Theme: The Spanish banking system, hard hit by its massive exposure to toxic real estate assets following the collapse of the country’s property market in 2008, is on the mend.

Summary: The banking crisis was concentrated in the regionally-based savings banks. Their number has fallen from 45 in 2009 to seven. The European Stability Mechanism came to their rescue with €41 billion in funds for recapitalisation in return for reforms that are being gradually put into place. Income statements are beginning to look better and balance sheets stronger. Spain exited the bail-out programme successfully in January, but banks are not yet out of the woods.

Analysis

Background

Spanish banks were excessively exposed to toxic real-estate assets following the collapse of the country’s property market in 2008. The then Socialist government, however, apparently did not realise this. The Prime Minister, José Luis Rodríguez Zapatero, told a meeting of Wall Street bankers in New York, nine days after the collapse of Lehman Brothers in September 2008, that ‘Spain has perhaps the most solid financial system in the world. It has a standard of regulation and supervision recognised internationally for its quality and rigor’. After the bubble burst and Spain went into recession (GDP shrank by around 7% between 2008 and 2013), the loan defaults of property developers and construction firms as a percentage of total bank lending to these two sectors (known as the non-performing loan, or NPL, ratio) surged from a mere 0.6% in 2007 to more than 25%. NPLs jumped from 0.7% of lending to all sectors to a record of 13.6% at the end of 2013 (excluding the toxic loans placed in SAREB, a ‘bad bank’). The volume of NPLs rose by €30 billion in 2013, an unprecedented annual increase, to €197 billion. SAREB was established in 2012 after the Popular Party (PP) took office as one of the conditions set by the European Stability Mechanism in exchange for receiving up to €100 billion in recapitalisation aid for various ailing banks.

The banking crisis was concentrated in the regionally based and unlisted savings banks, known as cajas, which accounted for around half the loans of the domestic banking system. As they did not have share capital, they were not subject to typical market-discipline mechanisms. The cajas were governed by a general assembly and boards of directors packed with unqualified political appointees, local businessmen and savers. Over the years the large cajas, such as Caja Madrid and the Barcelona-based La Caixa, moved on from their humble origins in the 18th century as quasi-charitable institutions to become financial services groups on a par with commercial banks. They also took stakes in companies. The removal of restrictions in 1989 on establishing branches outside their home regions enabled the cajas to expand around Spain, and they did so at an inexorable pace. The number of savings-bank branches rose from 13,650 in 1990 to a peak of 25,035 in September 2008, while the number of branches of the much more prudent commercial banks, most notably the two big ones, Santander and BBVA, dropped over the same period from 17,075 to 15,617. There was almost one branch for every 1,000 inhabitants in Spain in 2009, almost twice the density of the euro-area average.

The culture of the cajas was one of greed, cronyism and political meddling, and there was also a woeful lack of adequate supervision by regulatory bodies or looking the other way. The first to fall was Caja Castilla La Mancha (CCM) in the then Socialist-controlled region of Castilla-La Mancha when the Bank of Spain took over its administration in March 2009. Among other reckless projects, CCM had provided finance to the building of the white-elephant airport at Ciudad Real at a cost of more than €1 billion. The region’s PP government (since 2011) unsuccessfully tried to sell the airport in 2013 for €100 million. Two other cajas, CajaSur, mainly controlled by the Roman Catholic Church, and Caja de Ahorros del Mediterráneo (CAM), based in Valencia, ground-zero of the property collapse, were also seized. CAM was sold to Banco Sabadell for €1 in 2011.

The most spectacular near collapse in May 2012 was that of Bankia, the fourth-largest bank which had been created in December 2010 from the merger of seven cajas including Caja Madrid and was headed by Rodrigo Rato, a former Managing Director of the IMF and PP Economy Minister. The total number of cajas has declined from 45 to seven. Bankia’s nationalisation triggered the bailout by the European Stability Mechanism which came to the rescue in December 2012 with €41 billion, most of it for Bankia. In subsequent testimony to a judge overseeing a criminal fraud investigation into Bankia, Miguel Ángel Fernández Ordoñez, the former Governor of the Bank of Spain who stepped down in May 2012 before his term expired, said he feared Bankia’s collapse would force Spain out of the euro zone.

SAREB took over €36,695 million of real-estate assets at the end of 2012 from four nationalised financial institutions including Bankia. The government, through the Fund for Orderly Bank Restructuring (FROB), is the majority owner of a significant part of the banking sector. It holds an estimated 18% of loans.

‘In the real estate and financial bubble years there was a sort of euphoria which led to the risks that were accumulating to not be seen, or not wish to be seen’, said Luis Linde, the Governor of the Bank of Spain who took over from Fernández Ordóñez in June 2012. ‘It was as if nobody wanted to forecast scenarios of recession, interest-rate rises or collapses in funding’, said Linde. As George Orwell, the British writer, observed in 1946, ‘to see what is in front of one’s nose needs a constant struggle’. Spain’s political and financial elite failed to do so.

Analysis of results in 2013

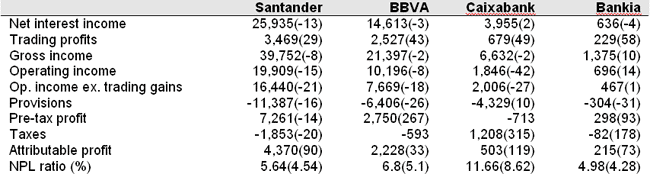

The 2013 income statement of Spain’s banking sector paints an improved picture. The attributable profits of six of the largest banks (Santander, BBVA, Caixabank, Popular, Sabadell and Bankinter) were four times higher than in 2012 at €7.8 billion, but well below the more than €18 billion in 2008. The nationalised Bankia is not included here, although it is the fourth-largest bank, because its figures distort the picture. It posted a loss of €19 billion in 2012, the biggest ever in Spain’s corporate history. In 2013, it generated a profit of €608 million.

The rise in profits, however, was mainly due to extraordinary factors: a sharp drop in loan-loss provisions from exceedingly high levels in 2012 and trading profits in the securities markets. The ability to generate income from core banking activity remains impaired. Net interest income –the profit made on core lending activities (the difference between the income from loans and the cost of deposits) and which is essentially recurrent revenue– declined or hardly grew (see Figure 1). Banks are constrained in their lending, and with the economy only now emerging from recession after five years and an unemployment rate of 26% demand for loans is low. The credit squeeze is such that even solvent companies are finding it very difficult to finance their activity. The economic recovery and other constraints will not be sufficient for the banking sector to return to the pre-2008 levels of profitability for some years.

Figure 1. 2013 results of the main Spanish banks (€ million) (1)

(1) Percentage change over 2012 in brackets except for the NPL ratio, which is the actual figure for 2012.

Source: Statements of the banks.

The extent to which profits have been dragged down by the massive provisions set aside can be gauged from the improvement in impairment losses on financial assets –from €82.4 billion for the whole banking sector in 2012 to €16.3 billion in the first nine months of 2013 (latest figure available for all banks)–. Banks were obliged in 2012 to increase provisions for real-estate-linked loans. This raised the average coverage of loans to the sickly real-estate sector from 18% at the end of 2011 to 45%.

Banks have benefited hugely from the profits on their sovereign bond holdings. This is easy income as banks borrow money cheaply from the European Central Bank (tantamount to a form of aid) and use it to buy high-yielding sovereign debt from their own governments. These bonds soared in value last year. Spanish banks trebled their holding of Spanish sovereign bonds between the end of 2007 and January 2014 to €272 billion. In the case of the mid-sized Banco Sabadell, its trading profits rose 170% to €1.48 billion, almost 40% of its total revenue (5% in 2008). Those of Santander, the euro-zone’s largest bank by market value, were 28.6% higher at €3.46 billion.

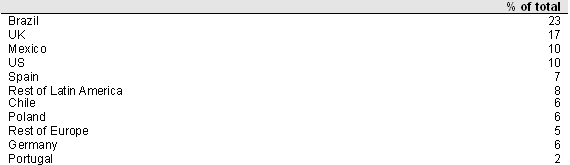

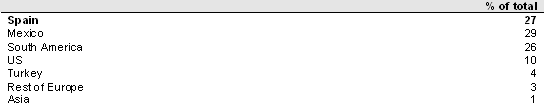

Santander’s and BBVA’s profits continued to benefit from geographic distribution to varying degrees, although both banks are beginning to feel the impact of problems in emerging markets. They generated, respectively, 53% and 60% of their profits in emerging markets in 2013 and 47% and 40% in mature ones (see Figures 2 and 3).

Figure 2. Distribution of Santander’s 2013 attributable profit (% of total) by operating segments (1)

(1) Excluding Spain’s run-off real estate.

Source: Santander.

Figure 3. Distribution of BBVA’s 2013 gross income by countries (% of total)

Note: BBVA does not provide a geographic profit distribution.

Source: BBVA.

While provisions declined, NPL ratios continued to rise in all banks. This reflected deleveraging, particularly in the construction sector, which lowered the denominator (total lending), but as the numerator (bad loans) continued to rise so did the NPL ratio. Caixabank’s ratio increased from 8.62% in 2012 to 11.66% in 2013 and that of BBVA, the second-largest bank, from 5.1% to 6.8%. Santander’s ratio for its whole group rose from 4.54% to 5.64%, but that for Spain, where business is sluggish, increased from 3.84% to 7.49%. The Financial Stability Board includes Santander and BBVA in its list of the world’s 29 most systemically important banks (ie, those that are considered too big to fail).

Progress in reforms

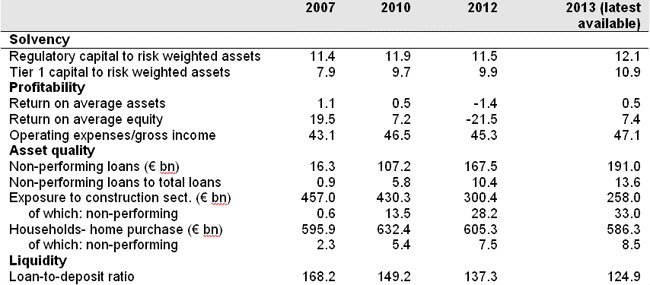

Reforms are being enacted under the July 2012 Memorandum of Understanding (MoU) with the European Commission, the European Central Bank and the IMF (known as the troika) on financial-sector policy conditionality, which sets out the measures to reinforce financial stability in Spain. Injections of public sector capital, burden-sharing exercises, asset sales, private equity issuance and the requirement for all intervened banks to transfer their foreclosed assets and real-estate loans over a certain amount to the bad bank SAREB, in exchange for government guaranteed SAREB bonds that can be used as collateral for European Central Bank financing, have boosted the banking system’s capital and liquidity (see Figure 4). As a result, Spain exited the EU bail out in January 2014.

Figure 4. Selected financial soundness indicators, 2007-13 (% or otherwise indicated)

Source: Bank of Spain, European Central Bank, Bloomberg and the IMF’s fourth progress report on Spain’s financial sector reform (February 2014).

Between March 2012 and September 2013, banks increased their provisions for losses on loans by some 80%. Yet the ratio of banks’ capital (CT1) to their risk-weighted assets nonetheless rose by about 1.5 percentage points. ‘This is an enormous effort in terms of recognising losses, cleaning up balance sheets, and bolstering buffers against adverse shocks’, said Kevin Fletcher, who headed the IMF team that prepared the final progress report released on 20 February. The IMF said the reforms have substantially reduced the likelihood of threats spreading from banks to the rest of the economy.

SAREB, after a slow start, made its first sale of properties last August when the private equity group HIG Capital acquired 51% of a portfolio including 939 homes, in a deal worth €100 million and using a low-tax financial vehicle known as Bank Asset Fund (FAB) to attract foreign buyers.

The law to reform the framework for former savings banks came into force at the end of 2013. It strengthens the regulatory regime for the few savings banks still carrying out directly a banking activity, and bars them from undertaking business beyond their home region. This limits these banks’ systemic importance and hence the risks that they could pose to financial stability (Bankia threatened to bring down the whole system). Former savings banks that indirectly exercise banking activity (through ownership of a commercial bank) are being transformed over the course of 2014 into ‘banking foundations’, some of whose activities are now supervised by the Bank of Spain. Only two savings banks, and tiny ones at that, continue to operate as before: Caixa Pollensa and Caixa Ontinyent. ‘The strategy appropriately differentiates savings banks based on their systemic importance, with tougher requirements for those that hold significant stakes in commercial banks’, said the IMF.[1] The so-called ‘revolving door’ between public administration and the world of finance has also been limited: politicians, as well as trade union officials and members of employers’ organisations, have to wait two years before they can join the board of a caja. In the past, regional politicians moved easily between these very different worlds.

Bankia, headed by José Ignacio Goirigolzarri, a former CEO of BBVA, has closed 1,120 branches (36% of its network), shed 4,600 employees (23%) and reduced the volume of its business by €36 billion, under the terms of its bail out. Goirigolzarri believes Bankia (68% owned by the state) will be in a fit state to be privatised by 2016. Goldman Sachs is to advise on the sale for a fee of €1.

Under the MoU, banks covered by the September 2012 stress test are submitting three-year ahead quarterly projections of their balance sheets to the Bank of Spain so there should be no more nasty surprises if all goes well. Another addition to the central bank’s increased supervision weapons are forward-looking exercises (FLEs) on banks to assess their solvency. Unlike the stress tests, which were one-off exercises based on pass-fail methodology, the FLE establishes a permanent framework to help the Bank of Spain regularly monitor banks’ health and guide its supervisory decisions.

Lastly, ‘rogue’ bankers are finally being investigated and in the cases of Roberto López Abad, the former General Manager of CAM, and Juan Ramón Avilés, Chairman of CAM’s control committee, it looks as if they will be the first to be brought to trial. The FROB recently stepped up its investigations, ordering 90 reports to be drawn up in order to ascertain the responsibilities of former caja executives in the collapse of banks. Spain, however, is a long way from the situation in the City of London where nearly 6,000 bankers, brokers and financial advisers have been sacked or suspended for misconduct since the start of the financial crisis in 2008, according to the Financial Conduct Authority.

Conclusion: Spanish banks have been through a very tough period. The financial system is now stronger. The Bank of Spain, however, cannot afford to let its guard down.

William Chislett

Associate Analyst at the Elcano Royal Institute and author of ‘Spain: What Everyone Needs to Know’ (Oxford University Press, 2013)

[1] Cited in the IMF’s second progress report on financial sector reform (March 2013), http://www.imf.org/external/pubs/ft/scr/2013/cr1354.pdf.