Introduction

The demographic changes occurring in Europe are well documented and impossible to misinterpret. Fewer children are born today than twenty years ago and people live longer and longer. These two trends give rise to a process known as population ageing which, in turn, has socio-economic consequences that are difficult to comprehend. This paper describes the demographic process that causes ageing and addresses its socio-economic consequences.

The final section analyses the socio-economic consequences of ageing in more detail and discusses possible ways of reforming the current welfare model. The socio-economic consequences of ageing have far-reaching implications for a country’s economic performance and can change a particular country’s position in the world economy in multiple ways. Ignoring these problems and avoiding their reform for the future could impede the economic dynamics that give rise to economic growth and productivity. All European countries face the same dilemma. Thus, dealing with ageing-related problems becomes a game of excellence. The country that best manages its ageing-related socio-economic problems has an opportunity to enter the post-ageing period in a stronger state and with a better economic growth potential than those who fail. I focus primarily on the Spanish case, especially as regards examples. However, the problems discussed have wider implications and many of the suggestions are relevant for other European countries as well.

The ageing process and its demographic consequences

The ageing process experienced by European countries is the result of two demographic trends: increased life expectancy and declining fertility.[1] Increased life expectancy simply means that people live longer. The life expectancy of Europeans has increased without pause since the end of World War II. For instance, between 1975 and 1998, Spain’s life expectancy at birth rose by 2.8 months per year, up from 73.34 years to 78.71 (these numbers refer to both sexes). What is less intuitive is that large gains in life expectancy change the population structure. A rise in life expectancy from 73 to 79 years means that many more people in the population reach age 79 than in the past. Put differently, the population is ageing.

Europe’s fertility rates started to decline in the 1960s. An interesting example of the importance of the decline is offered by Spain. In 1976, Spanish mothers gave birth to 707.498 children. In 2001, the number of births was 409.857. While the Spanish case is extreme, all European countries have seen a drop in fertility from well above the replacement level (2.1 children per woman) to its current average value of 1.5. When fertility declines there are less and less children born every year. This causes the population’s average age to rise and its consequent ageing. Moreover, when both trends are present, the ageing process is faster and more wide-ranging than if only one of them is present. In Europe, both trends have been present since the late 1960s. The result is that most European countries experience a ‘rapid ageing’ of their populations (Kim and Schoen, 1997).

The most intriguing aspect of ageing is that although declining fertility and increased life expectancy produce the same result they have very different structural implications.

The simplest way to explain the mechanics of increased life expectancy is that an average person, after having been born in a place where life expectancy is rising, can expect to die later than expected at the time of his/her birth. That is, increased life expectancy operates on the timing of people’s deaths. This means that the number of people in younger age groups will be roughly the same regardless of an increase in life expectancy in any given period.[2]

Decreasing fertility is more complex and its impact on a population structures is far more wide-ranging. For example, if the number of births in a population declines from 100 in year-one to 50 in year-two this means that there are 50 people less in year-two than in year-one. It also implies that by year-three there will be 50 one-year olds less than in the previous year, in the year after, 50 two-year olds less and so on, as people grow older. A drop in fertility results in a relative population deficit in the affected age groups, which disappears when the members of the age group exit the population at the end of their lives. If the change in the number of births is temporary and resumes its previous values rapidly, there is no reason to worry. But, if the decline is long lasting it will affect the size of entire generations rather than individual age groups.

Europe’s fertility decline has been very long lasting (see figure 2 below). The decline is changing the composition of the population in a variety of ways. To illustrate how this affects a population, consider the size of Spain’s potential labour force.

Figure 1. Absolute difference between the number of persons turning 26 and persons turning 65, 1970-2040

In figure 1, I compare the number of people turning 26 with the number of people turning 65 for each year between 1970 and 2040. The result is a graph showing the net growth of Spain’s potential labour force. Those turning 26 have exceeded those turning 65 by around 250 thousand between 1970 and 2003. Due to Spain’s low fertility levels in the past twenty five years, the increase in the active population is now becoming much weaker. From around 2015, the potential labour force should start to contract. By 2025, it should decrease by over 150 thousand persons per year. These changes are irreversible since it is not until 2025-30 that the Spanish labour force can grow from a sudden increase in fertility.[3] As we will see later, changes of this magnitude have serious socio-economic implications.

Figure 2. Fertility development: Spain vs the European average, 1960-2001

Another effect of low fertility is its long-term impact on population size. The fertility trend shown in figure 2 should cause the total number of births to decrease with increasing speed. The reason for this is simply that when the shrinking age cohorts born in the last twenty-year period reach reproductive age there are less potential mothers around. Less potential mothers combined with below-replacement fertility rates result in yet smaller birth cohorts. For example, in the next ten years Spain’s potential mothers (women aged 20-40) will decrease by 750 thousand. In 2050, they will be 2.5 million less than today.[4]

To understand how this negative growth momentum may come to influence Europe’s population development consider Lutz’s (2003) findings. If Europe’s fertility immediately returns to the replacement level, Europe’s population will decrease by 15 million by 2100. That is, the total population will decrease despite an instant rise in fertility. The explanation to this paradox is the deficit in potential mothers caused by below-replacement fertility rates for more than twenty five years. If Europe’s fertility remains at the current level (1.5) for ten more years and thereafter returns to the replacement level, the population would decline by 55 million people by 2100. Finally, if it were to stay at the current level for 30 more years the population decline would be 118 million by 2100.[5] Considering that the EU’s population is currently 380 million, these numbers are certainly impressive.

These estimates draw on EU average fertility rates. Note that individual countries such as Spain, with a fertility level which is substantially below the EU average, would face a larger population decline in relative terms than other EU countries.

If the number of births continues to decline in Europe and if life expectancy continues to rise (Vaupel, 1997; Wachter and Finch, 1997) we should expect: a) the ageing process to continue for a large part of the 21st century, since it is partly a result of lower birth rates; and b) a more or less serious outlook for population decline.

The socio-economic consequences of ageing

Why is Europe’s ageing population a problem? While ageing is a largely positive phenomenon for the average person, the process forces us to reconsider how welfare is distributed. The European welfare model rests on the assumption of intergenerational solidarity. That is, most EU countries have chosen to finance pensions and education using a system of intergenerational transfers. These transfers solve different needs occurring at different times in an individual’s life. The degree of intergenerational transfers or the number of goods encompassed by such transfers may vary across countries but the principle is the same.

For example, the European welfare model dictates that people reaching retirement cease to carry out wage work and start receiving pensions financed through a so-called ‘pay-as-you-go’ system. The implication of this system is that the people in working age pay the pensions received by those who are retired. The working age population subsequently receive their pensions from the next generation of workers. In economic jargon, this is known as an unfunded system as opposed to a funded system where financial resources collected today from a particular individual are invested or saved and then returned several years later to him in some form of retirement benefits (see Boldrin et al, 1999).

Similarly, children do not produce any economic output during their childhood. Nevertheless, children are consumers of goods with an economic value, such as education. To be able to consume goods with an economic value they usually rely on their parents, either directly through transactions or indirectly through taxes used in part to finance public education.

Both young and elderly are thus dependent on the working age population. Thus, an effective way to understand the magnitude of the socio-economic consequences of ageing is by studying changes in intergenerational dependency ratios.

If we accept the notion of economic transfers from working-age people to people in younger age groups, it follows that there is a potentially positive relationship between the ‘youth dependency ratio’ and the working age population’s financial burden. The more young people there are relative to working-age people, the larger the financial burden placed on the latter. Because the European welfare model implies a continuous intergenerational transfer of pensions from the working-age population to the retired population it follows that: if the share of old people increases relative to the labour force this is a rough indication that the potential financial burden in sustaining pensions at any given level also increases.

In analysing dependency ratios, it is important to establish the correct age intervals to ensure that these proxy measures of economic intergenerational dependencies reflect the economic effect of intergenerational transfers as effectively as possible. The simplest way to do this is by assessing the actual conduct at the individual level. That is, first, at approximately which age do young people start participating in the labour market to become financially independent? Secondly, at which age does a significant share of the labour force start to retire and become financially dependent on younger generations because of the ‘pay-as-you-go’ system?

In most EU countries, the younger age groups tend to start integrating gradually into the labour force at around the ages of 20-25.[6] Hence, it seems reasonable to construe the young population as being those aged 0 to 19, as a majority of this group rely on full or partial support from their parents. As for the elderly, most EU countries have a statutory retirement age of 65. Nevertheless, looking at the actual behaviour of EU citizens a somewhat different conduct emerges. Large shares of the EU’s population opt for early retirement. As a result, the average retirement age in Europe is 60 (Kinsella and Velkoff, 2001).[7] For this reason, I construe the group of elderly as those aged over 60. I calculate the dependency ratios by contrasting the share of people aged between 0 and 24, and those aged over 60 with the share of people aged between 25 and 59.

Figure 3a and 3b – Youth dependency ratio and old-age dependency ratio: Spain vs the EU average

The result is shown in figures 3a and 3b. The first measures the dependency ratio between the young and the active population, and the other between the old and the active.[8] Changes in the dependency ratios result from either ageing or rejuvenation processes. The process of ageing implies a shift in the dependent population from being primarily young to becoming primarily old.

The main conclusion from looking at both figures is that Europe and Spain are in the middle of an ageing process. This is because the transition from a high to a low share of young people is stabilizing, and because the significant increment in older people is starting to accelerate.

An interesting finding from the two figures shown above is that Spain currently shows significant signs of a more advanced ageing process than Europe as a whole –its share of young people compared to the active population is amongst Europe’s lowest. In fact, Spain’s population is the World’s fifth oldest after the populations of Italy, Greece, Sweden, and Japan (Kinsella and Velkoff, 2001).

The economic implication of these developments in dependency ratios is relatively straightforward. If we agree on the economic assumptions explained earlier, we can expect the potential financial burden implied by child and youth support to have declined rapidly since 1975-80. At the same time, old age dependency is rising. However, the increase in the old age dependency ratio is slower than the decrease in youth dependency.

We can gain additional insights into the ageing process and its socio-economic implications by combining the two dependency measures into a single indicator measuring the total dependent population over the working-age population. The interpretation of the combined measure is similar to that of each individual measure. The only difference is that we treat the young and the old as a common group based on the assumption that they need the support of the working-age population for their survival.[9]

Figure 4. Total dependency ratio

It may come as a surprise that the ageing process has pushed down the total inter-generational dependency from around 100 % in 1980 to 70 %-80 % in 2003 (see figure 4). The dependency ratio is at a historical low. However, this is about to change. The sharp increase in the old-age dependency ratio will push up the total dependency ratio to 110 % for Europe. For Spain, the outlook is worse. When Europe reaches equilibrium in the ageing process around 2030-35, Spain’s population will continue ageing through 2050. Its total dependency ratio will then be close to 130 %.

Another important finding is that in contrast with the last peak year around 1980, when two thirds of the dependants were aged below 20, in 2035 two thirds of the dependants are over 60 (see figures 3a and 3b). In other words, we are in the process of a complete reversal of the dependants’ profiles. A change of this magnitude entails an almost complete reversal of our intergenerational transfers. From targeting primarily young people, they now have to target primarily old people.

The European outlook and the case of Spain

The analysis of dependency ratios shows conclusively that European countries will experience an increase in their old-age dependency ratio over the next thirty years. All things being equal, this would cause pension expenditure to rise dramatically. Knowledge of what lies ahead has made some countries reform or consider reforming their pension system with a view to avoiding future financial hardship.

There are good reasons to encourage reforms. Accommodating the rising cost of pensions and other benefits is not only a national concern. Failure to accommodate increased pension expenditure could threaten the stability of the EU’s common market, particularly within the euro zone. The increased costs resulting from ageing are huge –in some cases they are in the range of 10 percentage points of GDP. Inter-communitarian economic cooperation makes it vital that all EU states manage the ageing challenge as smoothly as possible. If any one country fails in this task, it may upset the EU economy in general, and threaten or destabilize the economic union.

The Centre for Strategic and International Studies (CSIS) has produced perhaps the most interesting and extensive assessment of the EU countries’ capacity to meet the socio-economic challenges posed by ageing (Jackson and Howe, 2003). Its findings indicate that worldwide ageing is indeed challenging the developed world and that most developed countries are running a high risk of finding themselves in a fiscal and economic crisis if they fail to reform their current systems over the next few years. What is even more interesting is that the potential fiscal and economic problems caused by ageing are worse than usually assumed by the governments involved.

From a European point of view, the findings are discouraging for other reasons as well. European countries are in general facing more difficulties in addressing the ageing challenge than their primary competitors the US, Australia, and Canada.

Some European countries are in for a rougher ride than others. Spain stands out in the comparison as the country with the greatest future economic problem in accommodating the costs resulting from a rising proportion of elderly citizens, followed by Italy and France. All other European countries, including Germany, which has the reputation of being a country with gigantic reforms ahead to save its state finances, have a better outlook than Spain. The OECD (2003) arrives at similar conclusions. Several independent reports conclude that Spain faces the largest increase in pension expenditure of all EU countries (El País, 2003).

When comparing countries in the European Union, why is Spain worse prepared to tackle the ageing challenge? One answer lies in the timing of the necessary reforms. Of the countries considered, many have already started to implement extensive reforms to their social welfare systems (Italy, Germany, Sweden and the UK, for instance). As a result, they also have a better outlook than Spain, which has so far failed to undertake any serious reform work.

There are two reasons why Spain has not yet started its reforms: a) its current pension costs are on a par with its revenues; and b) there is a popular belief that Spain entered into the demographic transition that caused population ageing later than did its European neighbours, with delayed ageing as a result.

Delaying reforms because ageing has not yet caused any severe budget deficit is nothing but a temporary solution. The reason for this is Spain’s persistently low fertility. If fertility were to change favourably in the next few years it would take another 25-30 years before the effects of such improvements would have any impact on the old age dependency ratio just analysed. It takes that much time before new birth cohorts enter into the active population. Unless we accept very large immigration levels, we know with absolute certainty that the current system will become financially unsustainable in the course of the next few years (Herce, 2001).

It is also wrong to think that the demographic transition causing population ageing started later in Spain than in the rest of Europe. A more correct assessment is that Spain’s ageing process is slightly different, with a slower ageing process compared with the EU average in the late 1960s and early 1970s. In the 1980s the process speeded up and since the mid 1990s Spain’s ageing process is ahead of the EU average. The single most important reason for this is, again, the brutal and persistent drop in Spain’s fertility.

These differences are not to Spain’s advantage. While most European countries can look forward to completing their transformation into older societies by 2030, Spain will continue ageing for two more decades. When its ageing is complete, Spain will have a much higher old-age dependency ratio than its European neighbours. In other words, Spain’s low fertility is aggravating its ageing problem.

Spain’s poor performance in comparative exercises indicates a serious problem, which could have international implications. Spain has come a long way in catching up with its European neighbours in terms of economic development. If Spain’s future pension expenditure rises more and for a longer period of time than that of other European countries, its future economic status may be at risk.

Incapacity to deal with the rising cost caused by ageing would upset national economies and prevent stable economic growth for a substantial period of time. Since reform work is a national affair with international consequences, it is possible that some countries will come out weaker financially after the reforms. Yet others may become stronger. This implies that managing the economic consequences is an opportunity which, if seized well, may have consequences beyond the national scene. In addition, financing the growing pension expenditure would take away resources that Spain currently invests in other areas –such as infrastructure and research. The enlargement of the EU complicates things further. The structural funds that Spain has enjoyed since its entry into the European Union are likely to disappear soon. This implies that not only does the country have to rely on its own capacity to finance a range of development activities that have been subsidized by EU funds in the past, it also has to find the financial room to do this at the same time as its public expenditure has to accommodate the increased cost caused by ageing. If Spain fails in this task, it may very well face a period of economic instability that could result in a less powerful position when negotiating the future of Europe.

Dealing with ageing, reforming for the future

At this stage it should be clear that the ageing problem is starting to materialize, and that the process will accelerate over the next few decades. The shift in the dependants’ profile from young to old makes it necessary to reconsider the way in which we choose to distribute welfare in the future. There is no one obvious solution to our problem. More likely, we have to consider a toolbox of solutions.

To address the problem it is necessary to analyse the mechanics of intergenerational transfers in more detail. For simplicity’s sake, I will only consider a society with two types of intergenerational transfers –education and pensions–, which correspond to the most common European model.

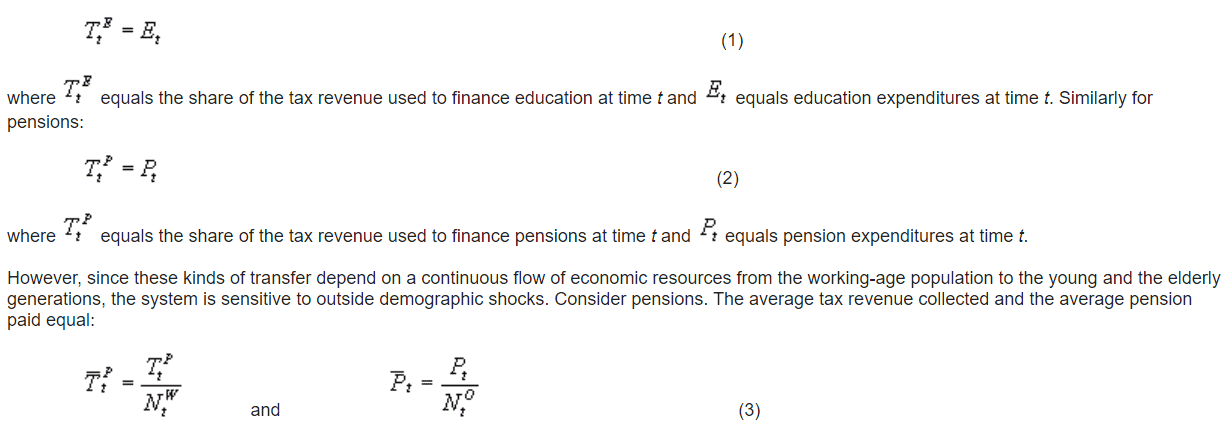

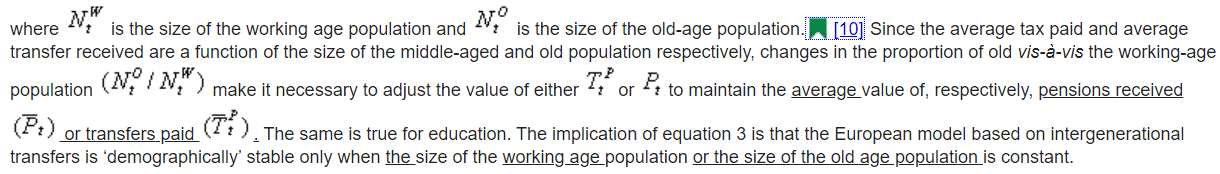

In a society with existing intergenerational transfers, we typically find a distinction between young, middle aged and old people as illustrated by the dependency measures explained above. To cover young people’s educational needs at time t the State collects tax revenues from the middle-aged (working) population at time t. The tax revenue is used to finance public education for the young at time t. Likewise, to finance pensions the government collects tax revenues or contributions from the working-age population at time t, which is used to pay for the pensions at time t. The ‘pay-as-you-go’ system, or an unfunded system, falls under this category of transfers. Expressed in a formal way, at the level of society, this system implies that:

As we have seen when analysing dependency ratios, the size of these population groups are far from being constant. This implies that we are facing a situation whereby we have to start manipulating the values of either the transfers or the benefits or, if the goal is to preserve the values of transfers and benefits, rely on ad hoc solutions to finance the deficit resulting from demographic developments. Figuring out which of these solutions to apply is what most countries in Europe are currently concerned with. There is an abundance of options at our disposal to manipulate the economic parameters in the described model.

Solutions to save future pension benefits

The sharp decrease in young people suggests that the educational systems is, or will be, over-dimensioned. Hence, it is tempting to consider a reallocation of resources towards public services targeting the growing number of elderly in the population. However rational such a decision might appear, there is more to it than just the instrumental aspects.

Economic theory advises against a cut in educational resources. Perhaps the most crucial component in sustaining future pensions is a positive development in labour productivity. The productivity-enhancing effects of education is well known (Becker et al, 1990; Boldrin et al, 1999; Pecchenino and Pollard, 2002). The decline in fertility creates an instrumental deterioration in human capital: the absolute number of people with an education will decline. The result could easily be declining productivity. This implies that the challenge awaiting policymakers throughout Europe is to increase productivity so that less people can produce the same output or more than a similarnumber of persons do today. And all this in a context where demographic developments, in the form of smaller student cohorts, could trigger situations that are unfavourablefor the quality, variety and diversity of education. Thus, instead of cutting back on education, most research on the relationship between education and productivity suggests that it is advisable to invest more per student/capita to achieve higher productivity in the future. Thus, shifting resources from younger age groups to cover the increasing financial deficit created by a growing number of old people is counterproductive if the political goal is sustained pensions.

Raising taxes and/or lowering pension benefits are perhaps the most obvious choices from an economic viewpoint when the dependency ratio is increasing. However, this approach is problematic and many European countries have already ruled out these options (Jackson and Howe, 2003). Ad hoc solutions and tax rises have negative effects on economic growth, apart from being unpopular. Manipulating the value of the benefits is also an unpopular solution. Governments usually tend to preserve the value of, particularly, pensions. Boldrin et al (1999) have shown that this has been the policy on pensions for the past ten to 15 years in most EU countries, despite increased costs of pensions throughout the period. It cannot be excluded that this will be the policy also in the future since the older generation is growing in size and with it its capacity for political influence.

An economic solution regarded by many as the most effective is privatizing pensions. That is, instead of curing ‘a sick patient’, voices are being raised in favour of a complete make-over whereby at least pension expenditures should be funded, instead of unfunded as they are today. While the current ageing ‘crisis’ certainly provides an opportunity for a change of this magnitude, we cannot get around the fact that the current system is an effective catalyst for equality, social cohesion and equal opportunities. In more than one-way, it represents the European model of life. It offers a low capital risk, particularly in investments in future pensions. In addition, substituting it for an individual, funded system implies high transition costs for the current working-age population (Boldrin et al, 1999; Barr, 2001). Thus, preserving the current system has many advantages (Barr, 2001; Esping-Andersen, 2002), which taken together could outweigh the advantages of a funded system (Boldrin et al, 1999). We should, however, not rule out the possibility of considering a partially-funded system of the type adopted by Sweden (Jimeno, 2002).

The solutions targeting productivity and labour market participation rates are more promising. Economists recommend using the working-age population more effectively. Many European countries have low total participation rates in the labour market and female participation rates are sometimes under 50%. Lowering unemployment levels is another important structural measure. Active labour market policies targeting the total participation rate, combined with measures lowering unemployment, increase the tax base and provide important tax revenues to meet the increasing cost of pensions. If successfully implemented, such policy actions would make up for a large part of the economic consequences caused by ageing (Boldrin et al, 1999). On the downside are the implications on our way of life. Southern Europe, especially, has a long tradition of using the family as a source of welfare (childcare and care for the elderly). Higher participation rates would weaken the family’s capacity to fulfil its role of welfare provider. Hence, it is necessary to revise family policies to make labour market policies effective.

An increasing life expectancy implies that more people reach retirement age and more people receive pensions for a longer period once they are in retirement. To compensate for the increased cost of pensions caused by these developments, a natural measure would be to raise the statutory retirement age. So far, this has not happened. Instead, the trend is towards lower retirement ages. Recall that the average age is 60 in Europe. A first measure would be to reinforce the statutory retirement age. Raising the average retirement age by just five years would make the pension system much more viable and counteract the economic consequences of ageing (Herce, 2001; Boldrin et al, 1999). A second measure would be to consider a successive rise in the statutory retirement age, compensating for increased longevity. However, this could be an unpopular solution among the growing number of persons close to retirement. Thus, the latter measure is politically sensitive. Despite this, it is unlikely that we can avoid raising the retirement age if we want to preserve the value of pensions in the future.

It would be impossible to talk about solutions to ageing without mentioning immigration. Immigration changes the composition of a population, usually by contributing to the size of the labour force. The result is a lower dependency ratio. However, immigration is the most unpredictable and hardest population trend to control. We have no effective way to predict who are coming, when they come and when they choose to return, if they return. Size and scope vary as legislation and migration opportunities change. Events outside the control of any particular country, such as wars and economic turmoil, all change international migration trends. Hence, there is a large element of ambiguity as to how immigration might influence the ageing process. The lack of immigration regulations explicitly targeting labour migration also clouds the picture. There is hardly any legal way in which to enter Europe as a labour migrant. Thus, many immigrants enter and work illegally and never contribute tax revenues to our welfare systems.

While it is unlikely that immigration alone can solve our ageing problem (UN, 2001), without immigration the future labour force would become even smaller and the cost of ageing would be further aggravated. For example, to balance the changes between 2003 and 2040, Spain would need more than 18 million immigrants, or over 400 thousand per year. It is doubtful that any European society is capable of absorbing such high levels. An alternative and more realistic scenario would be to achieve zero labour-force growth through immigration. This would require a smaller intake of immigrants. In Spain’s case, this would mean approximately 6 million immigrants or 160 thousand per year, if immigrants are relatively young when they arrive. Numbers of this magnitude are close to current levels in Spain. The side effects of zero growth of the labour force would imply that we still have to face a significant ageing of the population (Jimeno, 2002). This solution would require revising immigration policies by making legal labour migration possible at the range indicated above.

Designing policies targeting low fertility

While all the solutions discussed above would result in a reduction of the economic consequences of ageing, none of them address the main cause of the underlying problem of ageing. Reiterating this point, despite the economic concerns we have regarding the growing number of elderly, the ageing problem is a demographic problem, caused mainly by unprecedentedly low fertility levels. Hence, not considering a solution targeting fertility would decrease our chances of dealing effectively with the economic problems originating from ageing.

Another reason why targeting fertility is potentially so important has to do with how current demographic trends influence economic growth in general in the future. Below-replacement fertility leads inevitably to population decline. The imminent problem concerns the potential for labour supply deficits caused by the smaller birth cohorts that are starting to enter the labour force. In the long term, the concern is the population at large. Recall that Lutz et al (2003) foresee a population decline for the European Union in the range of close to 110 million people by 2100 if fertility remains at current levels.

Population declines of this magnitude could make economic growth increasingly difficult in the future. This would undermine the economic patchwork most EU countries consider as viable solutions to the welfare dilemma posed by their ageing populations. What will happen to economic growth when there is less and less potential labour around? What will happen to our domestic markets, which only experienced population growth in the past, when they have to deal with the effects of declining populations? Can we really expect sustained economic growth when population declines? Hence, in dealing with the ageing problem, addressing the economic consequences of ageing without paying sufficient attention to the demographic elements is likely to be hazardous or even erroneous.

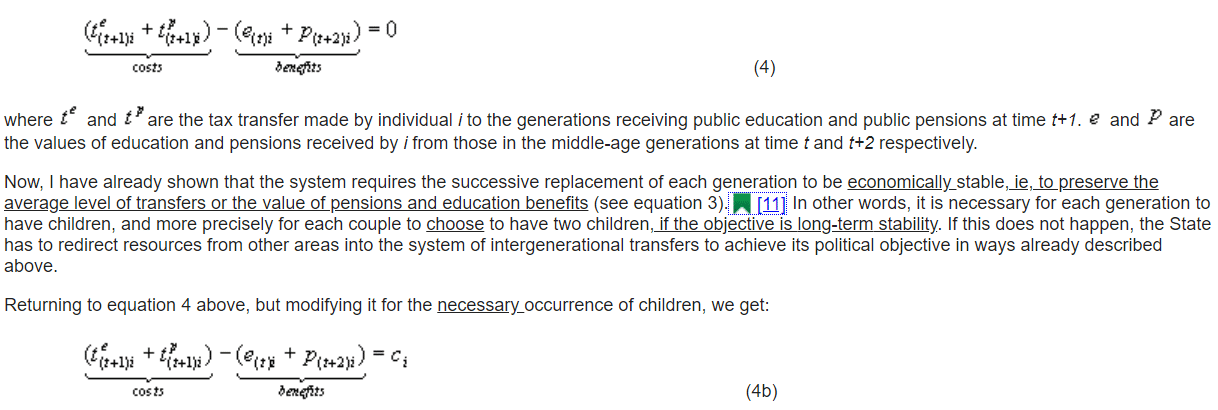

One of the problems of the existing system of intergenerational transfers is that it does not explicitly make a connection between the replacement of generations and intergenerational transfers. Stretching this a bit further, I will argue that in relative economic terms, having the optimal number of children (two) required to achieve a stable population is less favourable than having no children or only one child. That is, the current system of intergenerational transfers provides a large positive economic incentive for couples choosing to have zero or one child in their life instead of two children. Moreover, the economic incentive is greatest for childless people. The conclusion of this argument is that the current model is to some extent responsible for the economic dilemma that we are trying to overcome.

For an average individual i, a system of intergenerational transfers implies that at time t, when i is young, i receives an education financed through transfers from the middle-age population. When i reaches middle age at time t+1, i reciprocates by providing the generation who have now retired a pension benefit. At the same time, i provides a new generation of young people a benefit equal to the current value of education, with the expectation of receiving in return a future pension benefit at time (t+2) when i reaches retirement. Over the life course of an average individual we can summarize these exchanges as:

To solve the free-rider problem described above it is necessary to reconsider the importance of children at the time of the transfer of economic resources from one generation to another. In principle, we face three alternatives: a) introduce policy measures targeting the cost of bringing up children (such as tax-financed day-care, child allowances and tax exemptions for families with children); b) eliminating the free-rider problem described above by lowering the pensions for people with less than two children; and c) a combination of both.

The first option is well known and there are plenty of good practical examples, particularly in the Nordic countries. However, the results are far from satisfactory in so far as countries opting for this approach still face low fertility. Another problem with this approach is that since it mainly targets the disincentive of having children instead of the incentive of not having children, it does not address the free-rider problem effectively. And, as a result, it would still be possible to free ride.

The second and third alternatives break with some of the demographic taboos of our current welfare model. Instead of regarding children as exogenous to the model, they introduce the presence of children directly as a dependent variable when assessing the future value of pensions. This solution does not imply denying childless individuals the right to pensions altogether. Childless individuals have after all contributed to economic resources to both education and pensions throughout their working lives. This gives them a right to a pension the same as everyone else in society.

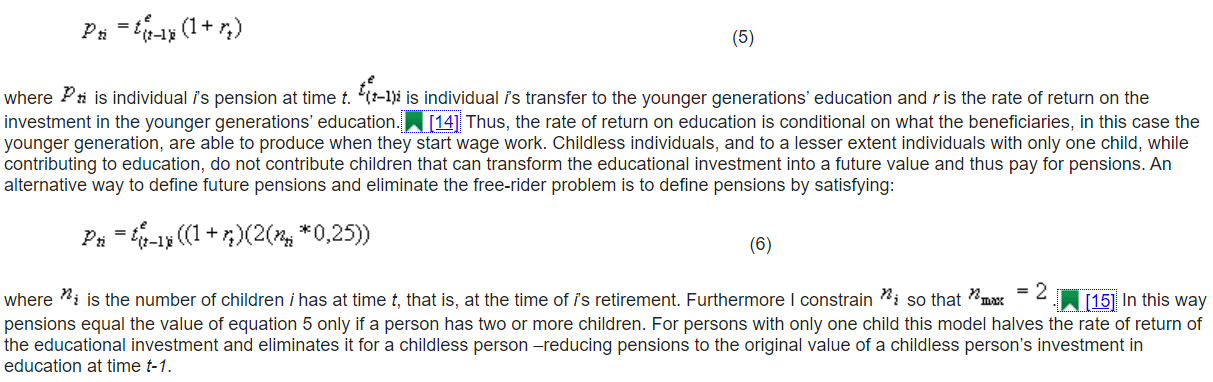

Eliminating the free-rider problem implies recognizing that the collective has to consider the value of children when calculating the value of pensions in the current system. One way of defining the value of pensions is by satisfying:

An observation of this model is that it does not target the cost of having children per se as expressed in equation 4b. It only targets the existing positive incentive of not having children. The contribution of the model is that it makes the cost of future pensions more viable and helps solve some of the ageing-related economic problems discussed above.

In this model, having children is still very much a private choice. Thus, while the proposed model is likely to have some effect on fertility, it is doubtful if this measure alone would make fertility return to the replacement level. If the long-term political objective is to avoid population decline and ageing, it is necessary to consider policies that also target the cost of having children as well as the cost of trying to have children in combination with the proposed solutions.

First, making the value of pensions partly contingent on an individual’s reproductive choices implies that those who want to have children, but for reasons outside their personal control cannot, are facing a dilemma. To compensate for this the State may want to consider tax exemptions for fertility-related treatment and adoption. Secondly, the State should seriously consider introducing family-friendly policies that reduce some of the costs of bringing up children and remove some of the economical disincentives of modern society. The key to this is to find solutions that make it possible to combine an active working life with childcare. The latter is important considering that one of the ways to cope with ageing is increasing the participation rate of the working age population, including that of women.

Policy recommendations

This paper has focused on the consequences of ageing. I have argued that Europe’s ageing process gives rise to two types of economic consequences: a) an unsustainable cost of future pensions; and b) deteriorating prospects for future economic growth due to population decline. However, while the consequences are primarily of an economic nature, the causes are of demographic origin. More precisely the low or very low fertility seen in many European countries is responsible for a large share of the economic consequences covered in this paper. To solve the problems and make the European welfare model financially sustainable in the future, based on the findings of this paper I invite those concerned to consider the following set of recommendations:

1) Introduce active labour market policies aimed at raising the total participation rate and reducing unemployment.

2) Introduce a set of immigration policies that are capable of securing a sufficient number of economic immigrants to prevent the labour force from declining over the next three or four decades. In the case of Spain, such a policy should provide for an average yearly intake of approximately 160 thousand labour immigrants. Furthermore, to ensure an increased tax base to cushion the economic consequences of ageing, these policies should also consider measures against illegal migration and illegal contracting.

3) In a first step, enforce the statutory retirement age of 65 by devising mechanisms that eliminate early retirement. Secondly, consider a successive increase in the statutory retirement age to compensate for increased longevity.

4) Recognize that pensions financed through intergenerational transfers require successive replacement of generations by conditioning the value of pensions on the number of children raised by the beneficiary. That is, eliminate the possibility of childless persons free-riding on those who choose to have children, by making them financially responsible for their choice of not having children.

5) Make fertility close to the replacement level an explicit political objective by introducing policy measures targeting childcare and the cost of bringing up children. In addition, make adoption and fertility treatment economically accessible for those requesting these services.

Rickard Sandell

Senior Analyst,

Demography, Population and International Migration

Real Instituto Elcano

References

Barr, Nicholas (2001): The Welfare State As Piggy Bank, Oxford, UK: Oxford University Press.

Becker, Gary S., Kevin M Murphy and Robert Tamura (1990): ‘Human Capital, Fertility, and Economic Growth’, The Journal of Political Economy, 98:12-37.

Boldrin, Michele, Juan J Dolado, Juan F Jimeno and Franco Peracchi (1999): ‘The Future of Pension Systems in Europe. A Reappraisal’, Economic Policy, 14:287-320.

El País:La UE exige reformar las pensiones y la sanidad para limitar el impacto del envejecimiento, by Carlos Yárnoz, 12/11/2003.

Esping-Andersen, Gøsta (2002): Why We Need a New Welfare State, Oxford, UK: Oxford University Press.

Franco, Ana and Sylvain Jouhette (2003): Labour Force Survey: Principal Results 2002 EU and EFTA Countries, Eurostat: Luxembourg.

Herce, José A. (2001): La Privatización de las Pensiones en España [Documento de trabajo], Madrid, Spain: Fundación de Estudios de Economía Aplicada.

Jackson, Richard and Neil Howe (2003): The 2003 Aging Vulnerability Index, Washington DC: The Centre for Strategic and International Studies and Watson Wyatt.

Jimeno, Juan F. (2002): Demografía, Empleo, Salarios Y Pensiones [Documento de trabajo], Madrid: Fundación de Estudios de Economía Aplicada.

Kim, Young J. and Robert Schoen (1997): ‘Population Momentum Expresses Population Ageing’, Demography, 344: 421-7.

Kinsella, Kevin and Victoria A. Velkoff (2001): An Ageing World: 2001, Washington DC: US Government Printing Office.

López, Luis Matías (June 22, 2003): ‘¿Peligran Nuestras Pensiones?’, El Pais.

Lutz, Wolfgang, Brian C. O’Neill and Sergei Scerbov (2003): ‘Europe’s Population at a Turning Point’, Science, 299: 1991-2.

Olson, Mancur (1965): The Logic of Collective Action: Public Goods and the Theory of Groups, Cambridge, MA: Harvard University Press.

Organization for Economic Cooperation and Development (2003): OECD Economic Surveys: Spain, Paris: OECD.

Pecchenino, Rowena A. and Patricia S Pollard (2002): ‘Dependent Children and Aged Parents: Funding Education and Social Security in an Ageing Economy’, Journal of Microeconomics, 24: 145-69.

Preston, Samuel H., Patrick Heuveline and Michel Gullot (2001): Demography: Measuring and Modeling Population Processes, Oxford, UK: Blackwell Publishers Ltd.

Sandell, Rickard and Charlotta Stern (1998): ‘Group Size and the Logic of Collective Action: A Network Analysis of a Swedish Temperance Movement 1896-1937’, Rationality and Society, 10: 327-43.

United Nations (2001): Replacement Migration. Is it a Solution to Declining and Ageing Populations?, New York, NY: United Nations.

Vaupel, J.W. (1997): ‘The Remarkable Improvements in Survival at Older Ages’, Philosophical Transactions of the Royal Society of London, 352: 1799-804.

Wachter, K.W. and C.E. Finch (1997): Between Zeus and the Salmon: The Biodemography of Longevity, Washington DC: National Academy Press.

[1] Ageing occurs when changes in either mortality rates or fertility rates are present. This means that ageing is a process not a state (Preston et al 2001). Increased life expectancy is the result of a decline in mortality rates. In this paper I use the concept ‘increased life expectancy’ instead of ‘declining mortality’.

[2] I am not denying that an increase in life expectancy can affect age distribution. Sudden and large reductions in, for instance, child mortality would increase life expectancy significantly and could have long-lasting temporal effects on the population structure.

[3] While an increase in fertility is welcome, it takes about 25 years before the newborn reach the age of 26 and become part of the labour force.

[4] It is well known that population growth is exponential. The reverse is unfortunately also true. Thus, if a country’s fertility is persistently located under the replacement level (2.1) the population will decrease exponentially (Preston et al, 2001).

[5] In estimating the momentum effect Lutz et al (2003) assumed a zero net migration, with no increases in life expectancy.

[6] Recent Eurostat data support this notion: the average employment rate for people aged 15-24 is 40.5 % compared with 77.2 % among those aged 25-54 (Franco and Jouhette, 2003).

[7] The employment rate for people aged between 55 and 64 is 39.8 % compared with 77.2 % for those aged between 25 and 54 (Franco and Jouhette, 2003).

[8] Data and projections are from Eurostat 1999 revision baseline scenario (source: Eurostat, Luxembourg).

[9] Note that I do not make any adjustment for differential needs or costs that are likely to exist between the two groups in using this measure. For example, government expenditure on education and pensions as a percentage of Spain’s total GDP amounts to 4.5 % and 8 % respectively. The younger age group amounts to approximately 12 million people and the elderly to 6 million. Thus, in terms of per capita tax based transfers the elderly cost more.

[10] More precisely, is the size of the working age population with a taxable income, and is the number of elderly with pension rights. The latter group can be the total elderly population if pensions are universal, or only those who have contributed to pensions in their active life, depending on the system in any particular country.

[11] Even if stable population is achieved the proportion between the old and the working age population can still change as a result of increased life expectancy. The only way to offset the effect of increased life expectancy and still preserve the values of pensions and transfers is by successively rise the retirement age.

[12]approaches zero as government transfers targeting approach the value of . Subsidised childcare, tax exemptions for couples with children, etc, are examples of policies reducing the cost of bringing up children.

[13] See Olsson (1965) and Sandell and Stern (1998) for a more extensive discussion of free-rider problems and individual decision-making.

[14]See Boldrin et al (1999) for a detailed description of this definition of and an economic assessment of r.

[15] To some extent, it can be argued that having more than two children also produce an economic incentive. This incentive is different, however. If we assume that the cost of bringing up three children is higher than bringing up two children, people with three children are worse off. However, since people are obliged to make the same education transfer, regardless of the number of children, the educational cost per child approaches zero as the number of children increases. While this does not imply a free-rider problem, it lowers the average educational transfers and as a result the investment in human capital for all people. Currently, this is not a significant problem since Europe suffers from below-replacement fertility. But, it would pose a problem if fertility rises above the replacement level. Hence, the restriction of the number of children in model 6.