Theme: This study considers the likely regulatory impact of the proposed EU-US Transatlantic Trade and Investment Partnership (TTIP) in three key policy areas: investor protection, public services and food safety.

Summary: While advocates of TTIP have spoken of the agreement’s ability to boost growth and jobs and set global standards, its detractors claim that the agreement threatens hard-fought social and environmental protections. In light of the charged public debate on the issue, this paper looks at the likely regulatory impact of TTIP in three key policy areas: investor protection, public services and food safety. It finds that the agreement is unlikely to lead to one big deregulatory ‘big bang’. The investor protection provisions being considered offer some protections for states regulating in the public interest, public services are not exposed to wholesale liberalisation and the EU’s relatively more stringent food safety standards appear to be institutionally entrenched. That said, this study concludes that the agreement, as it is currently envisioned by European negotiators, is still likely to constrain regulatory autonomy through its investment provisions, provide insufficient protection for public services and lead to some downward pressure on standards in the area of food safety. The agreement establishes the primacy of the competitive disciplines of trade liberalisation, simply seeking to carve out regulatory exceptions. This approach faces significant practical limitations.

Analysis: The Transatlantic Trade and Investment Partnership (TTIP) –the free-trade agreement currently being negotiated between the EU and the US– has sparked considerable passion on both sides of the Atlantic, and especially in Europe. For its advocates, including the UK’s Prime Minister, David Cameron, it represents a ‘once-in-a-generation-prize’, allowing the EU and the US to boost their economies by eliminating remaining regulatory barriers to trade and setting global standards.[1] To its detractors, TTIP threatens hard-fought social and environmental protections and ‘would let rapacious companies subvert our laws, rights and national sovereignty’.[2]

It is of course too early to tell exactly how TTIP will turn out. Not only are negotiations in a relatively early stage, and this despite six rounds of talks, but (in the tradition of past trade negotiations) many of the relevant documents have not been made available to the public (although there is pressure to change this). As a result, the aim of this paper is not to make hard-and-fast predictions but rather to assess the state of play in the negotiations in a number of key areas from the available evidence[3] and use this to reflect on the regulatory impact of the agreement.

The areas I focus on here are investor protection, public services and food safety, which have elicited some of the strongest responses from critics of the agreement. The evidence I consider here suggests that TTIP is unlikely to lead to one deregulatory ‘big bang’, but that –as it is currently envisaged by negotiators– it may constrain the regulatory autonomy of states, entrench competitive disciplines in public services and put downward pressure on food safety standards. All in all, TTIP’s negotiators appear to view regulating in the public interest as an exception to the competitive disciplines of trade liberalisation, while significant challenges exist for adequately ‘carving out’ such regulation.

Investor protection: privileging investors over states?

One of the most contentious issues during the negotiations have been the agreement’s proposed investor protection provisions, and in particular the potential for investor-state dispute settlement (ISDS). This latter provision would allow foreign investors to seek redress for violations of their investor rights before independent arbitration tribunals, such as the International Centre for Settlement of Investment Disputes (ICSID).

The European Commission’s rationale for including such provisions are that they are ‘a tool […] to attract and maintain FDI’ by protecting investors against (direct and indirect) expropriation and unfair and discriminatory treatment, with ISDS necessary to enforce the provisions of the agreement (which may have no standing in domestic courts).[4] In contrast, such provisions have been criticised for ‘provid[ing] significant advantage to multinational enterprises at the expense of governmental flexibility’.[5] In other words, they privilege foreign investor rights over states’ present and future ‘right to regulate’, as states may avoid taking future regulatory decisions in order to avoid costly arbitration arising from claims of indirect expropriation (‘regulatory chill’). The workings of ISDS tribunals have also been criticised as lacking in transparency and the appropriate mechanisms to ensure the impartiality of arbitrators (who, for example, often act as both advocates and judges in different cases). Moreover, such provisions have been described as unnecessary between two partners (the EU and the US) which possess developed legal systems that adequately protect investors.[6]

While it is certainly novel for the EU to be negotiating such agreements –it has only had the competence to negotiate investment protection since the Treaty of Lisbon–[7] investor protection (including ISDS) has been a common feature of the network of bilateral investment treaties (BITs) signed by EU Member States and the US. These agreements were largely negotiated between developed countries and developing countries, such that most EU Member States, with the exception of a number of Central and Eastern European countries, have no BITs with the US. These agreements are commonly acknowledged to have generally provided little protection for states’ ‘right to regulate’, giving investment arbitrators considerable latitude to interpret investment protections broadly and find against the regulatory measures adopted by states.[8] That said, while this network consists of approximately 3000 BITs, it arguably only covers a small proportion of FDI flows: one estimation by investment arbitration expert Gus Van Harten puts it at only 15%-20% of US FDI flows.[9]

Investor protection provisions in TTIP would likely represent somewhat of an improvement on these BITs. On the basis of the document released by the Commission as part of a public consultation on the issue held from March to July 2013, and the EU-Canada Comprehensive Economic and Trade Agreement (CETA) investor protection clauses this approvingly cites, the Commission is:[10]

- Seeking to carve out greater regulatory autonomy for states, establishing more circumscribed and binding (on arbitrators) definitions of what constitutes indirect expropriation, unfair and discriminatory treatment, excluding non-discriminatory regulatory moves taken to achieve a legitimate public policy objective.

- Working to improve the ISDS mechanism by limiting conflicts of interest for arbitrators and increasing the transparency of arbitration.

This has been taken by some as implying that, as investor protections are already widespread, TTIP represents an opportunity to rewrite the flawed architecture of the current network of BITs, setting a higher standard for future investment protection provisions.[11] However, there are four main reasons to remain critical of investor protection in TTIP as it is currently envisaged:[12]

- There remains considerable latitude for arbitration tribunals to interpret provisions on non-discrimination and fair and equitable treatment.

- While improving the transparency of proceedings, the revised ISDS procedure does not address the broader conflicts of interest that exist within the field of investment arbitration as a result of a lack of judicial independence (arbitrators still rely for their remuneration on the claims brought by investors and are appointed on a case-by-case basis).

- Most importantly, it establishes the primacy of foreign investor rights over regulatory sovereignty, with legitimate public policy measures being framed as exceptions to the rules. Notably, the principle of the ‘right to regulate’ is only mentioned in the preamble rather than embedded within the text of the CETA agreement.

- Finally, TTIP, would at the very least, allow firms greater latitude in ‘forum-shopping’, ie, selectively bringing claims through the (in their eyes) most advantageous investor protection regime. It may go as far as significantly increasing the opportunities for firms to make use of such provisions, as estimates suggest that existing BITs only cover 15%-20% of US investment, with TTIP potentially bringing this up to 65%-80% of US FDI flows.[13]

All in all, and while it is hard to definitively assess the nature and the impact of TTIP’s investor protection provisions, the manner in which investor protection is currently envisaged potentially poses an additional constraint on state regulatory capacity. Of course, some doubts have been raised over whether these provisions will even be included in TTIP after the significant campaign against it from European civil society (which culminated in the Commission receiving around 150,000 submissions in its public consultation on the issue) and the opposition of Social Democrats in Germany and the European Parliament. That being said, their inclusion in CETA does suggest they are far from moribund.

Public services: locking in the privatisation of healthcare and education?

A second issue of considerable controversy has been the subject of public services. Civil society activists in Europe have been up in arms over what they perceive to be the privatisation of healthcare and education services (as well as some public utilities). In the UK, this discussion has focused on the impact TTIP may have on the NHS –with the fear that the agreement would ‘lock-in’ the market-led reforms introduced under the current Conservative-Liberal Democrat coalition government–. The Commission’s response, in turn, has been to reassure such actors that the provision of public services will be sufficiently protected in TTIP.

It is certainly the case that without any carve-outs for public services, these would potentially be subject to considerable disciplines under TTIP. Services liberalisation works on the basis of commitments made under ‘market access’ and ‘national treatment’ (which, under the General Agreement on Trade in Services –GATS– is not automatic as under the General Agreement on Tariffs and Trade –GATT–, covering trade in goods). Market access commitments would result in the prohibition of monopolies, exclusive service suppliers or economic needs test (all of which are fairly common in the field of public services), while commitments on national treatment would force ‘like’ treatment of domestic and foreign service suppliers (non-discrimination).[14]

The manner in which such commitments are made is also of some importance. In essence there are three approaches to trade in services liberalisation: (a) positive listing (the agreement only covers those commitments that are explicitly made in the market access schedule); (b) negative listing (market access and national treatment apply unless a specific exemption is listed in relevant Annexes); and (c) a hybrid approach. Unsurprisingly, negative listing is generally conducive to more expansive liberalisation as only those sectors explicitly mentioned in its Annexes (which cover both existing measures and future measures) are exempted. In the case of TTIP, the leaked draft market access offer suggests that the hybrid approach is being used (specifically using positive listing for market access and negative listing for national treatment),[15] although it is conceivable that this may move towards negative listing.[16]

Given this context, where the mechanisms of liberalisation are potentially quite expansive, the question is whether Member States have provided for sufficient leeway in the proposed agreement’s language to exempt public services from the requirements of market access and national treatment. In a letter seeking to allay fears over TTIP’s impact on the NHS in the UK, the Commission spells out its approach, namely:[17]

- A reliance on a specific safeguard for services supplied ‘in the exercise of governmental authority’.

- The exclusion of commitments on publicly-funded services from the agreement, or specific reservations protecting them.

An examination of the available evidence –including the EU’s leaked TTIP draft market access offer– does not suggest that TTIP, as it is currently envisaged, would legitimate wholescale privatisation or marketisation of public services. But at the same time the protections mentioned by the Commission in its letter are not as water-tight as they are presented, for the following reasons:

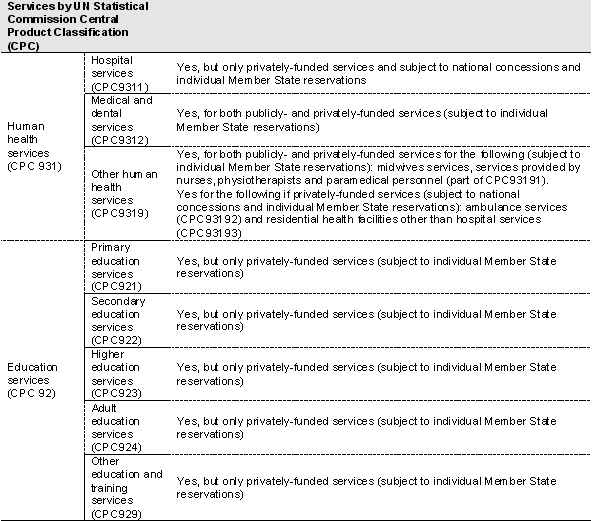

- As Table 1 illustrates for health and education services, the EU has made a number of commitments to services liberalisation. While most of these are limited to privately-funded services, for medical and dental services and a number of other health services these extend to publicly-funded services. Moreover, arguably the distinction between publicly- and privately-funded services is open to considerable interpretation and therefore does not provide a clear exemption.[18] Ultimately, a lot depends on whether the Member States enter appropriate reservations to protect their public services, which they may not wish to do, with the default option (especially if a more encompassing negative list approach is used) being liberalisation.

- A similar problem relates to the Commission’s invocation of a general safeguard for public services supplied ‘in the exercise of government authority’. Such clauses have generally been interpreted in quite a narrow light to only cover the ‘core sovereign functions’ of states. Indeed, the GATS explicitly excludes those services supplied ‘on a commercial basis’ or in ‘competition with one or more service suppliers’,[19] which may be inappropriate for public services subjected to competitive tendering.

- As many of the liberalisation commitments reviewed in Figure 1 cover mode 3 service delivery (ie, the establishment of a service supplier), any suppliers entering (or already in) the EU market would fall under the purview of TTIP’s potential investor protection provisions.

Table 1. Draft EU market access offer in health and education services in TTIP negotiations

Sources: leaked draft EU market access offer in TTIP negotiations.

The assessment provided here is naturally still tentative and based on limited documentation. That said, it suggests that, despite ensuring some carve-outs from the competitive disciplines of trade liberalisation, the current approach to public services in TTIP leaves considerable ambiguity in the interpretation of exemptions for such public services as healthcare and education. It ultimately relies on Member States to make all the appropriate reservations (which they may well chose not to do if they wish to lock-in the liberalisation of their public services, as the UK government is being accused of doing). In this vein, it is interesting to note that –in contrast to the approach taken for healthcare and education– France successfully pushed for the complete exclusion of the sensitive area of audio-visual services. It remains of course to be seen whether negotiators will not be forced to change their approach in the face of public pressure (which is mounting). But as it stands, their approach has focused on offering the (somewhat flawed) reassurances noted above.

Food safety: diluting the precautionary principle?

The impact of TTIP on food safety has been another issue to hit the headlines. There has been much talk of the agreement leading to a reduction in EU standards, with genetically modified (GM) foods, chlorinated chicken and beef hormones (amongst other examples) being commonly cited as foods that will make their way into European markets (where they are currently banned/severely restricted). The Commission, for its part, has strongly asserted that ‘that EU law on hormone beef and genetically modified foods won’t change as a result of this deal’.[20]

Critics argue that, given pressure from US negotiators and agribusiness, TTIP will significantly downgrade the EU’s more stringent approach to risk regulation in this domain, which is based on the precautionary principle. This is the notion that the EU will take regulatory action on a preventative basis even in the absence of a clear and scientifically-proven risk (and thus focuses on regulating the process of food production rather than just the final product). In contrast, so the argument goes, the US largely adopts a more lax ‘science-based’ model of risk management where foods (and other risks) are exclusively regulated on the basis of such proven risks (and is thus focused on regulating the product rather than the food production process). We should of course avoid falling into the trap of caricaturing EU and the US approaches to risk regulation as inherently precautionary or ‘science-based’ as there are some differences across policy domains and time.[21] But, it is probably fair to say that on the whole, the EU’s approach to risk management these days is more precautionary than that of the US, and especially so in food safety. [22]

That being said, a wholesale deregulatory ‘big bang’ is not likely to result from TTIP in this domain. The precautionary approach to food safety regulation is quite institutionally entrenched in the EU, with multiple veto points constraining the ability of the Commission to adopt more ‘science-based’ methods into its risk management practices. Genetically modified organisms (GMOs) are a case in point. Despite repeated attempts by the Commission to facilitate the approval of new varieties for sale and cultivation in the EU, Member States have successfully blocked the approval of all but a handful of GMO crops. Previous attempts at transatlantic cooperation in this domain also saw EU regulators see eye-to-eye with their US counterparts on the need to adopt more ‘science-based’ procedures, only to face opposition at home from civil society groups and Member States.[23]

Critics, however, are right to note that under TTIP there has been considerable pressure to move the EU to a more ‘science-based approach’ in risk management for food safety. Not only has this been stated explicitly by the US Secretary of Agriculture, Tom Vilsack,[24] but even the (soon to be former) Trade Commissioner Karel De Gucht has expressed sympathy with this view.[25] Indeed, two key scholars of the EU-US GMO dispute show ‘the Commission consistently attempting to use international pressures to secure reforms to domestic European legislation [on GMOs]’.[26]

The leaked draft text of the Sanitary and Phytosanitary (SPS) measures chapter of TTIP [27] –while still incomplete, containing numerous bracketed provisions, and highlighting considerable ambiguities (for example, as with investor protection, the ‘right to regulate’ is mentioned in the cover note but not in the text itself)– does suggest that there is a move towards greater mutual recognition. As criticised by the Institute for Agriculture and Trade Policy (IATP), it proposes eliminating port of entry re-inspection and testing for food products where standards are considered equivalent, even though such re-testing is a common feature of EU food safety risk management. IATP cites the case of seafood shipments into the EU from countries with equivalent standards, of which the Commission mandated that 20% of be re-tested in 2012.[28]

So, all in all, in the area of food safety TTIP is not likely to lead to blanket deregulation, but there is certainly some downward pressure on standards. This, moreover, would not require a wholescale rewriting of EU food safety regulations, as the Commission repeatedly assures TTIP will not do, but rather could be achieved via an increased mutual recognition of standards.

Conclusions

TTIP as a ‘living agreement’?

Having considered the available evidence on TTIP’s regulatory impact my conclusion is that it is unlikely to lead to a large, deregulatory ‘big bang’. The investor protection provisions being considered offer some protections for states regulating in the public interests, public services are not exposed to wholesale liberalisation and the EU’s relatively more stringent food safety standards appear to be institutionally entrenched. On this latter point, there is a whole history of less high-profile and more modest attempts at transatlantic regulatory convergence struggling to take off for similar reasons. For example, a series of very limited mutual recognition agreements (MRAs) signed in 1997 were held up by US federal regulators zealous to preserve their regulatory autonomy. Reflecting on this past record of transatlantic cooperation, one prominent expert therefore wrote in 2005 that a ‘legally binding treaty or a fully-fledged transatlantic free trade agreement […] are unlikely to be realised in the near future’.[29]

That said, the evidence also suggests that the agreement, as it is currently envisioned by European negotiators, is still likely to constrain regulatory autonomy through its investment provisions, provide insufficient protection for public services and lead to some downward pressure on standards in the area of food safety. The trend is to establish the primacy of the competitive discipline of trade liberalisation, simply seeking to carve out regulatory exceptions. This, as we have seen above, is an approach that faces significant limitations.

In the light of these conclusions, which it should be stressed are based on assessing three specific policy areas, it is worth very briefly reflecting on a provision in TTIP which may have impact beyond its (eventual?) ratification. Even if very little is agreed, TTIP could still become a ‘living agreement’ for the negotiation of regulatory barriers to trade. Negotiators envisage TTIP to contain a horizontal ‘regulatory coherence’ chapter, whose intention would be to provide a strengthened institutional context for regulators to discuss ‘any planned and existing regulatory measures of general application with significant (potential or actual) impact on international (and in particular transatlantic) trade’.[30] While this is likely to be constrained for similar reasons to previous transatlantic deliberations between regulators, it certainly provides an important forum in which trade-related questions can be discussed away from the prying eyes surrounding the TTIP negotiations. The likely tenor of such discussions, judging by the evidence considered above, is likely to see non-competitive, public-interest driven public policymaking as the exception rather than the rule, with all the challenges raised above of ensuring appropriate regulatory ‘carve outs’.

Gabriel Siles-Brügge

PhD in Politics and Lecturer in Politics, University of Manchester

[1] D. Cameron (2013), ‘G8 Summit: US & EU Trade Statement’, speech delivered at the G8 Summit, Lough Erne, 17/VI/2013, (accessed 15/IX/2014).

[2] George Monbiot (2013), ‘This transatlantic trade deal is a full-frontal assault on democracy’, The Guardian, 4/XI/2013, (accessed 15/IX/2014).

[3] Some of this has been released by the negotiating parties, while there have also been selective leaks of negotiating drafts and other papers in key areas.

[4] European Commission (2013a), ‘Investment Protection and Investor-to-State Dispute Settlement in EU Agreements’, Factsheet, November, (accessed 15/IX/2014), pp. 4-5, emphasis in the original.

[5] G. Van Harten (2005), ‘Private Authority and Transnational Governance: The Contours of the International System of Investor Protection’, Review of International Political Economy, vol. 12, nr 4, p. 600.

[6] L.N.S. Poulsen, J. Bonnitcha & J.W. Yackee (2013), ‘Costs and Benefits of an EU-USA Investment Protection Treaty’, report commissioned by the UK Department for Business, Innovation and Skills, London School of Economics, London, April, (accessed 15/IX/2014).

[7] See G. Siles-Brügge (2014), Constructing European Union Trade Policy: A Global Idea of Europe, Palgrave-Macmillan, Basingstoke, pp. 74-77, 161.

[8] See, for example, Van Harten (2005), op. cit.

[9] G. Van Harten (2014), ‘Comments on the European Commission’s Approach to Investor-State Arbitration in TTIP and CETA’, Legal Studies Research Paper Series, Research Paper nr 59, Osgoode Hall Law School, (accessed 15/IX/2014), pp. 28-29.

[10] European Commission (2014a), ‘Public Consultation on Modalities for Investment Protection and ISDS in TTIP’, (accessed 15/IX/2014).

[11] R. Basedow (2014), ‘Far from being a threat to European democracy, the EU-US free trade deal is an ideal opportunity to reform controversial investment rules and procedures’, LSE EUROPP Blog, 7/II/2014, (accessed 15/IX/2014).

[12] The following draws on Van Harten (2014), op. cit.

[13] Ibid, p. 29.

[14] M. Krajewski (2013), ‘Public Services in EU Trade and Investment Agreements’, Paper prepared for the seminar on ‘The Politics of Globalization and Public Services’ organised by the European Federation of Public Service Unions, European Trade Unions Congress, the Austrian Trade Union Federation and the Austrian Federal Chamber of Labour, 14/XI/2013, pp. 11-12.

[15] This draft market access offer dates from June 2014. For the leak, by the Spanish organisation Fíltrala, see Data 3-filtrala2014.

[16] E-mail correspondence with an NGO representative, 28/II/2014.

[17] European Commission (2014b), ‘Letter to the Rt Hon John Healey, MP, Chair of the All-Parliamentary Group on TTIP’, 8/VII/2014, (accessed 15/IX/2014).

[18] Krajewski (2013), op. cit., p. 24.

[19] Ibid, pp. 30-1.

[20] K. De Gucht (2014a), ‘What we need to make TTIP work’, speech delivered at the German Economy Ministry Conference on the Transatlantic Trade and Investment Partnership, 5/V/2014, (accessed 15/IX/2014).

[21] See B. Wiener, M.D. Rogers & P.H. Sand (Eds.) (2010), The Reality of Precaution: Comparing Risk Regulation in the United States and Europe, RFF Press, Abingdon; and D. Vogel (2012), The Politics of Precaution: Regulating Health, Safety and Environmental Risks in Europe and the United States, Princeton University Press, Princeton.

[22] See Vogel (2012), op. cit.; and M.A. Pollack & G.C. Shaffer (2009), When Cooperation Fails: The International Law and Politics of Genetically Modified Foods, Oxford University Press, Oxford.

[23] Pollack & Shaffer (2009), op. cit., pp. 85-112.

[24] EurActiv (2014), ‘US Wants Science to Settle GMO Debate in Trade Deal with EU’, 18/VI/2014, (accessed 15/IX/2014).

[25] K. De Gucht (2014b), ‘Statement by Commissioner Karel De Gucht on TTIP’, European Parliament, 15/VII/2014, (accessed 15/IX/2014).

[26] Pollack & Shaffer (2009), op. cit., p. 82

[27] This leak dates from 27/VI/2014. For the leak by IATP, see http://www.iatp.org/files/2014.07_TTIP_SPS_Chapter_0.pdf.

[28] S. Suppan (2014), ‘Analysis of the Draft Transatlantic Trade and Investment Partnership (TTIP) chapter on food safety, and animal and plant health issues (proposed by the European Commission, as of June 27, 2014’, IATP, (accessed 15/IX/2014).

[29] M.A. Pollack (2005), ‘The New Transatlantic Agenda at Ten: Reflections on an Experiment in International Governance’, Journal of Common Market Studies, vol. 43, nr 5, p. 916; see also F. De Ville & G. Siles-Brügge (2014), ‘The Transatlantic Trade and Investment Partnership and the Role of Computable General Equilibrium Modelling: An Exercise in “Managing Fictional Expectations”’, paper presented at the 44th Annual UACES Conference, Cork, Ireland, 1-3/IX/2014, (accessed 15/IX/2014), pp. 13-17.

[30] European Commission (2013b), ‘TTIP: Cross-Cutting Disciplines and Institutional Procedures – Position Paper: Chapter on Regulatory Coherence’, (accessed 15/IX/2014).