Theme

Trump’s ‘supply-side’ energy policy proposals imply only minor impact on the trajectory of renewable energy and the low carbon transition; however, his trade and foreign policies could significantly magnify such impact.

Summary

For much of the past year, energy specialists have debated the potential impacts of Donald Trump’s energy policies on renewable energy (RE) and the Paris Agreement. Although there is now a broad consensus that Trump’s energy policies –along with his pledge to withdraw the US from the Paris Agreement– will favour fossil fuels, many have questioned whether the new advantages to be bestowed on the industry would translate into any real sustainable gains for oil, gas, or coal.

Challenged by the current low price of oil –and by the intensifying imperatives of the low carbon transition– oil and gas remain relatively inelastic, or insensitive, to the kinds of supply-side measures proposed by Trump, primarily the easing of regulatory and access conditions. Such measures include a wider opening of federal lands and offshore areas to fossil fuels, and the rollback of Obama’s energy and climate regulations, particularly the Clean Power Plan.

However, domestic producers of oil, along with related industries, would gain from Trump’s proposed 20% border ‘adjustment’ tax on imported oil –a price/tax intervention which would stimulate domestic oil production far more than the rest of Trump’s supply-side measures combined–. It would also raise the price of gasoline in the US while driving a wedge between US and world prices, driving down the latter.

Many have likewise doubted whether the total package of such energy-plus-trade policies would pose any lasting handicap upon the ascendant trajectory of low-carbon energy, now increasingly divorced from the price of oil and driven primarily by its own economics –and no longer, as in the past, by policy support–. On the contrary, today renewable energy (RE) and low-carbon policy is increasingly catalysed by the economics of RE costs, which continue to collapse. RE costs fell by more 50% over the past decade and are projected to experience another similar dramatic decline –halving again– by 2025.

Furthermore, REs (mainly wind and solar) now account for three-fifths of all new additions of electrical installed capacity each year globally (the percentages are similar in the US). Such building up of low-carbon momentum has pulled forward projections of the ‘tipping point’ for renewable energies from the long-term horizon of the 2040s to the mid-term of the early 2020s. Finally, nor was there anything concrete in Trump’s Inaugural Address (which did not mention energy) or in the brief summary of his ‘America First Energy Plan’ that would necessarily require this sanguine outlook for RE and the low-carbon transition to be changed.

However, this is only the picture of the energy future that takes shape if Trump’s energy policy is viewed in isolation from his expected foreign policy. When Trump’s energy policy is overlaid with his foreign policy, and the two are analysed together (both of which aspire to carry the same ‘America First’ banner), the emerging angle of energy horizon shifts noticeably in favour of fossil fuels (particularly in the US, if Trump imposes his proposed border tax on imported oil) and against the likelihood that the Paris Agreement’s objective of defending the ‘2-degree guardrail’1 and avoiding runaway climate change will ultimately be achieved.

Analysis

Trump’s energy policy

Trump’s ‘America First’ energy policy is one of apparent fossil-fuel favouritism, but at the same time it is overwhelmingly a ‘supply-side’ approach. The central pillars of this policy are focused on the easing of regulatory and access conditions for fossil fuels and, as such, they primarily address the market supply of fossil fuels and not demand. Trump’s proposed supply-side measures –a more extensive opening of federal lands and offshore areas to fossil fuel production and a regulatory rollback of a wide range of Obama’s executive orders on energy and climate change, including his Climate Action Plan (CAP) and Clean Power Plan (CPP) and his restrictions on the Keystone XL and Dakota Access pipelines– are bound to provoke some increased domestic production. But any expansion in US fossil-fuel production as the direct, discreet result of such policies is likely to be only modest. This is because, in the current environment, fossil-fuel production is relatively inelastic to supply-side measures.

Oil: production and price

Oil production is far more responsive to price than to regulatory or access conditions. Easier access to more federal lands and offshore areas is not likely to stimulate more production, given that more than half of current federal oil leases remain undeveloped –unless of course price rises significantly–. Trump’s regulatory rollback (particularly of restrictions on expanded pipeline construction) could cut transport costs for Bakken shale oil (presently shipped out, in large part, by rail) by as much as US$5 per barrel (or nearly 10% of current prices). But US shale production, to say nothing of higher-cost offshore production, would rise by much more –with or without Trump’s supply-side policies– if the price level were to sustainably rise above US$60/bbl.

But the chances of that are slim for the foreseeable future, at least if the US shale-oil sector remains engaged in a supply-price tug of war with OPEC and other producers, exerting a strong neutralising influence upon any upward price pressures. OPEC’s previous output-expanding, market share-maximising strategy did temporarily cap the post-2010 surge in US oil production, but the price had to fall to US$30/bbl for it to begin to subside. Furthermore, in addition to helping to shake out and consolidate the shale sector, that last chapter in the price war provoked a temporary recession (and a shedding of jobs) in the oil-producing regions of the US heartland, which no doubt benefited Trump in the November election.

However, in the immediate wake of the election, 11 OPEC members and 12 non-OPEC (NOPEC) producers agreed to cut production by a total of approximately 1.8 million barrels a day (1.2mbd and 0.6mbd, respectively). Although the effect of the announced agreement brought the price of oil up to US$55/bbl in December and January, inventories of US crude oil nevertheless grew significantly in early February (by 5.8 million barrels, compared with the market expectation of only 3.3 million), not only depressing the price again towards US$50 but also demonstrating that US shale-oil capacity –and the mere threat of increased production– is placing the ceiling on what is now widely perceived as a relatively stable global price band of US$50 to US$55-US$60/bbl.

Indeed, there is no apparent Trump energy policy, strictly speaking, capable of raising this ceiling, or breaking this price-band equilibrium produced by the supply-price tug of war between the US and most other oil-producing states. On the supply side, all of Trump’s announced policies work to strengthen the current ceiling of the range –to the same extent that they have any real traction on domestic production–. On the demand side, one option that the new Administration might exercise to stimulate oil demand would be to rescind the long-term target mandates for vehicle fuel efficiency (also put in place by Obama to raise automobile and light-truck efficiency levels to 54 miles per gallon by 2025). Such a measure could boost the oil demand curve over the coming decades, but it would only have a minor effect on price in the short run. Federal and state fuel taxes could be lowered or eliminated, but they are already very low in the US (only 45 and 55 cents per gallon for gasoline and diesel, respectively, compared with tax levels nearly 10 times higher in Europe), and therefore likely to produce only a modest and, most importantly, only a one-off effect.

However, Trump’s ‘America First’ protectionist trade policies could come to the support of his supply-side energy policy to produce a clear, concrete ‘America First’ impact on the world. Trump’s proposal to impose a 20% ‘border adjustment’ tax on imported oil would boost the price of oil by a similar amount in the US by protecting domestic supply –provoking more domestic shale oil production– but it would also divorce the rising domestic price of oil from the world price. Furthermore, expanded US production would directly cut US oil imports, reducing the US demand call on world oil supply and further depressing the world price.

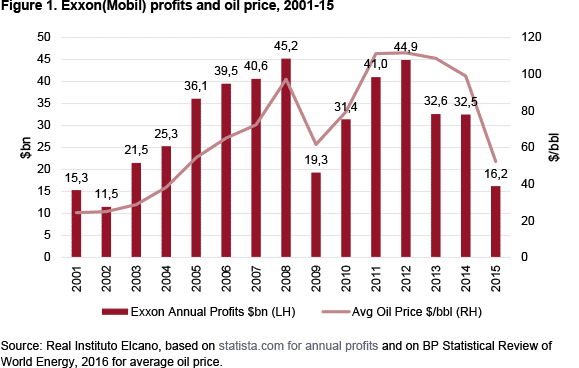

Nevertheless, while clearly benefitting domestic shale producers who operate primarily in the US, such a development would prejudice many of the oil majors, particularly those (like ExxonMobil, the ex-CEO of which, Rex Tillerson, is now the Secretary of State) with most of their booked reserves outside the US. Already Exxon’s profits have plummeted from an annual peak of US$45 billion (in both 2008 and 2012) to US$16 billion in 2015, pulled down directly by the falling price of oil from well over US$100 to just over U$50/bbl. Indeed, in the 15 years from 2001 to 2015, Exxon made a cumulative US$453 billion in profit: an average of US$30.2 billion a year during a period in which the oil price averaged nearly US$70/bbl, well above its current level (see Figure 1).

As oil prices dropped even further, on average, last year to US$43.5/bbl (and even dropped briefly below US$30/bbl), ExxonMobil earnings in 2016 were recently reported as the worst in 20 years. The picture is similar among the other IOCs. Chevron posted its first annual loss in more than 37 years.

US consumers would also likely object to any kind of tax raising the price of gasoline, a measure which has long been considered politically taboo in the US. But it is also just as likely that Trump will appease or coax both large oil producers and consumers with countervailing incentives coming from other policy areas within Trump’s overall strategy (like corporate profits and individual income tax cuts).

However, while effectively delivering on his America First promise –at least in the short-run and at least with respect to the oil shale constituencies– Trump’s supply-side energy policies, particularly if combined with an oil import tax, could easily continue to frustrate the efforts of the oil-producing countries of OPEC and NOPEC to stabilise price somewhere in the US$60 to US$90/bbl range. Given that most of the world’s oil producers cannot currently meet their national budgets –or maintain domestic economic and politically stability– unless prices are in a stable range well above $60/bbl, this could turn out to be the most salient international impact Trump’s energy policy in the short run.

Therefore, the overall global impacts of Trump’s initial energy policy reinforcement of this global price ceiling of US$60/bbl could soon become apparent. Although the geopolitical challenges and the strategic opportunities that might arise from any such resulting instabilities in the oil-producing states or the private oil sector remain beyond the strict scope of this analysis, they will be given further treatment below in final section on Conclusions and caveats. Indeed, oil prices will tend to rise in proportion to the level of perceived uncertainty that Trump, his mercantilist trade policy and his ‘unilaterateral’-‘realist’ foreign policy, either inject directly into the international system with his various interventions, or leave to fester, unresolved (a subsequent analysis, however, will be undertaken shortly to demonstrate that when Trump’s energy policy is overlaid with an analysis of his foreign policy, a clear potential emerges for a ‘fossil-fuel nexus’ to animate and inform his evolving ‘grand strategy’).

Gas, coal and renewable energy

Although gas is somewhat more sensitive to regulatory and access conditions than oil, it is most elastic with respect to the cost of renewable energy (its major competitor in the power sector). Coal is also somewhat elastic with respect to regulatory and access conditions (particularly to the CPP and the moratorium of coal leasing in federal lands), but it is, in turn, far more sensitive to the evolution of the price of both gas and renewable energy.

But wind and solar power costs have been plummeting for many years. The cost of wind turbines has fallen by a third since 2009, while the cost of solar PV panels has dropped by 80%. Meanwhile, the ‘levelised cost of energy’ from wind and solar power fell by 61% and 82% respectively during the same period.

Global investment in renewable energy grew from US$240 billion in 2010 to US$286 billion in 2015 (revised upward to US$304 billion at the end of last year). Although global clean energy investment experienced an approximate 18% annual decline in 2016, most of the pullback came from Asia, where it had surged the most over recent years: investment in Japan was down more than 40%, and in China by 26%. On the other hand, US investment declined only 7% to US$58.6 billion. Furthermore, much of this could be accounted for by cheaper capital costs for installations stemming from rapidly falling costs.

Sure enough, RE installed capacity has not stalled. In 2015 renewable energy accounted for 61% of all new electrical capacity added globally (and more than 50% since 2012). Only 40 gigawatts (GW) of solar PV capacity was installed in 2010; in 2015 more than five times that amount came into operation (20% of the total). According to BNEF, a record 70 GW of solar power were installed in 2016 (up from 56 GW in 2015) along with an addition 56.5 GW of wind (down only slightly from 63 new GW in 2015, but still the second-highest annual addition of global wind capacity ever).

Such developments have led many in the US to project that the ‘tipping point’ –when wind and solar power will provide the cheapest available new kilowatt-hours (without subsidies)– will arrive sometime over the next five years (by the time the recently renewed renewable energy tax credits in the US are set to expire after 2020), and in much of the country, it already has. Wind and solar power are being bought at auctions around the world for as little as $0.03/kWh. Assuming appropriate regulatory and policy frameworks, IRENA forecasts that renewable energies will experience further cost declines of between 25% and 50% (59% for solar PV) by 2025. In 2030 solar energy alone will account for 13% of the global energy mix and solar PV, on its own, for 7%.

The Trump Administration could try to directly undermine renewable energy deployment –for example, by rescinding the renewable energy production and investment tax credits (recently renewed to 2020-21 by the Congress in December 2015, after having previously expired)–. However, Trump has remained unusually mute on this issue. In any event, this would be problematic for either the White House or the Congress to achieve. First, the Democrats could block any such legislation through a filibuster in the Senate. Secondly, and more importantly, to eliminate the tax credits would pose an electoral risk, particularly for Congressional Republicans, but also possibly for Trump.

Although it is true that US public opinion is increasingly polarised on the politicised issue of ‘climate change,’ overwhelming majorities of Americans favour investing and deploying more renewable energies as opposed to fossil fuels. In a March 2016 Gallup poll, 73% of Americans claimed they preferred more alternative energy to more oil and gas, including a majority (51%) of self-defined Republicans. In a more recent Pew poll in October 2016, 89% wanted more solar installations and 83% wanted more wind.

The increasingly favourable attitude towards renewable energies across many states in the American ‘heartland’ which voted for Trump will likely temper any inclination for excessive favouritism at the Department of Energy towards fossil fuels, or for an early end to the renewable energy tax credits (although Trump’s regulatory freeze has already stopped four Obama rules designed to enhance energy efficiency). Many of the ‘red’ states in the heartland are expanding wind power –Texas, itself, is now the country’s largest wind producer– and have benefitted directly from the production tax credit (PTC). They will not be anxious to see the tax cuts prematurely rescinded: the last time the PTC expired in 2012, new wind-power projects dropped by 92% the following year (although they rebounded once the credit was renewed).

After all, there are now 700,000 jobs among the various renewable energy sectors (including hydro and biomass), and there is growing evidence that modern REs are more labour-intensive than fossil fuels. Indeed, today’s US low-carbon sectors generate three times more jobs on average (17 versus five) than fossil fuels for every US$1 million invested. Sustainability jobs –in energy efficiency, renewable energy, waste reduction and environmental education– now account for an estimated 4 million to 4.5 million jobs in the US. Although in many of these ‘red’ states the balance of support for renewables still tilts towards wind, as opposed to solar, this could change. Solar power now employs more people than any other energy source except oil (and more than any other in the power sector) and is creating more jobs per kilowatt-hour generated than any other energy source (including double the number of jobs created per dollar invested in fossil fuels) and at a rate 12-times higher than in the US economy in general. As a result, political support for solar power is likely to continue to radiate from the West Coast and the South-west states across the American heartland.

Furthermore, already 29 states, led by California and New York and many so-called ‘blue’ states (although not exclusively, and constituting the bulk of the country in energy, economic and population terms), have put into place renewable energy portfolio standards and nearly all states have at least some kind of policy incentives for RE which have already begun to reorient markets. Sixteen cities have committed to 100% ‘clean energy’ and some are well on their way to achieving it. The hard fact that energy policy will continue to be formulated and implemented closer to the ground in the states and cities neutralises much of the potential of a Trump presidency to stop, let alone roll back, the ongoing investment in the deployment of renewables. States and cities are leading the way, although some less populous red states might resist the overall trend for ideological reasons.

Although the elimination of the CPP would likely result in some gigawatts of otherwise projected renewable energy supply in the power sector being crowded out it by fossil fuels, most of this would come from gas and, as a result, would only increase US emissions by less than 6% (or 0.41Gt of approximately 6.9Gt) over its horizon to 2030 (compared with levels projected under the once-anticipated CPP implementation). However, this will not detain the economic and political momentum produced by falling electricity costs and faster job creation, or significantly delay the imminent arrival of the ‘tipping point’ for renewable energy in the power sector. Therefore, many analysts –even low carbon advocates– have maintained a relatively sanguine outlook on the low-carbon transition, even in the face of Trump’s supply-side, fossil-promoting energy policies and his promise to withdraw the US from the Paris Agreement.

Peak oil demand and electrification

In the end, however, the kilowatt-hour/grid-parity ‘tipping point’ in the power sector referred to above is far less relevant to the oil industry (although it remains relevant for gas) than is the equivalent ‘tipping point’ in the transport sector. Oil has already been nearly squeezed out of the power mix by gas and renewables now increasingly compete with gas in electricity generation, and will continue to displace it –to a greater or lesser degree– over the coming decades under most scenarios. But hydrocarbons still account for over 95% of the global transportation fuel mix, and transport still absorbs nearly two-thirds of all oil consumed globally.

The transport sector ‘tipping point’ is directly linked to the future evolution of global oil demand. Yet projections of peak oil demand continue to rush forwards from the long run towards the short run. The most conservative projections still come from the oil industry itself. Neither Exxon nor BP foresee global oil demand peaking any time within their long-term projection horizons (BP: 2035; Exxon: 2040). Two of the World Energy Council’s three major future scenarios have peak demand occurring around 2030. But Bloomberg New Energy Finance (BNEF) recently moved forwards –to 2023– an earlier projection of 2028. Fitch also recently projected peak oil demand for 2023. Finally, Shell, somewhat surprisingly, just forecast 2021.

Such an early arrival of ‘peak oil demand’ would likely trip the ‘tipping point’ at which electric vehicles (EVs) crowd out enough liquid-based vehicles to prompt investors to move, en masse, into the emerging new dominant energy framework for the transport sector –that is, renewable energy-fed electrification–.

Although the electrification of transport is still only nascent, most of the early peak projections for demand assume an increasingly rapid rate of EV penetration over the short to medium run. Such development –along with a move by large cities to electrify public transport and mass transit– would be the most significant turn in the road for the oil industry thus far in the low-carbon transition. Because the transport sector (and to a lesser extent industry) represents the only possible future for oil (and probably the only long-term future for gas) it also potentially poses the largest barrier to reducing energy emissions enough by 2050 to successfully defend the Paris Agreement’s ‘2-degree guardrail’.

An additional pressure faced over the longer run is the prospect of significant future losses stemming from ‘stranded assets’ (currently estimated at some US$2.2 trillion) under a 2-degree scenario. Therefore, a large segment of the hydrocarbons sector may feel compelled to fight politically to defend the dominance of the current liquids-based transportation infrastructure –perhaps by lobbying to undermine the speed of short-term EV penetration and to forestall deeper investments in storage and electrification systems, or perhaps by supporting an more intense development of ‘carbon capture and sequestration technologies (CCS)– in an attempt to delay the ‘tipping point’ in the transport sector by ‘infrastructurally locking-in’ as much future oil demand (and profit) as possible.

US withdrawal from the Paris Agreement

Finally, Trump could take the US’s signature off the Paris Agreement, as he has promised, although it would still take the US four years to formally withdraw. Such a hostile move towards the spirit of the international agreement by one of its prime architects might increase the incentive for ‘emissions free-riding’ by other parties to the accord. In addition, both Trump and Congress have threatened to block any appropriations for the US Paris commitment to contribute to the financing of climate action in developing countries.

But China, another prime architect –and just as key as the US– just recently assured the world from Davos that it will fill any resulting leadership gap in the global fight against climate change. Even if it is difficult to know how credible such a pledge really is, it nevertheless sends a powerful signal that will tend to moderate free-riding, facilitating the five-year reviews built into the Agreement and supporting the required progressive ‘ratcheting up’ of emissions cuts. Europe, still another prime architect and traditional global climate leader, is also bound to support China in this effort by picking up some of the slack generated by American withdrawal. Renewable energy deployment and climate mitigation and adaptation efforts have also picked up momentum in Latin America and Africa.

Therefore, it is not at all clear that US withdrawal from the Paris Agreement will noticeably affect most of the national, regional or local renewable energy policies of the world –which account for a growing bulk of global energy emissions even despite the US’s still significant share–. On the other hand, US withdrawal will not influence current renewable energy cost trends in a meaningful way and, as a result, will not significantly impact on the arrival of the renewable energy tipping points in either the power or transport sectors (although the latter is admittedly more vulnerable than the former to potential fossil fuel-induced delay).

Conclusion and caveats

The provisional conclusion of this analysis of Trump’s proposed energy policy is that the prospects for REs remain, on-balance, more positive than those for fossil fuels –even with Trump’s fossil favouritism–. The central aspects of Trump’s energy policy are supply side measures –easier access conditions and regulatory rollback– that can have only minor impact on domestic production (which is now much more elastic to price).

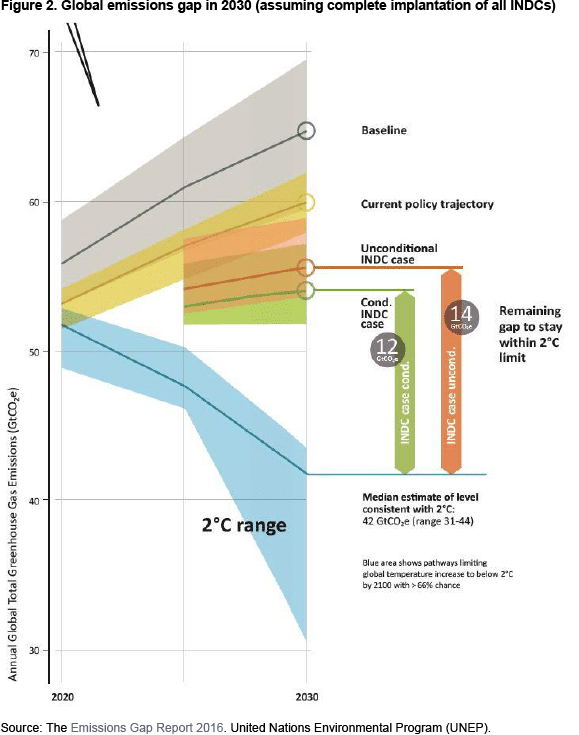

On its own, Trump’s energy policy is likely to only marginally effect the ultimate trajectory of the low carbon transition. As it stands now, the world’s emissions gap in 2030 –the difference between the projected global emissions level if all current policies in place are enforced and those required to keep the world on a feasible pathway to defend the 2-degree guardrail– is still estimated at 15 gigatons of GHGs (56Gt globally versus the 42Gt target for 2030). Even if all the INDCs presented to the Paris Agreement in their ‘conditional form’ (in which their commitments are dependent on the pledged assistance or other actions from the international community) the gap would still be 12Gt (and 14Gt if all INDCs are assumed to only meet their ‘unconditional’ targets).

But even if the Clean Power Plan is repealed, given current projections US energy emissions will only rise by 0.41Gt in 2030 as a result –well under 5% of the projected global emissions gap (at least 15% of which will have to be met by reducing emissions from agricultural, forestry and land-use/change (AFOLU)–. In order words, although Trump’s energy policies could shift the long-run emissions curve upward to some degree, it will not by itself –even assuming some increased emissions in the US transportation as well power sectors– derail the low carbon transition.

Nevertheless, for the world to follow a 2-degree-consistent scenario pathway –like the IEA’s 450 Scenario, for example– would require much larger annual investment sums to be dedicated to renewable energies and low carbon technologies than have yet been achieved. Bloomberg New Energy Finance projects that an additional US$5.3 trillion will be needed in ‘green power’ investment by 2040 –an average of US$230 billion a year–. However, the United Nations Environmental Programme (UNEP) recently estimated that in order for renewable energy to double its current share of world energy by 2030 (required by a 2-degree pathway), current levels of annual ‘clean energy investment’ (approximately US$300 billion) must be more than doubled –to at least US$770 billion annually– in each year between now and 2030.

In other words, the world’s massive challenge –embodied in these emissions and investment gaps– remains massive with or without Trump’s energy policy. Nevertheless, global momentum is picking up for the low-carbon transition, as the economics of renewable energy begin to pull policy with it –as opposed to being pushed from behind by state mandates and supports) and as the critical ‘tipping points’ in both the power and transport sectors emerge over the middle-run horizon–.

The foreign policy caveat

However, this is only the picture of the energy future that takes shape if Trump’s energy policy is viewed in isolation from his expected foreign (and other international) policies. When Trump’s energy policy is overlaid with his foreign policy (both of which aspire to carry the same ‘America First’ banner) and the two are analysed together, then the possibilities of the energy horizon shift noticeably in favour of fossil fuels –and against the likelihood that the Paris Agreement’s objective of defending the ‘2-degree guardrail’ and avoiding runaway climate change will ultimately be achieved–.

The appointments of Rick Perry as Secretary of Energy and Scott Pruitt as Administrator of the Environmental Protection Agency (EPA) –both former political enemies of the departments they now lead– can be interpreted, alternatively, as an open door to a fossil-fuel revival which could cripple the already vulnerable low-carbon transition (as they have been by many of low-carbon advocates) or as a harbinger of only minor setbacks for renewable energy (as they have been by many others who also support the Paris Agreement).

On the other hand, the appointment of Rex Tillerson as Secretary of State does at least foreshadow a potential linkage of energy and foreign policy within Trump’s ‘grand strategy’. Tillerson is not only a life-long Exxon man and recent CEO, but also an experienced Russia hand, and a friend and business associate of Vladimir Putin, the President of what could be called the world’s largest ‘petrostate’ and current geopolitical master of the great Eurasian heartland. Indeed, if Trump’s energy and foreign policies turn out to be linked around a ‘fossil-fuel nexus’, then a reassessment of the impact of Trump’s presidency on not only the future of the low-carbon transition, but also that of the current international order would be more than justified, if not essential.

The ’fossil-fuel nexus’

This ‘fossil-fuel nexus’ is only a potential. It is not a clear policy objective, a fixed institution or explicit constituency alliance, but rather a seemingly coincidental, multiple overlapping of fossil interests which, by pointing all in the same direction –to higher prices in the short run and defence of oil demand (particularly in the transport sector) in the middle-to-long run– produce the potential for an ‘over-determining’ of US policies in favour of fossil fuels.

In the short run, the key variable affecting this nexus is the price of oil. The key groups with overlapping interests include not just the US shale sector but also the oil majors and the oil producing countries. Their bottom lines and their national budgets –along with the stability and quiescence of their stakeholders (shareholders, electorates, subjects, allies, etc)– all depend on price.

But one cannot push against a string –one can only pull in the opposite direction–. To generate further sustainable increases in domestic production it will be necessary to supplement Trump’s supply-side easing of regulatory and access conditions for fossil fuels with his other international policies, like trade and foreign policy, that have the potential to influence the global price.

We have already mentioned that the proposed oil import tax would stimulate US production, at least in the short run, by raising the domestic price of oil. However, such a protectionist policy cannot raise the international price of oil; on the contrary, the US oil import tax will distort the price of oil by driving a wedge between the resulting higher domestic price and the world price, which will fall due to a reduction of the US demand call on global supply.

Although an oil import tariff-engineered increase in the domestic price of oil will create some jobs in the oil-producing regions, such employment will be relatively insignificant next to the current pace of job creation in the renewables sectors (see above). However, it would also raise the price of gasoline in the US (historically perceived by consumers as politically ‘taboo’) while at the same time placing further downward pressure on the international price of oil, intensifying currently economic political instabilities in other oil producing countries.

There are ways for Trump to coax up the international price of oil, intentionally or inadvertently. The global oil price is shaped primarily by market fundamentals (supply and demand) but it is also influenced at the margin by market perceptions and uncertainties. In the realm of perceptions, geopolitical uncertainties generally lead to higher price. The mere perception of coming instability in an oil producing country generates a ‘geopolitical premium’ and drives the price higher.

The important distinction to be made here is that any noticeable increase in production stemming from Trump’s policies can only come through price intervention in the area of trade policy (ie, the imposition of taxes on energy imports) or through the exercise of his foreign policies –either explicitly through a new form of producer country supply collaboration which would include at least the tacit cooperation of the US, or (more likely in this case) simply by allowing current nascent instabilities in other producer states to fester– perhaps by provoking them, however inadvertently. On their own, such low price-induced instabilities will increase market uncertainty and impose a higher ‘geopolitical premium’ on the international price of oil.

But the long-term evolution of oil demand –upon which the current liquids-based transport system depends– will remain the key emissions variable during the rest of the low-carbon transition and the transport sector will constitute the most crucial focus of the political competition between fossil fuels and renewable energy.

Concluding note

A subsequent ARI will be published shortly in which the above analysis of Trump’s energy policy is overlaid with an analysis of his foreign policy. From it, a clear potential emerges for a ‘fossil-fuel nexus’ to animate and inform Trump’s evolving ‘grand strategy’ –likely to be somewhat ‘Jacksonian’ in form, if also ‘neorealist’ in terms of its active, substantive content– including Trump’s possible play of a ‘Russia Card’ and his ultimate, final policy stance towards the low-carbon transition and the electrification of transport.

Paul Isbell

Senior Associate Fellow, Elcano Royal Institute, and Senior Fellow, Center for Transatlantic Relations, Johns Hopkins University SAIS, Washington, DC | @SeaChangeIsbell

1 The ‘2-degree guardrail’ refers to the global limit of greenhouse gases (GHGs) that can be emitted by 2050 without provoking global temperatures beyond 2 degrees above pre-industrial levels. This corresponds to a GHG limit of 450 parts per million in the atmosphere, at which there is still a 50% probability that most of the worst potentials for climate change to be avoided (including a number of ‘tipping points’ like the disappearance of light-reflecting Arctic and Antarctic ice, or the melting of methane releasing permafrost). To successfully defend the ‘2-degree guardrail’ global emissions must fall by 80-85% from 1990 levels.