Theme

What are the prospects of Russian energy returning to the EU after a ceasefire in Ukraine?

Summary

In a scenario of an eventual end to the conflict in Ukraine, even in terms that are very unfavourable for Kyiv or European interests, it is likely that the debate over a potential return of Russian energy to the EU will resurface. This analysis argues against such a scenario on four main grounds: (a) much of the infrastructure required for energy transport is no longer available; (b) long-term supply contracts have been cancelled; (c) legal certainty has been profoundly undermined; and (d) lifting the sanctions regime imposed on Russia requires unlikely unanimity among the 27 Member States of the Council of the EU.

Analysis

As Trump promised during the election campaign, his arrival at the White House has opened a negotiation process with Russia to end the War in Ukraine. It seems unlikely that these negotiations will not include the energy sector, the main source of income for the Russian Federation and the target of major sanctions and restrictions since February 2022 by the G-7 countries. The EU is not expected to participate in these negotiations, but a peace agreement in Ukraine will once again open the debate on the future of Russian energy in Europe.

This analysis examines the feasibility of a return of Russian energy to the EU following a potential cessation of hostilities in Ukraine. It begins by outlining the current state of energy decoupling and identifies four key obstacles to reversing this process: (a) the availability of transport infrastructure; (b) the status of long-term contracts; (c) the deterioration of legal certainty amid ongoing international arbitrations; and (d) the limited reversibility of sanctions imposed on the Russian energy sector. The analysis concludes that, within the current geopolitical context, particularly one shaped by a peace agreement negotiated bilaterally between Washington and Moscow, a return of Russian energy to the EU appears highly unlikely.

1. EU-Russia relations in 2025

Three years after the invasion of Ukraine the EU has made substantial progress towards the main objective of the REPowerEU plan: ending Russian energy imports by 2027 (Figure 1). Imports of coal and, with limited exceptions, Russian oil have been banned. Even in the absence of formal sanctions, natural gas imports from Russia have been reduced by 75%. While the EU has paid a high cost, it has succeeded in diversifying its hydrocarbon supplies and shedding the energy dependence that had long constrained its relationship with Moscow.

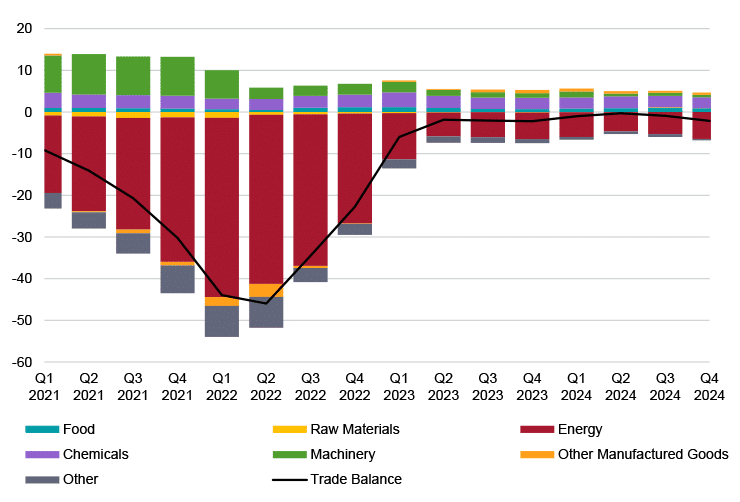

In economic terms, the EU’s energy trade deficit[1] with Russia has gone from more than €40 billion in the first quarter of 2022 to around €6 billion in the last quarter of 2024 (Figure 2). The remainder corresponds mainly to purchases of natural gas and crude oil from Slovakia and Hungary and, to a lesser extent, nuclear fuel, which is more complex to replace for technical reasons.

Figure 2. Trade balance with Russia by product, 2021-24 (€ bn)

The EU has reduced its dependence on Russian energy both quantitatively –through lower trade volumes and economic value– and qualitatively, by restructuring its gas and oil infrastructure, cancelling contracts, engaging in complex arbitration processes and imposing sanctions. These shifts make the return of Russian energy to the EU unlikely, at least under the current geopolitical circumstances.

2. Infrastructure

Three years after the invasion much of the infrastructure that made energy exchanges between Russia and the EU possible is no longer available, especially for natural gas, or has been adapted to accommodate new suppliers.

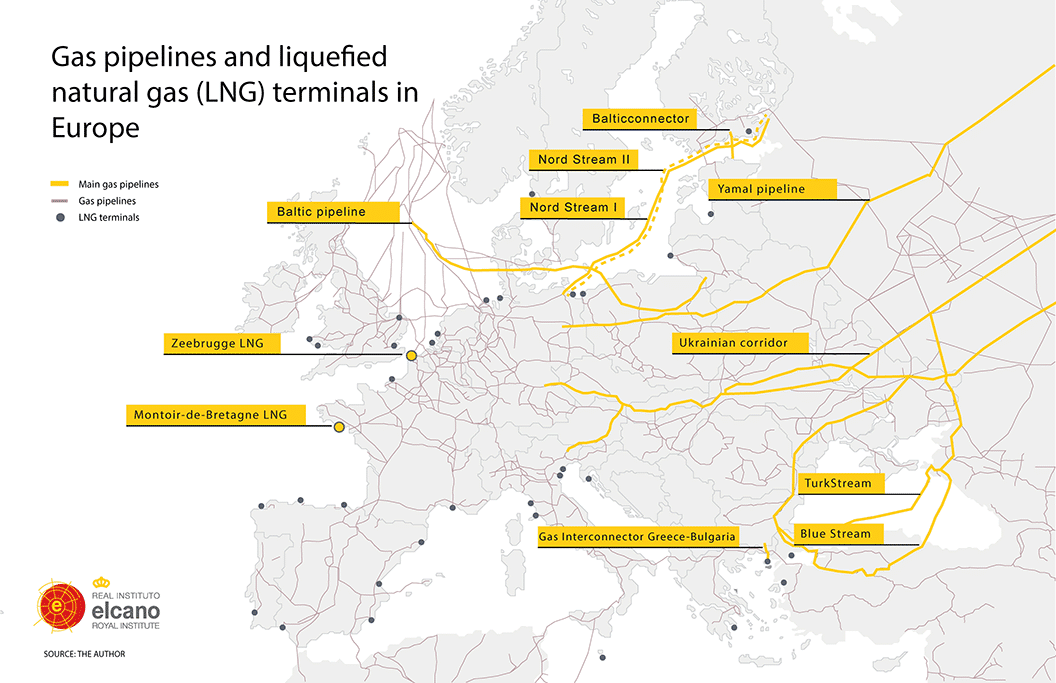

The main gas pipelines supplying Europe have seen their operability reduced or conditioned: Nord Stream 1, which connected Russia with Germany via the Baltic, was rendered unavailable following sabotage in September 2022; the Yamal-Europe pipeline, which transported gas through Belarus and Poland, has been closed and its Polish section nationalised; and the Ukrainian pipelines, which still connect Russia with Europe, would be available, but without a valid transit contract. Finally, TurkStream, which transports gas across the Black Sea, is operating at full capacity, with no margin to increase its volumes.

Regarding the Ukrainian gas pipelines, the contract governing the transit of Russian natural gas through Ukraine expired on 31 December 2024, with no renewal agreement reached due to Kyiv’s refusal. Since then, Slovakia has been pressuring both Brussels and the Zelensky government to resume gas flows, leveraging its veto power in the EU Council and its electricity exports to Ukraine as instruments of influence. However, following the latest clashes in the Kursk region, the operational status of these pipelines remains uncertain. Russian troops used the empty pipelines to penetrate Ukrainian defence lines, in an offensive that included drone attacks and heavy artillery in the vicinity of the pipelines. The Sudzha metering facility, the only operational entry point for Russian gas into Ukraine since February 2022, is reported to have been seriously damaged. Ukraine and Russia have traded accusations over who was responsible for the attack.

The case of Nord Stream 2, which never became operational, is perhaps the most uncertain. Although the sabotage operation on Nord Stream 1 also damaged part of this infrastructure, it would still retain 50% of its transport capacity.[2] However, Nord Stream 2 never obtained the administrative permits in Germany to become operational and is 100% owned by Gazprom through the Swiss company Nord Stream 2 AG, currently under sanctions by the US and in the process of filing for bankruptcy. Various rumours recently published raise the possibility that US investors could buy Nord Stream 2 AG in parallel with a lifting of sanctions by the Trump Administration. This manoeuvre, unthinkable just a few months ago, would have to be approved by the new coalition government in Germany, which has already ruled out the possibility.

With regard to liquefied natural gas (LNG), Europe’s import and regasification infrastructure faces no technical barriers to continuing Russian LNG imports, or even increasing them in the event of new supply, given that only 42% of available capacity was utilised in 2024.

Figure 3. Gas pipelines and liquefied natural gas (LNG) terminals in Europe

In the case of oil, the infrastructure is still functioning with some restrictions. The Druzhba oil pipelines remain operational: the northern branch, although with reduced volumes, transports Kazakh crude to Germany and Poland, while the southern branch continues to supply Russian oil to Hungary, Slovakia and the Czech Republic thanks to an exemption granted in the eighth EU sanctions package. EU oil terminals could also resume purchases of Russian oil immediately, although since the start of the war, refineries have made significant investments to adapt their operations and reduce their dependence on the type of crude oil Russia exports. Something similar is happening with coal. While ports and railway lines would continue to be available to resume imports, thermal power plants that used to operate with Russian coal have adapted their operations to accommodate purchases of Colombian, US or South African coal.

The electricity trade, much less significant economically than the one of hydrocarbons, is unlikely to return to pre-war levels. In February 2025, Estonia, Latvia and Lithuania completed their disconnection from the BRELL system and their synchronisation with the EU’s electricity grid, deactivating 16 interconnection lines with Russia and Belarus. Ukraine, for its part, also disconnected its electricity grid from the Russian system in February 2022 and, in March of the same year, synchronised its grid with the European one.

3. Long-term supply contracts

The contractual framework for Russian gas in Europe has been virtually dismantled. Of the more than 120 billion cubic metres (bcm) contracted in 2019 (Figure 1), 25 bcm have expired without renewal, while 47.3 bcm have been cancelled for various reasons: Russia’s unilateral demand for payment in roubles in 2022, Gazprom’s repeated failure to fulfil agreed deliveries, and the unavailability of key transport infrastructure, notably Nord Stream and the Ukrainian transit route. Although in formal terms contracts for around 50 bcm per year remain in force, less than 15 bcm are operational. Currently, Hungary, Slovakia and Greece are the only EU countries that continue to import Russian gas through TurkStream and whose long-term contracts with Gazprom are not subject to international arbitration. The remaining 35 bcm are in various stages of arbitration, initiated by the buyers themselves after the various interruptions in deliveries since February 2022.

The ruling of the Stockholm Arbitration Tribunal in June 2022 regarding the largest natural gas contract in Europe, the one between Germany’s Uniper and Gazprom, could be decisive for the future of Russian gas in the EU. The tribunal ordered Gazprom to pay compensation of €13 billion for the suspension of gas flows through Nord Stream and allowed the German company to terminate its bilateral supply contract, including the take-or-pay obligations. This ruling could serve as a reference for the other arbitration processes underway, such as those of the German company RWE, the French company Engie and the Italian company Eni. In all these cases, gas deliveries have come to a complete halt, but their contracts are in a legal limbo pending the decision of their respective arbitrations.

As Stern, Yafimava and Ason state with regard to the cancellation of the Uniper contract associated with Nord Stream 1: ‘As long as the long-term contracts remained in force, even with supplies suspended, there was always the possibility (however remote) that the end of the war in Ukraine, especially if combined with a political change in Russia, could create the conditions for substantial volumes of Russian gas to return to Europe’. Therefore, although irrelevant at this time from a commercial point of view, the termination of the contracts would be an important barrier to the return of Russian natural gas to the European market.

In the case of LNG, the contracts linked to Novatek’s Yamal project are still in force, with long-term agreements signed with companies such as TotalEnergies, Naturgy, SEFE, Gunvor and Shell, with terms running until 2041. From May 2024, EU legislation on gas markets allows Member States to ban the import of Russian LNG into their regasification terminals. To date, none of the main importers of Russian LNG in the EU (Spain, France or Belgium) has shown any intention of using this authority. In a scenario of negotiated peace or even a frozen conflict, such a measure would probably be avoided, given the impact it would have on the security of supply of these Member States and on the financial stability of the companies involved, in addition to the growing geopolitical risk associated with its main alternative: LNG from the US.

Figure 5. Contracts of European companies with the Russian Yamal LNG project

| Seller | Buyer | Volume (bcm) | Start | End |

|---|---|---|---|---|

| Yamal LNG | Gazprom Germania (SEFE) | 4.2 | 2018 | 2038 |

| Naturgy | 3.5 | 2018 | 2038 | |

| TotalEnergies | 5.6 | 2018 | 2032 | |

| Novatek Portfolio | TotalEnergies | 1.4 | 2018 | 2041 |

| Gunvor | 0.7 | 2018 | 2038 | |

| Shell | 1.26 | 2018 | 2041 |

For oil and coal, the contractual issue is irrelevant, as these markets operate with short-term supply agreements and in the spot market. Russian coal imports ceased entirely after the EU ban in 2022, which means that any previously existing contracts (they usually have a duration of three months) have already expired. In the oil sector, purchases of Russian crude oil and refined products have fallen dramatically due to the sanctions, with specific exceptions such as imports from Hungary and Slovakia. Since crude oil and coal purchases are not structured around long-term contracts, any attempt to return Russian energy to Europe in these sectors would require negotiating new purchasing conditions from scratch and would be conditional on the lifting of current sanctions and restrictions, both European and national, as well as those of the US and with extraterritorial character.

Finally, Rosatom’s nuclear fuel imports, regulated by contracts of between 10 and 20 years, have continued, and five Member States are still acquiring technology and fuel from Russia for their 19 Soviet-designed VVER reactors. Although not very significant economically, the annual purchases are around €300 million, replacing this supply is complex, as it requires the adaptation of supply chains in a sector with limited options. Currently, the operators of these plants work with the French company Framatome and the US company Westinghouse for the supply of nuclear fuel.

4. International arbitration and the nationalisation of assets

Before the war in Ukraine and the imposition of sanctions, arbitration was the standard mechanism for resolving disputes between European and Russian energy companies. The decisions of the arbitration tribunals were respected by the parties, even at times of maximum geopolitical tension. Russia’s use of energy as a tool of coercion and the subsequent European sanctions on the Russian financial sector have been elements of dispute that have been brought before their respective arbitration tribunals.

In this respect, the arbitrations have yielded different results, although, in general terms, they have been favourable to European companies. In the case of Gasum vs Gazprom, the arbitration court backed the demand for payment in roubles, considering that the European restrictions on the Russian financial system constituted a case of force majeure, and ruled in favour of Gazprom, obliging the Finnish company Gasum to pay compensation of €300 million. However, other rulings have benefited European companies, such as the aforementioned Uniper vs Gazprom, where the arbitral tribunal ruled that the German company should be awarded €13 billion in compensation for the unjustified interruption of the natural gas supply. This ruling, which demands a historic level of compensation, represents an existential threat to Gazprom, whose stock market valuation has fallen dramatically, from US$100 billion in 2021 to approximately US$45 billion in the first months of 2025.

In anticipation of possible similar decisions that would force Gazprom to pay compensation that could bankrupt the company, Russia has adopted a legal strategy to minimise the impact of international arbitrations on its companies. Through rulings by its own national courts, it has prohibited Gazprom and other Russian companies from complying with foreign arbitration awards and imposed disproportionate fines on European companies that try to exercise their rights in these proceedings. In March 2024, a national court in St. Petersburg issued an anti-arbitration injunction against Uniper, imposing a fine of €14.3 billion if it continued with its international arbitration. This was not an isolated case, as Gazprom obtained similar rulings against several European companies, including OMV, Net4Gas, Engie and Gasunie, prohibiting them from resorting to foreign arbitration tribunals and arguing that Western sanctions prevented their legal representation and a fair trial.

These court decisions in Russia undermine the legitimacy that international arbitration has built over decades as a trusted mechanism for dispute resolution. They reinforce the perception that arbitration no longer guarantees impartiality or enforceability, weakening confidence in its effectiveness for settling commercial and energy-related disputes. This dynamic adds to a broader trend signalling the accelerated breakdown of the rules-based liberal international order, one with significant implications for the global energy sector.

Furthermore, in this context of the loss of international legal security, both Europe and Russia have nationalised or taken control of energy assets for strategic reasons. Russia took control of the assets of Fortum and Uniper[3] and, in parallel, Germany nationalised Gazprom Germania (which has been renamed SEFE) and placed Rosneft Deutschland under state trusteeship. In Poland, the government transferred Gazprom’s stake in EuRoPol Gaz to Orlen, asserting full control over the Polish section of the Yamal-Europe gas pipeline, and the Bulgarian government has forced Russia’s Lukoil to look for a buyer for its Burgas refinery.

All these moves have wiped out decades of investment and trust, with no simple roadmap for their restoration. The signing of new supply contracts, for example, would be very complicated given the ineffectiveness of the arbitration courts for conflict resolution and the existence of such a recent history of asset seizures. The war has not only eliminated much of the energy trade between the EU and Russia but has also eroded valuable intangibles such as legal certainty.

5. Sanctions and the reconfiguration of the hydrocarbons trade

It is reasonable to think that successful negotiations between Russia and the US to end the war in Ukraine will include the lifting, at least partially, of the wide-ranging package of sanctions and restrictions imposed on the Russian energy sector. The US and the G7 allied countries have applied two main types of restrictions:

- Trade restrictions: the G7 has imposed a price cap of US$60 per barrel on Russian crude oil and derivatives that rely on Western transport, insurance or financial services. In parallel, direct bans have been introduced on the purchase of Russian energy: the US has prohibited the import of all hydrocarbons, while the EU has banned seaborne oil and coal imports, with limited exceptions. Additionally, restrictions have been placed on the transfer of technology, access to financing and the provision of related services.

- Individual restrictions:[4] transactions with entities designated by the G7 countries have been banned, from oligarchs, companies, financial entities, energy or oil projects to the shadow fleet.

A suspension of trade restrictions would require coordination between the countries involved in their implementation, especially the EU, which was Russia’s main energy customer before the invasion of Ukraine. A unilateral lifting of sanctions by the Trump Administration would not have a major impact in the short term, as US imports of Russian hydrocarbons were of little relevance. In the case of the G7 price cap, insurance and reinsurance companies are mostly European and therefore maintaining this system would ultimately depend on the EU.

In the case of individual restrictions, a potential lifting of US sanctions on Russian oligarchs, banks, and oil and gas projects would have immediate effects. For example, the US$20 billion Arctic LNG 2 project –currently stalled due to US sanctions– could begin exporting its first volumes of natural gas to Asian markets within days. It would also regain access to essential technical assistance for project completion and be able to operate the icebreaking LNG tankers built in South Korean shipyards, whose delivery to Russia was blocked because of sanctions.[5] Although the EU could prevent European investors from returning to the project, it is US sanctions, with their extraterritorial effect, that have so far prevented its completion by inhibiting the participation of Chinese, Korean and Japanese companies. However, it is possible that this type of concession to Russia will not be politically easy for the Trump Administration. In the past, Congress has tightened restrictions on the President’s capacity to suspend sanctions on Russia, limiting the executive’s room for manoeuvre through laws such as CAATSA and the REPO Act, which impose strict controls and would require majorities, sometimes of 60%, in Congress.

In any case, a general waiver of sanctions would run counter to the mercantilist narrative of Trump’s first term in office and US energy dominance. Although a return of Russian hydrocarbons to the international market would have a deflationary effect, it would do so at the expense of the market share gained since 2022 by US oil and LNG. In a context of tariffs on Canadian and Mexican oil, in addition to new sanctions on Venezuela, Russian crude, with similar characteristics, would be a very attractive alternative for refineries in the Gulf of Mexico. Despite the latest statements by Trump and his team, it is unrealistic to think that the recent rapprochement between Washington and Moscow can translate into new US investments in the Russian energy sector. The investments of Western oil companies in Russia, favoured by the opening up of the sector in the 1990s, have ended in financially ruinous operations with a high reputational cost.

With regard to the EU, any modification of the sanctions regime on Russia would require the unanimous approval of the 27 Member States in the Council. This means that any member state could veto the lifting, even partially, of the 16 packages of sanctions currently in force against Russia. Poland and the Baltic states have been clear on this and will not accept a return of Russian energy to the EU unless it is within the framework of a peace agreement that incorporates security guarantees and defends the territorial integrity of Ukraine. On the other hand, the countries most favourable to resuming the purchase of hydrocarbons from Russia, Hungary and Slovakia, are already doing so, leaving the current status quo on sanctions as the most likely option for the medium term.

The Arctic LNG mega-project, which would stand to benefit most from a potential lifting of US sanctions, is also targeted by EU restrictive measures. However, unlike the EU’s permanent embargoes on oil and coal, the sanctions on Arctic LNG 2 are individual designations that require active renewal every six months by the Council of the EU. In theory, a single member state –such as Hungary or Slovakia– could block their renewal with a veto. Yet it is more likely that they would reserve this leverage to oppose measures affecting their ongoing pipeline imports of Russian oil and gas. As a result, the prospect of increased Russian LNG imports to European ports remains limited in practice, even though natural gas trade is not currently subject to EU sanctions.

The fragmentation of global energy markets triggered by Western sanctions also raises questions about its reversibility. In the specific case of the G7 price cap, the mechanism has largely proved ineffective, as Russia has managed to circumvent it through the deployment of a ‘shadow fleet’ and sustained exports to China, India and Turkey. Once established, this fleet has little incentive to disband. Its operators –part of an opaque and geographically decentralised network– are likely to keep it active for commercial and strategic reasons. For Moscow, the shadow fleet offers not only a means of bypassing sanctions, but also a geopolitical asset. This parallel oil trading system provides insulation against future Western restrictions and aligns with Russia’s broader vision of a multipolar, de-dollarised global order.

Conclusions

Not an easy return

Emerging negotiations between the US and Russia to end the war in Ukraine are reshaping the geopolitical outlook for Europe. Should hostilities come to an end, it is likely that some actors will seek to revive the debate over a potential return of Russian energy to the EU. This narrative –grounded in the argument that renewed hydrocarbon imports from Russia could help mitigate Europe’s industrial crisis– is unrealistic. It overlooks the fact that the energy decoupling between Russia and the EU is, for the most part, irreversible.

This assessment rests on four key arguments. First, much of the infrastructure required for energy transport –particularly for natural gas– is no longer operational or available. Secondly, long-term supply contracts have been cancelled, and the business networks that once sustained bilateral energy trade have largely disintegrated. Third, legal certainty –previously underpinned by the legitimacy of international arbitration mechanisms– has been fundamentally undermined, with no realistic prospect of restoring the pre-invasion status quo. Finally, any lifting of the sanctions regime would require unanimous agreement among the EU’s 27 Member States in the Council –an outcome that appears highly unlikely in the current political context–.

A potential lifting of US sanctions by a future Trump Administration could have significant implications for the Russian energy sector and global markets. However, it would not fundamentally alter the situation in Europe. In the current geopolitical context, the return of Russian hydrocarbons to the European market remains highly improbable. US decisions regarding the war in Ukraine and the sanctions regime are unlikely to reverse the broader and largely irreversible process of energy decoupling between the EU and Russia.

[1] In Eurostat statistics, EU energy trade includes transactions in crude oil and petroleum products, natural gas (pipeline and LNG), coal and solid fuels, electricity, biofuels, hydrogen, peat and nuclear fuels.

[2] To put it in context, 50% of Nord Stream 2’s capacity is equivalent to one third of Germany’s consumption of natural gas in 2024.

[3] Although Uniper lacks operational control over its assets in Russia, the German company has expressed interest in selling them. Uniper’s assets in Russia were valued at around €1.7 billion in 2019. However, Uniper subsequently gave them a book value of €1, reflecting the great uncertainty about the actual sale price of the asset and could constitute a de facto nationalisation or seizure.

[4] In the EU, trade restrictions are considered permanent, and any amendment –whether to lift or strengthen them– requires unanimity in the Council. In contrast, individual restrictive measures must be actively renewed every six months, also by unanimous decision of the Council.

[5] See Ignacio Urbasos (2024), Western sanctions on icebreakers stall Russia’s Arctic LNG expansion. Elcano Royal Institute, ARI, nr 88/2024.