Existing tax rules were not designed for the new digital economy or for the business models that are being established. Many companies are digital or conduct a major part of their business in the digital sphere. Nine out of the world’s 20 largest companies by market capitalisation are digital, compared with one just 10 years ago. They often generate business and profits without any physical presence, because this is no longer essential (although it is essential for part of the online market, because people still have to eat, dress and move around, among other things). The users themselves generate value for digital companies, in exchange for theoretically free services, which usually elude traditional taxation. Adaptation is in order. States need to do it. The EU has tried, albeit in a provisional way, and failed, shackled by the rule of unanimity in these matters and the fiscal rivalry that exists between its member states.

The EU has not only missed a chance to adapt its taxation system to the 21st century, so far the century of digitalisation, but also to lay down global standards in this area, something that now falls to the Organisation for Economic Development and Cooperation (OECD) and the G20. Four countries (Denmark, Finland and Sweden, led by Ireland) have availed themselves of the EU’s unanimity rule to veto even a watered-down proposal on the issue. This is because their tax regimes are highly advantageous to many companies that operate within their shores, and out of fear of US reprisals, even if Trump is toying with the idea of levying new taxes on the digital giants.

According to the European Commission, which one year ago suggested a heavily Paris-inspired proposal to tax firms’ ‘digital presence’, the average tax rate levied on digital profits in the EU is 9.5%, as opposed to 23.2% for traditional profits. There is also the matter, in terms of the losses suffered by states, of where VAT is paid (usually Ireland or Luxembourg, although the latter was not under discussion). It is not a case of combatting fraud, but rather tax avoidance, in order to create a system that is fair and efficient, needed by states that are short of finances.

The European Commission proposed a 3% levy on what digital platforms earn through advertising and data sales (the latter was dropped, but will continue being crucial). It would apply only to large digital firms with annual income of at least €7 million in the state in question, €750 million in the world and €50 million in the EU, 100,000 users and 3,000 contracts for digital services. It was a proposal clearly aimed at Google and Facebook, hence the ‘Google tax’ soubriquet (the official name is ‘corporate taxation of a significant digital presence’). The Commission calculates that member states would collect an annual total of €5 billion. It would be a case of taxing at the point products and services are consumed, not where they are created or generate value. It focuses on volumes rather than on profits, which states find more elusive in the digital era.

The proposal had been gaining support, and relatively quickly by EU standards. The larger member states were in agreement, including essentially export-led countries such as Germany and the Netherlands, and jealous protectors of their national systems, like Luxembourg and Austria. It was a case of something limited and temporary, until such time as an OECD proposal should come to fruition. It was just a start, as everyone knew, including the countries that scuppered it. A tax on social media platforms, on e-commerce and on the data users generate and are subsequently monetised was set to follow (something that will also end up changing).

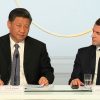

France is pressing ahead with its own Google tax. ‘We want to create the tax of the 21st century’, the Finance Minister, Bruno Le Maire, declared. Germany is looking at it. The Conservative government in the UK has also proposed a 2% Digital Service Tax for 2020, to be levied on search engines, social media and online sales, only applicable to profit-making companies so as not to harm start-ups. In Spain, the new tax on digital services has been side-lined by the calling of elections, but it will probably return in one guise or another. Again, for the time being at least, these are European but not EU solutions, which could fragment and complicate the European market. According to its Finance Minister, Olaf Scholz, who thereby broke a taboo, Germany is now prepared to abandon the unanimity rule in the EU for these financial issues. But of course, unanimity is required to renounce unanimity, so power over the padlock remains in the hands of the reluctant.

The EU is not giving up yet. The European Commission is hanging on to its proposal, which it will put forward again if the OECD fails to come up with a consensus plan by the middle of 2020. Business models evolve more rapidly than taxation systems, and even countries. Preventing tax dodging is something that is in the interest of many, including developing countries, possibly more so. Because at a time when welfare systems are growing all over the world, particularly in East Asia and Latin America, states need to enlarge, certainly not shrink, their income streams. The solution will have to be global, or almost. Europe may have served as a catalyst.