Theme

Two episodes of panic have broken out in China’s financial markets in the course of no more than a month: a stock market collapse and only very recently a Renminbi (RMB) depreciation engineered by the People’s Bank of China (PBoC). This note reviews what has happened so far and explores the potential consequences.

Summary

This paper analyses the recent collapse of China’s stock market and the measures taken by the Chinese authorities to prop it up as well as the potential consequences of its actions. It also reviews the recent decision of the People’s Bank of China (PBoC) to put the Renminbi (RMB) on a course towards depreciation in the quest of both more exchange-rate flexibility and to regain external competitiveness for an economy that is rapidly decelerating.

Analysis

(1) The stock market collapse: what to read from it and its potential consequences

Bull and bust: what has happened so far

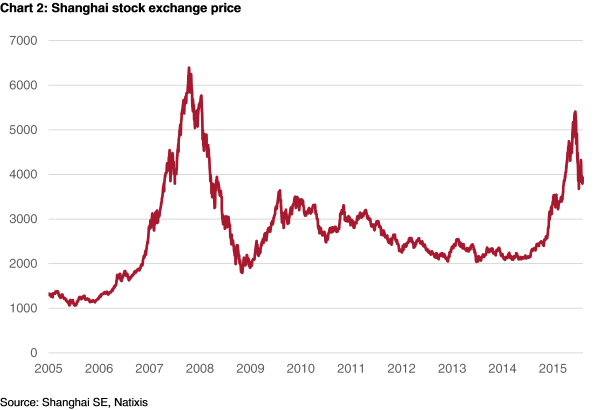

It has taken three weeks of unprecedented government intervention but the Chinese authorities have finally managed to subdue the world’s wildest stock market. After eight bear years, the Chinese stock market started to rally last autumn against the backdrop of a new easing cycle introduced by the People’s Bank of China (PBoC), which officially started in November 2014. As if this were not enough in a largely liquidity-driven market, the PBoC promoted stock market financing by easing margin credit conditions.

Why was there a bull market to start with?

The stock market rally was clearly sponsored by the Chinese government. It all started with the widely trumpeted announcement of the Shanghai-Hong Kong Stock Connect last year and the plan for a huge number of IPOs following suit. The underlying reason for pushing the stock market at that time was that Chinese banks and corporations needed a venue to raise equity after an era of excessive leveraging and neither the Shanghai nor the Hong Kong stock markets were well placed after years of a bear market.

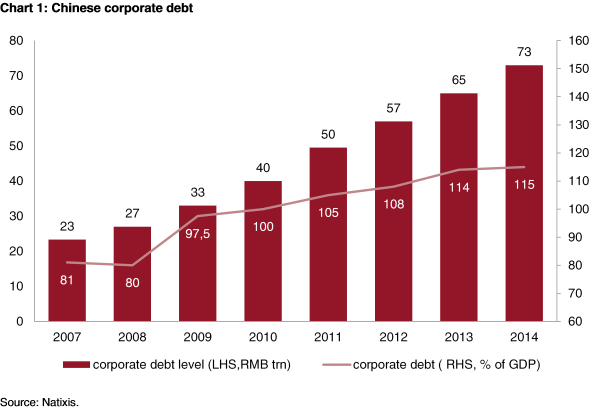

The need for Chinese corporations and banks to avail themselves of fresh equity cannot be underestimated. On the one hand, corporate debt has grown six times from 2005’s levels (see Figure 1). On the other hand, Chinese banks are not only heavily exposed to these corporates, which are still their main source of finance, but also to local governments whose borrowing from banks is starting to be restructured under a pilot programme to swap the loans for bonds, which –in any case– will continue to be held by banks. To make a long story short, China’s governments needed a bull stock market to transfer part of the cost of cleaning up its corporates’ and banks’ balance sheets. It was also positive that the Stock Connect would help gather more cash outside China.

The key measures to support the bull market came from the PBoC via several interest rate cuts as well as the reserve requirement ratio. All of this encouraged companies to bring IPOs to the market and to carry out debt for equity swaps, but it also allowed Chinese corporates and banks to continue to leverage as ample liquidity was available. In order words, as it could not be otherwise, monetary easing has only helped put more wood on the fire rather than help China to deleverage. The demand for stocks came easily for two mean reasons: the real estate market was no longer a venue for quick gains and monetary policy easing had made it even harder to get a decent return on money, not only in the official banking sector but also in shadow banking.

As a result, the Shanghai stock market skyrocketed with nearly a 60% increase between January and June 2015 (see Figure 2).

In the third week of June, things took a turn for the worse until they quickly ended in a dramatic sell-off on 4 July. The trigger was actually the announcement by China’s securities regulator that it would ban brokerage firms from providing unregulated margin funding to investors. To make things worse, the announcement came as investors went into profit-taking as doubts emerged about further easing from the PBoC. This was more of a shock to the system than one can imagine as margin financing in China is much larger than elsewhere (around 5%-6% of market capitalisation and 12% of the float). As the sell-off continued over several days, there was a broader pull-back of margin trading coupled with margin calls that forced some investors to sell their holdings. The situation deteriorated rapidly so that one third of China’s stock-market capitalisation was wiped out, equivalent to a quarter of the country’s GDP.

What have the Chinese authorities done to tame the stock market?

There can be no doubt that the Chinese authorities have conducted the most aggressive and swiftest stock-market intervention in world history. The measures taken can be classified into two types: first, injecting as much liquidity as possible to the system; and, secondly, reducing the market to its minimum so that intervention can be even more effective.

As regards liquidity intervention, the PBoC was the first to act by scrapping the loan-to-deposit ratio on 24 June and then cutting interest rates and reserve requirements, selectively, on 27 June. Immediately after, on 29 June, the State Pension Fund was allowed to buy a larger share of stocks. On 5 July as the stock market continued to slide down, brokerages announced they would put US$19 billion to prop up equity prices until the Shanghai SE index reached 4.500 points. On 8 July insurers were given greater freedom to buy stocks and China Securities Finance Corporation (CSFC) –a relatively unknown company until then– started buying stocks, especially from smaller companies. As if these measures were not enough to inject liquidity, a massive stock-support plan –run by CSFC and valued at as much as US$483 billion– was announced on 20 July. Just to put this figure into context, it would require as much as 200 basis points in reserve-requirement cuts to throw this amount of liquidity into the system. It is also more than half what the US Government earmarked for the Troubled Asset Relief Program in 2008 to boost banks’ capital levels and rescue ailing institutions.

The second type of measures, geared to reducing the size of the market, include taking out over 1,000 companies from China’s various stock markets (about half of its total stock market capitalisation) from 5 July onwards. Also on 5 July, as many as 28 IPOS on the waiting list were cancelled. During the same time, foreign investors were not allowed to (short)sell and executives at Chinese corporations were asked not to dump their shares.

With such drastic measures, it is no surprise that the Shanghai Composite Index rebounded around 14% from its low to close above 4,000 points on 21 July. By the same token, volatility also came down to pre-sell-off levels.

The fact that the stock market is now calm should not be interpreted as if all problems have vanished. The sell-off even seems to be as a sudden rush which shows the degree of the malaise affecting the Chinese economy. In fact, the economy is clearly decelerating well below the official 7% growth rate of the second quarter of 2015 and, at the same time, it is continuing to leverage.

It is important to ponder on what might be the potential consequences of the sell-off by detaching ourselves from the level of the Shanghai Composite Index and looking ahead.

Some thoughts on potential consequences

First, corporations who had access to the stock market or where counting on an IPO will need to find funding elsewhere. More bond and bank financing will need to happen. Shadow banking does not seem to be as easily available as it has been coming down to growth levels similar to the rest of the banking sector, so it is now harder for corporations to find any new financing space there. This means that corporate leverage will continue to increase and there may be some selective defaults as the economy remains weak and there is a good chance that it deteriorates further. The sectors at higher risk are those with large overcapacity, such as coal, steel, shipbuilding and commodity trading.

Secondly, banks will have a hard time tapping equity (other than organically) to grow at the pace needed to keep funding cash and equity-strapped corporates. At some point, thus, the central government may need to recapitalise the banks.

Thirdly, notwithstanding monetary easing (through orthodox and unorthodox measures as those described above), additional leverage will make corporations think twice before engaging in new investment, which will not help economic growth. Beyond the funding constraints, the confidence shock of the stock market collapse both for investors (including households) and borrowers (corporations funded in the stock market) should take a further toll on the economy.

Finally, and most importantly, on the fiscal side, conditions are extremely lax and they will continue to be so in the near future since the Chinese authorities are terrified at a sudden economic slowdown at this time. Local governments are back with new expansionary measures as reflected in the RMB600 million new bonds issued in May. The second debt swap for an additional RMB1 trillion also opens the door to new projects. Such fiscal easing will help growth but only marginally since the return to such massive investment can no longer be as high. In fact, investment-to-GDP was close to 49% in 2014. In addition, many of the measures (especially the US$483 billion stock-support plan through a China Securities Corporation) should also increase the central government’s fiscal deficit (if properly reported). In addition, part of the burden of the local government debt is being passed on to the central government through the debt swap initiative so there is no doubt that central government debt will increase. An increase in taxes should be ruled out in the current circumstances.

In a nutshell, not only will corporates be much more leveraged, but also the public sector at large, including the central government. China’s total debt is close to 300% of GDP according to McKinsey Global Institute so it can only get worse given the measures taken to tame the stock market sell-off. On this point, it is obviously too early to know what the impact on the economy will be but it is important to realise that, even if the situation stabilises, at least one percentage point could be shaved from China’s growth rate for 2015. The main damage will be in the financial sector, security brokerages and banks, which itself could already account for that one percentage reduction in growth this year (more so if it is considered that the booming stock market has added more than half a percentage point to growth in the first quarter of 2015). This could be just the starting point so that we should be aiming at a larger reduction in GDP growth unless the government re-engineers another monster of the likes of the 2008-09 fiscal stimulus package. However, do not forget that this would only be a short-term relief to China’s long-term issues anyway.

(2) A difficult exchange rate depreciation and what to expect

What has happened so far and why?

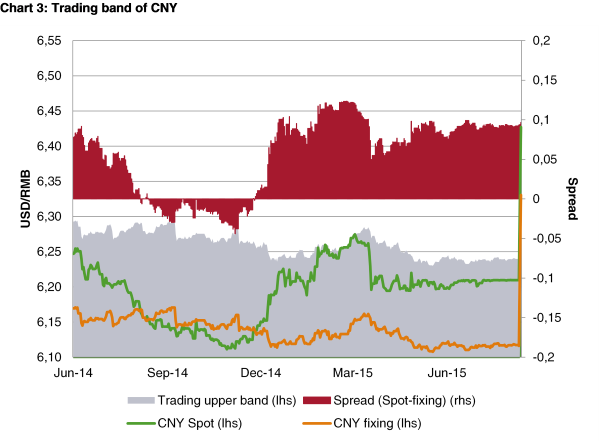

The PBoC surprised the markets yesterday by lifting the daily fixing rate of US$-CNY by 1.9% and triggered an effective 1.8% RMB depreciation against the US$ –the currency’s biggest one-day move since July 2005 when Beijing first started the exchange rate reform–. The market actually knew that the RMB was too appreciated as shown by a spot rate which was consistently above the fixing for quite some time already. Today, the PBoC managed to surprise those who believed that yesterday was a one-off action as suggested by the PBoC itself. By lifting the daily fixing again by 1.6% today, the PBoC basically followed its announcement that it would use the contribution of FX market makers for the fixing. Ironically, the day is closing after heavy intervention by the PBoC and allied forces to prevent the RMB depreciating too rapidly.

It looks as if the rules of the game are now clearer so that the PBoC will take the market’s view before setting the daily fixing. As we realise today by the PBoC’s massive intervention to keep the exchange at a depreciated but manageable level, this will not be as simple as that. In fact, the view that the PBoC will now –after so many years of exchange-rate control– become a price taker in the forex market to achieve reserve currency status is probably too naive. If that was the objective, the PBoC would have been much better off widening the exchange rate band as it initially announced on 24 July and it never really did. A wider band would have allowed the market to move the RMB to its cheaper ‘equilibrium’ value without such a strong hint from the PBoC (by a sudden change in the fixing). That sudden change in plan and the very negative data we have had during the last few days seems to indicate that the key reason for such an action was supporting a flagging economy.

They way forward for the PBoC

In the current circumstances the PBoC will need to strike a balance so that it can achieve enough of a depreciation without destabilising the markets and, thus, avoiding massive capital outflows.

China’s lost competitiveness is pretty massive. The weakening of the euro and the yen explain a good part of it as shown by the 25% nominal effective appreciation of the RMB last year, basically coinciding with the beginning of the US dollar bull market. However, things are even worse when taking into account China’s higher inflation compared with its trading partners. No matter how low Chinese inflation may be, other key trading partners, especially Europe and Japan, have even lower rates. This is why China’s real effective exchange rate has already appreciated by more than 30% since the beginning of 2015. Finally, wage increases, the bread and butter of manufacturing costs, have hovered around 10% for quite a few years notwithstanding the very low inflation environment.

On the other hand, capital outflows have also been massive. Both recorded and unrecorded outflows reached a peak in the first quarter of 2015, at around US$200 billion. Overall, regardless of surplus in the current account as well as the still positive net inflows from foreign direct investment, China still lost US$345 billion in reserves in one year (from June 2014 to June 2015) and as much as US$42.5 billion only in July. It is quite clear that capital outflows are an important concern for the PBoC to allow for a substantial depreciation of the RMB.

Finally, it is quite clear that engineering a moderate but still relevant depreciation would be ideal but it will be difficult to achieve and many risks still lie ahead. To minimise the risk, the PBoC will continue to provide ample liquidity to the system and probably restrict capital outflows even further.

Conclusion

The second half of 2015 will probably be remembered in China as one of the worst in recent times. Not only has the stock market collapsed but the engineered depreciation might not work out as expected. At the same time, the economy continues to show its weakness regardless of the massive monetary stimulus. Both markets will need to be watched very carefully, as will the consequences for the rest of the world.

Alicia García-Herrero

Senior Research Fellow at the Elcano Royal Institute | @Aligarciaherrer