Spanish banks are conquistadores. In the latest drive to conquer banks abroad, Banco de Sabadell has boldly offered €1.7 billion for TSB, the UK retail bank carved out of the ailing Lloyds Banking Group two years ago.

While the much larger Banco Santander and BBVA have become household names in the UK, Brazil and Mexico after acquiring banks in these countries over the last 20 years, Sabadell is much less well known.

Based in Catalonia, Spain’s most economically dynamic region which is pushing for an independent state, Sabadell has doubled in size since 2007 –the year before the bursting of the country’s massive property bubble– as a result of snapping up smaller rivals hit by their overexposure to the real-estate sector, such as Caja de Ahorros del Mediterráneo (CAM) and Banco Gallego. Before the crisis, Sabadell bought Banco Atlántico in 2003 and Banco Urquijo in 2006.

The collapse of various banks in 2012, most notably Bankia, formed from the merger of seven ailing savings banks, forced the government to accept a €42 billion bailout for the financial sector (exited in January 2014).

Sabadell paid just €1 for the savings bank CAM, which gave it more than 1,000 branches and 3 million clients, as well as €5.25 billion in capital from the Spanish government and a promise to bear 80% of any additional losses arising from CAM over the next decade. This purchase catapulted CAM into the top five banks in Spain.

In 2013 it bought Lloyds Banking Group’s retail and private banking business in Spain and local investment management business. Under this deal, Lloyds took a 1.8% stake in Sabadell.

Sabadell also ventured abroad, acquiring TransAtlantic Bank, Mellon United National Bank and JGB Bank in Miami, but nothing on the scale of its bid to enter the highly competitive UK retail banking market.

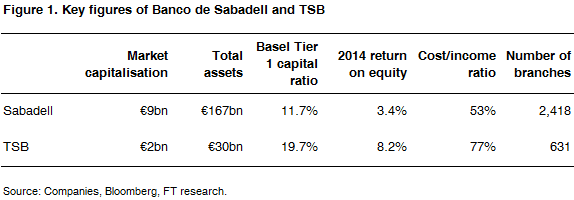

TSB is smaller and more specialised than Sabadell, but better capitalised and more profitable (see Figure 1). The European Commission forced Lloyds to sell 600-odd branches as a condition of its 2008 bailout. The Co-operative Bank was originally going to buy them, but the deal was cancelled and these branches then formed the stand-alone TSB.

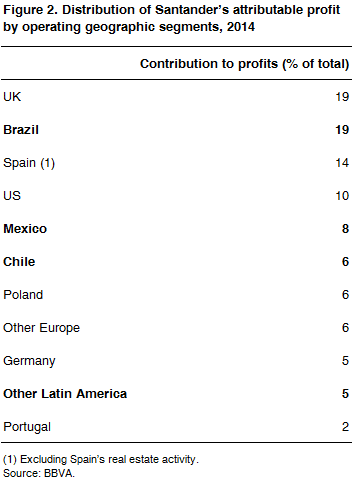

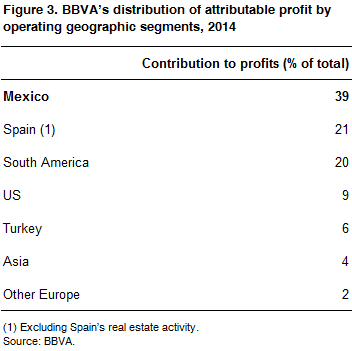

Sabadell, unlike Santander, the euro zone’s largest bank by market capitalisation, and BBVA, currently earns a small share of its profits (8%) from its international business. Latin America generated 38% of Santander’s total profits in 2014 and Mexico provided 39% of BBVA’s (see Figures 2 and 3).

Vince Cable, the UK Business Secretary, welcomed Sabadell’s offer, saying the deal could provide a much-needed boost to small business lending, an area that Santander is pushing. Lloyds, which still owns half of TSB, also indicated its approval, suggesting that Sabadell’s bid will go through unless other bids are made.

Sabadell is prepared to offer 340p per share, a handsome price for TSB shareholders, particularly those who bought at last June’s 260p initial public offering, but costly for Sabadell shareholders.

Spain’s international expansion began in earnest during the late 1980s, starting with Latin America, where today Santander and BBVA are major players. The region’s banking underdevelopment, attractive margins, high potential rates of return and improved supervisory and regulatory systems in an environment of liberalisation opened up the kind of business opportunities that had existed in Spain 20 years before the expansion abroad. In addition, there was a shared language and cultural affinities.

Acquisitions in Latin America were followed by purchases in the US, the UK, Germany and China, among other countries.

Santander’s US operation –it has fully owned Sovereign Bank since 2008 (rebranded as Santander Bank in 2013)– took a knock earlier this month when the Federal Reserve vetoed its capital plans after finding serious deficiencies in capital planning and risk management. This was the second year running that Santander failed the test known as the Comprehensive Capital Analysis and Review.

Failing the test, which is designed to assess whether lenders can withstand another financial crisis, prevents the US entities of foreign banks from distributing capital to their parent companies. Santander, however, was not prevented from paying dividends.

Spain’s depressed banking market is picking up. Banks sailed through the health test imposed on them last year by the European Central Bank and the European Banking Authority.

Santander more than doubled its profit in Spain to €1.12 billion, driven by a lower cost of funds, reduced costs and a fall in provisions from the credit risk improvement. Lending grew for the first time since 2008.

Sabadell has outperformed Santander and BBVA in recent years on their home turf as it is thinly diversified. This will change with the purchase of TSB. Only time will tell whether it made the right move or over stretched itself.