Theme

This paper unravels the economic security strategies between the EU and the Republic of Korea; it assesses the state of cooperation in the field and discusses prospects for further collaboration.

Summary

This paper argues that the EU and the Republic of Korea (ROK) could and should leverage on the compatibility of their economic security strategies to strengthen cooperation in this field. In recent years the EU and the ROK have stepped up their efforts to address economic security challenges. Their approaches are highly convergent as to both conceptualisation and implementation. More broadly, the EU and ROK are like-minded partners, whose relationship is built upon a strong legal and institutional framework. The worsening geopolitical environment has brought the two partners closer, encouraging them to cooperate far more on a broad range of security challenges, including economic security. This materialised in the conclusion of the Digital Partnership Agreement in 2022, which is translating into a more focused and structured dialogue and joint research activities. There is a willingness and a potential to expand EU-ROK cooperation on economic security. The EU and the ROK could boost their economic security partnership by: (a) establishing a three-pronged framework on critical technologies capabilities, dependencies and vulnerabilities; (b) focusing their discussions on technology policy on investments in design, manufacturing and industrial policy: and (c) coordinating their technology diplomacy including with third countries and at multilateral forums.

Analysis

Over the past few years, in a context of growing geopolitical tensions, both the EU and the Republic of Korea (ROK) have developed a specific view on economic security, underlining the importance of a resilient economy over maximising short-term economic growth. Considering their significant technological capabilities, their normative and geopolitical alignment, and the lack of historical disputes between them, the EU and the ROK are in a favourable position to cooperate in this field. This paper elaborates on this issue and is divided into three parts. The first analyses the conceptualisation of economic security both by the EU and the ROK and how this shapes their cooperation in this field. The second presents the bilateral political and institutional context that frames EU-ROK cooperation on economic security. The third part introduces specific proposals for boosting an EU-ROK partnership on economic security.

1. Compatible views on economic security

Both the European Commission and the ROK recognise the critical importance of economic security in today’s globalised and turbulent environment for guaranteeing the welfare of their populations and ensuring their roles as geopolitical players. The most obvious examples from the European side are the release of an economic security strategy in June 2023 and the subsequent progress in its implementation in January 2024. From Seoul’s perspective the relevance of economic security emerged before than in the EU and is even more important considering its very high dependence on foreign trade, which accounted for 97% of its GDP in 2022. The Moon Jae-in administration (2017-22) had already shifted from strategic ambiguity to a proactive economic security strategy, which has been further developed by the Yoon administration. President Yoon established an in-house economic security centre at the Ministry of Foreign Affairs, reshuffled the presidential National Security Office to create a team dedicated to economic security, and appointed Cho Tae-yul, a diplomat with a long and high-profile career in international economic governance, as Minister of Foreign Affairs. Moreover, although the growing awareness of economic security in the EU and South Korea has been shaped by their distinctive geopolitical contexts, their conceptualisation of economic security is quite compatible and conductive to bilateral cooperation in this area.

According to the economic security strategy released by the European Commission, the concept refers to the EU’s ability to protect its economic interests, maintain and increase its technological edge and ensure resilience against various risks. The Commission identifies three priorities (the so-called three Ps): (a) promoting European competitiveness; (b) protecting the EU’s economy; and (c) partnering with like-minded countries. This includes dealing with vulnerabilities in supply chains, critical infrastructure and technological advancements that could be exploited by geopolitical adversaries and could undermine economic competitiveness and social resilience. This is quite compatible with the conceptualisation of economic security as elaborated in chapter 7 of The National Security Strategy of the Yoon Suk Yeol Administration, which in addition makes an explicit relationship between economic and traditional security, linking technological leadership with military capabilities.

This very similar conceptualisation of economic security also translates into a comparable implementation process. On 24 January 2024 the EU announced five initiatives to strengthen economic security aimed at: (a) tightening inbound investment screening rules; (b) advancing export control conformity throughout the EU; (c) contemplating the establishment of an outbound investment screening mechanism; (d) scaling up dual-use and advanced technology research; and (e) protecting research and advanced technology from leakage to strategic competitors. In the past few years South Korea has also approved legislation with the same goals. The Foreign Investment Promotion Act has been updated to reinforce foreign investment monitoring by improving the security screening process and widening the scope of screening targets. The Industrial Technology Protection Act has been approved to prevent critical technology leakage, enhancing both export approval/reporting systems and establishing an outbound investment screening mechanism. Research and development of advanced technologies has been also spurred by the National Strategic Technology Nurture Plan (NSTNP), which includes new regulation on research security. In addition, the ROK is implementing a Framework Act on Supply Chains which includes several measures such as the creation of a Supply Chain Stabilisation Fund, sponsoring the diversification of export destinations in the private sector, domestic and overseas facility investments, and technology development, as well as the preparation of crisis response guidelines by relevant ministries to guarantee the stable management of economic security items.

This development of the ROK’s approach to economic security strategy has been driven by two main factors. First, various forms of economic coercion from neighbouring powers such as China (2016-17) and Japan (2019), plus unilateral actions implemented by the Trump Administration. Secondly, growing pressure from the US and China to choose between the two – particularly in relation to high-tech industry investment–. In the EU, the US and China have played a role similar to that in Korea, and Russia has emerged as the main concern in particular after its invasion of Ukraine. Learning from these experiences, both the EU and South Korean authorities are aware of the risks derived from commercial, financial and technological dependence on foreign actors, especially if geopolitical and regulatory disagreements or the geographical distance with these actors introduce elements of uncertainty in bilateral relations. But they are also aware of the limitations and additional costs resulting from an economic and technologic development strategy merely based on self-reliance strategy. Hence, both the EU and the ROK combine in their economic security strategy self-reliance with cooperation with foreign actors.

According to the ASPI’s Critical Technology Tracker, China leads R&D in 37 out of 44 technologies, and the US the other seven. The EU tends to be represented in the top research and development seats due to Germany, France and Italy’s positions in high-impact research. South Korea also tends to be included as part of the second-tier group of countries with a higher impact. Still, the impact gap concerning China and the US (which mostly ranks second across all critical technologies) is wide. Acknowledging that the distance with far leading countries is broad, the evolution of the research partnership between the EU and South Korea is a sign of effective performance. While the EU and the ROK are not priority partners, they are like-minded and trusted technological partners that have other partners in common such as the US.

Since Joe Biden’s arrival at the White House both the EU and South Korea have privileged cooperation with the US, but have also identified other actors, including each other as ‘strategic partners’ in the field. In addition, they also share a preference for maintaining significant economic relations with China. This is unambiguously stated in the National Security Strategy of the Yoon Suk Yeol administration: ‘Pursuing stable supply chain cooperation with China, which is Korea’s largest trade partner, is essential for our sustainable economic growth. Therefore, we will actively promote bilateral cooperation to maintain stable supply chains between the two countries. We will also continue our long-term efforts to diversify our supply chains for critical items’. This approach conflicts with a China-centred economic security strategy as developed in the US, in particular, when Washington unilaterally pressures its allies to follow suit on its China policy, for example, through the extraterritorial application of US export controls against EU and Korean firms. This trend will most likely increase if Trump wins the presidential elections in November, creating incentives for a more diversified cooperation on economic security among likeminded US allies such as the EU and Korea.

2. EU-ROK cooperation

The convergence EU and the ROK’s interests in economic security and their outward looking approach create favourable conditions for their cooperation in this field. They both consider each other important partners to strengthen cooperation in economic security, amid growing geopolitical tensions. The National Security Strategy of the Yoon Suk Yeol administration identifies the EU as partner to strengthen cooperation in economic security and to enhance strategic partnerships on critical and emerging technologies. The five initiatives to strengthen economic security also identify Korea as a like-minded partner with whom the EU is strengthening its cooperation.

Overall, EU-ROK cooperation is built on a solid legal and institutional framework. Bilateral relations were upgraded with the establishment of the Strategic Partnership in 2010. Political and economic cooperation is further structured by their Free Trade Agreement (2011) and the Framework Agreement (2014). In 2023 the EU and Korea launched negotiations for a digital trade agreement, which expands their economic cooperation to the digital domain and aims to counter digital protectionism, as well as to lead the development of digital trade rules. Sectoral cooperation on Information Communications Technology (ICT) has also been a longstanding element of EU-ROK cooperation, structured through the 2006 Scientific and Technological (S&T) Cooperation Agreement, which established Joint Committee on S&T Cooperation. The Framework Agreement also encouraged further cooperation on ICT, including on interoperability, standardisation and research cooperation. More specifically, in 2014 the two partners issued a Joint Declaration on Strategic Cooperation in ICT and 5G, with the ambition of cooperating in the establishment of global standards. This adds to their strong record of research cooperation: in the framework of Horizon 2020 (2014-20), 130 grants were signed with 197 participations by 128 Korean entities.

This framework, together with their strong normative and geopolitical alignment, has provided the ROK and the EU with a solid basis to strengthen their cooperation on economic security. In recent years, there has been a growing sense of urgency to make cooperation more robust due to the vulnerabilities exposed by the pandemic and the deteriorating geopolitical context. Since 2022 the annual EU-ROK JCC meetings include a specific commitment to address economic security, evidencing a growing interest in incorporating this topic into their discussions.

This interest materialised in the adoption of the Digital Partnership Agreement (DPA) in November 2022. The DPA provides a general framework for further cooperation across a broad range of digital technologies. It includes specific commitments such as facilitating access to their respective High-Performance Computing (HPC) and quantum infrastructures. Both sides also agreed on cooperation on online platform governance, an area where they are both stepping up their efforts, as evidenced by the EU’s Digital Services Act and Markets Act, and the recently adopted ‘Self-Regulation for Platforms’ on the Korean side. The DPA showcases EU-ROK alignment on normative issues, as it includes cooperation on human-centric digitalisation, a broader scope than the DPAs with Japan and Singapore, which are more narrowly focused on economy and regulation.

Beyond what was agreed in 2022 the DPA is a flexible instrument which foresees expansion and adaptation based on the interests and needs of both parties. The annual DP Council reviews progress and identifies priorities to facilitate the implementation of the DPA. The first DP Council, which took place in June 2023, launched a permanent dialogue on AI, as well as the Quantum Experts working group to identify common research topics for collaboration on issues such as quantum simulators and quantum communications. The DP Council met again in March 2024 and identified new areas of cooperation, such as network connectivity.

The DPA has created momentum for further EU-ROK cooperation on economic security. This was included in the Joint Statement at the May 2023 Summit, in which the EU and the ROK agreed to expand their Industrial Policy Dialogue. This mechanism, now called the Supply Chain and Industrial Policy Dialogue, took place in December 2023 and agreed to deepen collaborative research and bilateral cooperation on the supply chains of advanced industries, such as batteries and semiconductors. In October 2023 Korea opened a Quantum Science Technology Cooperation Centre in Brussels to advance joint research projects with Europe. The Joint EU-Korea Research Forum on Semiconductors took place for the first time in March 2024 with the aim of establishing connections between young researchers from both sides. These efforts evidence their mutual appreciation as technology advanced partners and their growing interest in identifying synergies to strengthen cooperation on economic security.

Similarly, in March 2024 both partners concluded formal negotiations for Korea to associate with Horizon, the closest possible cooperation on research and innovation with the EU. Korea is expected to take part in Horizon as of 2025. In the meantime, both partners have launched two calls for collaborative research on chips research and on Radio Access Networks (RAN) and 6G technology, with projects to start in 2024. Moving forward, Korea’s announcement that it will establish strategic R&D centres in Europe opens up new opportunities for further research collaboration.

EU-ROK dynamism in economic security has been sustained and expanded through the ROK’s cooperation with EU Member States. In 2023 the ROK and the Netherlands agreed on a ‘semiconductors alliance’ and established three dialogues on semiconductors and economic security. The ROK has also committed to enhance cooperation supply chain resilience and technological competitiveness with France. Additionally, Korea and Germany established a Digital Dialogue in 2022, which is working to enhance the alignment of political strategies and initiatives and promote high-tech. This showcases the growing interest in cooperation by leveraging on different channels of cooperation in Europe-ROK relations.

3. Policy areas to be improved or strengthened

The EU and the Republic of Korea still fall short on certain policy approaches, either within the existing initiatives or because of the lack of many emerging technology orientations. Still, several measures can be fostered to go beyond the purely research and development stage, which has proved to be necessary but insufficient.

First, in terms of ‘protecting’ their economic security, they should establish a three-pronged framework on critical technologies capabilities, dependencies and vulnerabilities. The Spanish Presidency of the EU Council published a Resilient EU2030 report, which distinguishes three criteria to zoom into the technologies that can allow a region to possess actual economy security: (a) it already has a competitive edge over certain technology; (b) it has the potential to establish itself as a frontrunner; and (c) it needs to have minimal and critical capacities to at least avoid shocks and disruptions. In this categorisation, the first step is for each stakeholder to identify its own capacities, dependencies and vulnerabilities. The European Commission called each Member State to deliver a mapping of technological threats upon its recommendation for a list of critical technologies, which has been delayed.

Of the 10 critical technology areas, the Recommendation on critical technology areas for the EU’s economic security for further risk assessment with Member States from the European Commission identifies four technology areas that are considered highly likely to present the most sensitive and immediate risks related to technology security and technology leakage: (a) advanced semiconductors technologies (microelectronics, photonics, high-frequency chips and semiconductor manufacturing equipment); (b) artificial intelligence technologies (high-performance computing, cloud and edge computing, data analytics, computer vision, language processing and object recognition); (c) quantum technologies (quantum computing, quantum cryptography, quantum communications, quantum sensing and radar); and (d) biotechnologies (techniques of genetic modification, new genomic techniques, gene-drive and synthetic biology). The following critical areas are: (e) advanced connectivity, navigation and digital technologies; (f) advanced sensing technologies; (g) space and propulsion technologies; (h) energy technologies; (i) robotics and autonomous systems; and (j) advanced materials, manufacturing and recycling technologies.

Meanwhile, the NSTNP of the ROK identifies 12 national strategic technologies: semiconductor and display, secondary cells, leading-edge mobility, next generation nuclear energy, leading edge bio, aerospace and marine, hydrogen, cybersecurity, AI, next generation communications, leading edge robotics and manufacture, and quantum technologies. Most of them coincide with the EU’s list proposal. Korea announced that it would expand its R&D investments in the 12 National Strategic Technologies, and newly invest ₩265 billion to technologies that have urgent need for growth, such as 5G open ran, quantum computing, sensors and innovative SMR. In order to strengthen qualitative strategic R&D investment, the Korean government aims to establish a pan-government strategic roadmap that clarifies national missions and development goals of sub-specific technologies. However, the EU is still at the early stage of collecting the nationally-led mapping of critical technology areas by each of the 27 Member States, which might slow down the maturity development of these projects in the long run compared with other counties that are frontrunners in these critical technologies. Also, Member States are likely to have some different approaches in critical technologies, thus budgets and willingness to create cross-country R&D projects might largely differ within the EU.

Once this step is fully accomplished, the second step is to channel discussions between the EU and the ROK on this matter to identify sensitive technology areas where their priority-setting should be focused.

Also, several emerging policy areas are as yet unaddressed in the bilateral conversation. This is the case of undersea cables. In the last Digital Partnership Council, the European Commission highlighted the importance of cooperation on connectivity. This includes undersea cable connectivity projects through the Arctic to provide trusted data flows and cooperation on secure and resilient connectivity in third countries. In turn, the European Commission has also launched a Recommendation on the Security and Resilience of Submarine Cables, where the international engagement dimension is also included.

On the other hand, the ROK and the EU have addressed the topic of the future of digital networks and the connectivity market within their respective territories. Korea applied a levy on OTT to pay for telecommunication companies on the networks they make use of. The European Commission has proposed a similar model. Given the fragmentation of the EU into 27 national telecom markets with different network architectures, different levels of network coverage, different national spectrum managements and different regulations, the White Paper on the future of the telecommunications market by the Commission identifies several scenarios to contribute to the creation of a single telecoms market. The three pillars are rethinking investment in such networks, creating a joint regulatory framework and ensuring that they have greater security. This issue ties in with the discussion about introducing a ‘fair contribution mechanism’ or a ‘telecoms levy’ on over-the-top content providers (OTTs) for the data traffic they generate when using telecom companies’ networks. While the ROK and the EU have similar approaches, both sides might still leverage resources to support each other in sharing information on best practices and lessons from each scenario.

However, this is not just an economic issue; it has much to do with the EU’s strategic autonomy. The future of the EU connectivity sector is at stake. Telecoms companies are a strategic and critical sector for the maintenance, security and resilience of essential services, both public and private, and the sharing of sensitive personal, industrial and utility data. Another area for partnering relies on the complementary strengths that both sides have. The EU side has a clear interest in learning from Korea’s experience to boost its own tech capacity and innovation, as evidenced by the European Parliament’s visit to Korea in late 2022, whereas during that same visit Koreans showed interest in EU regulations including the AI Act, the Digital Markets Act and the Digital Services Act.

Secondly, in terms of ‘promoting’ their joint economic security, the EU and the ROK should expand their discussions on technology policy towards investments in design, manufacturing and industrial policy, beyond research and development. In December 2023 the South Korean President Yoon Suk Yeol’s administration announced a new high-tech industry development initiative, seeking to funnel around US$422 billion of private money into key sectors like semiconductors by 2026. For instance, the EU Chips Act seeks to establish ‘semiconductor partnerships’ to manage dependencies and enhance supply chain resilience, including with the ROK, while the formalised access of the ROK to HorizonEurope and the launch of calls for R&D and the Semiconductors Researchers Forum is an opportunity to tie both sides’ interests in semiconductor development. In May 2024 South Korea announced a ₩26 trillion (US$19 billion) support package for its chip businesses, citing a need to keep up in areas like chip design and contract manufacturing amid ‘all-out warfare’ in the global semiconductor market, which could complement the EU’s efforts in this area.

Another example of inspiration would be the Memorandums of Understanding (MOUs) launched by the EU with Japan and India, respectively. The MoU with Japan from July 2023 intends to enhance bilateral cooperation on: (a) an early warning mechanism for the semiconductor supply chain; (b) research and development for semiconductors; (c) advanced skills for the semiconductor industry; (d) use cases of semiconductor applications; and (e) transparency of subsidies to the semiconductor sector. The MoU with India from November 2023 aims to share experiences, best practices and information on each respective semiconductor ecosystem; identify areas for collaboration in research, development and innovation among universities, research organisations and businesses; promote skills, talent and workforce development for the semiconductors industry and facilitate collaboration via the organisation of workshops, partnerships and the promotion of direct investments; and ensure a level playing field in the sector, including by sharing information on granted public subsidies.

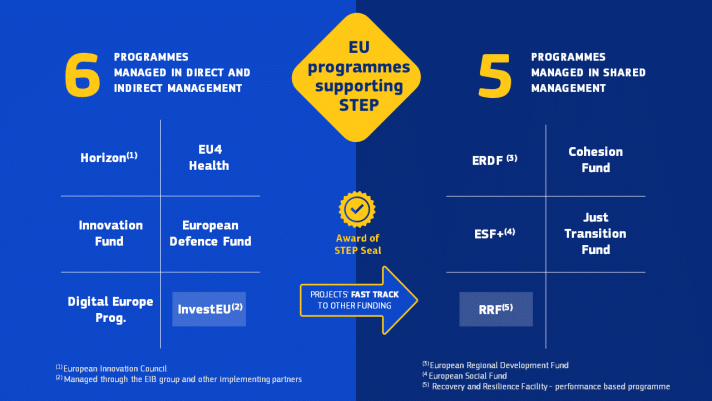

Moreover, the EU has launched a toolkit of diverse initiatives revolving around industrial policy for the green, digital and defence sectors. In particular, the Strategic Technologies for Europe Platform (STEP) enhances the EU’s industrial competitiveness by focusing on developing critical technologies for a sustainable, competitive future. It tests new strategic measures and strengthens the EU’s industrial policy. STEP focuses on projects in the development and manufacturing stages of three sectors: digital and deep technologies; climate, clean and green technologies; and biotechnologies. The selection of programmes falling within the scope of STEP are made based on two criteria: innovation (innovative, emerging or cutting-edge, and demonstrating significant economic potential on development or manufacturing, or spillover effects across Member States) and strategic dependencies (it should contribute to reducing or preventing them). While the expected budget for STEP was initially €10,000 million, the Council of the EU downgraded the amount to €1,500 million. However, STEP and the ROK’s NSTNP have some differences.

First, while STEP aims to reduce the dependencies of three areas of critical technologies that can become highly innovative, the ROK’s NSTNP aims to enlarge the number of strategic technology fields in which Korea possesses more capacity than 90% of that of the most developed country, from three in 2020 to eight in 2027. While STEP aims to reduce threats, the NSTNP looks forward to increasing the competitive edge of potential frontrunner sectors.

Secondly, STEP is a platform to raise and steer funding across 11 existing EU programmes to three target investment areas, and any stakeholder that aims to apply for it needs to comply with the guidelines of the corresponding programme, while the NSTNP establishes mission-oriented investment for each of the 12 identified strategic technologies. STEP does not create new eligibility rules. To be funded under a given STEP call, projects would need to meet the relevant eligibility conditions, as well as comply with the specific rules of the relevant funding programme (ie, defined in the work programmes and calls for proposals’ eligibility, selection and award criteria). In turn, there are three types of support: directly managed programmes, nationally managed funds and repayable forms of funding. If stakeholders apply for directly and indirectly managed fundings –Horizon, EU4Health, Innovation Fund, the European Defence Fund, the DigitalEurope Programme and InvestEU–, they accomplish their goals and are awarded a Sovereignty seal, the latter may fast-track the project to other new possible funding under the programmes implemented in shared management –European Regional Development Fund, European Social Fund+, Recovery and Resilience Facility, Cohesion Fund and Just Transition Fund–.

Figure 1. Funding model of the Strategic Technologies for Europe Platform (STEP)

In the case of the NSTNP, mission-oriented investments allow the public administration in Korea to separately manage core projects individually to secure strategic technology, and it will strategically concentrate the budget to guarantee performance outcomes. The introduction of the Fast-Track system will enable quick project initiation, and dramatic trend changes will be dealt with in a timely fashion by rectifying the submitted plans.

While each side is channelling its own economic investments to build up its own technological powerhouse, both sides should stretch out their efforts to find mutual investment across technology sectors where one market largely lags. This would help the other partner fill up the still missing capacities by relying on an external trustworthy partner in a sustained manner instead of reinventing the wheel from scratch. While it is not a comparable model, the Quad Initiative has created the Quad Investors Network, aimed at accelerating investment in critical and emerging technologies. The QUIN brings together investors, corporations and public institutions across Australia, India, Japan and the US in convenings, curated deal flow and public-private collaboration to implement joint ventures and co-investments into technology opportunities with strategic potential. The EU-LAC Digital Accelerator is a multi-sided platform to connect investors and business opportunities between the EU and Latin America and the Caribbean. An opportune model would be that of a joint investment platform between private companies in the ROK and the EU.

Third, in terms of ‘partnering’ for a truly effective engagement in economic security between both sides, the ROK and the EU should tie up their efforts in technology diplomacy and international engagement with third countries. Similar to the EU-US Trade and Technology Council’s increasing joint connectivity packages in third countries –Costa Rica, Kenya, Jamaica and the Philippines–, the ROK and the EU should seek third partners to engage with on a trilateral basis. This means that the engagement should go beyond information-sharing and be expanded into priority-setting and identification of country players of mutual benefit for the three partners. Similarly to other proposed models on the operationalisation of the EU-US-India technology triangle, the EU and the ROK should align forces in those countries where each of them already have individualised bilateral partnerships. This is the case in some Latin American countries, where the EU-LAC Digital Alliance is ongoing and the Korea-LAC Trade & Innovation Forum has taken place.

Jointly with this technology triangle with a third partner of mutual interest and benefit, both the EU and ROK should ‘multilateralise’ their bilateral partnership to engage with multiple countries. For instance, the EU and the ROK aim to strengthen their cooperation on critical raw materials in the context of the Minerals Security Partnership (MSP) and the recently established Forum. The MSP currently has 15 partners –Australia, Canada, Estonia, Finland, France, Germany, India, Italy, Japan, Norway, the Republic of Korea, Sweden, the UK, the US and the EU– and it aims to reach out to prospective members from America, Africa, Asia and Europe.

A third line of action is ROK-EU cooperation to influence in the agenda-setting and decision-making in international forums. For instance, both sides aim to increase their coordination in international technical standard-setting organisations, such as the International Organisation for Standardisation (ISO). In the DPA both sides commit to cooperate on the standard-setting of digital technologies, such as quantum, as well as to define and advance a common vision of 6G and coordinate their positions on AI governance at the Global Partnership on Artificial Intelligence and the OECD. The EU and the ROK have already engaged in discussions over the standardisation of trusted chips and chip security, and have an interest in strengthening cooperation in this area. Minister Lee Jong-Ho referred to the EU as one of Korea’s best partners for establishing technological standards. Similarly, the EU Standardisation Strategy considers Digital Partnerships a key standard-setting vehicle.

These measures on R&D, investments and industrial policy, and an internationalised bilateral agenda with third partners, will help frame the comprehensive approach that economic security merits and needs. This should be complemented with the current negotiations over a Digital Trade Agreement which will likely complement the EU-ROK Free Trade Agreement. Yet to be defined, it might become the regulatory framework on which these policy developments can fall back on.

Conclusions

Overall, EU-ROK relations are built upon a strong track record of cooperation, and a solid institutional and legal framework. Geopolitical tensions have injected dynamism into the relationship and pushed both partners towards more robust collaboration on economic security. There has also been fast progress on the implementation of concrete deliverables under the DPA, particularly those focused on dialogue and joint research activities. Structured dialogues facilitate learning from each other’s experiences and help to strengthen the oversight of critical supply chains. Collaborative research helps enhance their competitiveness in emerging digital technologies. There is both a commitment and a potential to build on the ongoing momentum to expand EU-ROK cooperation on economic security.

This publication was supported by the Korea Foundation’s Policy-Oriented Research Program.