When I bought a second home in Buendía, a Spanish village in Castilla La Mancha, in 1976, there was no running water (it had to be collected in large containers from a spring), the streets were unpaved, the primary school was rundown, phone calls were made in a cabin near the town hall via an operator who was the daughter of one of the bar owners, and almost every time there was a thunderstorm the electricity went off. Most of the impoverished villagers worked the land or were in construction. I will never forget walking in one of the streets and seeing someone plucking a sparrow, which I assumed he would cook.

For many years now, there is running water for the 408 residents, all the streets are paved, there is an automatic telephone exchange (fiber internet is being installed), a modern primary school and a health centre. Many of the villagers drive smart cars.

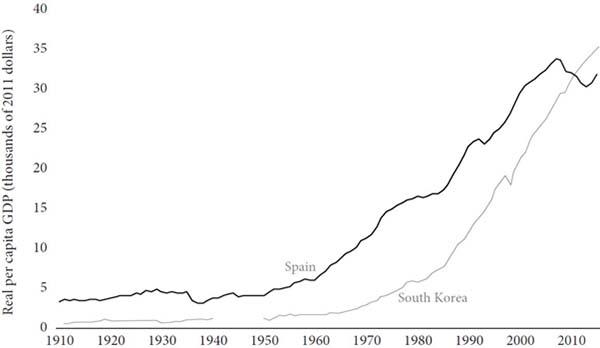

Anyone who has been following Spain over the last 50 years or so cannot but be amazed at how infinitely more prosperous the country has become. It is one of very few nations, along with South Korea, that has successfully transitioned from middle-income (per capita GNI of $1,036 to $12,535) to high-income status (see Figure 1). The latest figure for Spain’s per capita GNI is $30,330 (2019).

Of over hundred middle-income countries in 1960 only a dozen had become high-income by the turn of the century. Most have remained stuck in the middle-income trap. How Spain managed not to do this, seemingly against all the odds, is well told by Oscar Calvo-González, a Spanish economist at the World Bank, in his enlightening book Unexpected Prosperity (OUP) published next month.

The path to prosperity began long before Spain joined the EEC in 1986, which brought the country bountiful structural and cohesion funds, and it was much more than a bounce back from the devastating 1936-39 Civil War. Spain did not recover its pre-war level of economic output until 1953. The 1940s were years of hunger, autarky and ostracism by the international community because Franco had taken the side of the Axis powers.

The brutally repressive dictatorship, consolidated by the US as of the 1953 military bases agreement, gave Spain stability. Washington’s embrace of Franco during the Cold War was psychologically important, though it provided little financial assistance. The peace (a ‘peace of the cemeteries’ for the exiled political opposition) enabled long-term planning, encouraged gross capital formation to take off and made macroeconomic management predictable.

This is not a justification of that regime, but we should not forget that Spain suffered 53 coups between 1812 and 1935, seven constitutions and three civil wars. By the time Franco assumed the position of head of government in 1938, there had been 145 heads in the previous 100 years. Peace is one of the prerequisites for prosperity recognised by Adam Smith, along with a tolerable administration of justice and easy taxes.

Between 1950 and 1980, when the foundations of prosperity were laid, Spain’s real per capita income quadrupled –for comparison, it had taken the entire previous century to double. Per capita income went from 27% to 57% of that in the US during these 30 years. Spain caught up with both the US and the UK in infant mortality rates, and rapid urbanization was managed, largely without the by-product of the slums that are common in many middle-income countries today.

Political stability alone does not explain Spain’s take-off. An important factor was that both the public and private sectors drove investment, and not just the former, as in the case of communist countries. The rate at which new private companies were created, which had averaged around 1,400 a year in the first half of the 20th century, tripled to 4,500 in the 1960s. Taking into account the significant population growth, particularly in the 1950s and 1960s, fuelled by the baby boom that followed the Second World War, the creation of new firms rose from six per 100,000 population to 14 during this period.

Tourism, which has played such a key role in the economy, was largely private-sector led. The number of visitors skyrocketed, from less than half a million in 1950 to over 20 million a year by 1970 (83.5 million in 2019). Spain’s share of the global market of tourism rose from less than 2% to over 12% during those two decades.

The 1959 Stabilization Plan was key. Multiple exchange rates were abolished, the peseta heavily devalued, wages frozen, and some of the trade in private hands was liberalized. The peseta became convertible with major currencies. Restrictions on foreign direct investment were eased and economic policy became export-oriented. These and other reforms achieved a wrenching turnaround in economic policymaking, from 20 years of autarkic and statist orientation to a more open and market-friendly one, and, argues Calvo-González, were driven more by political stability than economic instability, which is not usually the case.

The growth dividend from better economic policies was large. Calvo-González says they accounted for much of the increase in per capita growth over the next 15 years. ‘Spain proves the case that there can be high returns from getting policies right, or more precisely, from correcting bad policy mistakes.’ Trade openness more than tripled between the 1940s and the 1960s to 17% of GDP.

Unemployment, however, remained high in the 1960s, forcing people to emigrate (some 1.5 million Spaniards sought work in Germany, France, Switzerland, and other European countries) at a fortunate time when the rest of Europe was expanding. Buendía’s population peaked at almost 1,900 in 1950 when villagers began to migrate within Spain or emigrate. By 1970, 3.3 million Spaniards were estimated to be living abroad, the equivalent of one-quarter of the working population in Spain at that time. It is interesting to speculate what might have happened to the political stability much vaunted by Franco if this ‘safety valve’ had not existed.

The book deserves to become one of the standard texts on Spain’s economic transformation.