Theme

European infrastructure firms are conspicuous for their limited presence in the Philippines. A lukewarm diplomatic context hinders their access to opportunities that play to their strengths. This paper suggests how they could reframe their strategic approach.

Summary

The Philippines continues to confound its critics. Prognoses of ‘political crises’ sinking the economy have become unfulfilled expectations. European diplomacy’s concern with alleged extra-judicial killings risks condemning EU firms to losing out on US$160 billion in infrastructure opportunities in 2016-22. But European firms could reverse this by committing to partnerships with Philippine firms. EU economic diplomacy could become more supportive by working with firms to promote their advanced technology, know-how and expertise.

Analysis

(1) Introduction

President Rodrigo Roa Duterte’s direct and forceful demeanour and his refusal to accept European aid have confounded European diplomats, who are accustomed to a greater deference from Philippine leaders. While China and Russia have made some headway in their pecuniary diplomacy, European firms have been left to scramble for business in a lukewarm –if not frigid– diplomatic context.

The European focus on Duterte’s ‘authoritarian streak’ and opposition to what are considered extra-judicial killings could be misguided. It ignores what the Philippines’ economic performance over the past two decades represents. In the midst of a context of uncertainty, coupled with political turmoil, Philippine entrepreneurial ingenuity has managed to flourish, as evidenced by the following:

- Constant GDP grew steadily from 2.89% in 2000 to a sustained 6%, hitting 7.69% in 2010 and 7.84% in 2013. The Great Recession from 2008 to 2012, which blighted the US and European economies, led to only 4.26% growth in 2008 and a trough of 3.02% in 2011. Economic strength has been rewarded by an investment-grade credit rating.

- Business Process Outsourcing (BPOs) grew from being a ‘backyard’ industry into a US$25 billion concern, with the Philippines overtaking India over the course of a decade as the global leader in voice and back-office services.

- Foreign remittances from overseas Filipinos topped US$30 billion annually, a source of funding that fuelled consumption growth.

- Philippine corporates are acquiring international companies, a reversal of roles from the formerly ‘insular’ and ‘introspective’ firms that are now seeking to make their mark abroad.

Admittedly, the diplomatic context constrains a broader European participation in Philippine infrastructures. To reverse such a disadvantage, European businesses may need to alter their strategic action by addressing the following questions:

- What do the Philippines have to offer as an investment destination within the context of ASEAN1 and the global economy in times of uncertainty?

- To achieve the Philippines’ economic objectives, what are the basic elements that open up pathways for European investment and financing?

- What do European investors need to do to profit from the emerging Philippine opportunities?

The lukewarm diplomatic climate may have its roots in how ‘polite society’2 is torn between staying true to its perceived ideals and the desire to do business in emerging markets that are judged to fall short of its standards. To start with, due process in law and good governance are considered fundamental to securing investments in a sound market framework. Implicitly, judicial and policing powers, and their attendant institutions, are assumed to be in place and fully functional.

The Philippines inherited by Duterte and his predecessors is far removed from these ideals. Without a modicum of effective governance, drug syndicates hold sway in the judicial, legislative and executive branches of government. While nowhere near a failed state, where the politics of narcotics rule, the country’s institutions have been sufficiently weakened so as to hinder socio-economic development. In the government’s thinking, dismantling the drug syndicates is a fundamental step to eliminating systemic blockages. Given the enormous stake at risk, the drugs trade will resist any moves to protect its turf and livelihood. In this competition for dominance, ‘polite society’s’ preference for following the ‘due process of law’ is self-defeating, with society as its victim.

Imagine this scenario: an accused drug dealer is arrested by a corrupt police officer. The accused is arraigned in court by a corrupt judge following ‘due process’ that selectively ignores incriminating evidence. Under the presumption of innocence, the accused is inevitably acquitted. A President intent on taking decisive action and breaking this vicious circle is resisted to ensure he fails. In its self-righteous view, ‘polite society’ demands that the ‘failed’ President resigns –or is impeached– to leave the way clear for a Vice-president waiting in the wings.

In this game of political chess, European businesses are up against an aggressive China. The Philippines benefits from China’s silk road and economic belt initiatives as a major investment destination. Russia is following suit, with Japan and Korea strengthening their already ubiquitous presence. Donald Trump’s US is working to repair its historical but frayed friendship due to Barack Obama’s stern criticism of Duterte’s war on drugs.

(2) Duterte’s pivot: reframing partnerships and economic transitions

Just what does Duterte’s agenda of change aim to achieve and why does it inspire mistrust from the opposition and ‘polite society’?

Quite simply, the dual pivots to Eurasia and the Philippine regions imply shifting influence and power. The traditional beneficiaries could see their relative shares decline as investments and growth shift to the regions. Globally, the rebalancing reallocates economic spoils. Specifically, the government’s economic agenda emphasises the following:3

- Enhance connectivity: by interconnecting regional markets through improved roads, rail, ports and communications, regional growth centres are created when production centres are linked to local, national and global markets.

- Decongest Metro Manila: promote tourism and strengthen regional markets, enhance local governance and improve agricultural productivity to disperse economic prosperity while achieving inclusive growth.

- Modernise agribusiness and logistics: adopt modern technologies to increase yields while improving logistics to augment the profitability of agribusiness ventures.

- Modernise network infrastructures: enhance information technology infrastructures, energy distribution and telecommunications to support the further expansion of business process outsourcing, improve the provision of information technology services and broaden the access to knowledge and training.

- Accelerate execution: simplify bureaucratic processes, reform taxation and resource allocation, and enhance access to global funding for business, infrastructures and social initiatives.

The tasks are cut out for European managers. Being amongst Asia’s fastest growing economies, corporate opportunism no longer suffices as the foundation for a Philippine presence. What can European firms do in order to profit?

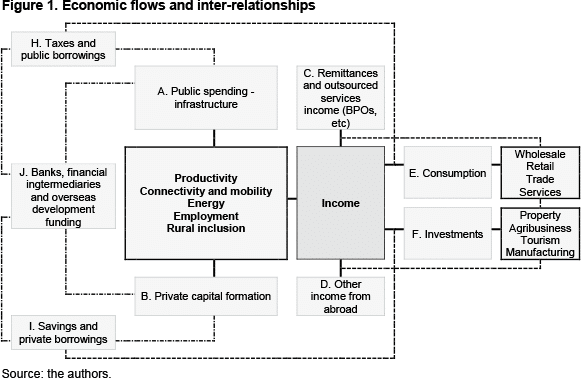

A deep analysis and understanding of what the Philippine market represents involves validating (or even questioning) what the media present as facts. The prognoses of doom are dispelled by how economic indicators are evolving. Using the analytical approach outlined in Figure 1, how the Philippine economy and its components interact is the basis for guidance in determining our thinking and subsequent discussions. We use current GDP to facilitate linkages to financial measures that use ‘money of the day’ values.

Public spending on infrastructure (A) is raised from 4.5% of current GDP in 2016, to a range of 5% to 8% by 2022. Private capital formation (B) is made more prominent with shares exceeding 30% of current GDP (from less than 23%). Improved infrastructures enhance productivity, connectivity and energy supply reliability that in turn feeds into raising employment and rural development. Income expands when remittances from overseas Filipinos and business process outsourcing (BPOs) (C) continue to grow, while trade and other income from abroad sustains its present pace (D). Rising income fuels consumption (E), while improving financial literacy and greater access to financial products and services could shift part of that income to savings (F). The reallocation could alter sector prospects (ie, retail to property, for instance), where a heavier reliance on investments could favour longer-term commitments in property, agribusiness, tourism facilities and development or manufacturing.

Annual infrastructure spending for 2016 to 2022 is estimated at Php1,333 billion (US$32.52 billion). This has to be funded by increased borrowings (or by savings), improved tax revenues or, to a lesser extent, official development assistance (ODA). The financial services sector is ripe for innovation and greater openness to competition, to support what Gordon has described as ‘investing the smartest / to prosper the best’.

At 13.64% of 2015 current GDP,4 Philippine tax incidence is well below the Organisation for Economic Cooperation and Development (OECD) average of 34.2%. With Philippine tax rates higher than its peers, the low rate is realistically attributed to poor collection and leakages. By raising this proportion to 20%, the Philippines could raise tax revenues without imposing new taxes by US$22.46 billion (US$353.19 billion * 6.36%), enough to fund 69% of public infrastructure spending.

Remittances of US$30 billion and BPO revenues of US$25 billion annually are spent largely on consumption, instead of accumulating savings. Greater financial literacy and availability of savings instruments could shift these cash inflows into savings. Add to this foreign direct investment of around US$10 billion and tourism receipts of around US$7 billion and up to 76.6% of the US$94 billion investment could be funded by known revenue sources. The US$22 billion shortfall would imply shifting roughly 8% of consumption into savings.

In the light of the apparent opportunities in financing, why do Philippine banks fail to act? Consumer lending is proving too lucrative and requires less capital requirements than project financing under the Central Bank’s rules.

(2.1) What is the record to date?

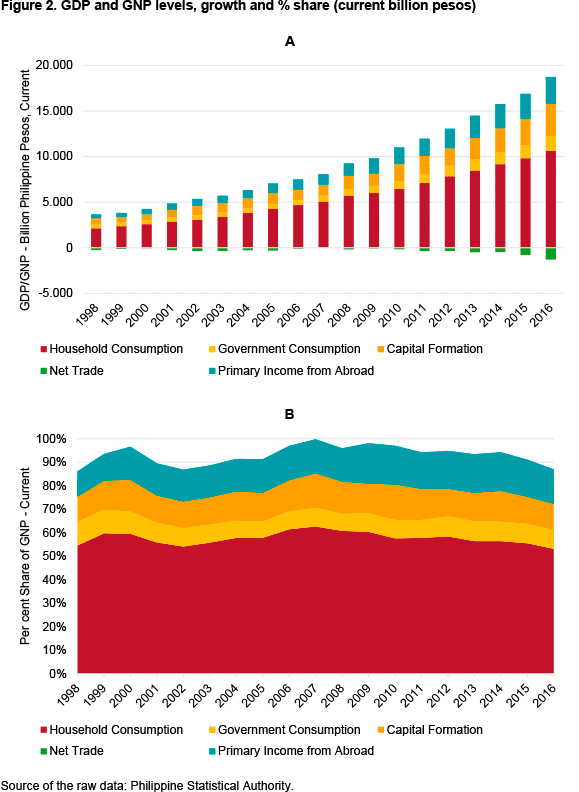

Over the past two decades (1998-2016) Philippine economic performance has been characterised by growth that is sustained despite local and global turmoil. Consumption (Figure 2A) has been dominated by dollar-based remittances and BPO revenues fuelled growth. Capital formation and foreign direct investments lagged behind the country’s ASEAN peers and accounted for only modest shares (Figure 2B). Trade and income from abroad were residual but an expanding proportion of current GNP. In effect, the economy proved resilient in uncertain times partly because of its large domestic base.

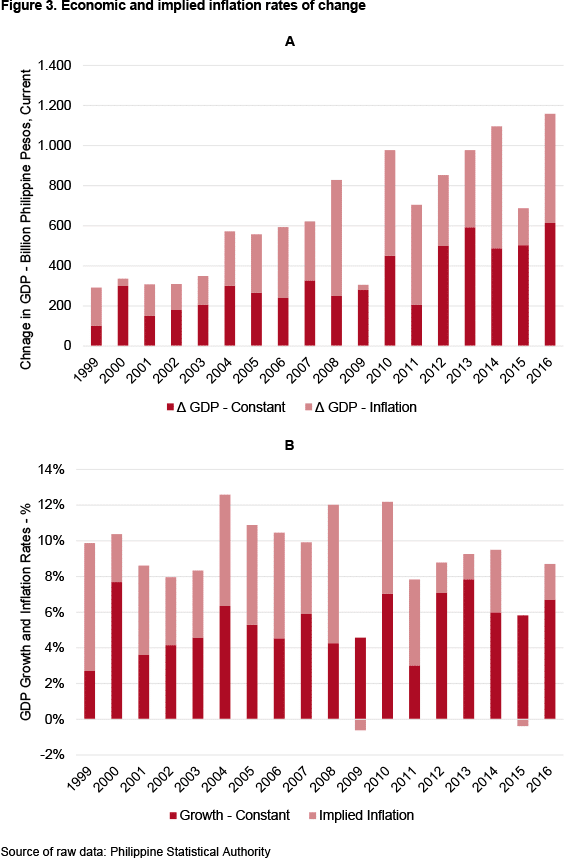

Volume expansion, with inflation remaining at bay, was a feature of Philippine growth. Figure 3A breaks down current growth from changes in constant GDP and inflation (or the difference between current and constant GDP). Figure 3B shows constant GDP (volume) growth and inflation (current less constant GDP growth).

Over this period the Philippines impeached president Joseph E. Estrada (the ‘actor-President’) in 2002. Faced with questions regarding her political legitimacy, Gloria Macapagal-Arroyo’s low popularity saw a doubling of current GDP (2002-10) that Benigno S.C. Aquino sustained through benign neglect. Notwithstanding Aquino’s persistent under-spending in public works and infrastructure, the economy cruised along on the strong foundations laid by Macapagal-Arroyo.

Tax and customs-duty collections are the bureaucracy’s weak spot. Their ill repute as corrupt agencies appears to be well deserved. While any estimates at best lack rigour, revenue leakages are suspected to be as high as half, a level that gains credence given the country’s low tax incidence, which is inconsistent with high tax rates. Within this imperfect system, prudent fiscal management and an expanding economy under Macapagal-Arroyo and Aquino placed Philippine debt at around 26% of GDP, among the lowest in ASEAN and globally. These observations have three policy and strategic implications for Duterte’s presidency:

- Tax collection efficiency, not necessarily higher taxes, is the decisive element in any tax reform.

- Lower tax rates and simplified taxation could lower the incentives for tax evasion if combined with stiff penalties (and actually implementing them) for tax evaders.

- Transparent tax and tariffs supported by a workable automated payment system to settle taxes and duties can reduce leakage.

For southern Europeans the phenomenon of underground economies is familiar territory. Its size is disputed. Corruption matters and has a cost for society. Duterte, rightly or wrongly, traces corruption’s roots to the drug trade that he is committed to eradicate.

Duterte has estimated that there are around 4 million addicts or the upper end of the 1.8-4 million estimates. On a daily expenditure of Php200 per head, Duterte’s calculations would value drug revenues at around Php800 million (US$16 million), implying annual revenues of Php292 billion (US$5.8 billion). This accounts for 2.7% of 2016 household consumption (2.0% of current GDP). Behind this industry, webs of corruption are entrenched within the government, with a backdrop of police protection and political patronage.

‘Back of envelope’ estimates can provide a perspective to the nebulous numbers game. On a 2016 current GDP of Php14,481 billion (US$353 billion), a 9.4 percentage point (26% less 13.6%) difference in tax incidence implies a potential leakage of Php1,361 billion (US$33.19 billion). On an average duty of 10% on an import value of Php5,348 billion (US$130.44 billion), a 30% leakage would imply Php160.44 billion (US$3.91 billion) is lost to the non-payment of duties. In 2016 public works expenditure was Php362 billion (US$8.83 billion) where up to 40%, or Php144.80 billion (US$3.53 billion) were potentially diverted as bribes. On these very rough estimates, up to Php1,958 billion (US$47.76 billion) are potentially lost to drugs, corruption and bribes, accounting for 13% of 2016 current GDP, or around 18% of 2016’s Php10,652 billion (US$259.80 billion) household consumption.

Agricultural production and rural development were impaired by poor infrastructure, since farming areas are not readily linked to markets by roads. In Mindanao, where a number of the poorest provinces are located, rural development is held back by recurrent terrorist attacks. Mindanao’s rich natural resources have beckoned investors since the Spanish colonial era. However, a fragile peace has hindered economic progress, leaving its prospects for prosperity unfulfilled.

The moral of the Philippine story is that economic resilience is displayed in full view amidst less than ideal political conditions. The economy is outpacing its peers, albeit at rates below its full potential.

(2.2) Divergent diplomatic responses, commercial consequences

Duterte’s unconventional behaviour has been met with surprise. Asian and Russian diplomacy have chosen to seek some common ground. The global community’s response is characterised by one of the following approaches:

- Pecuniary diplomacy: premised on respect and non-interference in internal affairs, the allies work with the recognised Philippine authorities to address specific areas of cooperation. The Japan International Cooperation Authority (JICA)5 embodies this approach, which China’s ‘silk road and economic belt’ initiatives are taking to a new level.

- Restoring old friendships: Trump’s presidency is quietly re-establishing the close US military and economic alliance and cooperation6 with an eye to an emergent China.

- (Small) carrot and (big) stick diplomacy: the EU continues to tie aid to a compliance with implicit (or explicit) demand for observance of rules against extrajudicial killings.

Duterte equates European assistance to a ‘licence to interfere’ (and dictate) to a neo-colonial vassal state. ‘Damned if you do, damned if you don’t’: when Duterte rejected European aid, he was branded ‘erratic and inconsistent’ by the political opposition.7 Richard J Gordon, a Philippine senator and Duterte ally, provides a viable translation in ‘polite society’ language: ‘When we refuse help we are forced to do things we once thought we can’t do. Like working our hardest, saving our darn best, investing the smartest – to prosper the best. I think that is what the president is trying to do. And that’s what all Filipinos should do’.

How did European diplomacy become so uniquely isolated?

A coincidence of errors inadvertently embroiled European diplomacy on the wrong side of Philippine politics. Simon Kuper’s8 observation on the cultural elite offers a possible explanation: ‘Trump voters see a class that talks equality while living privilege and exuding contempt’. The Philippine opposition pinned their hopes on Vice-president Maria Leonor Santo Tomás Gerona Robredo (Leni Robredo), to restore their political power through the Liberal Party’s Plan B.9 The latter fizzled out when the opposition’s numbers in the Philippine Congress dwindled to irrelevance, making it incapable of impeaching the President. Realising this, the Philippine opposition reverted to the notion that the President could do no right, finding support in the cultural elite’s singular focus on extrajudicial killings that conformed to the European narrative. The ensuing ‘word war’ between Duterte supporters and critics took on the same ferocity as the siege in Marawi City by DAESH-inspired rebels.10

Duterte’s loose talk and colourful language won him the undeserved title of ‘mass murderer’, as Robredo’s UN Human Rights Council message in Vienna aimed to convey. Alleged killings of political rivals and critics dated back to President Ferdinand E. Marcos’s martial-law regime. Europe’s cultural elite condemned the succeeding Presidents Corazón C. Aquino,11 Gloria Macapagal-Arroyo12 and Benigno S.C. Aquino13 for their inability to contain the killings while ignoring the government’s emphatic condemnations any extra-legal means to achieve its policy objectives. The European Parliament raised the stakes by officially condemning Duterte’s war on drugs and planned restoration of the death penalty.14

Duterte’s electoral platform focused on eradicating the drug problem. Political insiders attributed the spike in killings prior to Duterte’s accession to power to cleansing the ranks of potential informers or witnesses by corrupt officials. While the numbers are in dispute,15 Duterte’s colourful language was interpreted as an implied admission of complicity to police killings of suspects as officially sanctioned, and points to his character failures. Through a leap of faith, in the eyes of polite society, these flaws made him unfit to govern.

The futility of the debates points to a more fundamental issue: what constitutes good governance and decisive leadership?

Operating under a constrained political system, great leaders have the ability to balance the forces that promote the common good. Navigating through competing interests and pitfalls, effective leaders rely on achieving the best outcomes with a minimum of damage. A flawless character may prove inadequate, as Europe and many countries discovered, to drive through successful societal transformation. For this reason, ‘polite society’ draws a blank after expressing its lament: ‘What are you going to do about it?’.

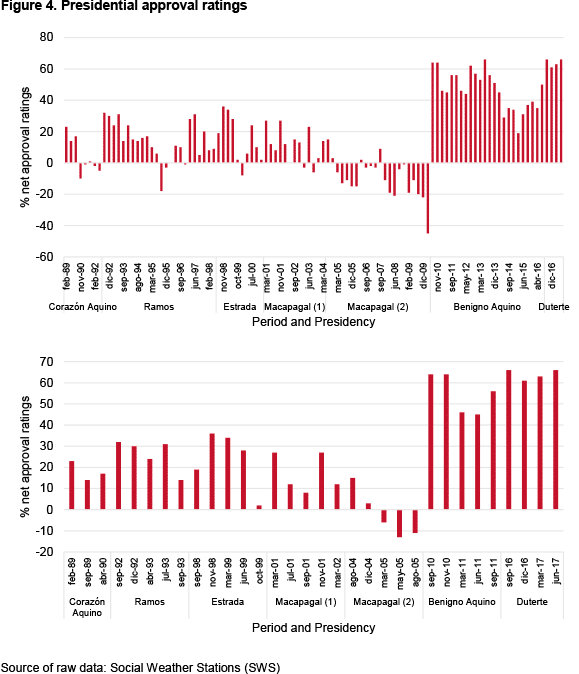

The paradox is evident: under a crescendo of ‘polite society’ criticism, Duterte’s approval ratings remain ‘very good’16 (Figure 4A), hitting a record after one year in office (Figure 4B). The economy continues to grow at a healthy pace while the opposition’s poll ratings continue to plummet.17

(3) Scenarios and uncertainties

Often touted as an economy rich in natural resources, populated by a young, educated and qualified workforce, and supported by strong foreign remittances and services revenues, a flourishing future is on the cards. However, natural calamities and self-inflicted disasters often cloud the positive narratives.

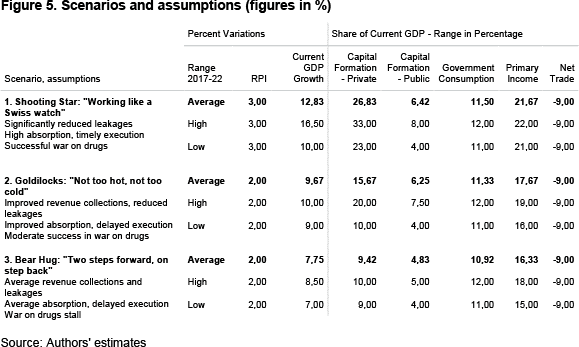

Figure 5 summarises our assumptions for the three scenarios for 2016-22. A nuanced view emerges that questions the ‘nothing is right’ melancholia and the unbounded ‘can do no wrong’ enthusiasm.

Scenario 1: shooting star: ‘ticking like a Swiss watch’

Under an aggressive infrastructure-spending programme,18 public spending takes centre stage, trebling the scale of works: ‘on target, on budget’ implies the rapid absorption of investments, reduced leakages and available competencies.

Scenario 2: Goldilocks, not too hot, not too cold

In an imperfect system, infrastructure builds up more moderately while success in curbing corruption and leakages is less pronounced. The uncertain global market backdrop could slow down currency inflows from remittances and business process outsourcing.

Scenario 3: bear hug, two steps forward, one step back

Bureaucratic hurdles and a limited absorption capacity by regional economies hinder timely execution. Lacklustre progress in containing corruption, accessing human competencies and deploying technologies erode confidence, slowing down capital formation and business expansion.

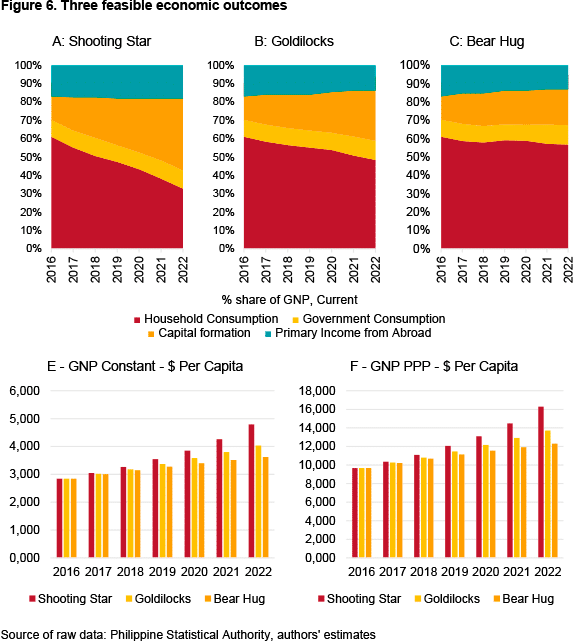

Figure 6 quantifies in graphs A, B and C how resources could be reallocated, whereas graphs E and F translate the feasible outcomes into per capita income measures. The government’s optimism, if or when fulfilled, could see average constant GDP growth of 9.83% (from Figure 4, current GDP growth of 12.83% less 3% inflation). Conversely, the pessimists would suggest 5.75% (7.75% less 2%). A realistic expectation is 7.67% (9.67% less 2%) under a Goldilocks scenario where the economy expands at a rate that is ‘not too hot, not too cold’.

We now turn to where the government intends spending its php8 trillion infrastructure programme.

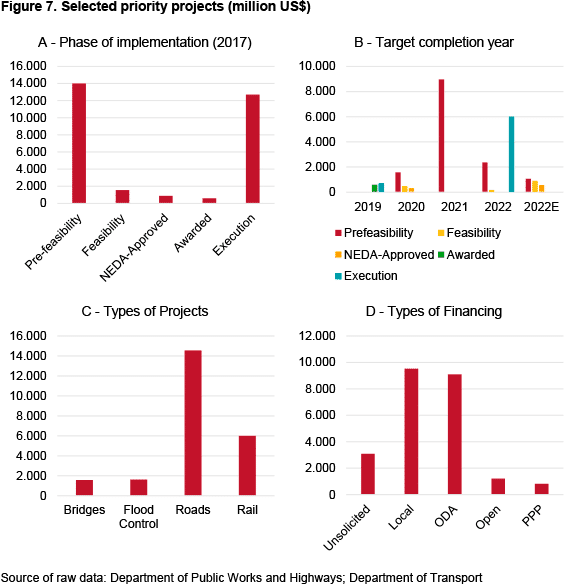

Using the underlying data of Appendix 1, Figure 7 provides an overview of the state of play as at July 2017. Cognizant of the changing stages of execution, graphs A to D give a sense of where the government is in terms of realising its projects. The list by no means presents a comprehensive overview since a sizeable number of projects are yet to be cost-out and are awaiting results for scoping their ‘business case’.

(3.1) Challenges and uncertainties

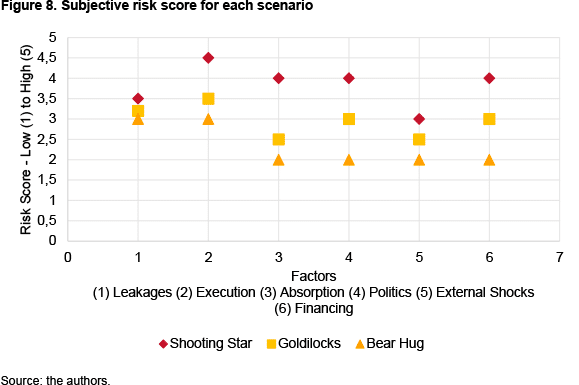

Applying an intuitive approach, risk factors are scored in Figure 8 (1-lowest, 5-highest) to compare Philippine opportunities against those that firms may consider.

Corruption, counter-intuitively, is a manageable risk. With its ‘democratisation’, influence peddlers compete where the outcome is increasingly open-ended. Under a more vigilant President, where seniority does not confer immunity, bribing officials becomes a trade-off between uncertain payoffs and the prospect of jail. In effect, corruption is seen as immoral, whose eroding economic value may hasten its demise.

External shocks are borne out by historical experiences as transient. The effects of the Asian crisis (1997) and the Great Recession (2008) were partly offset by remittances and BPO revenues. While growing moderately, the Philippines re-asserted its growth trajectory in less than two years. With the Philippines more integrated globally, as a gateway to ASEAN or a hub, external dependency may increase.

Execution, absorption capacity and politics are intertwined and are among the greatest risks to economic performance. As growth gathers pace, access to expertise and resources could tighten and deter successful implementation. This is where adaptive capabilities are critical, where hardware complements software to run regional economies at higher gears.

Chinese suppliers were plagued by quality and reliability problems.19 With Chinese firms increasingly called to supply and execute large-scale projects, supplier risks may increase significantly.

These constraints present opportunities for advisory or consultancy services, or for European suppliers to compete on quality and reliability, by working in tandem with government and entrepreneurs. Paradoxically, ODAs may not look as compelling, paving the way for the European firms’ re-entry –a long shot for now but a distinct possibility–.

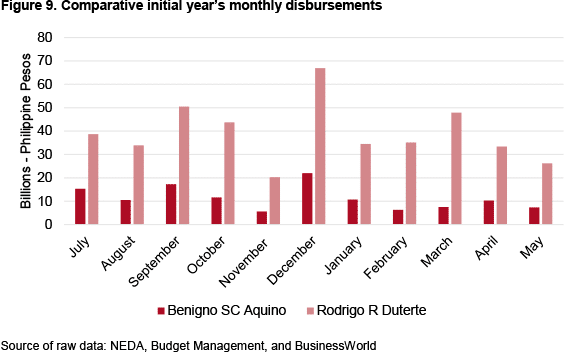

Duterte’s first year is promising in highlighting the government’s execution capabilities (Figure 9). Aquino’s first year significantly under-spent his infrastructure budget by choosing to cancel awarded contracts that significantly delayed implementation. By respecting Aquino’s contracts: (1) Duterte achieved accelerated project implementation; and (2) demonstrated his respect for the integrity of government obligations. The ‘low-hanging’ fruit increased spending to Php461 billion during Duterte’s first 11 months (vs Aquino’s Php135 billion during his first full year).

The tougher challenges come in subsequent years. With new projects still under early stages of evaluation (Appendix 1), delays and bureaucratic obstacles, particularly in right-of-way disputes, might slow down the pace of implementation.20

With banks experiencing excess liquidity, financing risks refer to the potential blockages that arise from a lack of instruments to convert remittances into savings. With limited facilities for long-term savings, poor financial literacy and restrictive single-borrowing limits imposed on Philippine banks, the prospect of under-deployed cash sitting idle (or being frittered away in consumption) is quite real.

On balance, the Philippines’ risk profile is counter-intuitive. As the growth trajectory settles to the pace of the ‘Goldilocks’ or ‘bear hug’ scenarios, the influence of politics and absorption capacity fade away, while remaining relevant. However, the more successful the government becomes, the more important political will shall be to enhance regional absorption capacity.

(4) Where can European firms play?

The government has a flexible approach to tapping government funding, shown as ‘local’ financing in Figure 7D, and ODAs. Speed, cost competitiveness and availability are the main criteria while recognising the prospect of multiple-source financing.

ODAs usually favour their nationals or firms based in the donor’s country to contract with the government. This is where JICA, and lately China, are comparatively well positioned to gain contracts on identified projects (Appendix 1a). The picture changes very little, although being more open-ended, for projects that are at the early stages of study (Appendix 1b).

European firms are disadvantaged when their governments focus on politics rather than on economics. They may resort to:

- Partnering with Philippine firms that need to complement their offerings via the provision of technologies, know-how and specific competencies, potentially sidestepping barriers around ODA-funded projects.

- Working closely with their respective governments to create niches in areas such as long-span bridge construction and related services, to open avenues for specialist contractors.

- Cooperating with multilateral agencies such as the Asian Development Bank, the Dutch FMO or national aid agencies, in identifying and designing their offerings in energy, agribusiness, communications or tourism-related infrastructures among others.

This brings us back to how the EU’s focus on the alleged extrajudicial killings is hampering European firms’ commercial access. Having its €250 million aid rejected, offers of more substantial financing could face a similar resistance. By default, Asian firms would take precedence over European ones for consideration as lead proponents.

Counter-intuitively, the Marawi siege21 may provide a narrow avenue for European diplomacy to re-assert its relevance. As the siege is successfully quelled, the tasks of rebuilding, reconstruction or rehabilitation offer an opportunity, specifically:

- Deploy modular construction techniques that reduce costs and accelerate programme execution.

- Resettle displaced persons and the delivery of emergency services, coupled with the provision of healthcare, utilities and support facilities.

- Restore, reconstruct or rehabilitate basic water, power and similar services using appropriate European technologies.

- Introduce waste, urban sanitation and environmental management technologies to improve environmental quality.

Involvement in such ventures potentially resets, or even reframes, relations from a model that antagonises to a focus on resolving actual problems that matter to the Philippine government.

Conclusions

Philippine entrepreneurial creativity turns obstacles into opportunities. It turned BPOs into a multibillion dollar industry with minimal government assistance. Political risks are two-way situations: they can either hinder or open up gaps from which entrepreneurs can profit by exploiting bureaucratic inefficiencies, market imperfections and constrained capabilities.

The route to Philippine prosperity is two-fold: reduce leakages and strengthen institutions. The EU is well recognised for its work in institutional strengthening. Private business can deploy its experience in areas where it has a competitive edge. This is where the real challenges and opportunities lie.

In an open market economy, European firms compete with the best providers from the US, Japan and other Asian countries. With infrastructure funding relying partly on ODAs, the opportunities are to a great extent tied to cash.

Europe could positively deploy the strength of its convictions. While China uses pecuniary benefits as its chosen diplomatic tool, Europe could impart the lessons and benefits that its more evolved justice systems have accomplished. European firms have a clear choice to make: engage in the Philippine and ASEAN market as a fully-fledged partner or reluctantly commit to the periphery of a fast-growing economy. By treating the Philippines as a marginal market, European firms may end up in the periphery of the ASEAN wilderness.

Europe’s commercial interests are best served when its firms focus on what they can offer that the Philippine market needs. Without this thorough understanding and a concerted effort at establishing themselves as credible commercial partners, European firms may find themselves fighting over the crumbs left over from the feast that Eurasian and US partners have partaken.

The choice is evident.

Ricardo G. Barcelona

PhD in Management, King’s College London, Professorial Lecturer, School of Economics, University of the Philippines, and Managing Director, Barcino Advisers Limited, Hong Kong

Bernardo M. Villegas

PhD in Economics, Harvard, Professor Emeritus, University of Asia and the Pacific, Philippines, and Chair, Barcino Advisers Limited, Hong Kong

1 Association of South-East Asian Nations, comprising Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand and Viet Nam.

2 Sometimes referred to as the chattering class, ‘polite society’ in the Philippines refers collectively to the political class, intellectuals and the media that emulate the stance and values of the western ‘cultural elite’.

3 The government’s programme of action was discussed more extensively in our three papers series: Ricardo G. Barcelona, Bernardo M. Villegas & Thomas G. Aquino (2016), ‘Building a better Philippines together: RACE towards prosperity’, Policies and Issues in Perspective, University of Asia and the Pacific, Manila, Philippines, August, last accessed 17/VII/2017.

4 This is based on current World Bank and Philippine Statistical Authority GDP data.

5 An established player in assisting Philippine policy and development initiatives.

6 Former ambassador Philip Goldberg was suspected by the government of working with the political opposition to overthrow Duterte. See the contrasting perspectives of the Philippine and foreign media: Yen Makabenta (2016), ‘Philip Goldberg and the arrogance of power’, The Manila Times, 29/XII/2016; and Melissa Chan (2016), ‘Philippine president Rodrigo Duterte calls US ambassador “gay son of a whore”’, Time, 10/VIII/2016.

7 Reuters (2017), ‘Philippines declines aid from Europe: Official’, 18/V/2017.

8 Simon Kuper (2017), ‘What’s wrong with the cultural elite?’, FT Magazine, 25/V/2017. This is based on the book by Joan C. Williams (2017), White Working Class: Overcoming Class Cluelessness in America, Harvard Business Publishing.

9 Roberto D. Tiglao (2016), ‘Plan B: Yellows throw Roxas under the bus (again), so Robredo becomes VP’, Manila Times, 12/V/2016.

10 An example is the interview in Hard Talk with Senator Antonio Trillanes, in which the BBC’s Stephen Sackur offered counter-factual data refuting the former’s assertions about Duterte’s forthcoming political demise (accessed 24/VI/2017).

11 Richard J. Kessler (1989), Rebellion and Repression in the Philippines, Yale University Press, Newhaven.

12 Alastair McIndoe (2009), ‘Behind the Philippines’ Maguindanao massacre’, Time, 27/XI/2009.

13 Anastasia Moloney (2016, January 7), ‘Killings of human rights defenders rise; PHL 2nd worst – rights group’, GMA Online Network, 7/I/2016.

14 Note how it was reported by Russian TV (2017), ‘Duterte tops Time poll as EU critics told ‘stick to child porn’”, 28/III/2017, and by the UK’s Independent (2017), ‘EU are “sons of bitches”, says Philippines president’, 24/III/2017.

15 Vice president Leni Robredo claimed more than 7,000 people killed as reported by The Straits Times (2017), ‘Philippine vice-president Leni Robredo slams drug war’, 15/III/2017. This was refuted by the then Senator Alan Peter Cayetano citing around 2,000 killed according to police statistics, claiming that the opposition counted as extrajudicial killing any death other than by natural causes. The problem is attributed to a lack of a commonly agreed definition of extrajudicial killings as presented in Christian D. Pangilinan (2012), ‘The dispute over extrajudicial killings: the need to define extrajudicial killings as state sponsored acts’, Philippine Law Journal, nr 86, p. 811-863; and Ateneo Human Rights Center (2017), ‘Summary & extrajudicial killings in the Philippines’, a submission to the UN Human Rights Council for the universal periodic review of the Philippines, 3rd Cycle, 27th session, 2017.

16 First Quarter 2017 Social Weather Survey: Net satisfaction rating of the Duterte National Administration at “Very Good” +66, Social Weather Stations, accessed 26/V/2017.

17 Philippine Star (2017), ‘Leni’s approval, trust ratings dip’, 18/IV/2017.

18 Appendix 1 lists a number of infrastructure projects that the Philippine Department of Public Works and Highways identified as priority expenditures.

19 Mass Rapid Transit’s (MRT) 48 defective rolling stock from the Dalian Locomotive & Rolling Stock Company continue to plague Metro Manila’s rail transport system as reported by Audrey Morallo (2017), ‘Senate to probe “unusable” China trains’, Philippine Star, 3/V/2017. An earlier report highlighted similar quality issues with the China Southern Railway Quingdao Sifang Locomotive & Rolling Stock Company’s 35 defective trains in Singapore in the report of Prashant Parameswaran (2016), ‘Did China firm “secretly recall” defective Singapore trains?’, The Diplomat, 5/VII/2016.

20 Romeo Bernardo & Marie Christine Tang (2017), ‘Settling in’, Global Source Partners, 16/V/2017.

21 DAESH-inspired rebels occupied the city and declared a caliphate on Philippine territory, prompting Duterte to declare martial law for Mindanao. The Philippine Supreme Court reviewed and concurred with the factual bases presented by the government. Unlike Marcosian martial law, the 1987 Philippine constitution limits its duration to 60 days, which can be extended by Congress subject to the existence of a rebellion or invasion as the sole justification.