Spain is blighted by a jobless rate that is still more than 24% six years after the economy took a nosedive, triggered by the popping of its debt-fuelled and massive real-estate bubble. According to the Consejo Empresarial para la Competitividad (CEC), which comprises the country’s corporate titans, it is possible to cut the rate to below 15% as of 2018 if very ambitious structural reforms are enacted.[1]

All international institutions, such as the OECD, the IMF and the European Commission, forecast the unemployment rate remaining at 20% or more until 2018.

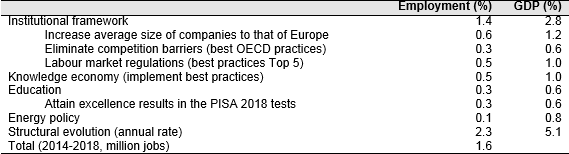

The CEC says the unemployment rate would drop to only 21.2% in 2018 as a result of the ‘inertia of the economic cycle’ and maintaining the reforms already in place. This would create some 750,000 new jobs, the CEC calculates. But if its recipe were to be followed, 2.3 million jobs could be created, lowering the unemployment rate to 14.2%, and without abandoning Spain’s fiscal commitments with Brussels. Structural reforms would be responsible for two-thirds of the 10 pp drop in the jobless rate.

The CEC’s plan consists of reforms in the institutional framework, knowledge economy, education and energy policy (see Figure 1).

The average number of employees in Spanish companies is less than half that of the UK and Germany. Of the close to 3 million companies in Spain, only 24,000 have more than 50 workers and 3,800 more than 250. Larger companies tend to be more productive, competitive and tend to seek foreign markets and hence employ more people.

In the institutional area, a driving force of employment would be to greatly improve Spain’s position in the closely watched World Bank’s Doing Business ranking by cutting red tape to an absolute minimum (ie, just the paying of taxes). This is already happening and sending a positive signal to foreign investors. Spain rose from 115th in the 2014 ranking out of 189 countries for ease of starting a business (142nd in 2013) to 74th in the recently released 2015 ranking.

Spain’s exports have increased notably in the last six years, and this progress needs to be sustained when, as is beginning to happen, domestic demand bounces back and imports are sucked in.

In education, Spain has big problems, particularly the still very high early school leaving rate of 25% and the even more worrying level of those between 16 and 24 who are not in education, employment or training NEETs). Overall, only 22% of Spain’s adult population studied up to higher secondary education compared with a 44% average for OECD countries. It is hard to see how Spain can create a much more knowledge-based economy in such a situation or meet the CEC’s objective of boosting R&D spending from the current low level of 1.3% of GDP to 3% (Denmark’s rate today).

The government’s 2012 labour market reforms are beginning to impact job creation, but the great majority of new jobs are temporary, sometimes with very few hours, and in the service sector (mainly tourism and hence seasonal). The yawning gap between insiders (on permanent contracts) and outsiders (on temporary contracts) needs to be reduced, but how remains to be seen.

Also, long-term unemployment (more than two years) remains very high. Spain has the highest share (20% in 2013) among OECD countries of unemployed people between the ages of 55 and 64.

Important areas to finally get to grips with are tax and labour fraud. Spain’s black economy is estimated at 23% of GDP (15% in Germany and France), the equivalent of 4 million jobs on the assumption that the informal economy has the same productivity as the formal one. This deprives the state’s coffers of between €60 billion and €80 billion a year (equivalent to 70% of the spending on public health).

Successive governments in Spain have been too tolerant of the black economy, or have turned a blind eye. In times of crisis, such as now, the informal economy acts as a cushion, which understandably the authorities are reluctant to crack down on, but even when the going has been good, the informal sector has not been tackled.

The large informal sector helps to explain why Spain’s tax receipts represent only 37.2% of GDP compared with an average of 44.2% for 12 euro countries, even though the county’s tax rates are amongst the highest.

The CEC’s reforms are concentrated on the supply side. They would improve the growth potential, but the problem at the moment is not a lack of productive capacity; indeed, a lot of it is idle because of a lack of demand due to depressed consumption.

The reforms sound feasible on paper, but politically speaking are wishful thinking. However, this does not denigrate their value. Only the Popular Party (PP) might have the courage to implement an agenda much more ambitious than its own programme of reforms, but all opinion polls show it most unlikely to be re-elected with a majority in 2015.

The Socialists (PSOE) have rejected the plan and for Podemos –the radical populist movement that stunned the political class by winning five seats in last May’s European election (with 1.2 million votes) and is forecast to do very well in next year’s general election– the CEC’s measures represent all that it stands against.

Nevertheless, the ambitious scope of the plan deserves to start a more serious debate on how to cut Spain’s unemployment more quickly. Resigning oneself to the gravity of the problem in the presumption that the country will always be able to withstand such a high jobless rate, as has been the case so far, is not an option.

[1] The full report is available at http://www.iefamiliar.com/web/es/consejo2.html and only in Spanish.