Summary

Spain is one of the worst affected eurozone countries by COVID-19. The country went into the pandemic with weak macroeconomic fundamentals including an unemployment rate of 14% (now higher). The tsunami of funds from Next Generation EU is a golden opportunity to make the economy more sustainable and more inclusive. The government must accompany this with long overdue structural reforms, particularly in the ailing pensions system and the labour market, and improve the education system, which is not providing the skills that Spain needs (the early school-leaving rate is 16%). The funds will sorely test Spain’s administrative capacity to adequately plan and execute them at a time when politics is absurdly polarised, particularly in Catalonia, whose government continues to push for independence.

International context

The COVID-19 pandemic hit Spain harder than most countries. More than 3.2 million people have been infected, the eighth largest number in the world, and over 75,000 died from coronavirus (see Figure 1).2

The virus was first confirmed on 31 January 2020, when a German tourist tested positive in the Canary Islands. By 13 March, cases had been confirmed in all 50 provinces and the next day the government declared a state of emergency, which ended on 21 June after three months of lockdown, the strictest in Europe. Policymakers did not take scientific advice sufficiently into account during the first wave: frontiers in Public Health ranked Spain near to bottom in its classification of 24 countries based on adhering to scientific advice (Donald Trump’s US was the worst).3

The lifting of restrictions over the summer produced a second wave of infections and a six-month state of emergency as of 25 October. An irresponsible easing over Christmas and the New Year caused another spike in infections and a third wave, leading to a tightening of measures which reduced the 14-day cumulative case count per 100,000 residents from 900 in January to just over 150 at the end of March 2021, when the infection rate began to rise again.Figure 1. Reported cases and deaths by the 10 main countries

| Total cases | Total deaths | Cases/1mn pop. | Deaths/1mn pop. | |

|---|---|---|---|---|

| 1. US | 31,038,713 | 563,271 | 93,366 | 1,694 |

| 2. Brazil | 12,577,354 | 314,268 | 58,861 | 1,471 |

| 3. India | 12,143,955 | 162,454 | 8,736 | 117 |

| 4. France | 4,554,683 | 94,956 | 69,664 | 1,452 |

| 5. Russia | 4,536,820 | 98,442 | 31,078 | 674 |

| 6. UK | 4,341,736 | 126,670 | 63,708 | 1,859 |

| 7. Italy | 3,561,012 | 108,879 | 58,961 | 1,803 |

| 8. Spain | 3,270,825 | 75,199 | 69,937 | 1,608 |

| 9. Turkey | 3,240,577 | 31,230 | 38,120 | 367 |

| 10. Germany | 2,800,917 | 76,664 | 33,351 | 913 |

Source: https://www.worldometers.info/coronavirus/#countries at 29/03/2021.

The economic impact was also severe. GDP shrank 10.8% in 2020, the deepest recession in 80 years and the harshest in Europe (see Figure 2). The main factor behind the larger than average impact is the weight of the tourism and hospitality sectors (26% of GDP –five points more than the EU average–), which have been decimated. The number of international tourists plummeted from 83.7 million in 2019 to below 20 million last year, the lowest figure since the late 1960s and generating just 4% of GDP compared with the usual 12%. Spain has the most bars and restaurants per capita in the world (one for every 175 people, according to a 2019 report by the National Statistics Institute).

The corporate structure also has a comparatively higher weight of SMEs than most other euro zone economies: in 2019, 90% of companies had fewer than 10 employees, compared with 75% in Germany. This makes firms more vulnerable, as they have less access to external financing and higher overheads relative to turnover.Figure 2. Real GDP growth, selected economies, 2020 and 2019

| 2020 | 2019 | |

|---|---|---|

| China | 2.3 | 6.0 |

| France | -8.3 | 1.5 |

| Germany | -5.0 | 0.6 |

| Italy | -8.9 | 0.3 |

| Spain | -10.8 | 2.0 |

| UK | -9.9 | 1.4 |

| US | -3.5 | 2.2 |

Source: Governments.

The unemployment rate, which stood at 14% when the pandemic started, close to double the EU average, rose to 16.2% at the end of 2020, less than predicted by some forecasters, including the Bank of Spain, because of the success of the job retention scheme known as ERTEs. Had teleworking in Spain taken a greater hold before the pandemic (only around 8% of workers regularly worked from home compared with 25% in the UK and Sweden), the rise in unemployment might have been lower. One year after the arrival of the pandemic, the teleworking rate reached almost 15% (2.8 million people), still well below the EU average of 21%.

The jobless increase, however, was a far cry from what happened during Spain’s last recession when unemployment soared from 8.2% in 2007 to 26% in 2013. More than 755,000 workers were still furloughed at the end of last year (744,00 in March 2021). The scheme was extended until the end of May and probably beyond. There has been little structural job destruction. Nevertheless, all members of working age in more than one million homes were unemployed, and youth unemployment was above 40%.

High unemployment, before the pandemic, was not the only weak macroeconomic fundamental. The fiscal deficit was 2.8% of GDP in 2019 (it took a decade to get below 3%, the EU’s threshold, discarded in 2020 because of the pandemic) and public debt stood at 95.5% of GDP, a worse starting position than most other EU countries. While unemployment has not risen significantly during the pandemic, albeit from an already high level, the fiscal deficit ballooned to 10.97% in 2020 including a €10 billion hit from the reclassification of the SAREB ‘bad bank’ as a public entity, and public debt to 120% (see Figure 3).Figure 3. Unemployment, budget balance and public debt, selected economies, 2020

| Unemplyment (%) | Budget (% of GDP) | Public debt (% of GDP) (1) | |

|---|---|---|---|

| France | 8.9 | -10.9 | 116.5 |

| Germany | 4.6 | -4.8 | 70.0 |

| Italy | 9.0 | 11.3 | 154.2 |

| Spain | 16.2 | -10.97 | 120.0 |

(1) Third quarter for France, Germany and Italy.

Source: Eurostat and Economist Intelligence Unit

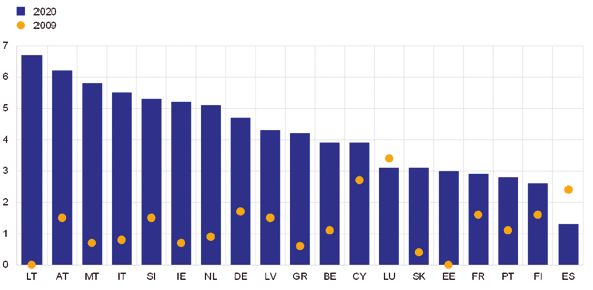

Spain’s fiscal response to COVID-19 in 2020 was the lowest in the euro zone, according to the European Central Bank (ECB). Measures accounted for 1.3% of GDP compared with an average of more than 4% (see Figure 4). The government disputes the ECB’s methodology for the calculations, as it excludes, among other things, the cost of the job retention scheme and the regional fund for health and education. The Finance Ministry says including these and other measures, Spain’s response represented 5.5% of GDP.

As regards providing COVID-19 related state aid to businesses, Spain was the least frugal EU country in GDP terms (see Figure 5).Figure 5. COVID-19 related state aid by EU countries to support businesses (% of GDP), 2020 (1)

| % of GDP | |

|---|---|

| Spain | 7.3 |

| France | 6.4 |

| Italy | 6.0 |

| Greece | 4.4 |

| EU | 3.3 |

| Hungary | 3.9 |

| Portugal | 3.6 |

| Poland | 3.3 |

(1) Between March and December and data that is not the same for all countries. Spain, for example, includes loans that have to be returned and the recapitalisation fund for large companies.

Source: European Commission.

William Chislett

Senior Research Fellow, Elcano Royal Institute | @WilliamChislet3

1 The author would like to thank Joaquín Almunia and Emilio Lamo de Espinosa for reading and commenting on this report.

2 Including ‘excess deaths’ –the difference between the observed numbers of deaths in a specific time period and expected numbers of deaths in the same period– the total number was much higher. Between 2 March 2020 and 14 February 2021, 91,800 more people died than in a ‘normal year’, according to the National Statistics Institute (INE), 27,053 more than the number attributed to coronavirus by the Health Ministry in that same period.

3 See https://www.frontiersin.org/articles/10.3389/fpubh.2020.621563/full.

Challenges and opportunities for Spain in times of COVID-19