Spain’s accelerating economic recovery is finally feeding through to job creation. In the 12 months between June 2013 and 2014, 192,400 jobs were created – the first year-on-year rise since 2008 when the economic crisis ended a 13-year period of strong growth and the country went into five years of decline after the bursting of a debt-fuelled property bubble.

The number of unemployed fell from 5.9 million in March to 5.6 million in June, the lowest since the fourth quarter of 2011, while the jobless rate dropped from 25.9% to 24.5%, the largest fall in a single quarter in the labour market series. Encouragingly, the drop occurred despite an increase in the labour force. This suggests that an upward trend in employment is taking hold and that the improvement is not just a statistical one.

The turnaround in the labour market came a day after the Bank of Spain upgraded its GDP growth forecast for 2014 from 1.2% to 1.3% and from 1.7% to 2.0% for next year. The economy grew by 0.5% in the second quarter. This was the fourth consecutive quarterly rise and the first positive growth for a 12-month period in six years. The number of households where no member is working declined by 145,000 to 1.8 million.

All of this was good news for the government, which has stuck to its guns of persisting with austerity measures and reforms, and it wasted no time in trumpeting the results. The Ibex-35 benchmark index of the Madrid stock market rose 1.6% on Thursday

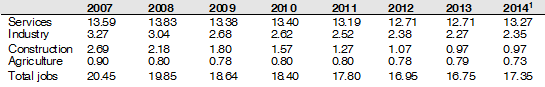

The number of jobholders stood at 17.3 million at the end of June, 402,400 more than in the first quarter and the largest increase since the second quarter of 2005. The great bulk of the rise in employment was due to the service sector – 263,800 more jobs in the last 12 months compared to a fall of 55,200 in construction and 13,800 in agriculture. Most of the new jobs in services were in tourism and related sectors as Spain is enjoying another bumper year in foreign visitors. They are thus seasonal jobs and not permanent ones.

Also, 53% of the 304,400 rise in salaried workers are on temporary contracts. The proportion of jobholders on these contracts rose by 0.8 p.p. to almost 24%, much higher than the EU average but well below the 32% at the height of Spain’s boom period.

The IMF’s latest report on Spain, issued earlier this month, forecasts that the jobless rate will still be 20% in 2018, despite labour market reforms in 2012 which lowered dismissal costs and gave companies the upper hand, depending on their financial health, in collective wage bargaining agreements. The greater flexibility has apparently reduced the GDP growth threshold for net job creation from around 2% to 1.3% (the rate at which the economy is projected to grow this year).

There is an even longer way to go before recovering the pre-crisis jobless rate of 8% that existed during the economic boom years, which was regarded as full employment in Spain since companies had difficulties filling posts, but which could be regarded as an unacceptably high by UK and US standards.

To do this, the number of unemployed has to be reduced by around 4.5 million. In order to reach the structural unemployment rate of the last 30 years (14%), unemployment has to be cut by more than 3 million. Growth in itself is not sufficient to reduce Spain’s unemployment, due to its composition: 61% are long-term jobless; 42% over the age of 45; 55% have not completed their advanced secondary education; 15% are under the age of 25 and have no work experience.

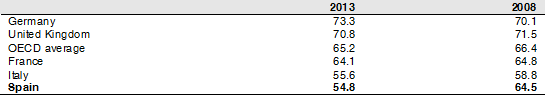

The dramatic situation is also highlighted by the sharp drop in Spain’s employment rate – persons with a job as a percentage of the population of working age (15- 64 years). It plummeted from 64.5% in 2008 to 54.8% in 2013 compared to a drop of just 1.2 percentage points in the OECD average (see Figure 1).

An important factor behind the dysfunctional labour market is the lopsided economic model, excessively based on bricks and mortar. The number of construction workers dropped from 2.7 million in 2007 to 979,000 in June 2014 (see Figure 2). Many of the construction workers who have lost their jobs left school at 16 and are poorly qualified.

The economy is slowly being rebalanced through greater exports but it remains to be seen whether the success of the last few years is here to stay or whether it will disappear once ‘normal’ GDP growth rates are restored and the domestic market picks up. Traditionally, the Spanish economy has been driven by domestic and not external demand.

Another element that tends to be overlooked when getting one’s head around the scale of Spain’s unemployment is the influx of immigrants, which has swelled the labour force. The number of foreigners in Spain rose from 900,000 in 1995 to 4.6 million at the beginning of 2014 (excluding naturalized Spaniards), according to the latest count. The jobless rate of foreigners at the end of June was 34.1% (37.7% in March), compared to a rate of 23.1% for Spaniards.

The number of foreigners remained pretty constant at 5.7 million between 2009 and 2011, as people hung in, and then the number dropped to 5.5 million in 2012. This caused Spain’s total population to fall for the first time since the regular census started in 1996, and it fell further to 4.6 million in 2013 (10% of the total population, down from a peak of 12.2% in 2010). This exodus is easing the pressure for jobs.

Spain faces a long and winding road to jobs recovery, but at least it has now started.