4.5 | 4 | China | 4.6 | 4 | UK | 4.5 |

| 5 | Netherlands | 3.8 | 5 | France | 3.9 | 5 | France | 3.8 | 5 | Japan | 4.4 |

| 6 | France | 3.4 | 6 | UK | 3.6 | 6 | Japan | 3.8 | 6 | France | 3.6 |

| 7 | South Korea | 3.1 | 7 | Netherlands | 3.4 | 7 | Spain | 3.3 | 7 | India | 3.3 |

| 8 | Italy | 2.9 | 8 | Italy | 3.1 | 8 | Singapore | 3.0 | 8 | Netherlands | 3.1 |

| 9 | Belgium | 2.7 | 9 | Hong Kong | 2.9 | 9 | Netherlands | 3.0 | 9 | Italy | 3.1 |

| 10 | UK | 2.7 | 10 | South Korea | 2.8 | 10 | India | 3.0 | 10 | Ireland | 3.0 |

| 11 | Hong Kong | 2.6 | 11 | Canada | 2.6 | 11 | Hong Kong | 2.9 | 11 | Singapore | 2.7 |

| 12 | Russia | 2.6 | 12 | Belgium | 2.5 | 12 | Italy | 2.6 | 12 | South Korea | 2.7 |

| 13 | Canada | 2.5 | 13 | India | 2.1 | 13 | Ireland | 2.6 | 13 | Canada | 2.6 |

| 14 | Singapore | 2.3 | 14 | Spain | 2.0 | 14 | South Korea | 2.2 | 14 | Spain | 2.4 |

| 15 | Mexico | 2.0 | 15 | Singapore | 2.0 | 15 | Belgium | 2.2 | 15 | Belgium | 2.2 |

| 16 | Taiwan | 1.8 | 16 | Mexico | 2.0 | 16 | Switzerland | 2.1 | 16 | Russia | 2.0 |

| 17 | Saudi Arabia | 1.7 | 17 | Taiwan | 1.6 | 17 | Luxembourg | 1.9 | 17 | Brazil | 1.7 |

| 18 | Spain | 1.6 | 18 | Russia | 1.6 | 18 | Canada | 1.8 | 18 | Hong Kong | 1.5 |

| 19 | UAE | 1.5 | 19 | Australia | 1.3 | 19 | Sweden | 1.7 | 19 | Australia | 1.4 |

| 20 | India | 1.4 | 20 | Brazil | 1.2 | 20 | Denmark | 1.6 | 20 | Saudi Arabia | 1.4 |

| Subtotal | 70.8 | Subtotal | 71.9 | Subtotal | 72.7 | Subtotal | 68.6 | ||||

| World | 100.0 | World | 100.0 | World | 100.0 | World | 100.0 |

Source: WTO.

The increase in exports was driven by the increase in foreign sales of exporters (intensive margin) and the growth in the number of companies that were launched for export to traditional markets and new destinations (extensive margin). The main export markets for goods are traditionally the EU (66%), countries in Asia-Pacific (7.8%), the rest of Europe (7.5%), Latin America (5.5%), Africa (5.4%) and the US and Canada (4%). The growth of exports to OECD countries is explained by an increase in the intensive margin, while in emerging countries such as China, India, Russia, Morocco and Algeria this is explained by an increase in the extensive margin. An increase in exports from the combined perspective of markets and sectors is evident, with around 95% of exports being classed as ‘old products to old destinations’ and only the remaining 5% being ‘new products to old destinations’ (Bonet, 2012).

Graph 2. Spain: exports and imports, 1998-2011 (flows in € million and VAT in %)

Source: compiled from Bank of Spain data.

In 2009, when there was a sharp contraction of international trade as a result of the effect of the Lehman Brothers bankruptcy in 2008, Spanish companies recorded a small drop in the markets where they were installed, which was a key factor for the strong recovery of exports in 2010 and 2011 (see Chart 2). Moreover, the exporting companies that best adapted to the new external context were those with lower levels of debt (Gonzalez et al., 2012).

Who were the agents of the export process? In 2000 there were 66,278 companies in Spain; in 2007 the number had grown to 98,513 and in 2009 to 108,303. Some 39,214 (Subdirectorate General of Analysis, Strategy and Evaluation, 2009) were considered regular companies (ie, that had exported continuously for the previous four years) and in 2009 this fell to 39,079 (AFI Report, 2010), only 135 less than in 2007 despite the sharp contraction in global exports in 2009.

Although the number of exporting firms might seem large in comparison with other European countries, exports are highly concentrated. A group of around 475 large companies, which exported more than €50 million and accounted for 0.5% of total export companies, were responsible for –up to 2009– 56% of the total volume of exports. This would seem to imply that in Spain few companies still export, so the unfinished business of the Spanish economy is to increase the number of international companies. This requires increasing the size of the average Spanish company, which is significantly smaller than that of other countries where a larger number of companies export, such as Germany.

From the perspective of a strategy for strengthening export capacity and increasing the participation in global production chains, it should be pointed out that ‘around 40% of total Spanish foreign sales are made by foreign companies established in Spain’ (AFI Report, 2010, p. 79). Furthermore, the presence of foreign capital in the Spanish production framework has a greater shareholding in the capital of companies that export regularly and very much less in inward-oriented companies (AFI Report, 2010, p. 79).

Financial integration of the Spanish economy

In the 1990s there came a growing financial integration that significantly intensified in the 2000s. The traditional importance of inflows of foreign direct investment was accompanied by a remarkable outflow of foreign direct investment from Spanish companies. In 1997 the Spanish economy became a net direct investor as, in most years, outflows exceeded inflows. In 2011 the Spanish FDI stock abroad accounted for 47% of GDP and the FDI stock in Spain stood at 43%, reflecting the significant progress along the path of international investment led by Spanish companies in the previous 15 years. The following section pinpoints the main features of this important process.

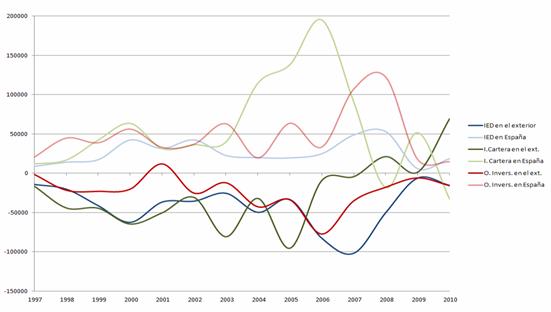

The increasing financial integration also highlights the intensity of portfolio investments and other investments made and received especially in the 2000s and until the beginning of the financial crisis in the summer of 2007 (see Chart 3). Since then there has been a sharp reduction in portfolio investments and in both foreign investment in Spain and Spanish investment abroad.

Graph 3. Spain: evolution of the financial balance components, 1997-2010 (€ million)

Source: compiled from IMF Balance of Payments Statistics data.

In particular, as Merler & Pisani-Ferry (2012) explained, since the European interbank market began to fragment and risk premiums in Spain and Italy began to rise (in late July and August 2011, in December of the same year and at various times in 2012), the Spanish economy has experienced a sudden-stop process.[4] Private flows that have traditionally financed the current account balance have been withdrawn by the contagion of the Greek crisis and the risk of redenomination that would result from the break-up of the euro, being replaced by public funding from the Eurosystem. This buffer, which has provided the necessary resources to offset the lack of liquidity in the interbank market in the euro area, has meant that Spain accumulates liabilities vis-à-vis the Eurosystem, which are recorded in the Target2 system. However, it would be desirable to standardise financial flows and for private capital to flow back to the south. However this requires changes in the governance of the euro and ECB action to end rumours of a possible break-up of the single currency.

FDI of Spanish companies abroad

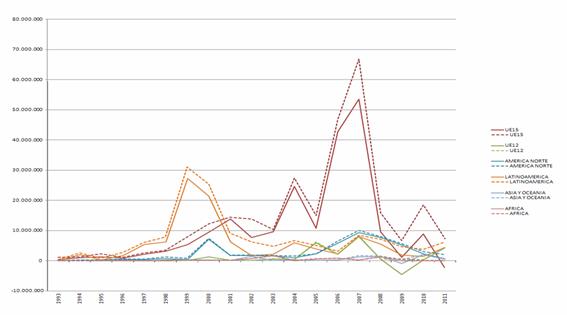

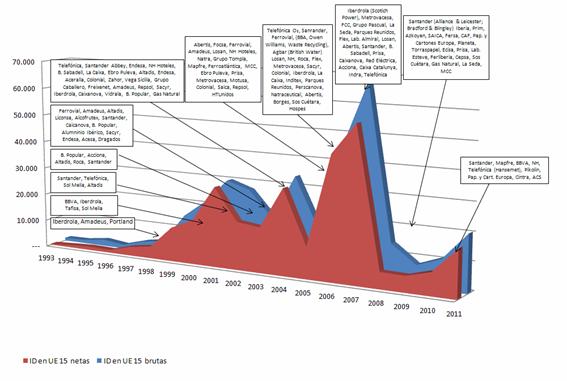

Spanish companies began a process of rapid expansion abroad in 1990, directing nearly 65% of investment flows to Latin American countries. This internationalisation process continued in the 2000s, the decade in which Spanish companies ventured beyond Latin America, in particular towards the EU (see Chart 4).

Graph 4. Gross and net FDI flows from Spain to its main target areas, 1993-2011 (€ thousand)

Source: compiled from data from the Foreign Investment Registry, General Directorate for Trade and Investment.

In the EU-15, Spanish FDI went to two groups of countries: (a) the first, which absorbed 92% of flows consisted of the UK (46%), the Netherlands (21%), France (10%), Italy (6%), Portugal (5%) and Germany (4%); and (b) the second, which attracted 8%, and consisted of Belgium (2%), Luxembourg (1.5%), Austria (1.5%), Greece (1%), Ireland (1%), Sweden, Denmark and Finland. The new trend towards EU-15 countries was the result of investments in large companies (see Chart 5) that carried out outstanding acquisition operations, especially in the first group of countries in the area.

Graph 5. Gross and net FDI flows and Spanish companies investing in the EU-15, 1993-2011 (€ million)

Source: compiled from data from the Investment Registry, Ministry of Industry, Energy and Tourism.

In the decade of the 2000s, the number of companies with investments abroad increased, so that by the end of 2008 there were already 2000 (OEME, 2010, p. 91), representing 2.4% of the total MNCs and positioning the Spanish economy in the 12th spot worldwide in terms of the number of international companies. As occurred with exports of goods and services, Spanish FDI abroad had been achieved by only a handful of companies. The largest presence abroad is held by 24 business groups that have a presence in over 30 countries (OEME, 2010, p. 106-107). They are followed by 62 companies with a presence in between 10 and 19 countries, then 174 business groups with operations in between five and nine countries, and finally, a large group of 1,192 companies with presence in between one and four countries (Arahuetes, 2011).

The 2,000 companies with international investments had 5,349 companies abroad, in the categories of subsidiaries and/or affiliated companies located in 128 countries. Around 41.4% of these companies were in the EU-15 (OEME, 2010, p.107), which ranks the area as a prime Spanish investment destination in terms of flows, stock and number of portfolio companies. Countries in the EU-12 were the fourth-largest recipients of Spanish investments, including Hungary, the Czech Republic, Poland and Romania (OEME, 2010).

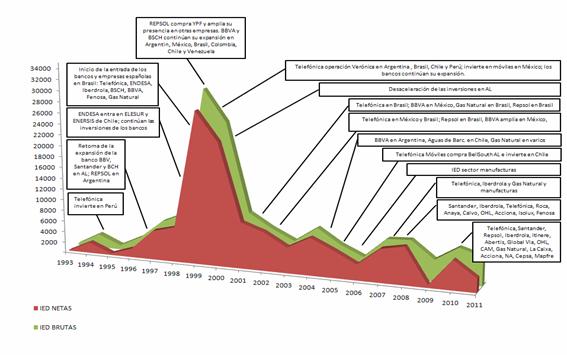

The second-largest investment destination of Spanish companies was Latin America, focused on three groups of countries: (1) the first, which absorbed 88% of the flows, was formed by Mexico (35%), Brazil (33%), Chile (11%) and Argentina (8%); (2) the second, which attracted 10.5% of flows, consisted of Uruguay, Peru, Colombia, Venezuela, Ecuador and the Dominican Republic; and (3), the third, which took up 1.5% of the remaining flows, was composed of Panama, Costa Rica, Guatemala and El Salvador, and, to a lesser extent Cuba, Bolivia, Honduras and Paraguay (see Chart 6).

Graph 6. Gross and net FDI flows and Spanish companies investing in Latin America, 1993-2011 (€ million)

Source: compiled from data from the Investment Registry, Ministry of Industry, Energy and Tourism.

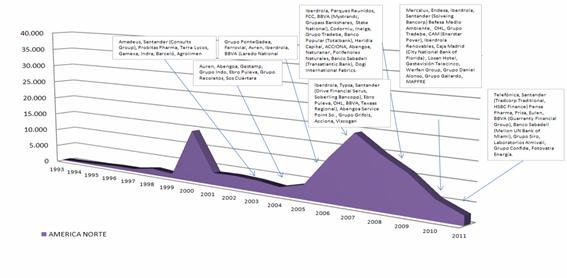

In the 2000s, the US has become a market with an increased capacity to attract Spanish investment. It accounted for 6.9% of the 5,349 Spanish companies abroad –subsidiaries and/or affiliated companies–, up to 2008 (OEME, 2010, p.107) and was ranked as the third most important investment destination for Spanish companies in terms of flows, stock and number of affiliated companies (see Chart 7).

Graph 7. FDI flows and Spanish companies investing in the US, 1993-2011 (€ million)

Source: compiled from data from the Investment Registry, Ministry of Industry, Trade and Tourism.

Direct investment by foreign companies in Spain

Another important dimension of an economy’s internationalisation that plays a crucial role in the shaping and transformation of its productive structure, job creation and the performance of the external sector consists of direct investments from foreign companies. FDI in Spain is key in the strategy to overcome the crisis with productive, technological and competitive strength.

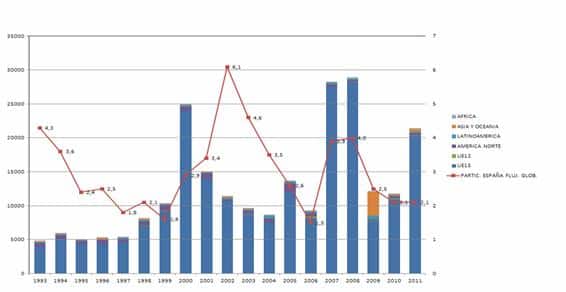

Graph 8. Annual flows of foreign direct investment in Spain and participation in global flows, 1993-2011 (€ thousand and %)

Source: compiled from data from the Investment Registry and UNCTAD.

The Spanish economy has a deep-rooted tradition in its ability to attract foreign direct investment since the onset of modernisation in the 1960s. This ability was retained even in the early 2000s, despite the attractiveness of the economies of the Central and Eastern European countries that were incorporated into the EU. In this respect, the annual flows received grew from 2.9% of global FDI flows in 2000 to 3.9% in 2004. In the following years, the flows recovered in absolute terms while their share in the global volume in 2007 and 2008 increased (see Chart 8). Even in the worst years following the 2008 crisis, the Spanish economy reduced (but did not lose) its appeal as an investment destination, receiving 2.5%, 2.1% and 2.1% of global investment in 2009, 2010 and 2011 respectively (see Chart 8).

Nevertheless, more FDI must be attracted to continue the modernisation of the economy’s productive structure and for the necessary growth of exports and for job creation. To this end, the attraction of new FDI projects requires the adaptation of the comparative advantages of the Spanish economy to the new productivity requirements of the highly competitive environment that globalisation demands at times such as these. The countries that maintain their ability to attract direct investments are experiencing the highest growth rates (Delgado, Ketels, Porter & Stern, 2012). In this respect, policies must be adopted to enable Spain to regain the level of appeal it had in earlier times for FDI and that it maintained until 2003.

Lessons for the future

The European monetary union was built on the idea that, with the disappearance of exchange rate risk, external imbalances between member countries could be financed in the international financial markets by limiting the risk arising from the economic players in each country. Financial transactions between the countries in a monetary union do not have any special characteristic differentiating them from transactions between regions within the same country. This vision was the most widespread and well accepted and was thus detailed by the European Commission in its report One Market, One Money (1990) when it noted that upon the disappearance of a restriction of balance of payments in a EMU, ‘private markets will finance all creditworthy borrowers, and the balance between savings and investment would no longer involve a restriction on a national level’ (Merler & Pisani-Ferry, 2012, p. 2).

According to this view, it was unthinkable that countries could suffer financial crises resulting from the excessive external indebtedness of their private economic agents. It was even more unthinkable that a country would be able to register a sharp deterioration in its financial system which would require special assistance programmes and strong support from the states. And even further, if such a thing were possible, it was inconceivable that the financial situation of companies and households, along with a prolonged economic stagnation, could finally unleash a contagion effect and compromise the sustainability of public debt.

It is true that the sovereign debt crisis in the euro zone was triggered by errors in the governance of the euro rather than by specific errors of Spanish economic policy, which in 2007 had a public surplus and a ratio of public debt to GDP of below 35%. However, the crisis has shown that the Spanish economy has a huge external vulnerability due to its weak external sector and chronic imbalances in the balance of payments, which require ongoing external funding, and which in turn gives rise to unsustainable private debt levels.

In this respect, perhaps the main lesson to be learnt from the crisis is that countries, even within a monetary union, should not neglect the supervision of the high domestic credit growth fostered by easy access to international finance, mainly from Union members, and the borrowing capacity of private agents. Due attention should be paid to the intense and prolonged expansion of imports (of consumer goods) and real estate booms when they coincide with large deficits in current account balances because these are unmistakable signs that countries are edging towards serious financial crises.

Several authors (Blanchard, 2007; Jaumotte & Sodsriwiboon, 2010; Giavazzi & Spaventa, 2010) have already noted that the ongoing negative balances in the current account were a reflection of low levels of savings relative to investment volume, of the credit booms generated by easy access to the international financial markets (which fed the bubbles) and of the sharp deterioration in competitiveness due to the appreciation of real exchange rates. They also stressed that these processes could trigger abrupt adjustments that would lead to very long recessions owing to the inability to devalue the currency.

Because, unfortunately, Spain is in recession, it is important to inform public opinion of the urgent need for reforms to accelerate the deleveraging process and restore growth. This is important to guarantee the sustainability of public finances in the long term, to solve the problems of the financial system so that credit can flow again and to move ahead with structural reforms to diversify, strengthen and add value to the productive framework.

As in previous crises, exports and capital inflows in the form of foreign direct investment are essential. The former because they represent an indispensable addition for weak domestic demand and the latter because they allow the density of the productive framework to be increased and to position Spain in global production chains, which will play an increasingly more important role. That is why the foreign sector is one of the keys to overcoming the crisis. Not surprisingly, in Spain this sector is responsible for 6.5 million direct and indirect jobs, it has managed to increase per capita income by US$1,275 for each additional 10 percentage points in the rate of opening up and has the potential to create 25 jobs for every additional €1 million of exports (AFI, 2010, p. 30).

This means that, apart from helping to redesign the euro, Spain’s main concern should be to address, as a priority, the challenges of the foreign sector. Otherwise, it will be doomed to low growth processes that make it difficult to sustain the welfare levels achieved.

Bibliography

Analistas Financieros Internacionales (2010), ‘Internacionalización, empleo y modernización de la economía española’, May.

Arahuetes, A. (2011), ‘Expansión global de las inversiones directas españolas’, Estudios Empresariales, nr 134, Deusto Business School.

Blanchard, Olivier (2007), ‘Current account deficits in rich countries’, IMF Staff Papers, Palgrave Macmillan Journals, vol. 54, nr 2, p.191-219, June.

Bonet, Alfredo (2012), ‘Luces y sombras del sector exterior: la competitividad de las exportaciones españolas’, presentation at the Elcano Royal Institute, 25/IV/2012.Delgado, M., C. Ketels, M. Porter & S. Stern (2012), ‘The determinants of National Competitiveness’, Working Paper 18249, NBER, Cambridge, MA.

Dirección General de Comercio e Inversiones (2010), ‘Flujos de Inversiones Exteriores Directas 2010’.

Donoso, V., & V Martin (2008), ‘Características y comportamiento de la empresa exportadora’, Papeles de Economía Española, nr 115, p. 170-185.

Chislett, W. (2010), ‘The way forward for the Spanish economy: more internationalisation’, Working Paper nr 1/2010, Elcano Royal Institute.

Ernst & Young (2012), Growth, Actually, European Attractiveness Survey.

European Commission (1990), ‘One market, one money: an evaluation of the potential benefits and costs of forming an economic and monetary union’, European Economy, nr 44, October.

Madrid Juan, M. (2009), ‘La empresa exportadora española. Características y su papel en el crecimiento de las exportaciones en el periodo 2000-2007’, Boletin Económico ICE, nr 2965, 16-31/V/2009.

Giavazzi, Francesco, & Luigi Spaventa (2010), ‘Why the current account may matter in a monetary union’, CEPR, Discussion Paper Series, December.

González Sanz, M.J., & A. Rodríguez Caloca (2010), ‘Las características de las empresas españolas exportadoras de servicios no turísticos’, Economic Newsletter, November, Banco de España.

González Sanz, M.J., & A. Rodríguez Caloca (2012), ‘Las características de las empresas españolas exportadoras de servicios no turísticos’, Economic Newsletter, November, Banco de España.

Jaumotte, Florence, & Piyaporn Sodsriwiboon (2010), ‘Current Account Imbalances in Southern Euro Area’, IMF Working Paper, WP /10/139, June.

Kohler, Wilhelm, & Jens Wrona (2012), ‘Offshoring tasks, yet creating jobs?’, University of Tubingen Working Papers in Economics and Finance, nr 12.

Merler, Silvia, & Jean Pisani-Ferry (2012), ‘Sudden Stops in the Euro Area’, Bruegel policy contribution, nr 2012/06, March.

Observatorio de la Empresa Multinacional Española (2010), ‘La empresa multinacional española ante un nuevo scenario internacional’, Esade Business School & ICEX.

Unctad, Estadísticas Mundiales sobre Inversión Extranjera Directa.

Unctad (2012), ‘World Investment Report. Towards a new generation of investment policies’, United Nations, Geneva.

[1] This paper was first published in the Atlas de Marcas Líderes issued by the Foro de Marcas Renombradas.

[2] In fact, although there is a correlation between trade openness and income level, it is not clear that the first factor explains the second. In addition, rapid and disorderly financial openness has proved counterproductive for many developing countries because it can lead to financial crises.

[3] Historically, trade models assumed that all firms in a sector were identical and merely explored the macroeconomic effects of the opening up of economies to trade.

[4] Merler & Pisani-Ferry (2012) have shown that the reversal of private capital has gone beyond the withdrawal of private capital from non-residents of the government bond market but is extended, by contagion, to the financing of private solvent agents so that the phenomenon can be characterised as a ‘sudden stop’ process, similar to that experienced by emerging countries before facing the crisis.