Theme: Despite the preliminary nature of the available data, what are the underlying, intermediate and proximate causes of the Deepwater Horizon oil spill, its main consequences and possible future developments?

Summary: A little over a month after the Macondo well started gushing oil off the Gulf of Mexico, Carol Browner[1] said ‘this is probably the biggest environmental disaster we have ever faced in this country’. This overarching statement is yet to be precisely quantified and qualified in order to be able to make a full damage assessment, necessary to help in planning compensation and the restoration of the damaged environment. In this ARI it is argued that a preliminary discussion of the causes of the oil spill and a brief reflection on its consequences can shed light on the key issues and help understand accidental oil spills such as this. The analysis is also intended to bring to the fore some of the recently suggested improvements in safety initiatives as well as the political and oil-industry fallout.

Analysis

Underlying, Intermediate and Proximate Causes

Current and future world-wide oil dependency, along with the ever-increasing need for deep and ultra-deep water offshore drilling, are the main underlying causes of the Deepwater Horizon disaster and of other accidental oil spills. Furthermore, the apotheosis of the ‘shareholder value’ management model –which places a premium on internal cost cutting– among the large international oil companies (the IOCs) over the last 20 years, together with a lax regulatory oversight –stemming from the increasingly collaborative relationship between oil companies and their public regulators– are the leading intermediate causes of the Macondo disaster. Finally, the proximate causes of the spill are the less-than-optimal safety conditions in force at the well and offshore rig at the time of the explosion. While safety risks are to some degree inherent to deepwater drilling, the underlying cause of an overriding oil dependency, along with IOC cost-cutting and producer-state regulatory laxity have severely aggravated the threat.

Underlying Causes

According to the Energy Information Agency (EIA), 37.1% of US primary energy consumption in 2008 came from oil.[2] This is similar to Europe, according to the European Commission.[3] Additionally, 40% of the oil consumed in the US is home-grown in oil-producing states such as Texas, Alaska, California and Louisiana. These four states produced 52% of US crude oil in 2007, of which 25% came from offshore platforms[4] in the Gulf of Mexico such as the Deepwater Horizon platform in the Macondo Prospect oil field where an explosion killed 11 workmen and caused an oil spill that lasted from 20 April to 15 July 2010.

Map 1 shows the myriad of active leases in the outer continental shelf in the Gulf of Mexico, where there are 3,800 active oil platforms.

Map 1. The Gulf of Mexico: active leases in the outer continental shelf

In a broader perspective, oil dependency is expected to continue under the EIA’s reference scenario. This means, ceteris paribus, a high likelihood of future spills.[5] Howard Gruenspecht, Deputy Administrator of EIA, said in May this year that in the absence of further policy changes to curb demand, fossil fuels will provide approximately 80% of world energy consumption by 2035, with petroleum liquids remaining the most important energy source within that mix.

Figure 1 below shows energy use at the world level by type of fuel type from 1990 to 2035.

Figure 1. World marketed energy use by fuel type

In addition to the level of high global oil dependency, approximately 70% of the oil fields discovered in this century are located offshore. Deep and ultra-deep water drilling has allowed the exploitation of previously unreachable oil deposits using the latest technology, although the challenges inherent to such endeavours are many. Some of these were recently reviewed by Mariano Marzo, Professor of Energy Resources at the University of Barcelona, and include high pressures, low temperatures and potential methane explosions, among others. In order to surmount these challenges minimum safety conditions and enforceable standards are paramount.

Intermediate Causes

Safety standards appear to have been compromised systemically within the oil industry in recent years, but this is particularly clear and nearly indisputable in the case of BP. Given the underlying cause behind the need for increasing offshore deep-water exploration and drilling –significant economic dependence on oil–, two independent but interlocking developments in the oil world have tended to increase the safety and environmental risks of offshore oil production, particularly in deep and ultra-deep waters. These two phenomena have contributed to the kind of lapses which unleashed the Macondo spill and, unless they are addressed by corporate behaviour and public policy, will make future spills even more likely.

The emergence of the ‘shareholder value’ management model within the global oil industry, but particularly among the largest companies, has compromised internal technical rigour and undermined safety and environmental standards and procedures. Over the last 25 years, ever since the oil price collapse of 1985-86, the US stock market crash of 1987 and the liberalisation of the global financial sector beginning in that same decade, the major oil companies have followed a very short-term profit-maximisation strategy in order to create maximum value for their investors through share buybacks (and the resulting rise in share prices) and large and increasing dividend payouts to shareholders. While shareholder value can be enhanced through investment leading to future increases in output, revenue and profit, in the short term it is most effectively and rapidly achieved by intense internal cost-cutting. Much has been written in recent years about the negative impact on investment rates and future production levels within the oil industry as a result of the predominance of such corporate behaviour across the sector. However, only now –in the wake of the Deepwater Horizon-Macondo blowout– can the impact of such a management strategy upon safety risks be clearly identified. The pressure to contain and cut costs, all the way down from the CEO to the offshore platform workers, inevitably compromises physical and environmental safety when such an intermediate objective is pushed too far. BP’s increasingly poor safety and environmental record –which in the last five years alone includes, among others, the pipeline spill in Alaska (due to neglected pipeline corrosion), the Texas City refinery explosion (which killed 15 people) and now the deepwater well blowout in the Gulf of Mexico– can be seen as the inevitable eventual consequence of the short-term profit maximisation and cost-cutting criteria that have come to dominate the oil industry. BP epitomises this tendency and has come to represent the highest expression of what is essentially a strategic business model that is widespread among the majors and super majors.

But the long chain of fallout deriving from the industry’s overwhelming reliance on the short-term profit motive –crystallised in and epitomised by BP’s spill in the Gulf– is only part of the story. The ‘revolution’ of smaller (and supposedly smarter, more effective) government under Presidents Reagan and Clinton proved to be another exercise in cost-cutting at any expense, only in this case on the State’s behalf. As a result, over the last 25 years the US Interior Department and the oil sector regulator which it houses (formerly the Minerals Management Service, or MMS, now the Office of Ocean Energy Management) has been faced with reduced budgets and an expansion of required tasks. The result has been a government-encouraged partnership with the industry that is supposedly being supervised and regulated (a clear example of regulatory capture). With state regulation and intervention devalued across the board, and the shareholder’s profit exalted, the last 25 years have seen an increase in human and environmental accidents and other forms of collateral damage to the environments and societies where oil companies operate.

The systematic cost-cutting undertaken to maximise short-term profit, along with the global devaluation of the State’s unique and independent role as regulator of the oil industry, have together paved the way for the Macondo spill and for other disasters like it in the future.

Proximate Causes

Tony Hayward, BP’s outgoing CEO, recognised that the spill should have been avoided. Despite the ongoing investigations it has been argued that safety faults such as having less than the recommended amount of centralisers on the platform or faults in blowout preventers (henceforth, BOP)[6] can be considered the proximate causes of the spill. These prevention issues plus the lack of effective management measures resulted in the continued gushing of oil for roughly three months. Thus, BP was cutting corners in safety in the opinion of politicians, civil society, the media and its own shareholders.

According to the results of the four-month investigation conducted by BP, several factors contributed to the accident. These are summarised in Box 1 below.

Box 1. Proximate causes of the spill according to BP

| The cement and shoe track barriers –and in particular the cement slurry that was used– at the bottom of the Macondo well failed to contain hydrocarbons within the reservoir, as they were designed to do, and allowed gas and liquids to flow up the production casing.The results of the negative pressure test were incorrectly accepted by BP and Transocean, although well integrity had not been established.Over a 40-minute period, the Transocean rig crew failed to recognise and act on the influx of hydrocarbons into the well until the hydrocarbons were in the riser and rapidly flowing to the surface.After the well-flow reached the rig it was routed to a mud-gas separator, causing gas to be vented directly on to the rig rather than being diverted overboard.The flow of gas into the engine rooms through the ventilation system created a potential for ignition which the rig’s fire and gas system did not prevent.Even after the explosion and fire had disabled its crew-operated controls, the rig’s blow-out preventer on the sea-bed should have activated automatically to seal the well. But it failed to operate, probably because critical components were not working. |

Source: http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7064893.

Investigations

Nine different investigations into the causes, responsibilities and consequences have been opened in the US since the 20 April Deepwater Horizon explosion.

Consequences

In addition to the tragic loss of lives, accidental oil spills have a myriad of economic, environmental and social consequences. They will be outlined briefly in turn, although they can never be precisely estimated until there is comprehensive information on the damage and foreseeable and complete recovery of the assets that have been damaged (García Negro et al., 2007).

Economic Consequences

It is arguably impossible to accurately value the environment. The primary value of the environment as the basis of all economic, human and non-human activity is well beyond the scope of market and non-market valuation. Ethical reasoning can additionally suggest that some would even find assigning money values to certain features of the environment morally repugnant. But when decisions have to be made, having the common measuring rod of money is of essence in the light of inevitable trade-offs. Market and non-market valuation techniques are hence considered to be useful in providing second-best proxies of the damages caused by spills.

Use-values lost due to the spill include the direct and indirect use of the damaged environment. Fishing, tourism and related activities are all included in this category. According to the NOAA,[7] in 2008 total fishing landing revenues from finfish and shell fish amounted to US$659 million and recreational fishermen made 24 million fishing trips. These figures are expected to drop significantly as a consequence of bans and of the reduction in recreational fishing trips. The time span for full recovery and associated costs will depend on a number of factors, such as the final extent of the spill (4.9 million barrels of oil) and the affected ecosystems and species. Long-term damages cannot be ruled out a priori.

Table 1 shows a summary of the characteristics of some of the affected commercial species and their economic relevance.

Table 1. Affected commercial species and their economic relevance

| Species | Value of landings (2008 figures) | Comments |

| Shrimps | Alabama: US$38.4 million Florida: US$23.3 million Louisiana: US$130.6 million Mississippi: US$17.7 million Texas: US$157.2 million | 73% of total national landings come from the GOM |

| Blue crab | Alabama: US$1.5 million West Florida: US$3.3 million Louisiana: US$32 million Mississippi: US$447,000 Texas: US$2.3 million | Louisiana accounts for 26% of the nation’s landings |

| Oysters | Alabama: US$243,414 Florida: US$5.47 million Louisiana: US$38 million Mississippi: US$6.87 million Texas: US$8.83 million | The GOM region lands 67% of US total |

| Red snapper | Alabama: US$ 237,141 West Florida: US$2.94 million Louisiana: US$2.03 million Texas: US$2.74 million | No data was available for Mississippi |

Source: NOAA (2010).

As regards tourism, Florida was said to be the State most exposed to losses, that could run into millions as its tourism industry brings a ballpark figure of US$60 billion from 80 million visitors. The industry furthermore employs 1 million people and yields 21% of state taxes on sales.[8] Marketing campaigns to counteract the oil scare among tourists have been released since the spill and even President Obama has helped with a midsummer family swim and holiday on the affected coast.

Policy-makers faced with other spills such as the Prestige, with tourism ‘hot spots’ affected, also designed strategies to counteract the drop in tourism (González Laxe, 2003). The extent to which tourism will drop and the time span in which the drop will be significant will depend on the affected area, the expected recovery time and the perception, by society, of the state of the affected areas. In the Prestige spill, for instance, preliminary estimates of the drop in tourism in the year after the accidental spill ranged from 15% to 25%. These estimates were based on other spills such as the Erika (Prada Blanco & Vázquez Rodríguez, 2004).

Non-use values such as existence, altruism and bequest values are not –or only imperfectly– captured by markets as they leave no behavioural trail. In order to determine these values, the techniques of preference such as contingent valuation or choice modelling can help evaluate changes in environmental goods and services.[9] No data is available yet on the non-use (or passive use) values lost as a consequence of the BP spill. The many available CV studies on the topic might well be used in benefit transfers to estimate the value lost. Alternatively, a new CV study could be conducted once there is a full foreseeable recovery (and hence outraged responses are minimised). Until such studies arise it can only be hypothesised that the value will be substantial.

Additionally, under the Oil Pollution Act of 1990 BP is responsible for funding the response and cleaning-up operations.[10] There are no final cost estimates but recently released figures calculate the cost of BP’s response to the spill at US$8 billion. Added to this, US$100 million will be paid by BP to workers in the oil industry who have lost their jobs, US$10 million will be devoted to study the effects of the oil spill on health and a further US$ 500 million to analyse the spill’s environmental effects.[11] BP also agreed to create a multi-annual fund of US$20 billion for forthcoming compensations. To this, significant penalties might be added if BP is found guilty of gross negligence. The costs have to be seen in conjunction with a 36% drop in the value of BP’s shares since the explosion,[12] past rumours of hostile take-overs by rival firms, the indirect effect on British government revenues and payments to British pension funds. All these issues point to the far-reaching consequences of unsafe deep-oilfield drilling. The likelihood of explosions and accidental oil spills is low, but the ‘back-of-the-envelope’ cost estimates for BP can be a powerful incentive to hire risk-averse safety personnel with wide ranging power over oil spill prevention, preparedness and management operations.

Environmental Consequences of the Spill

Approximately 71% of the earth’s surface is covered by either oceans or large seas. Direct and indirect environmental services and functions provided by marine and coastal areas include, among others: food production, biodiversity, nutrient cycling, climate regulation, disease control, waste absorption, flood protection and cultural and recreational services (Hassan et al., 2005). Marine and coastal areas are linked through the use that species and humans make of these ecosystems. The Millennium Ecosystem Assessment (2005) acknowledges that there is no definitive regional or global management framework to guide the inevitable trade-offs between competing activities that might affect coastal areas. One such activity is oil exploration and its related hydrocarbon transport. Accidental oil spills such as that caused by the explosion of the Deepwater Horizon platform off the Gulf of Mexico in April 2010 or the Prestige oil spill off the Spanish coast in November 2002 are recent examples of the conflicts between environmental protection and economic development.

The Millennium Ecosystem Assessment report expects oil spills to have a moderate impact on marine areas by 2025. Certain oil spills, however, cause long-term damage to marine and coastal ecosystems, especially if the areas affected are vulnerable or are already degraded. Accidental oil spills might not be the most serious threat to the marine environment but they are visible incidents that trigger policy action at various administrative and geographical levels, widespread media attention and civil society alarm, although according to a Pew survey,[13] over half of the interviewees thought that efforts to control the spill would be successful, which is not uncommon in the second stage of alarmed discovery and euphoric enthusiasm about environmental damages as analysed by the issue-attention cycle (Downs, 1972). In fact, the spill came to a halt in mid July.

The US National Wildlife Federation has reported damages to mammals, fish, birds, reptiles and habitats. A multitude of species rely on the Gulf’s ecosystems and these have been affected by the spill. Despite discrepancies between different institutions regarding the amount of oil that remains in the sea,[14] there is consensus that the damage to species and ecosystems is far from over. Long-term damage is expected. This has been the case in past spills such as Exxon Valdez, Erika and Prestige, among many others.

In relation to the existing discrepancies, the media has reported that 75% of the oil is gone whereas the National Incident Command (NIC) claimed that ‘burning, skimming and direct recovery from the wellhead removed one quarter (25%) of the oil released from the wellhead. One quarter (25%) of the total oil naturally evaporated or dissolved, and just less than one quarter (24%) was dispersed (either naturally or as a result of operations) as microscopic droplets into Gulf waters’. Scientists from the University of Georgia claimed however that, as much as 90% of the oil spill might remain in the Gulf of Mexico. On the other hand, some scientists have also reported that deep-sea bacteria (psychrophiles) are thought to have consumed a significant amount of the remaining oil. Future research will no doubt help resolve the debate.

Box 2 below shows some of the main affected species. The fact that some species are breeding or starting their nesting season, as well the chemical composition of the oil and dispersants are all expected to have a bearing on the effects of the spill. Scientists, however, warn that the effects on some species will not be precisely known until new crops of fish appear.

Box 2. Some key species affected by the BP oil spill

| Mammals | Birds | Fish & Shellfish | Reptiles |

| West Indian manateesBottlenose dolphinsSperm whalesBlue whalesHumpback whalesNorth Atlantic right whalesRiver ottersMinkSwamp rabbits | EgretsHeronsIbisesRoseate spoonbillsBrown pelicansWilson’s ploversRoyal ternsGullsDiving ducksWading birdsPipping ploverShearwatersNorthern gannetsFrigate birds | Yellow fin tunaBlue tunaBlue crabsGulf stone crabSharksOystersShrimpSnappersGroupersScalloped hammerheadShortfin &longfin makoBigeye thresherOceanic whitetip sharksSwordfishWhite & blue marlinsLongbill spearfishSailfishGrey triggerfishRed & black drumsDolphinsKing & Spanish mackerel | Loggerhead turtleGreen turtleKemp’s ridley turtleLeatherback turtleHawksbill turtle |

Source: National wildlife Federation and NOAA (2010).

In addition to these species, habitats that provide them with breeding and nesting grounds as well as food and shelter have also been exposed to the spill. These include, among others, mudflats, beaches, reefs, mangroves and wetlands. As regards the latter, the Society for Wetland Scientists said in May 2010 that the extent of the damage will depend on the type of wetland, the species inhabiting it, the type of oil and its weathering. In this respect, they claim that the wetlands in the Gulf of Mexico are sensitive to the oil spilled and that recovery might only be possible in the long term.

Map 2 below shows the oiled area and some of the key species affected.

Map 2. Main areas affected by the spill

Ex-ante and ex-post assessments of the state of natural resources are paramount in order to tailor clean-up and restoration projects. In this respect, the NOAA through its Damage Assessment and Restoration Program in conjunction with the Department of the Interior and BP are undertaking continuous data collection tasks to enable the analysis of the impact on plants, animals and habitats. Around 1,800 miles of shoreline were analysed through the collection of more than 11,000 samples.[15] Additional efforts to assess damages by universities and NGOs such as Greenpeace[16] will no doubt provide significant information on the state of the environment.

Social Consequences

The most salient social consequences of the spill include both health issues and temporary or permanent employment losses. The population most exposed and affected by the BP spill includes, among others, employees in marine and related sectors, citizens living in the areas affected and clean-up workers and volunteers. Despite the fact that experts consider the health effects of oil spills have so far been under-researched, there have been calls for health workers in the Gulf Coast to be attentive to both short-term and long-term health effects. These can include increased anxiety, depression, post-traumatic stress disorders, damages to internal organs such as the lungs, kidney and liver and the increased risk of cancer.[17]

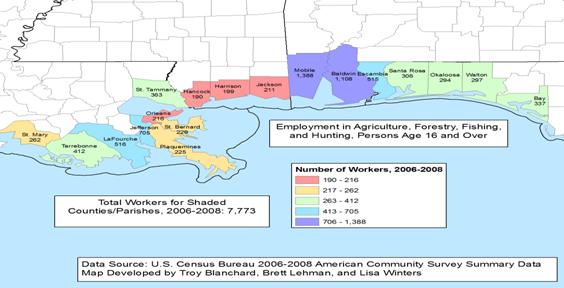

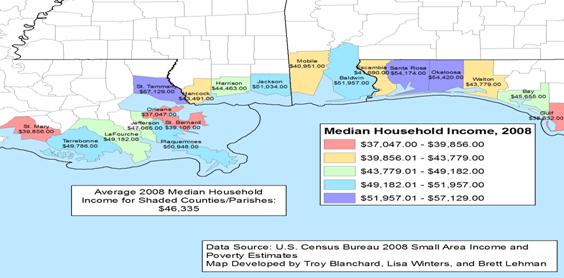

The unemployment rates prior to the spill ranged from 11% in Alabama to 11.5% in Mississippi and 12% in Florida.[18] Despite the fact that the effect on employment may be smaller than initial estimates, Maps 3 and 4 are interesting as they show the potential socio-economic vulnerability of the affected states. This information could help tailor future employment initiatives.

Map 3. Employment in agriculture, forestry, fishing and hunting

Source: http://www.lsu.edu/pa/photos/20100430/2009ag.jpg.

Map 4. Median household income

Future Developments

If we are to tackle the underlying causes of oil spills, it will be necessary to address the issue of dependency. This will entail painful yet needed internalisation of the external costs of oil production, distribution and consumption. The policy instruments, their advantages, disadvantages and agents’ resistances are not new. Command and control-type approaches can provide theoretical certainty and can be called for when emergency situations are to be addressed, despite their potential lack of static and dynamic efficiency. Reducing or eliminating harmful subsidies that make oil-use inefficiently cheap can also be a socially palatable option, yet resistance is to be expected from certain powerful groups. Increasing taxes on oil can send a clear message but regressive effects have to be considered and no certain outcomes can be guaranteed.

Despite the fact that it may be too soon to draw any definitive conclusions, according to the Department of the Interior, improvements in safety equipment, personnel training and operational responses have also been hailed as a must to face future spills.[19]

Table 2 shows the Department of the Interior’s safety recommendations.

Table 2. Improvements in safety after the Deepwater Horizon explosion

From a policy perspective, the EU has been quick to start thinking about its own risk exposure as regards offshore oil drilling. In the aftermath of the BP spill, on 11 May and later on 14 July, the EU’s Energy Commissioner Günther Oettinger met oil and gas industry representatives[20] operating in EU waters to ensure adequate safety measures were in place. Acknowledging the impossibility of avoiding all spills, Oettinger stressed the need to achieve the maximum possible safety levels, not only in the regulatory realm but also in the operational arena. No definitive initiatives arose from these meetings but more stringent safety conditions and plans for temporary bans cannot be ruled out.

Conclusions: This year’s Earth Day celebrations have been soaked in oil in the US. The BP spill should not have happened but current and expected oil thirst coupled with suboptimal preparedness in deep offshore drilling has resulted in what some have been quick to label Obama’s Katrina, in part due to past regulatory complacency as regards safety requirements. The loss of lives is a tragedy. Social, economic and environmental consequences are yet to be fully estimated but there is little doubt that they will be significant. It should be borne in mind, however, that the environment affected can be expected to recover, although in the long term, provided no thresholds are reached for vulnerable species and habitats.

A reactive and short-lived social and political attention span towards risk will only result in fickle policy ripples. Some improved safety measures (the proximate cause) are nevertheless expected to result from the spill. Additionally, the oil industry is likely to have heard the loud and clear wake-up call about safety in all its operations (the intermediate causes). The extent to which the industry will place safety at the heart of all its operations will depend on where it operates and on the regulatory ‘thrill’ (Tan, 2006) spurred in the aftermath of the BP spill. A shift away from oil (the underlying cause) seems unlikely to result from one incident although it may help push forward initiatives such as removing harmful subsidies or establishing earmarked taxation on drilling activities. Equity considerations should also be considered in order to avoid inequitable outcomes.

Paul Isbell

Director of Energy and Climate Change Programme and Senior Analyst responsible for the ‘Spain-US Relations’ project, Elcano Royal Institute

Lara Lázaro-Touza

Analyst, Elcano Royal Institute

Bibliography

Arrow, K., R. Solow, P.R. Portney, E.E. Leamer, R. Radner & H. Schuman (1993), ‘Report of the NOAA panel on contingent valuation’, Federal Register, nr 58, p. 4601-4614.

Bowen, Tom (2009), Oil: Money, Politics and Power in the 21st Century, Grand Central Publishing, 2010.

Carson, R.T., R.C. Mitchell, W.M. Hanemann, R.J. Kopp, S. Presser & P.A. Ruud (1992), A Contingent Valuation Study of Lost Passive Use Values Resulting from the Exxon Valdez Oil Spill, A Report to the Attorney General of Alaska, unpublished, http://www.evostc.state.ak.us/Universal/Documents/Publications/Economic/Econ_Passive.pdf.

Carson, R.T., & W.M. Hanemann (2005), ‘Contingent Valuation’, in K.G. Maler & J.R. Vincent (Eds.), Handbook of Environmental Economics, vol 2, Elsevier BV, North Holland, p. 821-936, http://www.econ.ucsd.edu/~rcarson/papers/Handbook.pdf.

Department of the Interior (2010), ‘Increased Safety Measures for Energy Development on the Outer Continental Shelf’, http://www.doi.gov/deepwaterhorizon/loader.cfm?csModule=security/getfile&PageID=33598.

Anthony Downs (1972), ‘Up and Down with Ecology—The Issue-Attention Cycle’, The Public Interest, nr 28 (Summer), p. 38.

García Negro, M.C., C.S. Villasante & A. Carballo Penela (2007), ‘Compensating System for Damages Caused by Oil Spill Pollution: Background for the Prestige Assessment Damage in Galicia, Spain’, Ocean & Coastal Management, nr 50, p. 57-66.

González Laxe, F. (Dir.) (2003), El Impacto del Prestige. Análisis y Evaluación de los daños causados por el accidente del Pestige y dispositivos para la regeneración medioambiental y recuperación económica de Galicia, Instituto de Estudios Económicos de Galicia Pedro Barrié de la Maza.

Hassan, R., R. Scholes & N. Ash (2005), Ecosystems and Human Well-Being: Current State and Trends. Findings of the Condition and Trends Working Group, vol. I, Millennium Ecosystem Assessment Series, Island Press, http://books.google.com/books/islandpress?id=UFVmiSAr-okC&printsec=frontcover&dq=ecosystems+and+human+wellbeing&cd=1#v=onepage&q=ecosystems%20and%20human%20wellbeing&f=false.

http://pewresearch.org/pubs/1590/poll-gulf-oil-disaster-obama-bp-support-for-drilling.

http://response.restoration.noaa.gov/dwh.php?entry_id=809.

http://uga.edu/aboutUGA/joye_pkit/GeorgiaSeaGrant_OilSpillReport8-16.pdf.

http://www.bp.com/extendedsectiongenericarticle.do?categoryId=9034427&contentId=7063885.

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7064893.

http://www.brookings.edu/opinions/2010/0617_obama_oil_spill_ebinger.aspx.

http://www.darrp.noaa.gov/southeast/deepwater_horizon/index.html.

Olmo García, P., & J. Pintos Ager (2003), ‘Responsabilidad civil por vertido de hidrocarburos ¿Quiénes deberían pagar los daños causados por el Prestige?’, InDret, nr 1/2003.

Prada Blanco, A., & M.X. Vázquez Rodríguez (Coord.) (2004), Economic, Social and Environmental Effects of the Prestige Oil Spill, Consello da Cultura Galega & Aerna, Santiago de Compostela.

Tan, A. (2006), Vessel-Source Marine Pollution, Cambridge Studies in International and Comparative Law, Cambridge University Press, New York.

[1] Energy and climate adviser to the White House.

[2] Energy Information Administration, Annual Energy Review 2008.

[3] http://ec.europa.eu/energy/observatory/eu_27_info/doc/italy_2010_d2008.pdf.

[4] http://www.eia.doe.gov/neic/infosheets/crudeproduction.html.

[5] Indeed, another offshore oil platform, the Vermilion 380 owned by Mariner Energy, exploded in the Gulf of Mexico on 2 September 2010; although there were no deaths, the fire was extinguished and there appears to be little possibility of the incident causing a BP-type spill.

[6] Blowout preventers are devices designed to stop the flow of oil from wells.

[7] NOAA is the acronym for National Oceanographic and Atmospheric Administration.

[8] http://www.reuters.com/article/idUSTRE64T23R20100530.

[9] The US led the way not only in the initial development of these techniques but in groundbreaking applications –such as that of the Exxon Valdez contingent valuation study undertaken by Carson et al. (1992) and the analysis by the NOAA-convened Blue Ribbon panel (Arrow, et al., 1993)– of CV as a valid technique for estimating passive-use values and as the basis for natural-resource damage assessments.

[10] http://www.epa.gov/BPSpill/qanda.html.

[11] http://www.bp.com/extendedsectiongenericarticle.do?categoryId=9034427&contentId=7063885.

[12] http://www.ksat.com/money/24921900/detail.html.

[13] http://pewresearch.org/pubs/1590/poll-gulf-oil-disaster-obama-bp-support-for-drilling.

[14] http://uga.edu/aboutUGA/joye_pkit/GeorgiaSeaGrant_OilSpillReport8-16.pdf.

[15] http://www.darrp.noaa.gov/.

[18] http://money.cnn.com/2010/06/08/smallbusiness/bp_hiring_unemployed/index.htm.

[19] http://www.doi.gov/deepwaterhorizon/loader.cfm?csModule=security/getfile&PageID=33598.

[20] The firms attending this meeting included OGP, BP, BP Group, ConocoPhilips, Apache, Chevron, ENI, ExxonMobil, Nexen, Repsol, Shell, Statoil, Maersk 0&G and Total.