Theme

Spanish companies stepped up their direct investment abroad in 2014, but it was still far from the pre-crisis annual average between 2005 and 2007.

Summary

Spain’s internationalisation, as measured by exports and direct investment abroad, has been remarkable and it happened in a relatively short period. The stock market has played a key role in this process.

Analysis

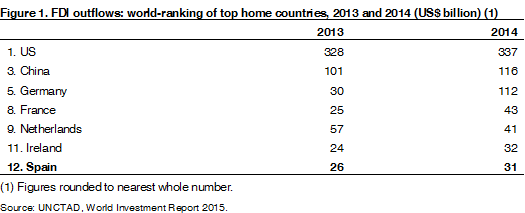

Spanish companies invested €30.6 billion abroad last year, up from €25.8 billion in 2013 but far from the average of €94.4 billion between 2005 and 2007 before the country entered recession, according to UNCTAD’s 2015 World Investment Report published on 24 June. Spain’s outflows of direct investment continued to be the world’s 12th largest (see Figure 1).

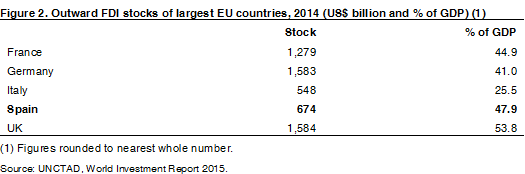

The outward stock of investment, however, dropped from €719.4 billion to €673.9 billion, as a result of divestments for strategic reasons or in order to reduce debt burdens (for example in the case of Telefónica). In GDP terms, Spain’s stock at 47.9% was the second-largest among the EU’s five biggest economies (see Figure 2).

Corporate Spain was a late-comer to expanding abroad, which began in earnest during the 1990s, following the country’s membership of the European Community, which opened up the economy, and gathered pace after Spain became a founding member of the euro zone in 1999. The outward stock of investment rose 45-fold between 1990 and 2014, making Spain the fifth most-internationalised economy based on the volume of its foreign trade and direct investment compared with 14th in nominal GDP terms. Spain accounted for 2.6% of the world’s stock of outward investment in 2014, well above its 1.8% share of GDP and 1.6% share of global exports.

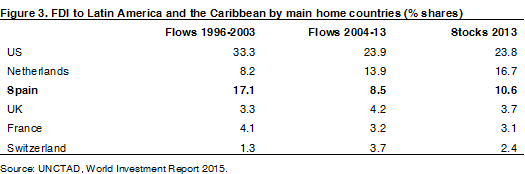

Latin America was a natural first choice for companies investing abroad. As well as cultural and linguistic affinities, there were factors that pulled firms to the region. Economic liberalisation and privatisation opened up sectors that were hitherto off-limits, and the region’s poor infrastructure was in constant need of development. The region accounted for 17.1% of Spain’s total direct investment outflows between 1996 and 2003, and this dropped to 8.5% in 2004-13 as the focus switched to other parts of the world. The combined share of the US and Spain, the two largest investors, in the region’s foreign direct investment flows fell from 50.4% in 1996-2003 to 32.4% in 2004-13 (see Figure 3).

Latin America generated €81.2 billion of net profits for Spanish companies between 2007 and 2012, and they were more stable than those earned in other parts of the world.

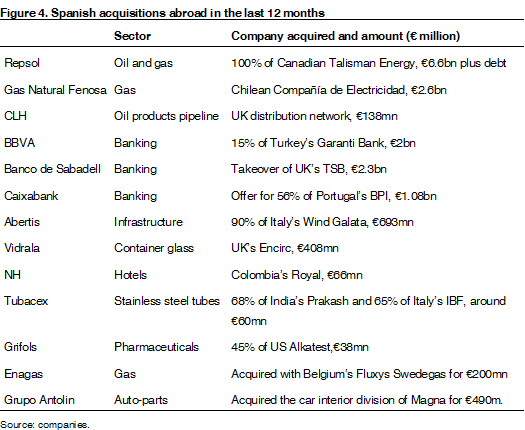

Spanish companies started a new wave of acquisitions around a year ago and mostly away from Latin America (see Figure 4), following the recovery in the domestic economy and spurred by large cash reserves, interest rates at historically low levels, an abundance of liquidity in markets and buoyant stock markets with an appetite for those companies financing their purchases by increasing their capital.

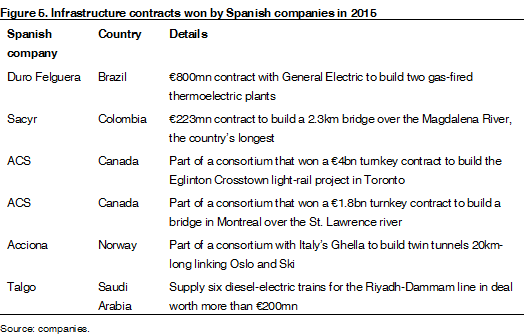

For several years there have been more Spanish companies in the annual ranking of the world’s top transport developers by the US publication Public Works Financing than any other country. The latest ranking, published last November, has six Spanish companies in the top 12 and another three make the top 39. These companies continue to win big contracts abroad (see Figure 5).

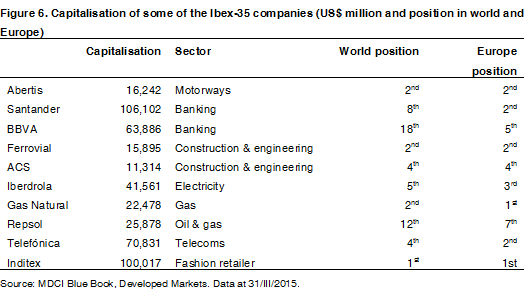

The Spanish stock exchange has played a key role in companies’ internationalisation. In the words of Antonio Zoido –the exchange’s president–, size, being listed and internationalisation feed off one another and form a virtuous circle. The companies that comprise the Ibex-35, the benchmark index of the exchange, which account for a tiny 0.1% of the total number in Spain (close to 70% of GDP), generated abroad 64% of their total revenues last year, up from 47% in 2007 and 24% in 1997. The Ibex medium cap and small cap companies obtained a similar share of their revenues from abroad (65.8% and 64.9%, respectively), while the rest of listed companies generated only 39.4% internationally.

In terms of capitalisation, some of the Ibex companies are among the largest in the world in their respective sectors (see Figure 6).1 The stock market is very active: the five initial public offerings (IPOs) raised €8.4 billion, more than a fifth of the funds for European new listings in the first half of this year and seven times Germany’s amount.

Spain is in the curious situation of having a small group of very large companies at one end of the corporate spectrum and at the other end 94% of firms are micro-businesses. The average number of employees per company in Spain was 4.7 in 2014 compared with 5.7 for France and 11 for the UK and Germany. Only Italy among the big EU countries has fewer workers per company (4.0).

The country needs companies of a larger size so that the costs involved in exporting regularly and investing abroad are sufficiently compensated by profits appropriate for the level of productivity.

Telefónica, fully privatised as of 1997, is a prime example of a company that has benefited from being listed ever since it was founded in 1924. Between 1989, when the company began to be privatised, and 2014 its customers rose 28-fold to 341 million and the number of countries where it operated increased from one (Spain) to 21. Revenues soared 12-fold to €50.3 billion. Today, it is the second most-internationalised telecoms group in the world after Vodafone: last year 88% of its accesses were from outside its market of origin and 76% of its revenues, compared with 96% and 85%, respectively, for Vodafone.

The international position of Spanish companies has also been strengthened during the country’s crisis by the surge in exports. Indeed, it was exports that pulled Spain out of recession in 2014 and prevented the economy’s shrinkage from being deeper between 2009 and 2013. Exports of goods and services have increased from 27% of GDP in 2007 to more than 34%, and even taking into account the decline in GDP this is a significant structural change. The success has helped to turn around the current account: from a deficit of 10% of GDP in 2007 to a small surplus in 2013 and 2014.

Despite this, reducing the negative net international investment position (NIIP, the difference between external financial assets and liabilities) has proved to be very gradual (from 92.6% of GDP in 2013 to 93.5% in 2014). A negative figure indicates a debtor nation and a positive one a creditor country.

This is a cause of concern as it exposes Spain to adverse shocks or shifts in market confidence. According to the European Commission, even under relatively benign growth and inflation scenarios, Spain would need to achieve a record current account surplus of 1.7 % of GDP on average over the 2014-24 period in order to halve its NIIP-to-GDP ratio by 2024.

Conclusion

The challenge ahead is to build on the internationalisation success and not let it ease up now that Spain is out of recession and growing at an accelerating pace.

William Chislett

Associate Analyst at the Elcano Royal Institute and author of ‘Spain: What Everyone Needs to Know’ (Oxford University Press, 2013) | @WilliamChislet3

1 Much more information about the international position of listed Spanish companies is contained in the pioneering report Posición internacional de la empresa cotizada española published in Spanish on 2 July 2015 by the Spanish stock exchange and Telefónica.