Theme

The Argentine economy is a complex labyrinth. It is plagued by distortions, controls, dollar prices of all types and colours, including the blue dollar, a plethora of financial instruments with indecipherable names, export taxes and import pre-authorisations, fiscal and quasi-fiscal deficits, decrees of necessity and urgency and omnibus laws, rampant inflation and recession. This analysis aims to unravel Argentina’s economic maze by going back to basics, ie, using the minimum necessary elements of economic analysis to try to shed light on the present and future of President Javier Milei’s stabilisation programme.

Summary

In the three months of President Javier Milei’s term, inflation climbed 100 points to 270% annually and the economy entered a deep recession. But financial variables evolved in a positive way: the blue dollar stabilised, the gap between the official and the parallel (or blue) dollar plummeted to 30%, and international reserves increased by 25%.

How can we explain this atypical combination, ‘bad in economics, good in finance’?

Milei’s arrival brought about the total or partial elimination of price distortions: a 100% devaluation of the official exchange rate, the liberalisation of controlled prices and a substantial adjustment in the prices of public utilities. The impact of these measures on the price LEVEL was enormous. In a period of only three months, the CPI multiplied by 1.7 times (an 800% annualised inflation).

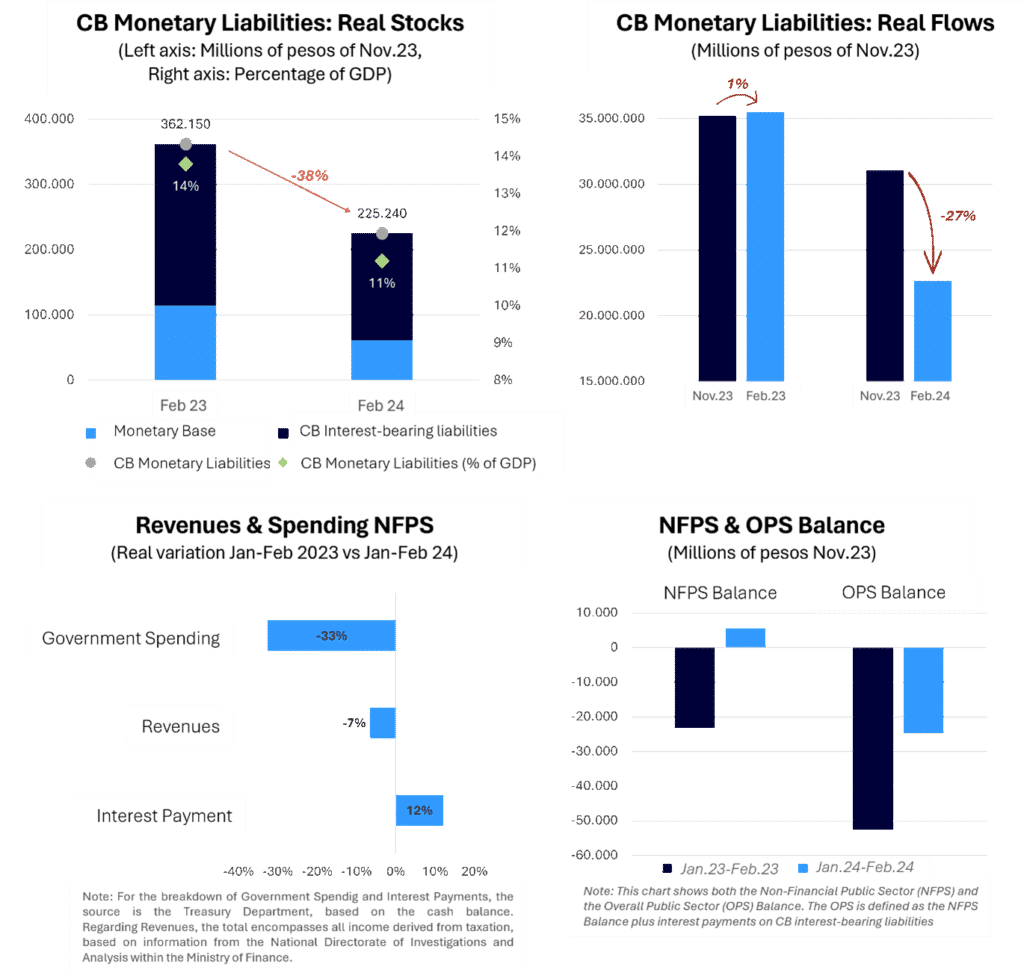

Such a shock to the price LEVEL diluted (ie, shrunk in real value) the monetary liabilities of the Central Bank of Argentina (BCRA) by 38% between November 2023 and February 2024. The strong illiquidity resulting from the dilution of monetary liabilities allowed the BCRA to issue its interest-bearing liabilities at substantially lower interest rates and forced the markets to sell dollars to the BCRA to secure scarce peso liquidity. Of course, the contraction in liquidity also resulted in strong recessionary pressures on the economy.

The jump in the price LEVEL also led to a strong dilution in public expenditures: real primary expenditure fell by 33% in the first two months of the year, compared with the same period of the previous year. Expenditure dilution allowed the government to move from deficit to surplus in the non-financial public sector and reduce the overall deficit (fiscal and quasi-fiscal) to less than half. In addition, the fiscal improvement contributed to a significant reduction in monetary financing, well below inflation.

If the analysis starts with the jump in the price LEVEL as a result of the devaluation of the official exchange rate and the elimination of price distortions, all the other pieces of the puzzle fall into place: an inflationary spike, illiquidity, falling interest rates on central bank interest-bearing liabilities, an increase in foreign exchange reserves, a stable blue dollar, fiscal adjustment and recession.

The apparent contradiction can be summarised in a single sentence: raise prices to lower inflation. That is to say, engineer a jump in the price level large enough to dilute monetary liabilities and public spending, to restore the level of international reserves and drastically and suddenly reduce the fiscal (and quasi-fiscal) deficit and the need to finance it by printing money and fuelling inflation. An old and very Latin American ‘trick’: dilute to adjust, and then stabilise.

Can it work?

In order for it to work, it will be necessary to gather the political support of Congress, where the ruling party is in a minority, to implement the so-called ‘Omnibus Law’ and to avoid the repeal of the Decree of Necessity and Urgency (DNU), which seek, among other objectives, to consolidate with substantive measures what has been achieved so far largely through dilution, and to facilitate an agreement with the IMF that will provide fresh funds.

Without political support to enact fundamental fiscal reforms and reach an agreement with the IMF, and as the effects of dilution fade away due to social, economic and political pressures, Argentina runs the risk of reverting, sooner rather than later, to the dynamics that brought the country to this point. And that resulted in the election of President Milei.

Or perhaps, this time it will be different.

Analysis

Argentina navigated the pandemic with a very high but relatively stable inflation rate, fluctuating between 40% and 50%.

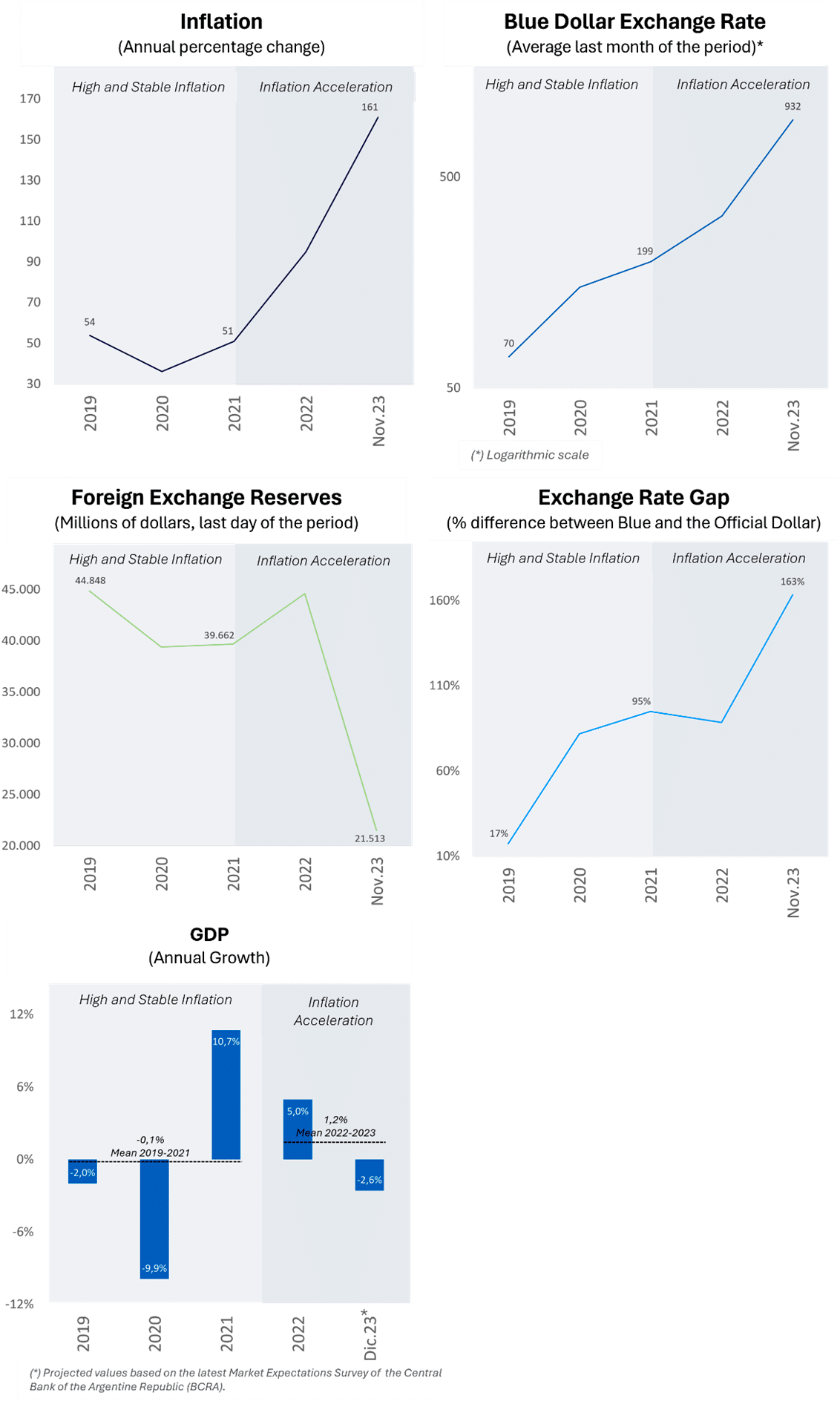

However, this relative stability took a drastic turn in 2022 and 2023. Prior to President Javier Milei taking office, inflation accelerated dramatically, soaring from 50% in 2021 to 160% in the 12 months to November 2023. This shift also affected other macroeconomic variables, which moved in tandem with inflation: the depreciation of the parallel exchange rate (commonly known as the ‘blue dollar’) surged from 200 pesos per US dollar at the end of 2021 to 930 pesos per US dollar in November 2023. The gap between the official exchange rate and the parallel rate widened to 160% during the same period, and international reserves halved (see Figure 1).

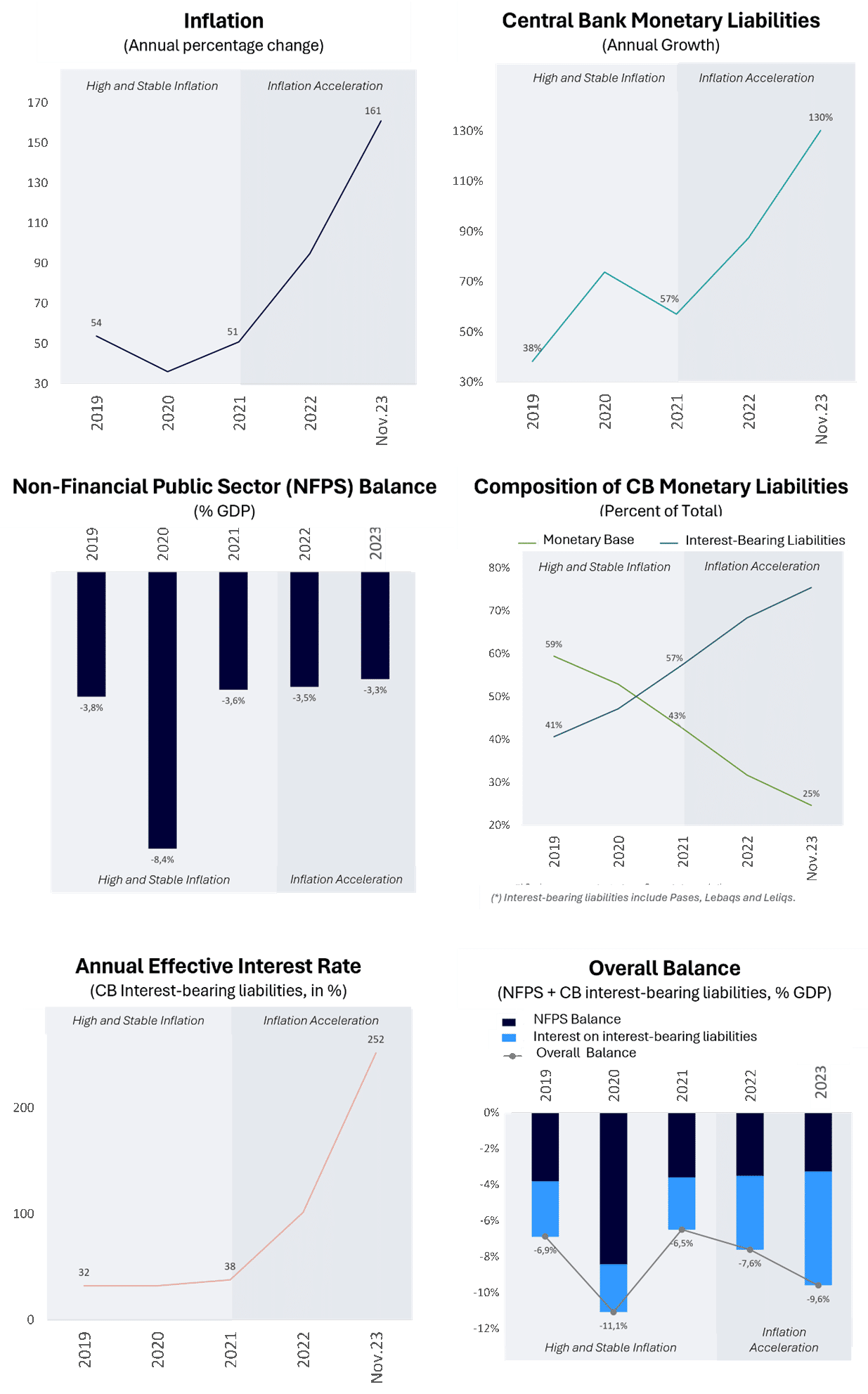

Monetary policy variables also moved in line with inflation. The growth of monetary liabilities of the Central Bank of Argentina (BCRA) accelerated dramatically, rising from 57% in 2021 to 130% in the 12 months to November 2023. This acceleration can be attributed to the deterioration in the quasi-fiscal deficit of the BCRA, which increased by 3.4 percentage points of GDP between 2021 and 2023, while the deficit of the non-financial public sector remained stable at around 3% of GDP (see Figure 2).

Figure 1. The two phases of the Argentine economy: macroeconomic performance, 2019-November 2023

Figure 2. The two phases of the Argentine economy: monetary-exchange rate / fiscal policy, 2019-November 2023

To prevent the flight away from local currency triggering hyperinflation, the BCRA raised interest rates on its interest-bearing-liabilities (Repos, Leliqs and Lebacs) to orbital levels: they rose from an effective annual rate of 38% in December 2021 to 252% in November 2023.

Such an increase caused the interest expense account on interest-bearing-liabilities to spiral from 2.9% of GDP in 2021 to 6.3% of GDP in 2023. This is a well-known phenomenon: the ‘snowball effect’ that central banks succumb to when they start paying interest on money (see Figure 2). Meanwhile, the real economy seemed not to notice what was happening with nominal variables. GDP grew an average of 1.2% annually between 2022 and 2023, compared with -0.1% between 2019 and 2021 (see Figure 1).

This combination of elements is familiar for an economy without access to credit and liquidity-constrained, without international reserves and forced to ration them with exchange controls, and with a structural fiscal deficit that must be financed by issuing money. This often forces central banks to pay interest on the money they issue to ‘persuade’ markets to stay in pesos and avoid the flight to the US dollar. The result was predictable: high and rising inflation and poor economic performance.

1. An atypical cocktail

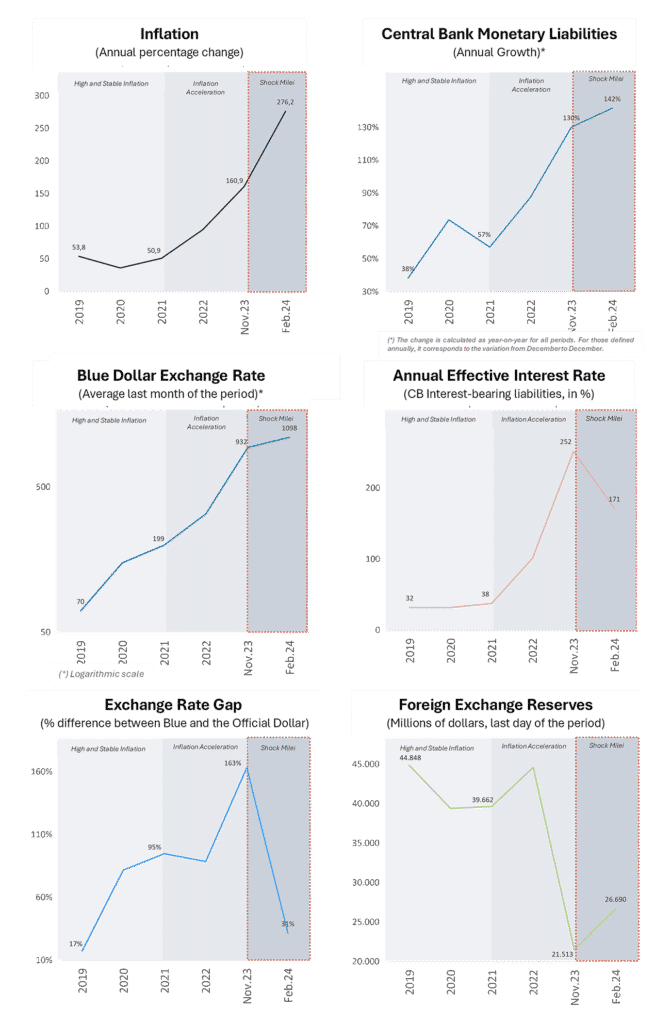

Since Javier Milei took office, inflation climbed more than 100 percentage points, from 160% in the 12 months to November 2023 to 276% in the 12 months to February 2024. However, the rest of the macroeconomic variables did not move in line with this inflationary acceleration, as they had in the previous two years (see Figure 3). The ‘blue dollar’ rate stabilised at around 1000, the exchange rate gap with the official rate collapsed to 30%, the BCRA’s international reserves grew by 25% (around US$ 6,000 million), and all this despite the BCRA reducing the effective rate on its interest-bearing-liabilities by more than 80 percentage points. Meanwhile, the real economy entered a deep recession and in 2024 GDP is expected to fall by 3,5% (see Figure 3).

How can this atypical combination, ‘bad economics, good finance’, be explained? What lies behind this apparent contradiction?

Figure 3. The Milei shock and the third phase of the Argentine economy, November 2023-February 2024

2. The Milei shock

The starting point to understanding this atypical combination in the behaviour of macroeconomic variables is to point out the obvious: Argentina is an economy with deep price distortions as a result of the existence of multiple exchange rates, price controls in sectors such as rentals, health, transport and prices of public utilities far below their costs.

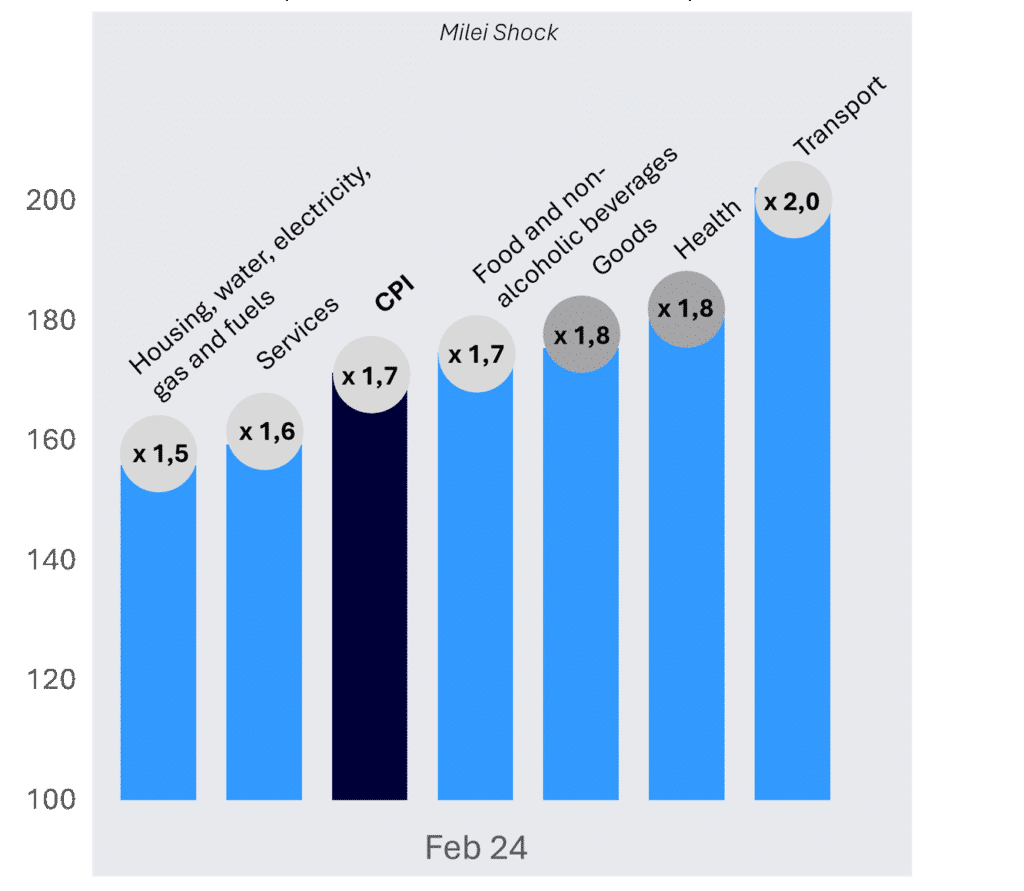

Upon arrival, Milei’s government eliminated totally or partially these price distortions: a 100% devaluation of the official exchange rate, liberalisation of controlled prices and a substantial adjustment in the prices of public utilities, which increased by 500% annualised in just three months.

The impact of these measures on the overall price LEVEL was enormous. In a period of only three months, the CPI multiplied by 1.7 in three months (an 800% annualised inflation), and the cost of housing and public utilities multiplied by 1.6, health by 1.8, and transport by 2.0 (see Figure 4).

Figure 4. Price shock: Consumer Price Index (base November 2023 = 100)

Such a large shock to the price LEVEL resulted in a dilution (that is, a reduction in the real value) of the BCRA’s monetary liabilities, a relevant measure of the economy’s liquidity. Liquidity decreased in real terms by 38% between November 2023 and February 2024, which represents 3% of the GDP (see Figure 5).

Figure 5. Dilution of monetary liabilities and public spending

The dilution of monetary liabilities led to a liquidity shortage which allowed the BCRA to inject liquidity into the market by issuing interest-bearing-liabilities at substantially lower interest rates and forced the markets to sell dollars to the BCRA to secure scarce liquidity in pesos. Such a sharp reduction in liquidity also resulted in strong recessionary pressures on the economy (see Figure 5).

From this perspective, if the analysis starts with the jump in the price LEVEL as a result of the devaluation of the official exchange rate and the elimination of price distortions, all the other pieces of the puzzle fall into place: an inflationary spike, illiquidity, lower interest rates on interest-bearing-liabilities, an increase in foreign reserves, a flat ‘blue dollar’ exchange rate and recession.

It could be argued that with an overall fiscal deficit (fiscal and quasi-fiscal) of 10% of GDP in 2023, the need to finance it by issuing money would easily more than compensate for the destruction of liquidity. And here comes into play the second part of the dilution: government spending dilution.

Real primary spending fell by 33% in the first two months of the year compared with the same period the previous year. According to our estimates, 60% of that reduction was via dilution, the rest by discretionary measures to contain the nominal growth of public spending (popularly referred to as the ‘chainsaw’).

Despite a real 7% drop in revenue in the first two months of the year due to the recession (see Figure 5), spending dilution allowed the government to move from deficit to surplus in the non-financial public sector and reduce the overall deficit (fiscal and quasi-fiscal) to less than half. Likewise, this fiscal improvement contributed to a significant reduction in financing needs with monetary issuance, well below inflation (see Figure 5).

An economy deprived of liquidity and with smaller requirements to finance the fiscal deficit by printing central bank money (whether interest-bearing or not), both obtained mainly through dilution, reveal the seemingly contradictory macroeconomic dynamics of the first three months of Javier Milei’s government: ‘bad in economics, good in finance’.

A contradiction that can be summarised in one sentence: increasing prices to lower inflation. That is, orchestrating a sufficiently large jump in the price level to dilute monetary liabilities and public spending, to increase foreign reserves and drastically and suddenly reduce the fiscal deficit and the need to finance it by issuing money (and inflation). An old and very Latin American ‘trick’: dilute to adjust, and then stabilise.

Can it work?

Conclusions

The political economy of Javier Milei’s economic programme

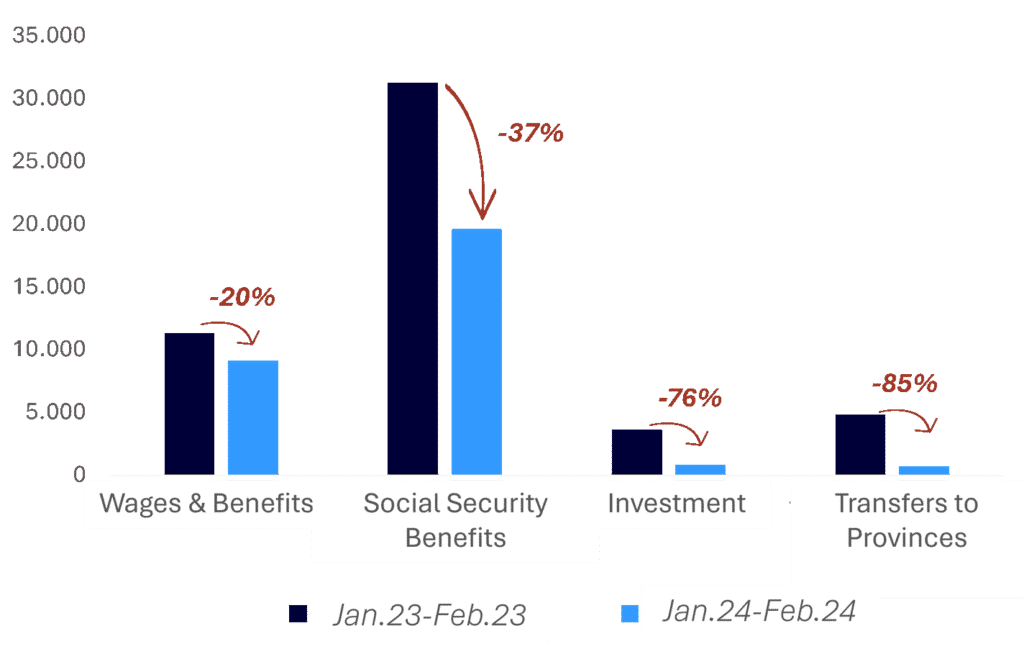

The counterpart of the sharp drop in public spending is an equally sharp drop in public sector wages of 20% and social security benefits of 37% in the first two months of the year (see Figure 6).

Additionally, transfers from the central government to the provinces fell 85% in real terms and public investment by 76% (see Figure 6).

These adjustments, largely obtained through dilution, will be extremely difficult to sustain for long. On the one hand, at a social level, an increase in pressure by street mobilisations aimed at recovering at least part of the purchasing power lost by both wages and pensions is foreseeable.[1] Economically, such a reduction in public investment is not sustainable without a deterioration of the physical infrastructure. And, politically, the reduction in transfers to the provinces threatens the possibility that provincial governors will support part of the government’s legislative agenda in Congress, where Milei and his allies from the PRO party are in the minority.

Figure 6. Public spending: real reduction by type of expenditure (millions of pesos of November 2023)

The fate of the government’s stabilisation plan hinges on the legislative agenda. This agenda, largely contained in the so-called ‘Omnibus Law’ and a Decree of Necessity and Urgency (DNU), seeks to consolidate, among other things, with fundamental measures a fiscal adjustment that so far has been carried out largely through dilution. It also aims to facilitate an agreement with the IMF to obtain the much-needed foreign reserves to eliminate exchange controls and unify the exchange market.[2]

Without political support to enact these fiscal reforms and reach an agreement with the IMF that provides fresh funds, and as the effects of dilution fade away due to social, economic and political pressures, Argentina runs the risk of reverting, sooner rather than later, to the dynamics that brought the country to this point. And that resulted in the election of President Milei.

Or perhaps, this time it will be different.

[1] In fact, the adjustment for the month of March resulting from the application of the current formula determines an increase of 27.18%. Additionally, an extraordinary bonus of US$70,000 will be granted to those beneficiaries with lower incomes.

[2] The ‘Law of Bases and Starting Points for the Freedom of Argentines’, commonly referred to as the ‘Omnibus Law’, and a Decree of Necessity and Urgency (DNU) constitute the pillars of an ambitious reform agenda promoted by the government of President Javier Milei.