Index

Executive summary – 5

Introduction 7 – 10

1. Summary of selected NRRPs 11 – 12

2. The climate component of NRRPs 13 – 14

2.1. High-impact climate investments 14 – 22

3. Policy instruments and just transition 23 – 24

4. Governance and implementation 25 – 27

5. Conclusions and recommendations 29 – 30

References 31 – 32

Executive summary[*]

The climate component of National Recovery and Resilience Plans (NRRPs) in Germany, France, Italy, Poland and Spain is compared. A sectoral analysis of high-impact climate-positive investments, contributing 40% or more to climate goals according to national governments, is also presented. This policy paper builds on individual country analyses published by the Elcano Royal Institute throughout 2021 and seeks to both provide a high-level overview of future investment opportunities that will make a significant contribution to decarbonising the EU’s largest emitters and to analyse the expected implementation challenges.

The focus on the above Member States is justified as they emit just under 2/3 of GHG emissions in the EU, will receive over 2/3 of the grants from the Recovery and Resilience Facility, just under 3/4 of REACT-EU funds and just under 1/2 of the Just Transition Fund (from the temporary recovery mechanism, Next Generation EU and NGEU). The success in the implementation of Europe’s recovery plan and the extent to which NGEU funds help transform the EU’s economy could arguably have a bearing on whether this temporary recovery mechanism (or variations of it) could be used in the future again, potentially fostering further European integration (De la Porte & Jensen, 2021).

| 1 | Assessment The EU’s top five greenhouse gas emitters have exceeded the requirement of allocating 37% of the NRRPs’ funds to the green transition in their NRRPs.NRRPs can help Member States meet their climate targets while recovering from COVID-19.However, all plans build on the existing policy frameworks and targets and are not expected to lead to increased ambition, except for Spain, which has brought forward its 2025 NECP targets to 2023 (Gobierno de España, 2021).Comparison across recovery plans should be exercised with caution as plans vary greatly in size, data is structured in different ways and plans mix funding instruments. Initially, some NRRPs only included grants (eg, Spain), some included grants and loans (eg, Italy), some included funding from national budgets (eg, Germany, Italy and Poland) and some are part of a larger recovery effort (eg, France). Additionally, climate ‘tagging’ is heterogeneous across NRRPs. |

| 2 | Criticisms Limited ambition (Germany and Italy).Lack of all-encompassing and clear performance targets (Germany and France).Insufficient allocation of funds to strategic areas, low cost-effectiveness, and poor monitoring and evaluation (Italy).There is a need to complement NRRP funding with regulatory changes (France).Limited focus on how to achieve objectives (Spain).Outdated energy strategies to face post-COVID and meet European energy targets (Poland). |

| 3 | Implementation Plans are thought to be feasible.Effectiveness will depend on:The roll-out of specific policies and initiatives in key sectors.Robust governance and project selection mechanisms.Public spending and regulation are the most popular policy instruments, while new carbon pricing initiatives under the NRRP could come at a later stage. |

| 4 | Key challenges The inclusion of concrete goals that will enable ex-post evaluation.The integration of NRRPs and broader climate and energy legislation.Updating legislative frameworks to reflect COVID-19 and Net-Zero targets.Greater definition of the policy instruments to be used.Limited administrative capabilities.Weak governance structures.The capacity to effectively absorb the influx of NGEU funds ahead of 2026.The selection of truly transformative projects.The engagement with sub-national governments and non-state actors.Preventing social and political backlash by ensuring a Just Transition, and explaining and raising awareness of the reforms envisaged in the NRRPs.Energy transition goals require long-term investments after NGEU funds are disbursed. Reflecting on long-term investment needs is arguably required. |

Introduction

The EU agreed on a recovery plan to help EU countries overcome the economic and social impact of the pandemic while laying the foundations ‘for a modern and more sustainable Europe’. The EU’s Multiannual Financial Framework (MFF) 2021-2027 (ie, the EU budget), coupled with Next Generation EU (NGEU)[1] –the largest ever stimulus package funded by the EU–, amount to €1.8 trillion and allocate 30% of funds to climate action. The NGEU’s main instrument, the Recovery and Resilience Facility (RRF), allocates 37% of the funds to investments that support climate action. Funding for the NGEU will be raised in capital markets from 2021 to 2028 and will be repaid from 2027 to 2058.[2]

The centrepiece of the Next Generation EU (€750 billion), the European Recovery and Resilience Facility (RRF), will make €672.5 billion in loans and grants available to support reforms and investments undertaken by Member States. The aim is to mitigate the economic and social impact of the coronavirus pandemic and make European economies and societies more sustainable, resilient and better prepared for the challenges and opportunities of the green and digital transitions.

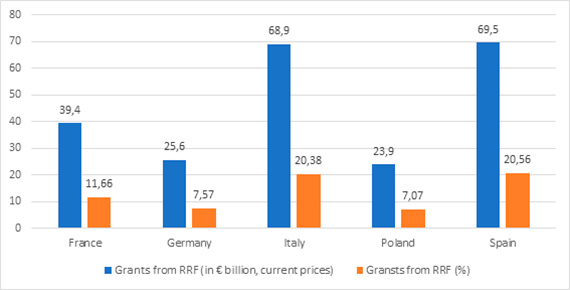

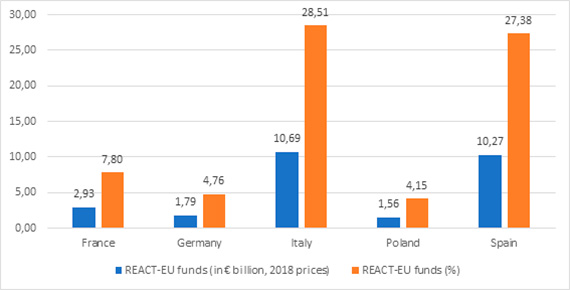

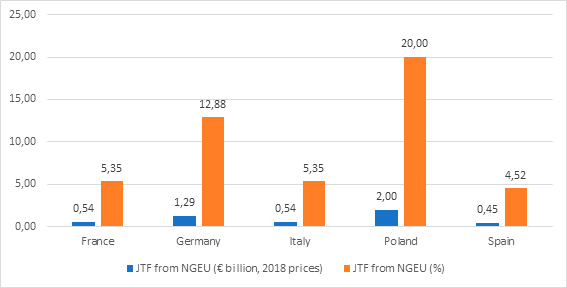

Figures 2, 3 and 4 illustrate the percentage allocation of key recovery funds (grants in the RRF,[3] REACT-EU and the Just Transition Fund) to each of the countries analysed in this policy paper (France, Germany, Italy, Poland and Spain). For the RRF and REACT-EU,[4] Spain and Italy are the main beneficiaries, followed by France, as their economies were significantly affected by COVID-19 in the first phase of the pandemic. For the Just Transition Fund, Poland and Germany are the largest recipients of funds due to their higher reliance on fossil fuels (especially coal) and energy-intensive industries, which means they are comparatively more affected by the low carbon transition.[5] The five Member States analysed will receive over 2/3 of the available grants from the Recovery and Resilience Facility (RRF), just under 3/4 of REACT-EU funds and just under 1/2 of the Just Transition Fund (from the temporary recovery mechanism, Next Generation EU, NGEU).

To access the funds under the Recovery and Resilience Facility, Member States had to prepare National Recovery and Resilience Plans (NRRPs), setting a coherent package of reforms and investments. These reforms were agreed with the European Commission (EC). Disbursements under the RRF will take place until 2023 and investments should be made by 2026. The EU guidelines for the NRRPs require Member States to explain: (1) the extent to which their plans will contribute to achieving climate neutrality and the 2030 energy and climate targets –included in the National Energy and Climate Plans (and updates thereof)–; and (2) how they will respect the 37% climate mainstreaming target and the ‘do no significant harm’ principle (EC, 2021b), in line with the European Green Deal (EC, 2021c).[6]

The European Council has given the green light to the first disbursement of funds to 22 Member States[7] on the basis of their National Recovery and Resilience Plans (NRRPs) (European Council, 2021). The approval of funds comes after the EC provided a positive assessment of these NRRPs, including compliance with the requirement of allocating 37% of investments to climate objectives. The EC’s evaluation of the NRRPs contribution to climate objectives slightly amended (downwards) the climate contribution of some of the investments included in Member States’ NRRPs.

Building on the country analyses undertaken by our colleagues at the Elcano Royal Institute and other think tanks and research institutions across the EU (Berghmans, 2021; Bieliszczuk, 2021; Feás & Steinberg, 2021; Kiefer, 2021; and Leonardi & Bellisai, 2021), this policy paper seeks to provide a comparison of the high-impact climate component of the National Recovery and Resilience Plans of the EU’s ‘big five’ emitters: Germany, France, Italy, Poland and Spain, which jointly amounted to just under 2/3 of GHG emissions in 2018 (Eurostat, 2020). We classify high-impact climate components of NRRPs as those investments that contribute to climate objectives with a ‘climate tag’ 40% according to the national governments of the countries analysed and as reflected in individual country analyses published by the Elcano Royal Institute.

The remainder of this policy paper is structured as follows: section 3 summarises the key elements of selected NRRPs. Section 4 analyses the sectoral focus of the NRRPs’ investments with a significant climate impact (climate tag ≥40% according to member States’ NRRPs). Section 5 discusses policy instruments and just transition elements across selected NRRPs. Governance and implementation are analysed in section 6 and section 7 summarises the main conclusions and provides some preliminary recommendations.

[1] The €750 billion temporary economic recovery instrument designed to help repair the immediate economic and social damage and build a greener, more digital and more resilient society.

[2] The Commission will strive to raise 30% of the funds through the issuance of green bonds.

[3] According to the EC’s regulation 2021/241, ‘70% of grants under the RRF are allocated to MS according to the countries’ population, the inverse of the GDP per capita and the relative unemployment rate of each MS’ between 2015 and 2019 (European Council, 2021). The remaining 30% of grants under the RRF is allocated according to population, the inverse of the GDP and the change in real GDP in 2020 and in 2020-21, which will be reviewed in June 2022 (Official Journal of the EU, 2021).

[4] For allocating REACT-EU funds, the economic and social impact of the crisis on Member States was considered. Analyses included reductions in GDP, increases in unemployment and the relative wealth of countries.

[5] Note that according to the EU, the Just Transition Fund (JTF) under the NGEU (worth €10 billion) allocates resources according to: countries’ GHG emissions, production of peat, production of shale oil, and employment in coal and carbon intensive regions. In order to allocate more funds to less wealthy Member States the differences between average EU Gross National Income (GNI) per capita and GNI per capita in the Member State is also considered. Finally, both an upper and a lower limit are established in the allocation of just transition funds. No Member State can receive more than €2 billion and the minimum amount of JTF resources per person is €6. According to the EC this allocation method will enable all Member States to receive meaningful resources for their transition while concentrating around 2/3 of these resources in the Members States that will face greater transition challenges (EC, 2021d).

[6] Note that Next Generation EU also includes €47.5 billion for Recovery Assistance for Cohesion and the Territories of Europe (REACT-EU). It is a new initiative that maintains and extends the crisis response and the crisis repair measures delivered through the Coronavirus Response Investment Initiative and the Coronavirus Response Investment Initiative Plus.

[7] As of 5 November 2021 the Council has approved the NRRPs of the following countries: Austria, Belgium, Denmark, France, Germany, Greece, Italy, Latvia, Luxembourg, Portugal, Slovakia, Spain, Croatia, Cyprus, Lithuania, Slovenia, the Czech Republic, Ireland, Malta, Estonia, Finland and Romania.

[*] The authors are indebted to Paz Guzmán, Miguel Muñoz, Federico Steinberg, Enrique Feás, Christoph Kiefer, Nicolas Berghmans, Bartosz Bieliszczuk, Matteo Leonardi and Francesca Bellisai for their comments to an early draft of this policy paper in 2021. They would also like to thank the authors of the country analyses and Ines Bouacida for their work in this project and for presenting their results at Elcano’s Energy and Climate Working Group. Any errors and omissions are the sole responsibility of the authors.