Theme

Global energy demand is shifting towards developing countries in the coming decades. This paper explores the implications for energy markets, trade relations and energy security and industrial strategies of three regions: the Global South, the Global North and fossil fuel exporters.

Summary

This paper explores the energy geopolitical implications of the ‘other’ energy transition, ie, the slow but steady shift in global energy demand from traditional OECD markets to developing countries in the coming decades. It is a pilot study that aims to raise attention and invite discussion on this topic. The focus is on implications for energy systems, market shares and trade dependencies on the one hand and energy security policies and industrial strategies on the other. The emphasis is on the impact in the Global South and the relations between three regions: the Global South (Latin America, Sub-Saharan Africa, India and South-East Asia), the Global North (OECD countries and China) and fossil fuel exporters (the Middle East and North Africa, Russia, Central Asia and the Caspian Region). Applying a step-by-step approach and using semi-structured interviews, this analysis concludes that the key factor in anticipating implications is how countries in the Global South will meet their new demands, with interviewees expecting the Global South to use fossil fuels in the short term and slowly but surely moving towards renewable energy over time. As such, rising demand is likely to lead to new competition for Global-South markets between the Global North (as clean-tech exporters) and current oil and gas exporters. In addition, rising demand will likely lead to more friction between the Global South and North over the siting of material processing and climate finance. The Global South and oil and gas exporters are likely to be natural partners for the coming years, creating the risk of a fossil fuel lock-in. A setting of increasing great-power rivalry and climate urgency politicises energy relations but also offers new drivers for cooperation.

Analysis

1. The other energy transition

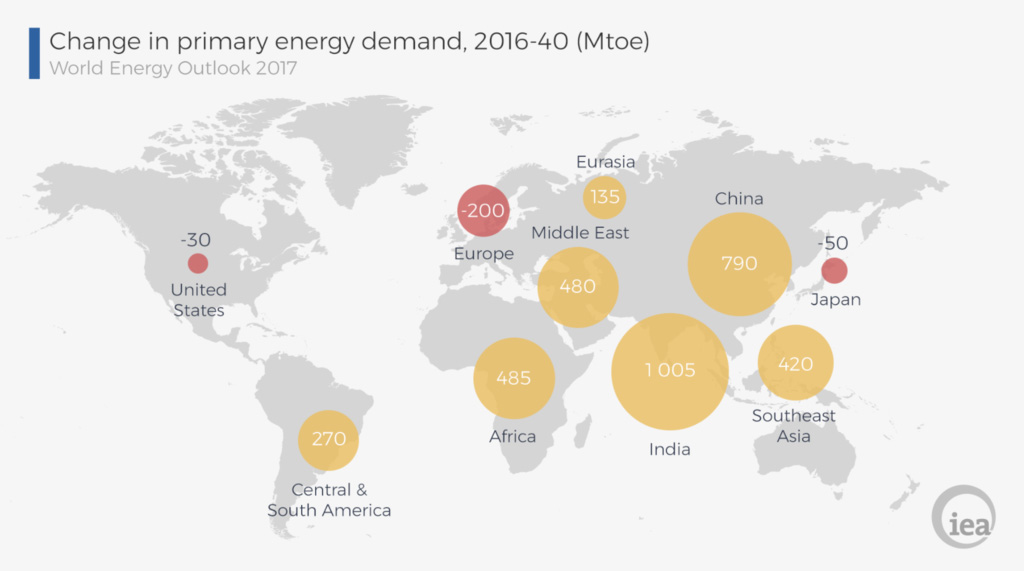

The term ‘energy transition’ is commonly associated with changes in energy supply, most notably the transition to renewable energy and other decarbonisation options. Yet there is another transition going on: global energy demand is slowly but surely shifting from traditional OECD markets to developing countries. Whereas the US, Europe and Japan but also Russia, are expected to see energy demand stagnate or decline, Latin America, Sub-Saharan Africa, the Middle East and North Africa, China, India and South-East Asia are expected to see considerable growth in energy consumption over the coming decades, both in absolute demand as well as in global consumption shares (WEC, 2019, p. 57; IEA, 2017, p. 65; IEA, 2018, p. 40; EIA, 2019, p. 23, 25).

The shift in global energy demand raises questions for energy geopolitics. Will it intensify the struggle to access oil and natural gas or will demand be met by renewable energy? How will it affect the position of countries in the Global South, the Global North, and oil and gas exporting regions in global energy markets and trade flows? Finally, how will this change energy security considerations and industrial strategies amidst increasing great power rivalry and climate urgency?

This paper explores the energy geopolitical implications of this ‘other’ energy transition, ie, the slow but steady shift in global energy demand from traditional markets to developing countries in the coming decades. The focus is on implications for energy systems, market shares and trade dependencies on the one hand and energy security policies and industrial strategies on the other. The emphasis is on the impact on the Global South and the relations between three regions: the Global South, the Global North and fossil-fuel exporters. The analysis is a pilot study to scout potential opportunities and challenges for the energy security policy of the three regions. It aims to raise attention on this topic and invite discussion.

We proceed by briefly detailing the trend in global energy demand and indicating how we intend to structure our discussion. Then we detail the main expected implications for energy systems, markets and trade, and energy security and industrial strategy based on the interviews conducted. We conclude with take-aways for energy security policy.

2. A shift in global energy demand

Global energy demand is expected to grow by 50% from 600 to roughly 900 quadrillion British Thermal Units between 2020 and 2050 (EIA, 2019). Most of this demand growth is expected to take place in developing countries, driven by a combination of economic and population growth (IEA, 2018, p. 40), while traditional OECD markets and Russia are expected to remain steady at current consumption levels or to show a minor decline (see Figure 1). Overall, roughly ‘70% of future energy demand is expected to come from non-OECD countries in 2040’ (Goldthau et al., 2020, p. 319). The shift is, hence, more about the growth of some than the decline of others.

Figure 1. Expected change in global energy demand until 2040

While the expected shift in global energy demand has clearly been noted (WEC, 2019, p. 57; IEA, 2017, p. 65; IEA, 2018, p. 40; IEA, 2019, p. 40; EIA, 2019; EIA, 2019, p. 23, 25; EIA, 2021, p. 7), its geopolitical implications have thus far been scarcely studied. On the one hand, the literature on energy geopolitics generally relates to changes in energy supply (technologies), not demand. The focus tends to be on securing oil and natural gas and related supply shocks and diversification policies. In more recent years, the focus has shifted towards the transition towards renewable energy (eg, Scholten & Bosman, 2016; Scholten et al., 2020; Vakulchuk et al., 2020; IRENA, 2019; Goldthau et al., 2019; Hafner & Tagliapietra, 2020). On the other hand, when it comes to energy in developing countries, scholarly attention tends to focus on energy transition, the fate of petrostates, energy justice and access, and the role of energy in economic development in general (Goldthau et al., 2020; Apfel et al., 2021). Mostly, the target is on how these countries can develop industrially whilst lacking the means to do so sustainably. A notable exception is the rise of China, and to a lesser degree India, which has attracted attention from energy geopolitical scholarship.

To explore the likely geopolitical implications of the shift in global demand, we follow the analytical framework devised by Scholten (2018, 2023) to structure our discussion. This means that we will progress along four steps, covering the implications of the shift in global demand on: (a) energy sources and systems; (b) energy markets and trade; and (c) energy security and industrial strategy; and (d) which contextual factors might impact the expected geopolitical implications of the shift in demand. In all steps, attention will be placed on the impact on the Global South, as it is there that most demand growth will take place, and on the relations between three regions: (a) the Global South, defined as Latin America (LA), Sub-Saharan Africa (SSA), India and South-East Asia (SEA); (b) the Global North, defined as OECD countries and China;[1] and (c) fossil-fuel exporters, defined as the Middle East and North Africa (MENA), Russia, and Central Asia and the Caspian Region (CACR). This division into three regions has been chosen to better capture future global energy dynamics between countries and/or regions that have different energy security and energy industrial considerations.[2]

In terms of methods, expectations are derived from nine semi-structured interviews revolving around four main questions that are structured along the framework.[3] The anonymous interviewees are 14 experts from academic institutions and think tanks across the world that focus on energy geopolitics and/or energy in the Global South. The summarised answers of the interviews have been transcribed and were sent to the interviewees for review. The information in the following sections can be attributed collectively to the interviewees unless otherwise indicated.

3. The geopolitics of a shift in global energy demand

3.1. Energy systems: how will new demand be met?

A shift in demand leads to a shift in supply. This holds true for volumes, but also for preferences, eg, fossil fuels over renewable energy. Not much change is expected soon in terms of volumes and new demand in the Global South will initially be met through fossil fuels, especially in regions with a lack of abundant renewable energy sources. Despite climate concerns, renewable energy is expected to increase its share only slowly, mostly because economic development takes precedence in the Global South, its fossil fuel infrastructure is well established and climate finance is lacking. This ‘pessimistic’ outlook for the Global South is in line with global energy expectations from the IEA, which expects renewable energy to replace coal but not oil and natural gas by 2050 in its Stated Policies scenario. Outlooks are more optimistic in its announced pledges and net-zero emissions scenarios, however (IEA, 2023, p. 104).

The overarching challenges to a more rapid transition towards renewable energy in the Global South are plentiful. First is a possible lack of available domestic renewable energy sources at affordable prices. Second is a lack of finance and know-how to construct renewable energy infrastructure combined with an established and entrenched fossil-fuel infrastructure. Put differently, there is no right ‘ecosystem for change’, but instead fossil lock-in and path dependence. This also affects local generation as rural communities often depend on external finance to cover the initial investment costs. Third, there is popular pressure on politicians to deliver economic development and better living standards, leading them to prioritise that over renewable energy and climate concerns. Fossil fuels are also a source of wealth and tax income, though it is becoming increasingly possible to develop in a green way. Fourth, renewable energy cannot easily and quickly cover all sectors. Therefore, oil will continue where electricity cannot, as in mobility and hard-to-abate sectors such as agriculture, petrochemicals, heavy transport and heat. Even the electricity grid itself may be an obstacle when grid access and reliability are limited. Finally, a smooth transition to renewable energy requires a stable regulatory and institutional environment for effective governance.

There are, of course, significant differences between countries and regions in the Global South. Latin America, for example, is well-endowed with renewable energy resources, water and energy infrastructure, and has a relatively developed economy and political institutions compared with other Global South regions. Moreover, while Latin America’s cross-border energy integration may be considered insufficient by some standards (Escribano & Urbasos Arbeloa, 2023), compared with other regions in the Global South it is relatively well interconnected. Hence, the energy transition seems to be a logical evolution of current practices.

Sub-Saharan Africa is at the other end of the spectrum in terms of economic development and effective governance mainly due to weak states and a politically fragmented continent. Energy access is low and energy demand mostly stems from cooking (biomass and coal), rather than from industrial or luxury demand. The lack of reliable electricity infrastructure will also hinder a faster renewable uptake, except where decentralised options are funded through foreign investments. Fossil fuels are the natural trend here, as they are tried and tested. As a consequence, the region’s focus is on economic development first, and renewable energy later.

South-East Asia is somewhere between the former two. It has comparatively few own resources (except for Indonesia) but has stronger economic development and governance institutions than Sub-Saharan Africa, though not as robust as Latin America and with regional cross-border infrastructure lagging behind intentions. Its proximity to India and China locates it centrally in global trade routes, creating potential for EV manufacturing, materials processing and exports to be key elements in driving growth. Its risk lies mainly in a coal and LNG trap: South-East Asia tends to prioritise affordability over sustainability, so if investments are made today, they are likely to opt for cheaper fossil options instead of renewable energy.

India, finally, is special in many ways. It is a country that is essentially a continent, and one that is densely populated and increasingly urbanised: by 2027 around 50% of the population is expected to live in cities according to the interviewees. Providing India with clean and reliable energy would be challenging for any government. Its scale also provides opportunities, however. India has the capacity, resources and market size to develop big infrastructure projects and attract foreign investment despite possible risks. Its strategic location in the Indian Ocean and growing economy also positions it as a key player in global politics, something it can eventually leverage on. To meet its demand, India will have to import energy for now and eventually move away from domestic coal reliance if it is to meet its 2070 net-zero target.

3.2. Markets and trade: prices, market structure and power, trade flows

Economic theory suggests that a growth in demand will lead to a rise in prices, all else being equal. But when the transition to renewable energy is adding new sources to the global energy mix and the shift in demand takes place over decades, everything else is hardly equal. Overall, the interviewees expect supply to match demand, leaving little effect on prices. If anything, a decline in OECD oil demand, due to, eg, electric vehicle use or climate policy, would actually free up capacity to supply the Global South. Moreover, the low marginal costs of renewable energy should, in theory, lead to lower electricity prices once the energy transition is sufficiently advanced. In addition, due to lower per capita income in the Global South, its willingness and ability to pay are lower than in Northern markets, creating pressure to lower prices. Prices can still rise in certain regions, though, especially in the short term when supply has not yet had the time to respond to changes in demand. This partly depends on the energy sources used. While oil and gas production can be increased and oil and LNG tankers can change course, renewable energy capacity is still developing and it may take a few years before demand can be met by new investments. A potential risk in this regard is price fluctuations resulting from shortages in mining/extraction and processing facilities of critical minerals and metals. It also depends on whether cheap domestic sources are available. Another risk for the Global South would be a rapid divestment of fossil fuels in other parts of the world that limit the ability to remedy insufficient renewable energy capacity growth.

In terms of market structure and power, rising energy demand in the Global South is not expected to have major impacts. First, while the shift introduces more consumer centres to global energy markets, implying more potential buyers for energy exporters and more potential competition for other energy consumers, the availability of renewable energy will counter this. This allows countries to source a larger share of their energy needs domestically, lowering the need for imports and negating any potential increase in market power of net-exporting countries. Secondly, there is a strong consensus among the interviewees that the leading role of the Global North in determining the nature of energy demand and markets will not change. The Global North is considered as market maker, while the South is a market taker. The North’s energy technology choices and demand preferences continue to shape global energy markets. Imagine a shift from biofuels to an all-electric or hydrogen car park in Europe and its effects on Brazil’s biofuels sector in this regard. Another example would be that the response of China to the EU’s Carbon Border Adjustment Mechanism (CBAM) will most likely determine that of South-East Asia. Yet countries with massive populations like India or key renewable energy resources and materials like Indonesia, Congo or Chile, can carve out some influence.

More change is expected by the interviewees regarding trade flows and supply chain once the share of renewable energy increases. In the short term, when demand is expected to be met by fossil fuels, coal and oil flows are likely to grow in the Indian Ocean, while LNG requires new investments in facilities, involves new trade routes and harbours the potential for lock-in. In the long term, international fossil-fuel flows are believed to decline in an increasingly renewable energy-powered world while critical material and cross-border electricity flows are set to increase. This shifts energy-security strategising from energy sources to carriers and materials. It is likely that material flows are more a North-South affair while direct energy flows become more regional and hence intra-South or intra-North affairs, apart from those regions where North and South meet (eg, the Mediterranean). The biggest differences between materials and oil and gas are that they involve a stock and not a flow and that they can be recycled. Moreover, the multitude of minerals and metals and new innovations will increase complexity compared with fossil chains and require a whole value chain view of energy security. The decisive factor determining material trade partnerships may well be how great-power rivalry will play out and enable or constrain trade. It is likely that countries will opt to cooperate with those with which they share similar values, market vs state preferences and/or security concerns rather than purely economic rationales if great-power rivalry increases. Concerning electricity, the Global South is not very interconnected (compared with, eg, the EU), mostly due to a lack of trust between neighbours and institutional safeguards that could remedy them. Necessity to trade, cost-effectiveness, proximity and political willingness all play a role here, as does the presence of a regional leader that drives integration.

3.3. Strategic concerns: energy security and industrial strategy

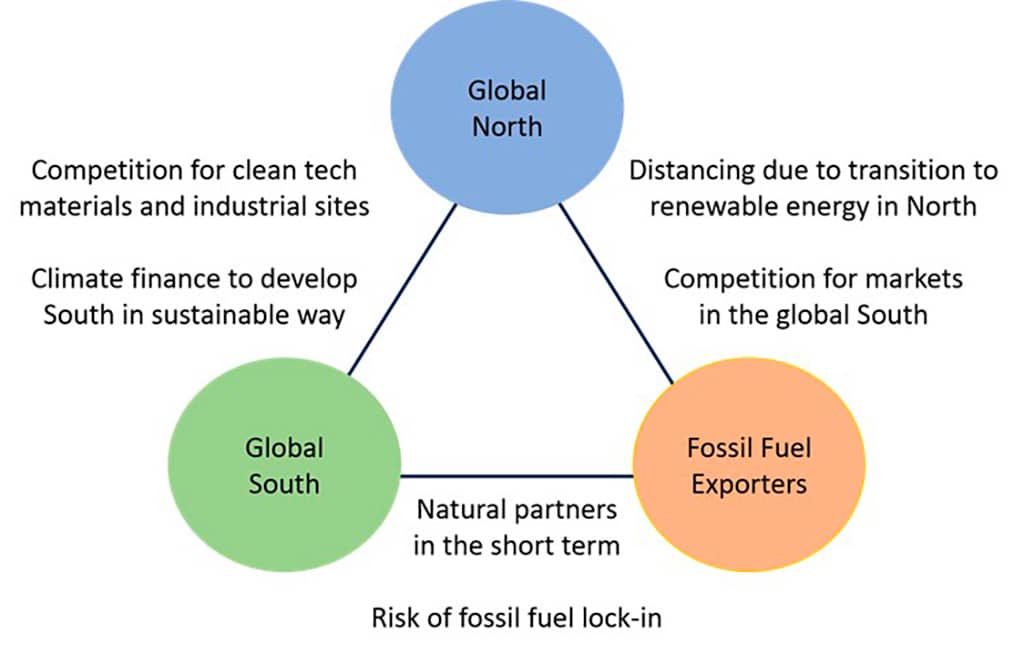

The shift in global energy demand leads to a number of strategic considerations for the Global South, Global North and fossil-fuel exporters, shaping relations between them. Which considerations dominate depends largely on how the Global South intends to meet its growing demand: through domestic resources or imports or through fossil fuels or renewable energy. Accepting the interviewees’ view that the Global South is slowly shifting away from fossil fuels towards renewable energy over time, there are a number of specific considerations in this respect (see Figure 2).

Figure 2. Strategic considerations between the Global South, Global North and fossil fuel exporters

The first consideration is internal to Southern countries that possess their own resources. For the Global South, access to cheap energy is key to economic development and political stability. Countries that possess domestic supplies, eg, Latin America with abundant resources, materials and fresh water, can use them and government policies to level global price shocks and provide cheap energy. Still, these countries may face a difficult trade-off: when energy, technology and material exports earn more than domestic sales, will governments opt for foreign revenues or supply the energy cheaply to domestic consumers, especially the poorer segments?

Several considerations relate to countries in the Global South that need to import fossil fuels or invest in renewable energy. When looking at fossil imports, countries in the Global South and fossil-fuel exporters seem natural partners in the short term, though at the risk of fossil lock-in. Securing imports from fossil-fuel exporters will become easier as the transition to renewable energy progresses in the Global North. The ‘freed’ coal, oil and gas are ideal for meeting growing markets in the Global South and provide OPEC countries with the means to diversify their exports and keep selling their resources, ensuring domestic stability. Still, as mentioned above, a too rapid divestment from oil and gas in the Global North is a potential risk to energy security in the South, especially if the renewable energy uptake is hindered by critical material shortages or prices. The big loser would be climate, as it locks the Global South into fossil-fuel use. Moreover, this would only be a temporary solution as increasing fossil-fuel scarcity and climate urgency will eventually force the use of renewable energy.

If renewable energy is the preferred option, then concerns around clean energy finance and know-how move North-South relations centre stage. The development of renewable energy in the Global South struggles with finding the necessary means. New technologies are high-tech and electricity infrastructure is expensive to build. Renewable electricity has the lowest marginal costs of all energy sources but is hindered by high upfront investments. Moreover, the existing traditional biomass, coal, oil and gas infrastructure is already in place and proved. There is the possibility for decentralised generation (foregoing building expensive transmission grids in rural areas), but local communities generally do not have the finance to start projects. Looking at the limited financial resources available for climate action within the COP format and their strongly politically contested nature, one may be pessimistic about large sums of finance moving from North to South. A possible alternative would be Just Energy Transition Partnerships (JETPs) where foreign loans for or investments in developing countries are matched by similar actions on their part. Still, without sufficient finance a rapid ‘greening’ of Southern energy markets is unlikely and climate-related damages and security risks prevail.

Another area of conflicting interests between the North and South concerns the placement of critical material processing and hydrogen production industries. There are other competition concerns as well, eg, US vs Brazilian biofuels exports. Put simply, the Global North does not want to lose industry to the South, while the South sees a possibility to develop economically in the energy transition by moving up the value chain. For many Northern countries, the energy transition is not only about climate change, local pollution and diversification/energy security but also very much about new jobs and revenues that come from the growth of a new industry. They fear that heavy industry will move to locations where hydrogen and critical materials can be produced or processed more cheaply. At the same time, great-power rivalry between the US and China, but also the EU and Russia, is driving re/on/near/friendshoring efforts, bringing vulnerable supply chains home or under control. For the Global South it presents the possibility of acquiring a better position in the value chain for renewable energy compared with current fossil chains. There, they are often the exporters of resources, eg, crude oil, and buyers of the final products, eg, diesel. The Global South would preferably see materials processing and hydrogen production in their countries, with processed or final goods, not raw materials, being exported. This is a complex tug-of-war between Northern and Southern countries involving competitive advantages such as capital, know-how, developed infrastructure, good governance and proximity to major demand centres in the North vs resources, cheap labour, growth potential and less regulation in the Global South. The Northern desire for access to critical minerals and metals gives Southern countries leverage. Indonesia’s ban on raw nickel exports would be an example where Northern countries are forced to invest in processing in the Global South instead of domestically, so as not to lose access to those resources. Moreover, in an era of great-power rivalry marked by industrial competition in green technologies, Southern countries can play Northern clean-tech exporters against each other for access to Southern markets. Of course, the opposite also holds true. Measures such as the US Inflation Reduction Act (IRA) or the EU’s Carbon Border Adjustment Mechanism (CBAM) stimulate and/or protect domestic production and force standards upon other parts of the world. Northern countries may also threaten to get their resources elsewhere (if alternatives are available) if Southern countries threaten to sell them elsewhere.

The issues over finance and industrial siting are a pity, for as some interviewees said, the country that shares finance and know-how can succeed in the South on more fronts than just business. Short-term economic interests need not stand in the way of long-term political and climate security goals. If the North and South cooperate regarding renewable energy, it may not only reduce poverty and climate-change damages but also limit migration and enable strategic political alliances in the long term. Instead of ‘expensive autonomy’, the North and South can opt for a ‘healthy interdependence’. This would, of course, require an agreement that reconciles Northern concerns about energy and material security, protection of intellectual property rights and industrial opportunity with Southern worries about finance, know-how and economic development. Another important precondition to such an arrangement would be a like-minded outlook on global politics and trade, with dividing lines being between democratic and market-oriented countries on the one hand or more state-centric, bilateral deals-oriented countries on the other. It would probably also require some form of compensation for fossil-fuel exporters or means to co-opt them in the energy transition, eg, through blue hydrogen, to ensure global decarbonisation succeeds.

In any case, one important consequence of the growing demand in the Global South is that oil and gas exporters and countries in the Global North that wish to export renewable energy technologies become competitors over Southern markets. This adds to the fact that these two groups already have tensions over the North’s drive towards an energy transition which undermines exporters’ prosperity. They will need to reinterpret their relationship as existing partnerships end or change, ideally in a way that does not alienate both sides but that focuses on establishing new trade in different sectors. In addition, it also makes Northern countries competitors for Southern markets.

A final consideration concerns possibilities for South-South cooperation and internal division. We saw earlier that countries in the Global South generally see themselves as price and development takers, not shapers. To have more agency over their fortunes, withstand external pressure and turn growing demand and the transition to renewable energy to their industrial advantage, countries need to cooperate. This will be difficult. The African Union (AU), ASEAN and MERCOSUR provide a starting point, but cannot hide that they are not (yet) as far-reaching as the EU. In addition, Latin America, Sub-Saharan Africa and South-East Asian countries will struggle to manage their diversity in terms of energy interests, economic development and preferred global partners. Especially the AU, with its 55 members from both above and below the Sahara and lacking a natural leading country to shape cooperation (like Brazil in Latin America), faces an uphill struggle. Moreover, countries bordering the southern Mediterranean might link up with Europe rather than with Sub-Saharan Africa due to geographic proximity and economic benefits. In Latin America a power dynamics between Brazil, Mexico, Argentina, Venezuela and Chile, with their different energy interests and critical material strategies, will need to be overcome. In addition, some countries prefer bilateral deals, while others opt for market-institutional approaches. Such shared preferences and societal values may well prove more relevant in deciding partnerships than geographic proximity, leading to Southern countries teaming up with likeminded Northern partners like the US, EU, Japan, China, Russia or the OPEC. If there is no cooperation, Southern countries are likely to be played against each other by Northern countries; a scenario that is deemed more likely by the interviewees than Southern countries teaming up in a critical-materials cartel, considering the differences between them.

3.4. Big what-ifs

Considering the timeframe until 2050, there is much uncertainty regarding developments. In this light, both the literature on energy scenarios and the interviewees point to great-power rivalry and the speed of climate change as the most influential uncertainties, though clean-technology breakthroughs have also been used to make energy geopolitical scenarios instead of climate urgency at times (Goldthau et al., 2019).

Great-power rivalry is expected to have a big impact on energy and material value chains, ie, who trades with whom, technology choices and industrial strategies to secure materials. More fragmentation politicises energy and material trade, increasing the likely role played by states and bilateral deals and prioritising security of supply over affordability. A détente, on the other hand, might allow global markets and associated institutions to do their work in facilitating trade, emphasising low prices over secure flows. In the former, countries are likely to think of themselves first and of global climate change later. In the latter, the opposite.

The other major driving force is climate urgency, considering that fossil fuels are not yet scarce and the core renewable technologies that have been invented. When temperatures rise and climate disasters become more frequent, it is likely that political willingness to invest in and cooperate on the energy transition will increase. This will affect the nature of energy demand, for example more demand for cooling instead of heating, and energy infrastructures will face new extreme weather-related threats. If climate urgency is perceived to be low or other issues like socio-economic development are given priority, domestic sources and the use of existing fossil infrastructure will prevail.

In all, the interviewees see the scenario that combines increasing great-power rivalry and climate urgency as the most likely one. This is a mixed blessing, as it is a scenario where climate concerns and economic competition drive the deployment of renewable energy but also one that holds the risk of politicisation of energy trade and resource nationalism.

Conclusions

Take-aways for energy security policy

This analysis explores the energy geopolitical implications of the slow but steady shift in global energy demand from traditional OECD markets to developing countries in the coming decades. It is a pilot study to scout potential opportunities and challenges for the energy security policy of the Global South, Global North and fossil-fuel exporters.

We have seen that the shift is mostly about rising demand in the Global South, not diminishing demand in the Global North. The key factor in anticipating implications seems to be how countries in the Global South will meet that demand: through domestic supplies, fossil fuel imports or installing new renewable energy capacity. By and large, the interviews indicated that the Global South would use fossil fuels in the short term and slowly but surely move towards renewable energy over time. As such, few changes are expected in global market prices, structure and power until 2040-50, but trade flows and partnerships can start to change, as either more oil and gas flows to the Global South or it chooses to install renewable energy and export and process critical materials. Different choices for domestic supplies, importing oil and gas, or installing renewable energy have different consequences but also some overarching strategic implications. Rising demand is likely to lead to new competition for Global South markets between the Global North (as clean-tech exporters) and current oil and gas exporters, an intensification of friction between the Global South and North over the siting of material processing and climate finance, and makes the Global South and oil and gas exporters natural partners for the coming years, bringing its own risks of fossil fuel lock-in. The Global North will also be transitioning towards renewable energy in the same period, reshaping relations with current oil and gas exporters. Finally, the degree to which the Global South can cooperate determines to a great degree whether they can withstand external pressure and use their growing demand or the transition to renewable energy for their own benefit in terms of industrialisation and economic development. By and large, these energy market, security and industrial considerations are seen within scenarios of growing great power rivalry and increasing climate urgency, ie, a world where countries are increasingly looking after their own interests, but where climate change urges us to proliferate renewable energy as fast as possible.

This pilot study has found that the shift in global energy demand is not changing global energy geopolitics and energy security strategy as much as the transition to renewable energy. Still, the trend should be included in analyses of global energy dynamics and policy thinking about trade between the Global South, Global North and fossil-fuel exporters. It helps to better understand the different concerns of these regions (as shown by the full picture of energy developments), develop mutually beneficial grand bargains (that resemble a healthy interdependence instead of neocolonialist practices) and in this way facilitate a smooth global energy transition.

[1] Note that China is included in the Global North in this analysis as it is a country that is able to compete with developed countries in many sectors and specifically in clean energy technologies, that dominates material (processing) supply chains and is able to challenge the Western powers in global politics. Its role in global energy chains is more similar to that of OECD countries than that of the Global South.

[2] Our classification deviates from the UN definition of developed, transitioning and (least) developing countries, or of common understandings of the Global North and Global South. This allows us to separate fossil-fuel exporters as a separate category, next to developed and developing countries. We realise that our classification can be somewhat problematic as there is overlap between the categories, eg, Chile is in the Global South while it is also an OECD member.

[3] Interview questions: Q1, how will demand likely be met in the Global South and in your specific region/country? Q2, how will the trend likely affect domestic, regional and global energy systems, markets and trade relations? Q3, how will the trend likely affect energy security policies and industrial strategies in the Global South/your country, but also in OECD and energy exporting countries? Q4, how does the trend relate to and/or interact with other developments like the transition to renewable energy, great power rivalry or digitalisation.