Spanish banks sailed through the latest EU-wide health check, signalling they do not need any more capital. This follows several years of tough adjustments as a result of the near collapse of the financial system in 2012 that triggered a €41 billion bail-out (exited in January).

Spanish banks were excessively exposed to toxic real-estate assets following the bursting of a massive property bubble in 2008. After the bubble burst and Spain went into recession (GDP shrank by around 7.3% between 2008 and 2013), the loan defaults of property developers and construction firms as a percentage of total bank lending to these two sectors surged from a mere 0.6% in 2007 to more than 25%. The total non-performing loan ratio jumped from 0.7% of lending to a record of 13.6% at the end of 2013, and has since begun to decline.

The European Central Bank (ECB) analysed 15 Spanish banks out of a total of 130 euro zone banks (81.6% of assets) in an asset quality review (AQR).[1] The worst performing country was Italy, with nine banks that failed, followed by Greece and Cyprus (three), Belgium and Slovenia (two) and one each for Austria, Portugal, Ireland, Germany, France and Spain.

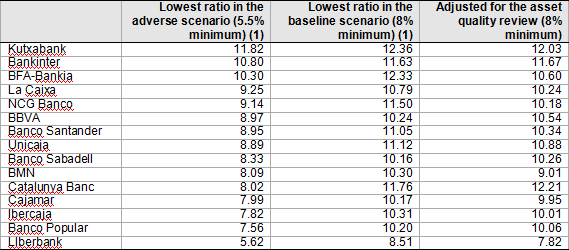

The Spanish bank that failed was Liberbank, but it has already covered its capital shortfall of €32 million (see Figure 1). Five Spanish banks failed in 2011, when different parameters were used by the European Banking Authority (EBA) to those by the ECB in 2014, out of a total of nine

Source: European Central Bank.

In an overlapping review, the EBA released the results of a complementary set of stress tests that showed 24 failures for the whole of the EU, one less than the ECB assessment. Liberbank was excluded because it had taken remedial action. The review was based on banks’ financial health at the end of 2013; Liberbank took subsequent action, increasing its capital by a very comfortable €637 million.

The results vindicated the Bank of Spain’s handling of the crisis. ‘We comfortably passed the test’, said Luis Linde, the Governor of the Bank of Spain. ‘We have comfortable ratios’. He said Spanish banks needed the least adjustment to their balance sheets of the analysed banks (less than 0.2% of their risk-weighted assets). The prudent Linde, however, said there was no cause for triumphalism as the assessment was a ‘fixed photo and not a guarantee for the next 15 years’.

The average reduction of the common equity Tier 1 (CET1) capital ratio for all the banks as a result of the adverse scenario in the stress tests was 3 percentage points, but only 1.4 for Spanish banks.

In a turnaround, the nationalised Bankia, whose collapse triggered the bail-out (it received €19 billion), obtained the third-highest capital ratio in the adverse scenario of 10.30%. It posted a loss of €19 billion in 2012, the biggest ever in Spain’s corporate history. In testimony to a judge overseeing a criminal fraud investigation into Bankia, Miguel Ángel Fernández Ordoñez, the former Governor of the Bank of Spain who stepped down in 2012 before his term expired, said Bankia’s collapse risked forcing Spain out of the euro zone.

The adverse scenario for Spain, which is most unlikely to occur, assumed a fall in GDP of 0.3% this year, -1% in 2015 and growth of only 0.1% in 2016. The economy is forecast to grow by around 1.3% this year, 2.0% in 2015 and 1.8% in 2016. The yield on the 10-year government bond in this scenario was put at a maximum of 5.7% (the current yield is 2.18%). Less than two years ago, at the height of Spain’s crisis when markets were jittery over the country’s prospects, the yield peaked at 7.62%. House prices were envisaged falling by a further 9.9%, having already plummeted by more than 38% on average.

None of the 15 banks examined would be able to withstand another recession like that painted in the adverse scenario and all of them would make a loss in one or all of the years.

Spain’s banking crisis was concentrated in the regionally based and unlisted savings banks, known as cajas, which accounted for around half the loans of the domestic banking system. As they did not have share capital, they were not subject to typical market-discipline mechanisms. The cajas were governed by a general assembly and boards of directors packed with unqualified political appointees, local businessmen and savers. Over the years the large cajas, such as Caja Madrid (since 2010 the main bank in Bankia, the product of a merger of seven ailing cajas), moved on from their humble origins in the 18th century as quasi-charitable institutions to become financial services groups on a par with commercial banks. They also took stakes in companies.

The removal of restrictions in 1989 on establishing branches outside their home regions enabled the cajas to expand around Spain, and they did so at an inexorable pace. The number of savings-bank branches rose from 13,650 in 1990 to a peak of 25,035 in September 2008, while the number of branches of the much more prudent commercial banks, most notably the two big ones, Santander and BBVA, dropped over the same period from 17,075 to 15,617. There was almost one branch for every 1,000 inhabitants in Spain in 2009, almost twice the density of the euro-area average. The number of cajas has since dropped from 45 to just eight.

Reforms have been enacted under the Memorandum of Understanding (MoU) with the European Commission, the European Central Bank and the IMF (known as the troika). Injections of public sector capital, burden-sharing exercises, asset sales, private equity issuance, much tougher requirements for assigning provisions for loans going sour and the requirement for all intervened banks to transfer their foreclosed assets and real-estate loans over a certain amount to the bad bank SAREB, in exchange for government guaranteed SAREB bonds that can be used as collateral for European Central Bank financing, have boosted the banking system’s capital and liquidity.

Banks are also submitting three-year ahead quarterly projections of their balance sheets to the Bank of Spain so there should be no more nasty surprises if all goes well. Another addition to the central bank’s increased supervision weapons are forward-looking exercises (FLEs) on banks to assess their solvency. Unlike the stress tests, which are one-off exercises based on pass-fail methodology, the FLE establishes a permanent framework to help the Bank of Spain regularly monitor banks’ health and guide its supervisory decisions.

Now that the banking sector is firmly back on its feet, the challenge is to boost lending, particularly to small and medium-sized companies. Having been far too lax in granting loans if not irresponsible in some cases, banks have generally gone to the other extreme.

[1] See the following two reports: Aggregate Report on the Comprehensive Assesment and Results of 2014 EU‐wide stress test.