After a lean period Spanish companies have returned to acquiring firms abroad, in another sign of the economy’s quickening recovery and increased business confidence.

Generally speaking, companies have refrained from investing abroad since the economy took a nosedive in 2008, and in some cases, such as Telefónica, international assets have been sold in order to reduce debt loads.

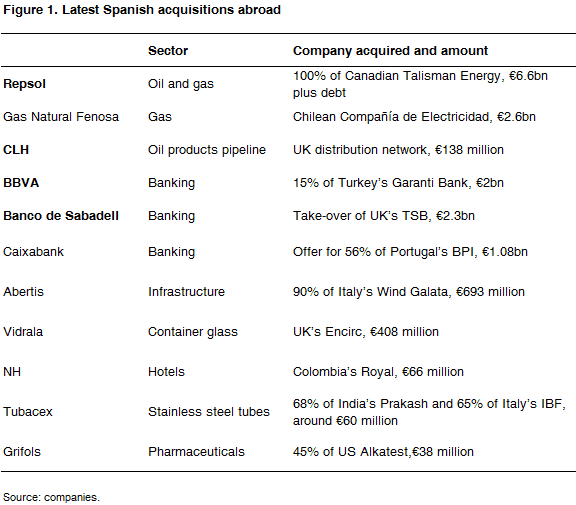

Over the last five months, more than €19 billion of operations have been announced. Repsol has acquired 100% of Canada’s Talisman Energy, BBVA has increased its stake in Turkey’s Garanti Bank from 25% to 40% and this month Banco de Sabadell agreed a take-over of the UK’s TSB and Corporación Logística de Hidrocarburos (CHL) purchased a 2,000 km pipeline network and 16 storage facilties in the UK, to name just a few of the recent big investments (see Figure 1).

Spain’s stock of investment abroad stood at US$643.2 billion at the end of 2013 (47.3% of GDP) and is likely to be higher when UNCTAD announces the 2014 figures. In GDP terms, Spain’s outward stock of investment is much higher than Italy’s (29%) and the same as Germany’s.

Many of the latest operations are growth strategies more than a way to mainly generate cost savings through synergies and economies of scale. In other words, companies have gone on the offensive rather than the defensive, and less so in Latin America, the favoured destiny of Spanish investment until now.

Companies have been helped by interest rates at historically low levels, the abundance of liquidity in the markets and buoyant stock markets with an appetite for those companies financing their purchases by increasing their capital.

The largest acquisition is Repsol’s purchase of Canada’s Talisman Energy, the largest international transaction by a Spanish company in the last five years, which puts the company among the 15 largest privately-owned oil and gas companies in the world. It increases its presence in politically stable countries and reinforcing its upstream business, which has become its growth engine.

North America’s weight in Repsol has increased to almost 50% of the capital employed in exploration. Latin America’s is 22%. The deal followed the US$5 billion compensation Repsol received last year for the nationalisation in 2012 of YPF, its Argentine operation.

The banks Santander and BBVA were among those that led Spain’s first wave of significant corporate expansion abroad some 20 years ago and after a period of consolidating their investments and making some divestments have gone on another shopping spree.

BBVA has raised its stake in Turkey’s Garanti Bank to 40%. Turkey is a fast-growing market and last year contributed 6% of BBVA’s profits.

Santander, the euro zone’s largest bank by market capitalisation, made a non-binding offer this month to buy Novo Banco, Portugal’s third largest lender and created last year from the collapse of Banco Espirito Santo (BES). Santander already controls Santander-Totta, Portugal’s fifth largest bank, which contributed 2% of its profits in 2014.

What is new this time round is that a much smaller bank –Banco de Sabadell– has decided to expand abroad, having attained the critical mass to do so after buying a spate of ailing Spanish banks.

Lloyds Banking Group has agreed to sell its 10% stake in TSB, which was spun off to comply with EU rules on state aid received during the financial crisis, to Sabadell, Spain’s fifth largest bank, and given an undertaking to offload its remaining 40% holding.

Sabadell could target further deals to boost TSB’s challenge to the UK’s ‘big four’ lenders HSBC, Barclays, Lloyds and Royal Bank of Scotland. Santander is the fifth largest player in the UK.

The acquisition by CLH of the UK’s largest oil distribution network is a particularly bold move and the first one into a European country outside Spain. CLH won the auction organised by the British government to buy the Government Pipeline and Storage System (GPSS).

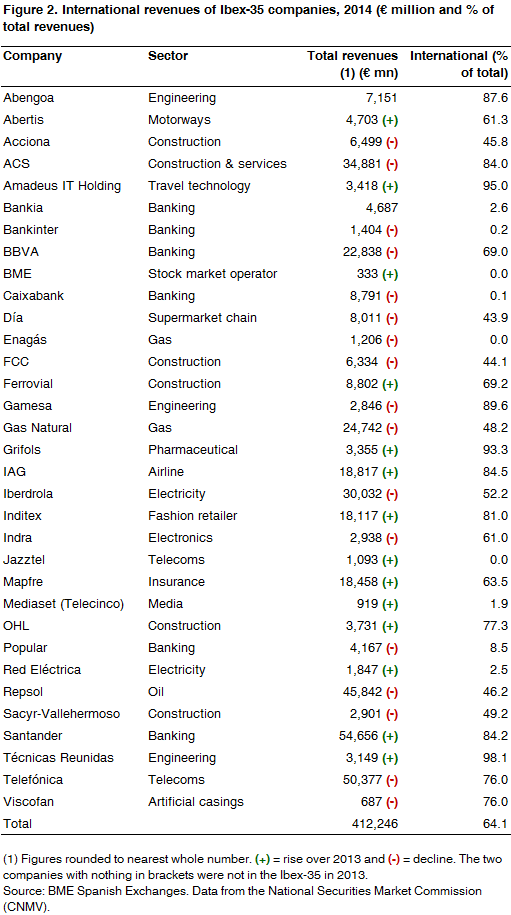

Internationalisation is playing an increasingly important role in corporate Spain. The companies that formed the Ibex-35, the benchmark index of the Madrid stock market, last year generated 64% of their total revenues abroad, slightly up from 2013 (see Figure 2). Fourteen of the 35 companies earned more abroad last year than in 2013.

The total revenues generated abroad were 3.2% lower at €412.24 billion, mainly due to falls at Repsol and Telefónica. Telefónica was hard hit by the Venezuelan crisis and other exceptional costs.

With a domestic market picking up but still weak, internationalisation is becoming increasingly important and can be expected to continue to rise. The large companies have blazed a trail, which others are following, and none more so than Inditex, the world’s largest fashion retailer whose flagship store is Zara. Inditex opened 343 stores in 54 markets in 2014 (44 of them in China and 69 in Russia), bringing the total to 6,683 shops around the world, three times more than a decade ago.