Original version in Spanish: Efectos económicos del Brexit en el Campo de Gibraltar: un modelo econométrico.

Theme1

The UK’s exit from the EU has become a political maze. Uncertainties increase and so do the negative economic effects, especially on Britain’s European borders: Northern Ireland and the Campo de Gibraltar in Spain.

Summary

Geographical proximity generates positive economic effects to the inhabitants of the Campo de Gibraltar, the area adjoining Gibraltar, due to cross-border employment (workers with a job in Gibraltar who live in the Campo) and the exchange of goods. This economic impulse is clearly necessary in a region with high levels of unemployment. However, the increasingly likely absence of an agreement is jeopardising these effects: both parties (Gibraltar and the Campo), considering the institutional instability in the UK, are readying themselves for the worst-case scenario.

In this context, the Campo is more than ever marked by the border with Gibraltar: in a hard Brexit (with no deal between the EU and the UK), the flows of goods, capital and labour will no longer be ensured or protected and non-tariff barriers will rise. This will entail remarkably negative consequences for the economy of the region. Losses due to Brexit are inevitable, but they can be reduced if there is an agreement concerning the special status of Gibraltar and its future.

Economic models such as the one presented in this paper can be a useful tool to shed light on a complex phenomenon like Brexit in the context of the Campo de Gibraltar. Predictions have been made under two alternative scenarios which correspond to a higher or lower degree of mobility of production factors. Their results have been compared with a counterfactual scenario, where the UK remains an EU member. All the predictions point to a common result: the Campo de Gibraltar will suffer worse economic effects if there is no deal.

Analysis

The UK’s exit from the EU has generated significant debate about the future of the European project in every dimension. Debate is growing in complexity and volatility and has been heightened by the division of the ‘Leave’ supporters as well as by the lack of a real alternative,2 with the Labour Party divided between a blurry scepticism and a discrete and reluctant support for a second referendum.

Nonetheless, the complexity of the debate should come as no surprise: the relations between the UK and the EU have never been simple even before the beginning of the European Communities, and they became especially tortuous since the Fontainebleau Summit in 1984, when Margaret Thatcher pronounced her famous ‘I want my money back’. The summit was a milestone in these complicated relations, because it began a sequence of grants and privileges to the UK that might otherwise have abandoned the European project long before 2016.

All these European issues have their consequences at the local level, more specifically on the border that separates the seven municipalities of the Campo from Gibraltar. In this region 10,000 cross-border workers,3 whose earnings impact the entire local economy, depend on the border. Moreover, the business network generated by geographical proximity sees a no-deal scenario with increasing concern.

Sector analysis: economic interaction between Gibraltar and the Campo

The economies of Gibraltar and the Campo are closely linked. Their geographical proximity makes possible a high volume of exchange of production factors between them: around 18.5% of the region’s GDP in 2013 was due to the interaction with Gibraltar and the volume has been increasing over the past few years.4 5

Two types of interaction between the economies have been identified: cross-border employment and the exchange of goods. The first refers to the workers with a job in Gibraltar that reside in the Campo, whereas the second relates to the important volume of trade (not only goods but also services) that takes place between the two areas. The enrichment has been mutual: Gibraltar also benefits from the geographical proximity and, until now, also from the integration process.6

Cross-border employment generates around 11% of the total employment in the Campo7 and it is concentrated mainly in the wholesale and retail sectors, as well as in construction and the hotel industry. Assuming that cross-border workers adopt the same expenditure pattern to the rest of the Campo’s workers,8 their wages are mainly spent on housing, groceries, leisure and transport, generating new cycles of activity.

Concerning the cross-border exchange of goods, Gibraltar’s imports from Spain9 are concentrated in construction materials, wholesale and retail.10

This sectoral analysis shows that there are synergies between cross-border employment and the exchange of goods between the Campo and Gibraltar: the sectors in which trade is greater are those that employ a higher number of cross-border workers. The productive structures of both economies are complementary; hence the importance of ensuring the flow of productive factors without imposing obstacles at the border.

Theoretical analysis: towards a theory of the economic disintegration?

Brexit also offers an opportunity to revise economic doctrine. Until now, economic theories have studied the rapprochement between different economies as a cumulative and gradual process formed by different stages that acted as a sequence: in the case of the EU, the starting point was a customs union followed by an imperfect single market that would ultimately lead to a still incomplete monetary and economic union.

Generally, economic integration processes begin by a ‘negative’ integration that consists in eliminating obstacles to trade between Member States. As the integration process moves forward it starts to shift towards a ‘positive’ integration defined by the creation of institutions that drive and articulate the process.11 It will need two conditions to be successful: similar initial economic situations of the Member States12 and the existence of a consensus in the formal criteria to be adopted during integration, which can vary between intergovernmental and supranational.

The EU, however, did not comply with any of these two initial conditions: there were not enough economic symmetries between the Member States and there were significant differences between the approach that should be adopted for the European project to be successful. These divergences in the formal criteria slowed down its development since the very beginning, especially in the UK’s case.13 Even so and despite these difficulties, the EU has helped Member States decisively in achieving levels of wealth that would have been unreachable without an integration process.

Brexit, however, disrupts considerably the rules of the game and brings up the need of analysing the costs of re-establishing the barriers that were removed a long time ago. This new field in economic doctrine has been named the ‘theory of economic disintegration’ and it pursues the study of the increasing fragmentation of global value chains. The model presented in this paper uses this approach to reach its conclusions.14

How can Brexit be applied to this new paradigm? There are two key ideas: first, the research carried out so far agrees in that Brexit will have adverse effects for the UK’s economy because it will create new obstacles to trade, immigration and foreign investments. However, studies differ in the magnitude of these effects in the long term and point to uncertainty as the greatest concern in the short and medium terms.15

Secondly, the political momentum of Brexit has brought up an uncomfortable debate about the future of the European project, especially amongst Eurosceptics: is the European project truly compatible with the national sovereignties of Member States? The theory of economic disintegration does not only quantify the price that the UK will have to pay for its withdrawal, but also reflects the direction that the European project itself should take.16 This concern has been laid down by the European Commission in its recent ‘White Book about the Future of Europe’.17

Plausible scenarios after Brexit

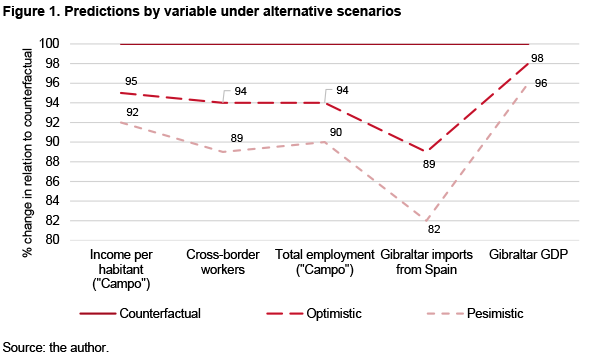

The model in this paper analyses the economic effects of Brexit in the Campo de Gibraltar under two alternative scenarios that are compared to a counterfactual. The first scenario (‘optimistic’ in Figure 1 below) consists of a ‘soft’ Brexit, where the UK and the EU are able to reach an agreement that remarkably reduces non-tariff barriers but maintains the obligation of European standards for the products exported to Europe from the UK. The latter has full sovereignty overs migration control and borders. Concerning Gibraltar, the border is open but bureaucratic costs and non-tariff barriers increase compared with the counterfactual scenario.18

Conversely, in the second scenario (‘pessimistic’ in Figure 1 below) there is no agreement between the UK and the EU and the former negotiates its commercial position vis-à-vis the European countries through the World Trade Organisation (WTO). This would increase restrictions on the movement of people, goods and services between Gibraltar and the Campo, resulting in a significant downturn in economic activity.

In the counterfactual scenario the UK remains a Member State in the EU. It retains the four freedoms of the single market and also its obligations. We assume that economic activity between Gibraltar and the Campo does not vary because the model tries to isolate the structural effects of Brexit.

Predictions

The predictions hereby presented have been made using a data base prepared specifically for this model. The variables have been carefully selected considering the interactions presented in the sectoral analysis: cross-border employment and exchange of goods. Since no disaggregated data for the Campo are available it has been necessary to territorialise it with regional data using a GAV (Gross Added Value)-related distribution key, using the methodology used by the Statistical Institute of Andalucía in similar studies.19

The model’s variables are as follows: income per habitant in the Campo; number of cross-border workers; employment level in the Campo; Gibraltar’s imports from Spain; Gibraltar’s GDP; and household income in the Campo. All of them have been used to create an econometric regression using the Ordinary Least Squares (OLS) technique where income per inhabitant acts as the dependent variable and the rest as regressors. Household income in the Campo has been used as a control variable in order to increase the quality of the results but has no part in the model’s interpretation.

In these predictions we assume that the data estimated for the year 2018 is representative and that it allows us to predict its future values in the ‘t+1’ period, which is taken as the year 2025. According to the different studies carried out so far,20 the initial effects of uncertainty will have dissipated by then and only structural effects will persist. The results are shown in Figure 1.

Figure 1 shows that predictions point to a negative tendency in every variable that gets worse in the pessimistic scenario. This first result supports the initial hypothesis of this empirical work: the economic effects of Brexit are worse in a scenario where the free movement of production factors is completely restricted.

In any event, the four freedoms (people, services, goods and capital) only take place in the counterfactual because in every other scenario the UK is no longer a Member State of the EU. Therefore, we obtain another result: whatever the Brexit negotiations may be, there will be negative economic effects due to the loss of the four freedoms of the single market, which are beneficial to both economies. The final result will be conditioned by the dynamics of negotiation in the upcoming months, especially in the agreements concerning borders.

Thirdly, the model also verifies another hypothesis. The Campo’s wealth seems to be explained simultaneously by two cumulative effects: cross-border employment and trade. The results show that both of them will be reduced after Brexit and that this will have negative consequences in the Campo’s economy. Figure 1 also shows that the variables linked to cross-border employment (number of cross-border workers and total employment) are more vulnerable to Brexit than those related to trade (imports and Gibraltar’s GDP).

Income per inhabitant in the Campo is the model’s most important variable, as it is the dependent variable in the OLS regression. Thus, its tendency is representative of the individual behaviour of all other variables and a specific analysis of its predicted values becomes significant: a 5% and an 8% fall in the optimistic and pessimistic scenarios respectively. Even if the difference between them may seem small, it can clearly be seen that income is 1.6 times more damaged in the latter.

However, it should also be clarified which of the two effects (employment or trade) has more weight in the total change of income per inhabitant in the two scenarios. All the variables decline in both scenarios, but they differ in each of the effects: while in the ‘employment effect’ the drop is equally distributed between the two variables (cross-border workers and total employment) in the ‘trade effect’ (imports and Gibraltar’s GDP) the change is mainly felt by imports. More specifically, according to the model it is expected that they might drop by 11% in the optimistic and 18% in the pessimistic scenario, whereas the GDP change would remain between 2% and 4%. We can see an additional result here: Brexit’s costs will take place mainly in the exchange of goods and, to a minor extent, in employment levels in the Campo (both cross-border and local).

Finally, these predictions allow us to conclude that Brexit will be detrimental to Gibraltar regardless of the outcome of the negotiations. In the optimistic scenario, Gibraltar would lose 2% of its GDP and, moreover, 11% of its imports from Spain. The latter would be especially harmful for an economy that depends on imports for its survival.

Conclusions

The econometric model presented in this paper allows us to quantify and determine the economic effects of Brexit in the Campo considering the current state of negotiations,21 the contributions of the theory of economic disintegration by Sampson22 and other authors and the specific nature of the interactions between Gibraltar and the Campo.

These interactions explain the wealth generated in the area due to the geographical proximity with Gibraltar through the ‘employment’ and ‘trade’ effects. They both generate positive effects in the economy and complement each other: the sectors where Gibraltar is more dependent in imports are those that employ most cross-border workers.

The mutually beneficial dependence between the two economies allows us to establish clearly that Brexit will be harmful to both parties. There will be increased costs for the mobility of production factors, particularly in imports and also, even if on a smaller scale, in cross-border and local employment.

These negative economic effects will be persistent no matter what the outcome of the present negotiations. However, they will be reduced if effective measures are taken in order to ensure the cross-border mobility of factors. Unilateral proceedings like closing the borders or increasing restrictions will be harmful to both economies. Ancient conflicts must be left behind and innovative solutions are needed to achieve a mutually beneficial solution. This paper shows how costs can rise if the parties fail to reach an agreement.

Luis Galiano Bastarrica

University of Seville, MA European Economic Studies – College of Europe (Bruges)

1 This article is based on a bachelor’s thesis at the University of Seville between January and June 2018. No facts were considered after April 2018 to create the model presented in it. The thesis was supervised by Eva Mª Buitrago Esquinas, Professor of Applied Economics at the University of Seville. This empirical work would have been impossible without her dedication, commitment and support.

2 ‘May y Corbyn se imponen líneas rojas que alejan un consenso en torno al Brexit’, El País, 18/I/2019.

3 HM Government of Gibraltar (2015a), ‘Employment survey’.

4 J. Fletcher, Y. Morakabati & K. Male (2015). ‘An economic impact study and analysis of the economies of Gibraltar and the Campo de Gibraltar, update 2015’, The Gibraltar Chamber of Commerce.

5 We do not consider here the economic activity generated by petroleum products.

6 HM Government of Gibraltar (2015b), ‘Abstract of statistics’.

7 HM Government of Gibraltar (2015a), op. cit.

8 Instituto de Estadística de Andalucía (2016), ‘Encuesta de presupuestos familiares’.

9 No disaggregated data were available on Gibraltar’s imports from the Campo.

10 HM Government of Gibraltar (2003), ‘Input-output study of Gibraltar’, (financial products are not considered).

11 E. Buitrago Esquinas & L. Romero Landa (2013), Economía de la Unión Europea, Ed. Pirámide, Madrid.

12 E. Feás (2017), ‘Brexit, Cataluña y la teoría de la desintegración económica’.

13 OECD (2018), ‘Organisation for European Economic Co-operation (OEEC)’.

14 A. Boussie, P. Foley, N. Hill, S. Punhani & G. Zanni (2016), ‘Brexiting the supply chain’.

15 B. Busch & J. Matthes (2016), ‘Brexit – the economic impact: A meta-analysis’, IW Report, 10/2016, p. 1-96.

T. Sampson (2017), ‘Brexit: the economics of international disintegration’, Journal of Economic Perspectives, vol. 31, nr 4, p. 163-184.

17 European Commission (2017), ‘Libro Blanco sobre el futuro de Europa’, Brussels.

18 A. Sentence, J. Hawksworth et al. (2016), ‘Leaving the EU: implications for the UK economy’, PricewaterhouseCoopers LLP, London.

19 I. Enrique Regueira (2009), ‘Estimación municipal del Valor Añadido Bruto en Andalucía’, Documentos de trabajo, nr 1, p. 1-57.

20 Busch & Matthes (2016), op. cit., p. 1-96.

21 Facts were taken into consideration for the empirical work until April 2018.

22 Sampson (2017), op. cit., p. 163-184.