This paper is a contribution to the joint project of the Elcano Royal Institute and the Portuguese Institute for International Relations (IPRI) regarding bilateral relations between Spain and Portugal. The views and information set out herein are those of the author and do not necessarily reflect those of the project promoters, the IPP, ISEG, the University of Lisbon or any other institution.

Theme

This paper looks at recent developments in the Portuguese economy from the troika period to the current recovery in the context of the political framework.

Summary

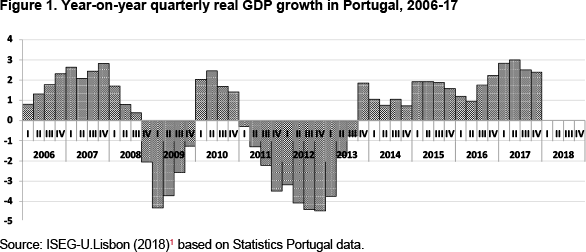

Save for 2007, the 2000s were a lost decade for the Portuguese economy. An expansionary fiscal policy put the economy quickly back on its feet after the global recession. But not for long, as the eurozone crisis brought it to a sudden halt, stopping the trend of massive capital inflows. What followed was a deep recession in the course of a financial assistance programme with strict conditionality regarding ‘front-loaded’ fiscal consolidation and structural reforms. Exiting the programme successfully in 2014, the economy gradually picked up pace, in tune with the improving environment in the euro area, thus beginning a strong acceleration process in late 2016.

A new government at the end of 2015, supported by an unprecedented parliamentary coalition between the socialists and far-left parties, was in itself a political ‘miracle’. However, the question is: was it behind the resurgence of the economy’s strong recovery, which, while below 3% annual growth, still seems miraculous considering recent events?

Analysis1

2008-11: euro fragility and economic and financial crisis

In the years after Portugal entered the EU along with Spain in 1987, its economy succeeded in attaining real convergence with the European average. In the late 1990s, Portugal was successful in maintaining the trend with nominal convergence: reigning in inflation and stabilising the exchange rates with its European partners, which was a requisite to stay on board the EMU train –while many other countries effectively cooled down their economic growth to attain these goals–.

Along with the extensive influx of structural and cohesion funds fuelling public investments over the period, this entailed a generalised euphoria with respect to the prospects for European integration and economic growth. It was a period when shopping malls and car imports multiplied, as the Portuguese brought their consumption patterns closer to the European standard, with very specific economic implications. It was expected that the financial integration that would surely accompany monetary integration would bring about increased economic integration, and certainly a continuation of strong economic growth into the 2000s. Many decisions taken at the time were based on these expectations, including policy decisions with respect to public investment and social policy and household decisions regarding increased consumption (and credit). Also, many felt that being in the euro meant the end of fiscal imbalances in relation to the economy’s external sustainability: ‘Nobody looks at the… external balance of Mississippi or any region of a large currency union’.3Figure 2. Growth in Portugal, 1987-2013

| Portugal | Average year-on-year growth rate | ||

|---|---|---|---|

| 1987-2000 | 2000-2007 | 2000-2013 | |

| Nominal GDP | 9.1% | 4.5% | 2.5% |

| Real GDP per capita | 4.0% | 1.0% | 0.2% |

Source: IMF-WEO and the author.

Reality, however, turned out differently. The years 2000-07 were a period of complete stagnation that would later, following the Great Recession, degenerate into a deep economic crisis in the midst of the Eurozone sovereign debt crisis. Considering both these periods, the performance of the Portuguese economy between 2000 and 2012 was among the worst on record in an advanced economy, comparing unfavourably with even the worst historical examples of lost decades.

In terms of real per capita GDP, the Portuguese economy grew less than the US in the Great Depression and less than Japan during its own ‘lost decade’ of 1992-2004.4 In average terms the Portuguese population was worse off in 2012 than in 2000. Before the sudden stop in 2011, household consumption continued to increase progressively, distorting people’s expectations regarding the sustainability of their own consumption patterns.5

During this period of stagnation, Portugal accumulated external imbalances, to a large extent funded with external debt, which grew substantially over these years. This amounted to a historically large influx of foreign capital in the country. It must be stressed that the inflows were mostly funded by debt and the counterpart was mostly imports of goods and services. Of these inflows, only a small part came in via foreign investment.

The capital inflow, coupled with an increasingly strong euro, resulted in a strong appreciation of Portugal’s real exchange rates and, most significantly, intra-euro real exchange rates. Since a large majority of Portugal’s export destinations were within the currency union it became relatively less attractive to sell abroad and the domestic market became more attractive. In an effect similar to that of other euro ‘debtor’ countries, the Portuguese economy became more ‘self-centred’: most fresh investment, not to mention portfolio reconfigurations of existing capital, was turned over to non-tradable sectors, namely real estate and construction but also utilities and infrastructure.6

In the 2000s there was a period of strong growth in social transfers and public spending levels in other areas remained largely untouched (although taxes gradually grew as some fiscal consolidation took place up to 2007). However, it was not invisible, and nor were its consequences unpredictable.7

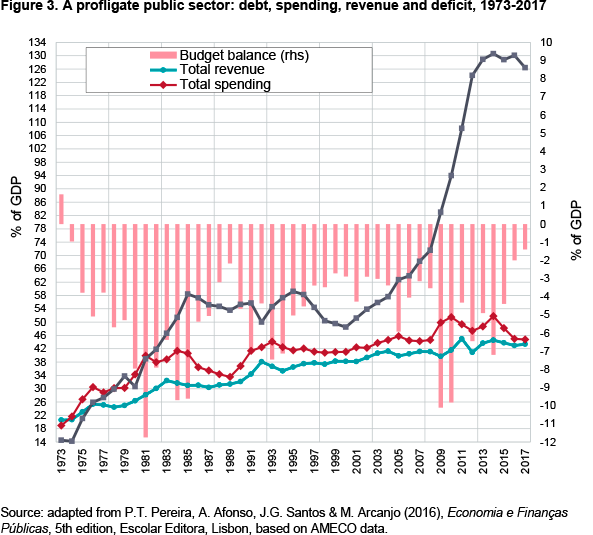

A poor fiscal track record

Since the fall of the dictatorship in 1974, Portugal had never recorded a budget surplus or even a balanced budget. In fact, the deficit figures reported in 2016 and 2017 were both ‘democratic’ records (recall, also, that in the current context this means significant primary surpluses). This is a singularity in the context of advanced economies. In Europe, only Greece has a similar track record.

Absolutely unique in Europe is the fact that, in that period, Portugal had three external intervention programmes, in 1978, 1983 (both IMF) and 2011 (an IMF-EU-ECB troika). And if in the first case the political and social turmoil pursuant to the ‘Carnation Revolution’, with a massive inflow of refugees from former colonies and the loss of external assets, and the oil crisis, are major exculpatory factors, the two latter cases, despite many other factors, would not have happened if not for the continued, unruly accumulation of fiscal imbalances.

The structural political meaning is clear: one of the remaining challenges after more than 40 years of democracy was Portugal’s ability to generate institutions and incentives that allowed fiscally responsible governance.

Portugal, 2011-14: the troika story

‘We are not Greece’ was the leading message to be read between the lines in the official discourse at the beginning of the troika period. As Greece struggled to lift itself and its economy out of the swamp it had fallen into with the debt cut it imposed on private creditors, Portugal sought to distance itself, try to restore market confidence and thereby re-establish the country’s access to the international capital markets. If not always stated in this way at the beginning, this was the main goal of the adjustment programme, and in that respect it was indeed a success.8

Strong political support, with a majority backing a new government –installed shortly after the beginning of the programme–, and the support of the main opposition party ensured political stability, unlike in Greece.

In that respect, the programme was a success, but respite only truly came from supportive monetary policy. Mario Draghi’s ‘whatever it takes’ speech and ensuing measures help to calm the markets and ensured that a de facto lender of last resort backed Portugal’s debt, as in the case of other countries under distress.

The external balance was regained, ending an era of high current deficits, but the internal balance was lost with a large spike in unemployment.

The fiscal situation improved as the deficit began to be slowly reduced in 2012, but at a much slower pace than expected. Portugal would only leave the excessive deficit procedure much later, in 2016. It is accepted by the institutions themselves today that the contractionary effects of strong fiscal consolidation measures were underestimated, leading to an inefficient fiscal process, as the same or greater consolidation could have been obtained at a lower cost in terms of unemployment and output.

In the financial sector, the significant imbalances were only partially resolved with a significant legacy of non-performing loans (NPLs) being left for later recognition, and bank restructuring and recapitalisation took place slowly. The troika programme included a €12 billion facility for bank recapitalisation that was only partially used.

The labour market’s reaction was severe and worse than expected, hitting a high of 16.4% in 2013, with particularly worrying rises in youth and long-term unemployment. Meanwhile, almost 200,000 people emigrated over the 2011-14 period. Also, as a result, the at-risk-of-poverty rate (with the poverty line anchored in 2008) spiked from 17.9% to 24.2%, meaning that around 2.5 million people (roughly a quarter of the population) were considered poor by 2014.

While a large rise in inequality was avoided, there was a significant impact: though the Gini coefficient did not rise much between 2009 and 2014 (by 0.3 pp to 34.0%), the S90/S10 and S95/S05 ratios, which measure the difference between the top and bottom 10% and 5% (respectively) of the income distribution, grew significantly, from 9.2 to 10.6 in the first case and 14.7 to 18.7 in the second.9 The adjustment programme included several measures for social protection and the tax changes introduced in this period were largely progressive (and are considered responsible for the fact that inequality figures did not worsen further). The Commission recognises, however, that the programme did not set specific social goals or include any requirements for monitoring its social impact.10

By 2014, however, economic conditions began to improve. The beginning of the use of ‘heavy artillery’ by the ECB had paid off and following a successful 10-year bond issue in April of that year, the decision was made: Portugal, like Ireland before it, would have a ‘clean exit’ from the assistance programme.

The budget for the following year, in which general elections were to take place, was much less hawkish than previous ones. It largely followed a no-change position, with a structural adjustment considered optimistic by the European Commission but good enough for approval.

The year 2014, however, still had a few events which prevented Portugal from forgetting the dire straits from which it had emerged. The still prevailing financial uncertainty kept spreads against Germany at high levels. All this occurred at a time when the prevailing idea was that Portugal was ‘lucky’, with its banks only having minor problems. Public opinion and the view of general observers was brought back to reality when the financial sector was taken by surprise by an earthquake called Espírito Santo.

Novo Banco

On a Sunday in August 2014, Banco de Portugal (BdP) announced the resolution of BES, which had fallen in disgrace after, a few days earlier, posting a €3.6 billion loss in 2Q14 that wiped out almost all of its capital. The size of the losses consumed the existing capital buffer, leading to a loss of access to central bank money, meaning the bank had effectively failed.

The decision –which had been prepared over the previous days– was to remove BES’s sound assets and place them in a ‘transition bank’ creatively named Novo Banco (NB, ‘The New Bank’). The decades-old BES was to be liquidated, keeping only those assets deemed ‘toxic’ in its balance sheet. While the shareholders and some junior bondholders were bailed-in (over a year later, on 1 January 2016, additional more senior bondholders, including many institutional investors, amounting to liabilities worth some €2 billion, were bailed-in as well), depositors and senior bondholders were also safely moved to NB, along with €4.9 billion of public funds.

In theory, taxpayers are not ultimately liable for these funds, since they came from the then new Portuguese Resolution Fund, which is fed by regular contributions made by banks operating in Portugal. However, having been recently created, the fund had almost no assets of its own, so the government financed the operation, expecting to be repaid by the Resolution Fund (using its receipts from financial sector entities). However, the funds accrue, of course, to the stock of public debt and, moreover, were finally considered in the 2014 headline deficit (increasing it by over 3 pp of GDP).

The political miracle

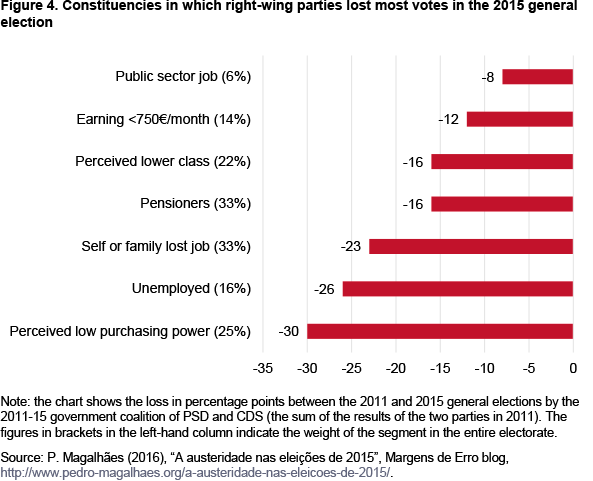

In October 2015, with an already improving economy, the general elections brought along two big surprises. The first was the victory of the right-wing coalition comprising the PSD (Social-Democratic Party) and CDS-PP (Democratic Social Centre), the two EPP member parties who had been in government since 2011, undertaking and exiting the troika adjustment programme, with 37% of the vote. Up to the weeks before the elections, the polls favoured the Socialist Party, which ended up coming in second place, with 32%. However, the two right-wing parties together lost some 10% of the electorate, meaning they no longer had a majority in Parliament.

This led to the second surprise, which was that the Socialist Party reached an agreement with the radical left Communist Party (and its Green Party partner) and the Left Bloc parties, who respectively had 8% and 11% of the vote, to form a parliamentary coalition. The government was to be made up only of Socialists, but the parties established written agreements laying down pre-conditions for the approval of both the government policy statement and the government budget for the following years. Such a configuration was completely novel in the Portuguese political environment (at the parliamentary level, as in local government such arrangements are more common) and entailed tough negotiations from the start, successfully confounding the severe scepticism that this ‘solution’ faced.11

As shown in Figure 4, post-electoral studies indicate that the evolution of the economy led to a significant loss of support for right-wing parties in groups which perceived they had been particularly affected (and unprotected) by the crisis (the young and unemployed) or targeted by fiscal consolidation measures (pensioners).

While for the Socialists the political incentives were clear, since only by managing to negotiate a deal with the far left could they form a government, for the far left they were less obvious, given their track record of being uncompromising in their lack of willingness to negotiate, let alone support, mainstream parties. But a closer look makes it more understandable: similarly to other modern far-left parties in Europe, the Left Bloc saw benefits in being more moderate on structural issues such as European integration (in 2011 their refusal to even take part in troika meetings led to a complete ballot failure) while remaining true to more dovish positions on fiscal and social matters. As for the hard-line Communist Party, it had a strategic incentive to support the government in order to prevent crucial privatisations that had already begun towards the end of the PSD-CDS era. Namely, in the transport sector, where the labour unions of companies such as the Lisbon transport operators (Carris and Metro) are crucial constituencies for those parties.

‘Turning the page on austerity’

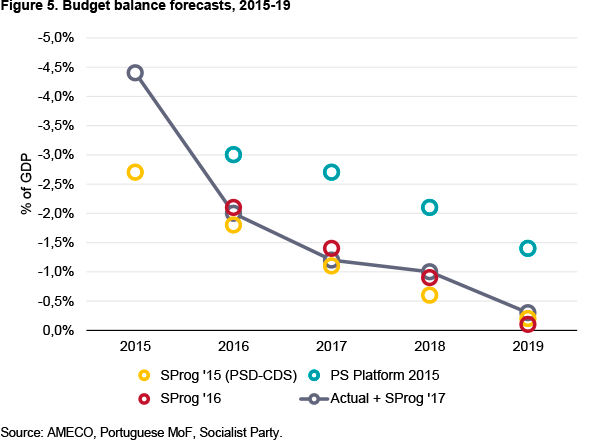

Back in 2015, when it became clear that a government supported by the far left was to be installed, both analysts and markets became somewhat nervous. As occurred in Greece shortly before, this would mean a swift return to fiscal profligacy and total disrespect for the rules of the Stability and Growth Pact.

The result of this political change was a significant shift in the nature of many fiscal and social policy measures. ‘Turning the page on austerity’ was the motto: raising the minimum wage and pensions, reverting ‘cuts’ to public-sector wages and bringing back some social support programmes, but not lowering taxes or social contributions, and keeping intermediate consumption and public investment under very tight control and limitations. However, the ‘page’ was not really turned in terms of overall fiscal strategy and outlook. In fact, the restrictiveness of fiscal policy did not change visibly compared to what had been seen at the end of the previous government term.

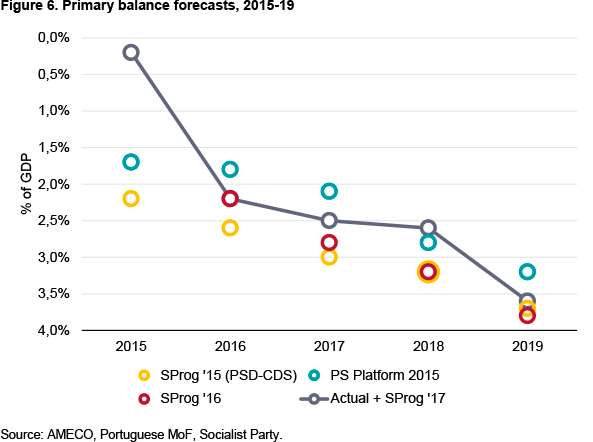

This is all the more interesting as, even before any negotiations had started with the far left, the original Socialist Party platform was accompanied by detailed simulations, which advocated a trajectory for the headline deficit that was significantly more lax than that proposed by the PSD-CDS coalition (the official Stability Programme 2015-19 was considered in the public discourse to represent their view of fiscal developments).

At the time, the Socialists advocated headline budget balance figures which should be 1-1.5 pp above the PSD-CDS’s Stability Programme. In reality, however, the deficit was much smaller in the last few years, closely following the path foreseen in the latter document. This deficit reduction of course benefited from several unexpected effects: economic tailwinds, especially in 2017-18, when growth surprised most observers; in 2016 a special tax-break programme for repayment of overdue taxes that offset an €800 million shortfall in tax revenues (CFP, 2017); and lower costs throughout the period with lower interest on public debt than expected.

However, the interpretation changes somewhat, though not completely, when looking at the primary balance, a slightly better measure of the fiscal consolidation effort undertaken by the economy.12 When comparing the initial prediction of the Socialists with the Stability Programme they themselves presented less than a year later, a certain conformation to a stricter budgetary path is still apparent (it converges with the ‘right-wing’ proposal of 2015). However, in reality things were quite different, especially in 2017 and 2018.

After some reduction in 2016 (without accounting for the Banif bank recapitalisation, the primary balance in 2015 would have been 1.4 pp higher), the consolidation in terms of the primary balance was slow in 2017 and is set to be practically nil in 2018, according to the 2018 budget accounts. In 2019 the 2017 Stability Programme projected a primary balance of 3.6% of GDP (that will, despite all the tailwind, likely be too ambitious a reduction.

In sum, the ‘page’ was visibly ‘turned’ in 2017/18 with the surprisingly high output figures and when fiscal consolidation has become marginal. The European Commission13 argues that the structural fiscal position is now worsening, since it forecasts a deterioration of the structural primary balance for 2017 and 2018, as opposed to the government’s estimates. However, this is mainly due to a different estimate of the output gap –Commission services believe the current economic growth level in Portugal is well above potential growth–. In any case, this is by no measure a return to fiscal profligacy, and certainly not such that an expansionary fiscal stance could be driving the current recovery.

A closer look at the recovery

In 2014 Portugal left the recession behind and started a significant recovery in 2015. That year’s surge was followed by a slight deceleration in 2016 (as the strong import-based demand growth in 2015 subsided), but since mid-2016 the pace became greater, culminating in a surprising 2.7% growth in 2017, which will be followed, according to the latest IMF forecasts (IMF, 2018), by 2.2% and 1.8% in the following two years.Figure 7. GDP growth in Portugal, 2014-17 (%)

| Yearly growth rate | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| Domestic demand | 2.2 | 2.7 | 1.6 | 2.8 |

| Exports | 4.3 | 6.1 | 4.4 | 7.9 |

| Imports | 7.8 | 8.5 | 4.2 | 7.9 |

| Real GDP | 0.9 | 1.8 | 1.6 | 2.7 |

Source: Statistics Portugal.

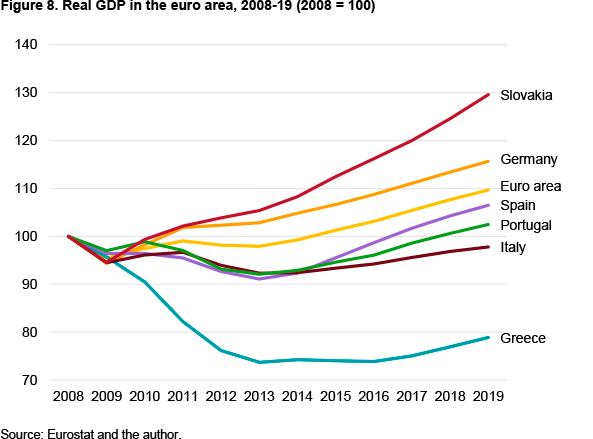

If we take recent history into account, the recovery has been encouraging. But it is not enough to ensure real convergence. The low point reached by Portugal’s real GDP in 2013, while ‘only’ an 8% drop from 2008, was enough to bring the indicator almost to its 2000 value, such was the stagnation in the preceding decade.

The growth of the past couple of years, and forecast for the next, is more or less on par with that of Germany (which determines to a significant extent that of the euro area), below what Spain posted and far below the pace of Slovakia, an example at the other end of Europe, of a similarly-sized economy. On the other hand, Portugal is now in a better shape than Italy or Greece.

Contrary to what had happened in the earlier stages of the recovery in Portugal, the current growth process is not contributing to any worsening of the external position. Ideally, exports should grow faster than imports, but at least the strong growth in exports in 2016 and 2017 was not surpassed by imports, unlike the two previous years (which saw a strong rise in private spending in durable consumption, possibly from delayed purchases).Figure 9. Domestic demand in Portugal, 2014-17 (%)

| Yearly growth rate | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| Domestic demand | 2.2 | 2.7 | 1.6 | 2.8 |

| Final consumption | ||||

| Households | 2.3 | 2.3 | 2.1 | 2.2 |

| General government | -0.5 | 1.3 | 0.6 | 0.1 |

| Gross capital formation | 5.1 | 6.4 | 0.8 | 8.4 |

Source: Statistics Portugal.

Importantly, however, the evolution of domestic demand conceals the fact that investment has recorded strong growth, much larger than consumption, in a pattern that is strikingly different from that which was seen in previous recent recovery stints in Portugal. This investment is mostly in construction, although, despite an increase in lending to households for real-estate purposes, a large share of the construction surge is foreign investment and a marked rise in housing prices seems to be fuelled by that investment rather than overheated lending (EC, 2017b;14 IMF, 2018). Significantly, Figure 9 above shows that the contribution of government spending to the growth in domestic demand has been very small.

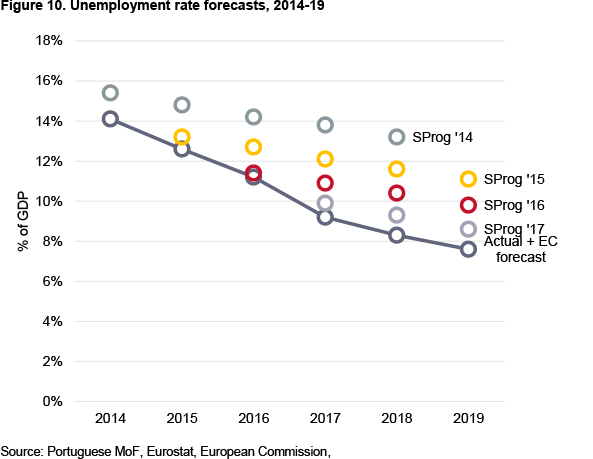

In the current recovery process, the labour market has shown very positive developments. Unemployment rate projections have been constantly beaten since 2014, meaning that the current dynamics of the labour market caught most observers by surprise. Note in Figure 10 above that in the Stability Programme 2014 the government (and the institutions) at the time expected that unemployment would still be above 13% in 2018, when in fact it fell to almost 8%.

The effectiveness of labour market reforms in the adjustment programme partly explains this trend15 and the surprising growth in the relatively labour-intensive tourism sector (hotels and restaurants) also accounts for a significant part of these results.

Challenges remain

The very positive labour market developments are, however, somewhat misleading in the sense that their resilience may be questioned, as the jobs created are to a significant extent short-term, low-skilled and low-pay.16

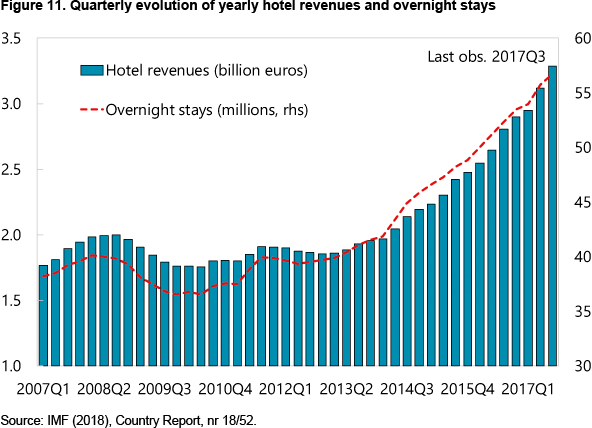

This relates to one significant shortcoming of the current recovery: the strong dependence on a tourism boost of historic proportions. Hotel revenues and overnight stays are almost doubling the figures recorded during the crisis (see Figure 11). This is a welcome boost but the dependence and shifting of resources to this sector is a potential risk that makes the recovery more fragile. Basing the reduction of the labour slack on these jobs might in itself prevent the development of skills and training in more technology-intensive, higher-skilled work that the Portuguese economy should aim to include to a greater extent.

The dependence on tourism poses significant risks for the near term. As in Spain’s case, the significant external demand shock in these sectors is due to geopolitical and security reasons that led to alternative destinations from North Africa. For example, the British Foreign Office lifted its ban on travel to Tunisia in 2017, which will certainly reduce the pace of growth in tourism coming from the UK, the country sending most visitors to Portugal in 2017 (according to Bank of Portugal data)

The still very high public and external debt levels are heavy burdens accumulated during the ‘lost decade’ and the ensuing crisis that dragged the Portuguese economy down and still shall be taken in consideration for the future.

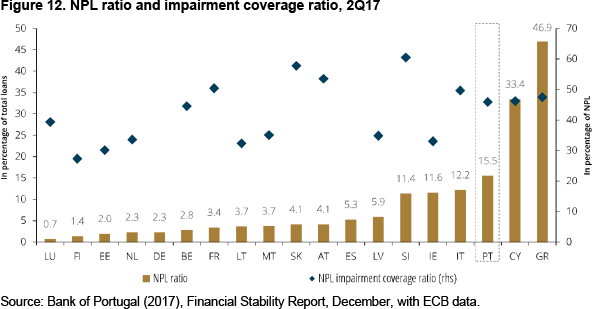

To this must be added the NPLs that still make it challenging for the financial sector to provide funding to the real economy and for monetary policy to be properly transmitted. Portugal still has the third highest NPL ratio in the EU, second only to Cyprus and Greece, and well above the figures of Ireland and Italy, the other peripheral countries that faced great difficulties, with the banking sector in the former and anaemic growth in the latter. Having said that, NPLs are currently covered by an adequate level of impairments in bank balance sheets (impairment coverage ratios compare well with the country’s European peers).

However, doubts can remain as to whether some of the performing loans (which are not in or near default) can actually hide a more complex reality, with a legacy of firms in a difficult financial situation lacking good growth prospects. A study17 based on official data showed that in 2015 25% of firms in Portugal (down from a high of 35% in 2012) were considered ‘zombie’ firms in the sense that they were being freed from bankruptcy via especially low financing costs, ie, benefiting from a de facto ‘subsidy’ from the financial sector.

While improvements have been made in terms of legislation and public facilities in terms of facilitating bankruptcy processes and corporate restructuring, there is still work to be done in terms of improving judicial sector efficiency (IMF, 2017). This would also facilitate an acceleration of the needed sectoral shifts and would further encourage foreign investment in a context where, according to the Global Competitiveness Index 2017-18, the ‘efficiency of the legal framework in settling disputes’ and in ‘challenging regulations’ is among the factors in which Portugal fares worst (ranking 121st and 89th, respectively, out of 137 countries included in the study). This is in contrast with the perceived quality of other aspects of government (eg, Portugal ranks 18th in the world with respect to infrastructure, health and education) and would allow Portugal to make the most of its ‘technological readiness’, a parameter where, ranking 26th in the world, it has an advantage compared with many of its European peers, including Spain.

Finally, foreign investment, especially from large institutional investors, might have been severely affected by the decision made by the Bank of Portugal regarding the ex post bail-in of a batch of Banco Espírito Santo bonds worth €2 billion, in what was perceived as an arbitrary and unexpected, though legally backed, decision.18 This was also reflected in the Global Competitiveness Report, where a drop in the indicators of ‘trustworthiness and confidence’ and ‘legal rights index’ regarding the financial sector was clear, and Portugal is now among the worst (respectively 131st and 107th in 137).

A possible answer

If it is considered that the Portuguese economy faced a long period of stagnation after entering the euro, followed by the global Great Recession and the Eurozone crisis, the current growth pattern is extremely encouraging even if cannot be considered ‘high’ growth: it is still not enough to ensure real convergence with Europe or with key partners such as Spain and Germany. Legacy issues related to public and private debt are likely preventing larger growth (eg, large fiscal surpluses prevent further public investment, while NPLs constrain corporate lending) and represent risks to be considered in a context of a global slowdown. Additionally, the goals of replacing old jobs with higher-skilled and technological-intensive jobs ara a work in progress and still deserve closer attention, as tourism still plays a significant role in reducing the labour slack.

There is, however, an important note in favour of sustainablility: the return to the previous dynamics of consumption growing well above productivity and external deficits does not seem to be taking place.

Conclusions

While the Portuguese economy faces multiple predicaments in the current positive economic cycle, the recent standard of many consecutive quarters of high growth seems miraculous. Is the political miracle of the parliamentary coalition behind such developments? The answer is as complex as unexpected.

The first answer is no. From a purely ‘economic’ perspective, growth seems to be externally fuelled and the public sector has by no measure taken an expansionary character nor has fiscal consolidation been interrupted (even if it is currently slowing down).

From another perspective, taking into account the internal social and political context (which also matters for the durability of this economic evolution), the answer can also be yes. The government was able to appease social unrest and use the economic tailwinds to improve some social indicators. Crucially, by enlarging the fiscal responsibility consensus to the left, it has contributed to the growing confidence in the Portuguese economy: not only to a more dynamic internal market but also –unexpectedly– to the attractiveness of the economy to international investors, which the government’s hard left partners are supposed to despise.

Luís Teles Morais

Institute of Public Policy (IPP), Lisbon, and ISEG, University of Lisbon | @_luistm

1 The author would like to express his gratitude to the Elcano Royal Institute, and Patrícia Lisa, for the invitation to submit this paper, and to Joana Andrade Vicente and Marta F. Teixeira for thoughtful comments. Errors and omissions remain exclusively the author’s.

2 ISEG-U Lisbon (2018), ‘Síntese de Conjuntura’, February, mimeo.

3 V. Constâncio (2000), Discurso de tomada de posse do Governador, 23/II/2000.

4 R. Reis (2013), ‘The Portuguese slump and crash and the euro crisis’, Brookings Papers on Economic Activity, The Brookings Institution, vol. 46, nr 1, Spring, p. 143-210.

5 V. Bento (2013), Euro forte, Euro fraco, Bnomics, Lisbon.

6 J.F. Amaral (2013), Porque devemos sair do Euro, 1ª edição, Lua de Papel, Lisbon.

7 O. Blanchard (2007), ‘Adjustment within the euro: the difficult case of Portugal’, Portuguese Economic Journal, vol. 6, nr 1, p. 1–21.

8 M. Eichenbaum, S. Rebelo & C. Resende (2016), The Portuguese Crisis and the IMF, IEO Background Paper BP/16-02/05, Independent Evaluation Office of the International Monetary Fund.

9 C.F. Rodrigues, R. Figueiras & V. Junqueira (2016), Desigualdade do rendimento e pobreza em Portugal, Fundação Francisco Manuel dos Santos.

10 EC (2016), ‘Ex post evaluation of the Economic Adjustment Programme. Portugal, 2011-2014’, Institutional Paper, nr 40.

11 A.R. Ferreira (2017), The Portuguese Government Solution, Report, Foundation for European Progressive Studies.

12 The primary balance is obtained by discounting spending relative to interest on public debt from the expenditure side. Ideally, we would look at the structural primary balance, which corrects the balance from cyclical effects and is the most appropriate measure of the fiscal consolidation effort. However, (1) there are significant theoretical and empirical issues pertaining to the estimation of the output gap and of structural expenditures, which are necessary to compute structural fiscal indicators; and (2) the Socialist Party platform did not provide such figures, preventing the comparison we want to draw here.

13 European Commission (2017), ‘Post-Programme Surveillance Report – Autumn 2017’, Institutional Paper, nr 70.

14 EC (2017b), Winter Forecast.

15 OECD (2017). Employment Outlook 2017, June.

16 Observatório sobre Crises e Alternativas (OCA) (2018), Retoma económica: o lastro chamado precariedade, Barómetro das Crises, nr 18, Centro de Estudos Sociais da Universidade de Coimbra.

17 F. Alexandre (Coord.) (2017), Investimento Empresarial e o Crescimento da Economia Portuguesa, Fundação Calouste Gulbenkian, Lisbon.

18 Financial Times (2016), ‘Novo Banco investors threaten legal action over €2bn losses’, 30/XII/2015.