Theme

This analysis of energy relations between Latin America and the EU pays particular attention to their potential and limitations.

Summary

This paper highlights some of the opportunities for diversification that Latin America offers the EU, the areas of the energy transition in which the two regions complement each other, and the potential for cooperation on hydrogen and transition minerals. It also discusses the barriers to cooperation created by energy and political fragmentation in the region and the lack of regulatory convergence.

Analysis

The ecological transition is rapidly re-shaping energy relations between the EU and Latin America, with a direct impact on bilateral trade, investment and value chain integration. While Latin American hydrocarbon exports have shown limited room for growth during the current energy crisis, cooperation on decarbonisation appears much more promising. Latin America’s renewable resources, the policies adopted by certain countries and the presence of European businesses make the region a natural partner for the EU in the energy transition. This complementarity is also tangible in the new value chains emerging from the transition and the expansion of renewables, from low-carbon hydrogen through to transition minerals. The greatest potential for hydrogen appears to lie in investment and in industrial and technological cooperation, as opposed to transatlantic trade. On mining, the EU remains in the shadow of China and needs to find a new narrative that incorporates elements of industrialisation, friend shoring and bi-regional integration of value chains.

The new cycle of elections in Latin America has brought a number of left-wing and progressive Presidents to power. While there is talk of a new shift to the left –the so-called ‘pink tide’–, this phenomenon also reflects the voters’ desire to punish ruling parties. Nonetheless, the current outlook may prove more favourable for energy and climate, despite political differences and varying levels of climate ambition. However, if the trend of renegotiating contracts and (re)nationalisation continues, it could have a chilling effect on European investment in renewables, low-carbon hydrogen and grids.

Latin American energy integration remains frozen, marred by two decades of mistrust and interruptions to regional projects, with limited room for cooperation at the multilateral level with the EU.

The energy crisis triggered by Russia’s invasion of Ukraine has revealed the costs of failing to invest in the integration of the European gas and electricity markets. The lack of interconnections has restricted the contribution of renewable capacity and gas from the Iberian Peninsula to energy security. The EU’s mistakes in this area illustrate the new strategic importance of regional integration in the energy transition: an integrated framework, both at the physical and regulatory levels, can deliver gains in efficiency, speed and security.

This analysis explores some of the opportunities for diversification Latin America presents to the EU. It analyses the main areas of bi-regional complementarity when it comes to the energy transition, highlighting the potential to revitalise and intensify energy relations. It also discusses two areas of cooperation: hydrogen and transition minerals. Lastly, it will examine three recurring barriers to cooperation: the fragmentation of energy policies in Latin America, the lack of a plan for integration in the region and the threat of green protectionism in the EU in the absence of regulatory convergence.

(1) Diversification

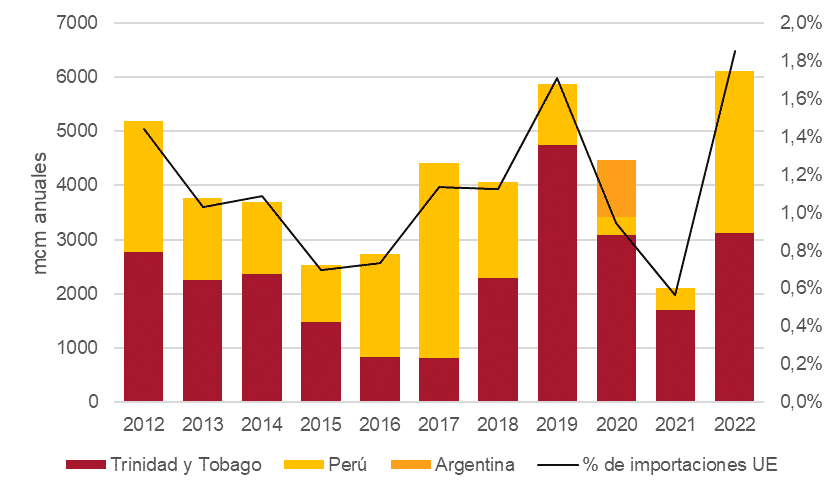

The Russian invasion and the diversification efforts of EU Member States have coincided with the relative exhaustion of fossil-fuel relations with Latin America. Guaranteeing the supply of natural gas over the coming winters remains the priority for European capitals. However, Latin America’s liquefied natural gas (LNG) market remains underdeveloped and is primarily geared towards US seasonal imports during demand peaks in the winter. Given the technical complexity and investment requirements of exporting LNG, only Peru and Trinidad and Tobago have infrastructure and production capacity to supply the European market (Figure 1).

Perú LNG, the consortium responsible for gas exports, has increased LNG shipments to Europe by 75% since the start of the Russian invasion, redirecting trade bound for the Asia-Pacific region and Mexico. The production of natural gas by Trinidad and Tobago has been falling since 2010. This led to negotiations with Washington to authorise the Treasury to reactivate the project to export Venezuelan natural gas through its spare LNG infrastructure.[1] The Southern Cone of Latin America, which is home to the only example of operational gas interconnections, has better relative conditions for substantial exports in the medium term. However, this will require a regulatory framework that attracts the foreign investment needed to tap the unconventional gas reserves of Santos in Brazil and Vaca Muerta in Argentina. Yet even under the most optimistic timescales, integration with the EU’s immediate plans for energy diversification will not be possible. It seems more likely that these resources will be used to meet Latin American demand with sporadic exports to Europe during summer in the southern hemisphere.

Figure 1. EU imports of LNG from Latin America (2012-22) (million cubic metres a year and % of total)

There have been other attempts at diversification. Colombian thermal coal, whose share of the German and Polish export markets has been dwindling for a decade against the higher-quality coal of Siberia, has seen a revival in Europe, with exports doubling in 2022. The embargo on Russian coal has breathed new life into a trade relationship Bogota and Brussels believed to be winding down, while also exposing a certain inconsistency in Europe’s climate narrative. The agreement between Iván Duque and Olaf Scholz to increase volumes of Colombian coal, including from El Cerrejón (the largest open-pit mine on the continent), has raised eyebrows on both sides of the Atlantic. The election of the anti-extractivist duo Gustavo Petro and Francia Márquez has not halted the agreement, which remains in place after tax reforms that saw an extra 10% levied on exports. The agreement appears to have reactivated development cooperation channels and in July 2022 a loan of €200 million was awarded by Germany’s Federal Ministry of Economic Cooperation and Development (BMZ) to accelerate the development of renewable projects in Colombia. Berlin is seeking to export its way out of the energy crisis, using coal as a stop-gap measure but accelerating the transition in the medium and long terms, seizing the opportunity created by the emergency to shape new structural dynamics.

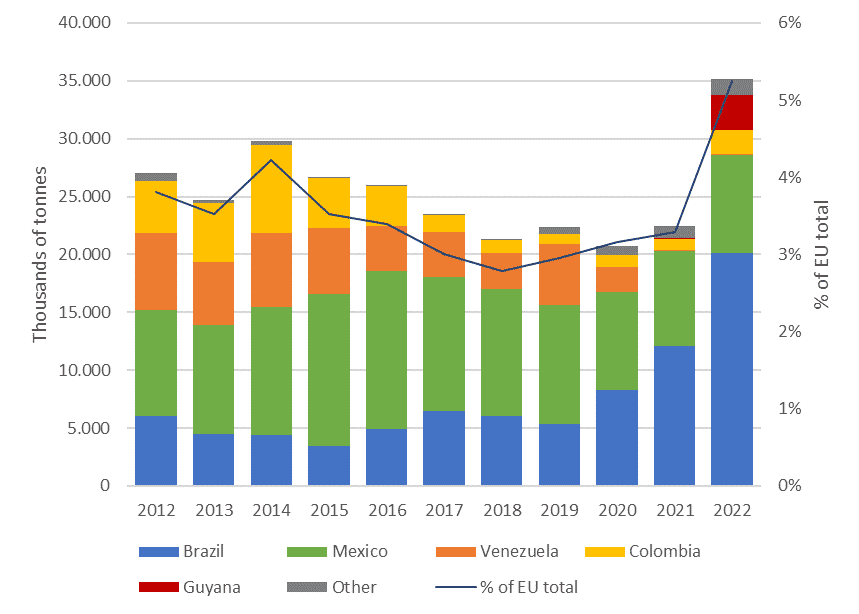

Latin American oil exports to Europe have undergone a similar shift, making a modest contribution to European energy security (Figure 2). The volume of Brazilian crude being shipped to European ports has increased substantially since February 2022 and its share has risen to 3%, compared with 1.9% in 2021. Similarly, Guyana began exporting to Europe in the third quarter of 2022, thanks to its new Liza mega-field. The Biden Administration’s authorisation to restart Venezuelan oil exports in response to rising prices has reactivated shipments to European refineries as payment of PDVSA’s debt to companies present in the country. However, this does not appear to represent a substantial change to Venezuela’s oil sector, which remains dependent on Iranian and Russian technical assistance to evade US sanctions. Complementarity between the EU and Latin America has been limited when it comes to the trade in petroleum products. Both are net importers of diesel and the decoupling of the European energy market from Russia has fuelled competition to secure US imports.

Figure 2. EU crude imports from Latin America in thousands of tonnes and % of total (2012-22)

In contrast to other traditional export regions, the energy crisis and high hydrocarbon prices do not appear to be driving a resurgence in European interest for Latin American fossil resources. Unlike in the Persian Gulf (with the exception of Iran), the Mediterranean neighbourhood and Africa, there has not been an uptick in visits from European leaders. For a decade now, European investment has been moving towards niche unconventional hydrocarbon exploration and production activities (Brazil’s pre-salt reserves, Guyana’s deep-water reserves and, to a lesser extent, Argentina’s Vaca Muerta shale reserves). This stands in contrast to the crisis that has gripped Venezuelan oil and the slow and consistent decline of production in Ecuador, Colombia and Mexico, where the business climate is less attractive to foreign investment. Similarly, the EU’s role as a major investor in hydrocarbon exploration and production is constrained by the ambitious 2050 decarbonisation strategies of the main oil companies present in the region (Repsol, BP, Total, ENI and Shell). Decarbonisation has come with a preference for natural gas, which is less abundant in the region than oil but whose consumption horizon and social acceptance are better aligned with corporate strategies.

In short, Latin America will make a modest but not insignificant contribution to European efforts to diversify away from Russian fossil imports. In contrast, cooperation on the energy transition appears more promising and of greater strategic value.

(2) Partners in the energy transition

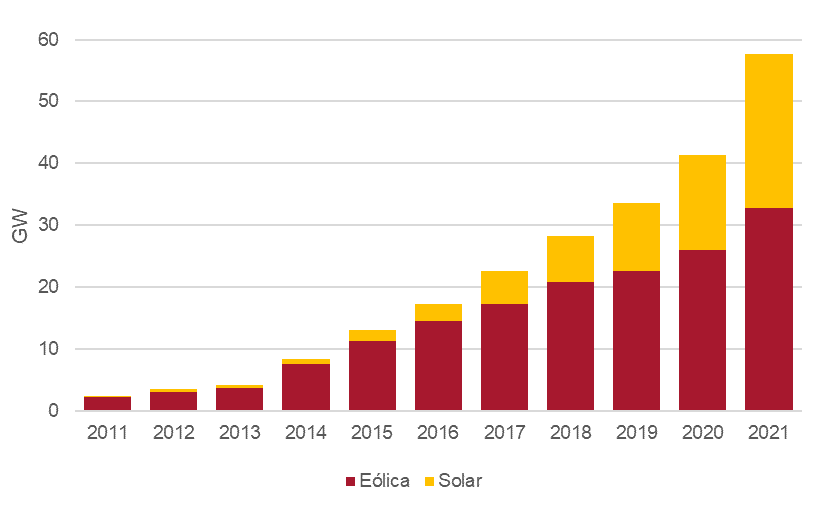

Latin America is one of the regions with the greatest potential for developing the external dimension of the European Green Deal. Since 2011 foreign direct investment (FDI) in renewables projects in Latin America has consistently outstripped investment in hydrocarbons. European companies have driven this trend, making up 75% of FDI in renewable energies, with Spanish, Italian and French electricity companies playing a key role. European FDI has been characterised by high labour, social and environmental standards and the level of technology transfer (eg, wind turbine manufacturing plants in Mexico and Brazil) in contrast to other investors like China and the US. Since 2012 the decline in the profitability of new renewables projects in the EU after the financial crisis has resulted in inflows of European capital that have dynamised the sector in Latin America (Figure 3).

These low-carbon investments have replaced the investments two decades ago in the oil sector, which has suffered a wave of nationalisations and contract renegotiations in Ecuador, Venezuela, Bolivia and Argentina.

This presence is also linked to development cooperation with a growing climate and energy component as part of the EU’s multiannual financial framework for 2021-27 and projects such as Euroclima+. Tools include the new Global Europe instrument, the European Fund for Sustainable Development Plus (EFSD+) and the Global Gateway initiative, all of which aim to drive European investment in sustainable infrastructure at the same time as promoting convergence on regulatory and legal frameworks.

Figure 3. Cumulative installed wind and solar capacity in Latin America (2011-21) in GW

European investment in renewables is concentrated on the most stable markets: Chile, Brazil, Mexico and Colombia. Recent tensions between European electricity firms and the Mexican government, in which the latter has been accused of reforming the regulatory framework to favour the state-owned company CFE, set a worrying precedent for the stability of investment in renewables, which until recently had escaped the nationalist impulses historically associated with hydrocarbons and mining in Latin America. Mexico was the region’s biggest recipient of FDI in renewables during the 2010s and has been used as a stepping stone for expansion into other Latin American markets. The freeze on European investment in the country could have serious implications for the region’s credibility as an investment destination, especially against the current backdrop of predominantly left-wing governments. Latin America is now competing in a less favourable climate for international investment, which, together with rising interest rates, NextGenerationEU and the US Inflation Reduction Act (IRA), could see investment in renewables drain from Latin American markets.

However, the pro-renewables policies of some countries make Latin America a natural partner for the EU in the energy transition. The region’s leading countries for renewables have developed a regulatory framework that is closer to the EU than other regions. Chile, Brazil and Colombia all have market-oriented energy policies, albeit with some nuances when it comes to state intervention and national preference. Attitudes towards foreign investment, which is key to developing the renewables sector, vary between countries and in some cases have resulted in inconsistencies in policy making. The attraction of foreign investment and attitudes towards globalisation are important because Latin America’s integration with the rest of the world benefits the roll-out of renewables and public policy and institutional frameworks play a key role.[2] According to BloombergNEF’s Climatescope 2022, Latin America offers some of the most attractive emerging markets for investment in renewables: Chile comes first out of the 108 countries, followed by Colombia (fourth), Brazil (ninth), Peru (15th), Argentina (17th), the Dominican Republic (22nd) and Panama (29th). Mexico (63rd), Ecuador (70th) and Paraguay (103rd) were among the lowest ranked.

Chile and Brazil lead the way on renewables in the region, with many similarities in the design of their markets. Brazil was the first country to conduct large-scale reverse energy auctions and now has national and international actors building and operating renewable plants with contracts awarded through regulated auctions and on the free market. Between 2005 and 2015, auctions became the main driver of growth in renewables. However, since the crisis of 2016 (especially during and after the pandemic), their importance has declined, due to a slowdown in the growth of electricity demand. The Brazilian Development Bank (BNDES), the main backer of renewable projects, places strict conditions on strict local content. Chile tends to follow the path of Brazil, albeit sometimes with improvements. Contracts for renewables (including small capacities) are settled via centralised auctions or freely negotiated agreements between independent producers and consumers, a sign of market maturity. For the region as a whole, auctions between 2015 and June 2019 resulted in the award of projects that increased installed capacity by 32,842.26 MW –mainly for wind (39%) and solar (38%)– with a similar trend in both countries.

(3) New value chains

Sources of complementarity and the potential for bi-regional cooperation on the energy transition are not confined to the roll-out of solar and wind. They also encompass new value chains, such as hydrogen and transition minerals.

(3.1) Renewable hydrogen as a vector for cooperation

Renewable hydrogen has caught the eye of investors and European institutional cooperation, especially following the publication of Chile’s ambitious National Green Hydrogen Strategy in 2020. If European investment in renewables can be regarded as a success, hydrogen has the potential to replicate this. The central role that REPowerEU gives to low-carbon hydrogen in European energy diplomacy complements Latin America’s potential to develop a new industrial sector. Renewable hydrogen could also help to cushion the blow of the EU’s Carbon Border Adjustment Mechanism (CBAM). The first phase of the CBAM will mainly affect iron and steel, fertilisers, aluminium, cement, electricity and hydrogen products. Brazil will be hardest hit: the country had steel exports to the EU worth US$1.4 billion in 2021 (3.4% of the total). However, Argentina, Chile, Mexico, Colombia and Uruguay will also feel the effects. Home to the world’s second-biggest iron reserves, Brazil is well placed to develop a low-carbon metallurgical industry, gaining exemption from CBAM by using sustainable hydrogen and biomass. Going forward, CBAM will also be extended to other products and raw materials, including mining. Therefore, it is important for the EU that hydrogen creates decarbonisation opportunities in Latin America simultaneously to new mechanisms for internalising the price of carbon emissions.

European investment in renewable hydrogen has geopolitical added value. Latin America depends on the rest of the world for 73% of nitrogenous fertilisers, with the figure as high as 85% in Brazil. Russia and Belarus dominate the supply of the three main fertilisers (nitrogen, potassium and phosphates), with a share of around 40% in Latin America. The invasion of Ukraine has imposed a high cost on the farming sector in developing countries. Farmers are highly dependent on fertiliser prices, which soared to a decade high at the start of the war, due to sanctions and interruptions to production in Europe caused by high natural gas prices. Food security and access to fertilisers was a key issue at the recent Summit of the Americas held in Los Angeles in June 2022 and Brazil has put in place a fertiliser strategy for 2022-50 that aims to reduce its dependence on imports.

Mexico is a prime example of the critical situation facing the fertiliser sector. Ammonia and urea production fell by 70% between 2017 and 2018, grinding to a halt in 2019 when there were issues guaranteeing gas supplies, before restarting (albeit with outages) at the PEMEX petrochemical complex in Veracruz in 2020. In July 2022, an agreement was reached with the US to increase imports, with subsidised prices for farmers. In an international context characterised by Russia’s isolation, developing a Latin American fertiliser market based on renewable hydrogen is an opportunity to reduce the international influence of the Russian oligarchy, which owns the main fertiliser export firms. It also provides a way to make progress on industrial decarbonisation to reduce natural gas consumption.

The EU should support hydrogen development in Latin American countries, working alongside multilateral organisations, the private sector and universities. The two EU Delegated Acts on Renewable Hydrogen should serve as a model for regulations in third countries, including Latin American ones with European investors and bilateral programmes for collaboration on hydrogen. Prioritising domestic industrial consumption appears to be the most sustainable route in social, economic and environmental terms, compared to a focus on exports. The EU should aim to support an industrial development narrative for hydrogen that seeks to avoid replicating one-way fossil energy flows and the regional trend towards the re-primarisation of economies.

(3.2) Rebuilding cooperation on transition minerals

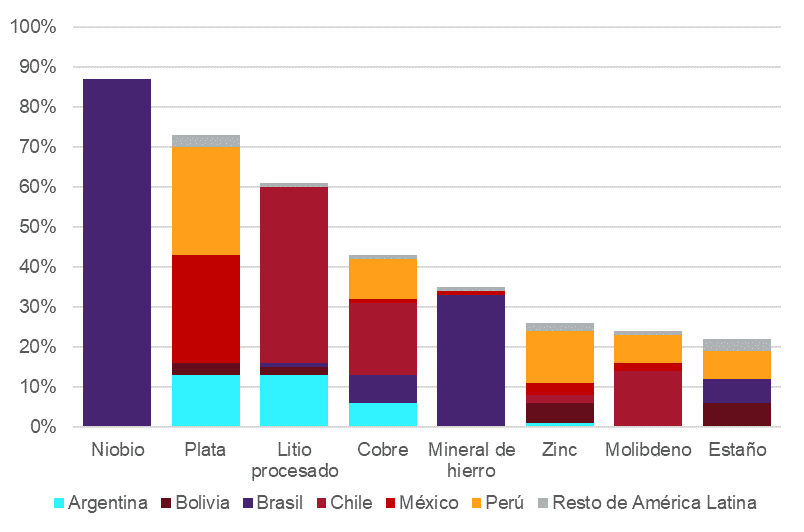

Ensuring access to critical and rare earth minerals is among the biggest challenges for the twin transitions (energy and digital). Here, Latin America has a crucial role to play in meeting the EU’s growing demand for transition minerals, both in terms of production and its reserves of niobium, silver, copper, lithium, cobalt, tin, iron and molybdenum (Figure 4). This puts it in a strong position to play a leading role in new low-carbon value chains, as shown by the central importance of copper and lithium in the most recent update to the Association Agreement between the EU and Chile. From a position of strength, Chile has improved access for its agricultural products to the European market in exchange for guarantees for the protection of European investment in mining and access to the market for lithium and associated products at the domestic market price.

Figure 4. Imports of selected strategic minerals from Latin America as a total of the EU’s supply in 2019 (%)

China is the top destination for South American mining exports. The country’s role as a source of FDI is also growing, thanks to an effective combination of investment by state companies and long-term, low-interest loans. China’s New Silk Road investment strategy for connectivity and logistics involves 20 countries in Latin America and the Caribbean and includes projects in the renewables, fossil and mining sectors. Over the last decade, state companies have acquired strategic lithium assets in Chile and molybdenum in Brazil. This has concerned Brussels and Washington, which have seen the move as a threat to the security of their supplies. There has also been alarm among Latin American governments, due to the lack of added value of these investments, alongside their contribution to the re-primarisation of their economies. China’s domination of mine-to-metal value chains ranges from 50% for lithium to 90% for rare earths. Similar to the hydrogen value chain, this highlights the importance of friend-shoring cooperation between Latin America and the EU. Expectations generated in Latin America around industrialisation associated with mining must be taken into account alongside the growing need for environmental sustainability. The EU’s challenge is to differentiate itself from other investors and importers. However, to do so, it needs to offer sustainable patterns of interdependence based on the effective generation and distribution of mining profits and reconciling sustainability with competitiveness.

(4) Barriers to bi-regional cooperation on energy

So far, we have seen the limited but significant potential for relations between Latin America and the EU as partners in the energy transition when it comes to diversification from fossil fuels and increasing their strategic weight, not just for the roll-out of solar and wind but also for the integration of low-carbon industrial chains. However, there are also barriers to bi-regional cooperation on energy, including the fragmentation of the Latin American energy industry and the region’s perceptions that parts of the European Green Deal constitute a new form of protectionism.

(4.1) The fragmentation of energy policy in Latin America

Differences on energy policy and regulatory frameworks across Latin American countries go beyond the classification of leaders on renewables (eg, Brazil and Chile), countries in the middle of developing renewables markets (some, like Mexico, in reactionary phases) and laggards (generally speaking, mono-producers of hydrocarbons but also Cuba). A further problem is that regional coordination of heterogeneous energy policies is not conducive to market integration. While leaders like Chile and Brazil are driving the transition and cooperation with Europe, others are holding back progress. The laggards continue to pursue more interventionist paths, with less emphasis on renewables: Venezuela, Bolivia, Cuba, Argentina and, more recently, Mexico, have all tended, to varying degrees, towards models with a high level of intervention and public-sector presence. This gives the EU less room for manoeuvre and reduces convergence, which in turn hinders both bi-regional and bilateral cooperation between Latin American and European countries.

This fragmentation is closely related to the two main energy policy models: the neo-extractivist model of nationalism and natural resources, which has been pursued by Venezuela, Bolivia, Peronist Argentina and Ecuador under Correa; and so-called ‘open energy nationalism’, which seeks to preserve control of natural resources and internal markets while attracting private and foreign investment, as has been the case in Brazil, Chile and also Mexico before the country’s energy reform in 2013. In most cases, policies follow hybrid models, combining free markets and intervention, with a mix of public, private and semi-private companies. The main consequence for bi-regional cooperation appears to be differentiation by country, which could reinforce barriers to Latin American energy integration.

(4.2) The absence of an energy integration project for Latin America

The history of energy integration in Latin America is one of high expectations and limited results. This has meant infrastructure in place has sometimes gone underused, with a lack of trust and a preference for self-sufficiency. Electrical interconnections have accompanied hydroelectric developments on borders and while there are some success stories, these have not been immune to geopolitical tensions, such as the Itaipú, Yacyretá and Salto Grande dams. The complementary nature, abundance and diversity of the resources of Latin America give it significant potential for cross-border exchanges of renewable energy. However, there are few examples of successful integration, largely confined to regional initiatives with limited volumes of electricity exchange. SIEPAC in Central America is the longest-running initiative, followed by the Andean Electric Interconnection System and other bilateral schemes in the Southern Cone. The growing penetration of intermittent renewables (wind and solar) makes electricity interconnections a competitive way to provide back-up services for systems and as such it is important to promote energy integration.

However, projects to produce hydrogen from renewable energy are presented as a potential barrier to new and even existing electricity interconnections. Paraguay’s Hydrogen Roadmap has identified green hydrogen production as an alternative to exporting electricity through bilateral hydroelectricity projects (71% of the country’s generation) at a time when the country is about to renegotiate its exchange agreement with Brazil. If hydrogen production generates greater added value than electricity exports, its development could exacerbate the fragmentation of low-carbon electricity exchanges. There is a risk this new type of nationalism over renewable resources could spread to other countries that have the potential to export low-carbon electricity, such as Bolivia and Ecuador, perpetuating their isolation.

In the case of natural gas, despite initial political and diplomatic support for energy integration through gas pipelines, this has been limited to bilateral initiatives between producers and consumers, without regulatory harmonisation or effective price mechanisms. Geopolitical divergences and mistrust have given rise to a fragmented market with the growing penetration of LNG. Peru and Chile are prime examples of these inefficiencies: Peruvian natural gas from Camisea is exported via LNG, while neighbouring Chile depends on imports via gas carriers. This fragmentation has allowed the entry of LNG from the US, which is perceived as offering greater security of supply, following bad experiences at the start of the century with Argentine and Venezuelan gas pipelines, which marked the end of a favourable period for the development of interconnections. The preference for LNG shows that, when it comes to gas, the geopolitics of fragmentation and diversification have won out over the logic of regional integration.

EU support for further energy integration means nothing without real interest from Latin American governments.

Intense European investment in transport and distribution grids has not translated into an increase in international interconnections, with these projects usually delegated to public or semi-public companies due to their strategic nature. If the region experiences a new window of opportunity for a new wave of integration like in the 1990s, the EU would be in prime position to cooperate and provide a model for the legal and organisational development of the market. However, the regional outlook is mired by mistrust and a preference for self-sufficiency, ignoring the dividends of efficiency and resilience that come with integrated energy systems.

(4.3) European green protectionism

Energy relations between the EU and Latin America are not immune from the roll-back of globalisation, the decoupling of supply chains and a renewed focus on strategic autonomy. In the case of the EU, Latin America has perceived protectionist impulses, which, despite sometimes being justified on grounds of sustainability, could nonetheless stand in the way of cooperation on energy. In addition to the aforementioned CBAM, a fresh look is also being taken at the trade in biofuels (a major part of European imports from Latin America), with the European Parliament’s drive for stricter sustainability criteria threatening their continuity. These measures respond to the EU’s attempts to reduce imported deforestation, a key element of the European Green Deal and one that will require Latin American cooperation.[3]

In the absence of regulatory convergence and more cooperation, the EU’s efforts to reduce the environmental impact of its imports could affect trade relations with Latin America. Another key aspect is the debate on imports of hydrogen and associated products. The open trade model proposed by Germany stands in stark contrast to France’s preference for self-sufficiency based on strict sustainability and governance criteria. The negotiations for the EU-Mercosur agreement will show the direction of travel following Lula da Silva’s victory in Brazil. The paralysis of the negotiations in 2019 came as a result of the French veto in the absence of safeguards to guarantee the protection of the Amazon rainforest. Despite the new government’s increased commitment to the fight against deforestation, it remains unclear if this will be enough to dispel the protectionist concerns harboured by some Member States.

Conclusions

The EU’s decision to accelerate the energy transition in response to Russia’s invasion of Ukraine opens up an alternative path in light of the dwindling complementarity of fossil-based relations between the EU and Latin America. The success of European investment in renewables provides grounds for optimism regarding a future of increased bi-regional energy cooperation, which, in addition to consolidating traditional cooperation on renewables, would extend it to hydrogen, industrial decarbonisation and mining. The fragmentation of energy policies, the lack of regional integration in Latin America and the spectre of green protectionism in Europe (in the absence of regulatory convergence) are seen as the main barriers to cooperation. Even though the majority of Latin American countries are natural partners of the EU and potential beneficiaries of the external dimension of the European Green Deal, the process of complementary decarbonisation requires long-term efforts and strategies to promote drivers and break down barriers.

[1] In January 2023 the US Treasury allowed Trinidad and Tobago to do business with PDVSA (subject to sanctions) and develop the Dragón gas field. The project is initially expected to supply LNG to the Dominican Republic and Jamaica.

[2] See, for example: M. Koengkan, J.A. Fuinhas & R. Santiago (2020), ‘Asymmetric impacts of globalisation on CO2 emissions of countries in Latin America and the Caribbean’, Environment Systems and Decisions, vol. 40, nr 1, p. 135-147; and M.E. Sánchez, R. de Arce & G. Escribano (2014), ‘Do changes in the rules of the game affect FDI flows in Latin America? A look at the macroeconomic, institutional and regional integration determinants of FDI in the region’, European Journal of Political Economy, nr 34, p. 279-299.

[3] For a more detailed analysis of this and other instruments of the European Green Deal see A. Averchenkova, L. Lázaro & G. Escribano (2023), ‘The European Green Deal as a driver of EU-Latin America cooperation’, Elcano Royal Institute, Policy Paper.