Theme

The Prime Minister of Japan, Shinzō Abe, won a majority in the elections to the Lower House of parliament held on 22 October, supported by a cyclical economic uptrend. However, without meaningful structural reforms to lift productivity, Japan’s long-term outlook remains gloomy. Labour reform, at the heart of necessary productivity-enhancing structural reforms, remains elusive under Abe’s leadership as it would clash with the objectives of his most resilient electorate.

Summary

After calling for snap elections again, Japan’s Prime Minister Shinzō Abe capitalised on the relatively unexpected economic recovery. The problem is that the ongoing economic uptrend is cyclical, supported by a large fiscal stimulus package, which will end next April, and a much stronger global economy.

The long-term outlook for Japan is clearly less upbeat. Even if the government were to achieve the ambitious goal of doubling the number of inbound tourists, this would still be negligible for the size of the Japanese economy. The key for long-term growth is the somewhat forgotten third ‘arrow’ of Abenomics, namely structural reforms. The two most important ones –labour reform and deregulation– have been held back, keeping potential growth very low. At the same time, Abenomics’ first two ‘arrows’ (Bank of Japan ultra-expansionary monetary and government fiscal stimulus) are exhausting their effectiveness.

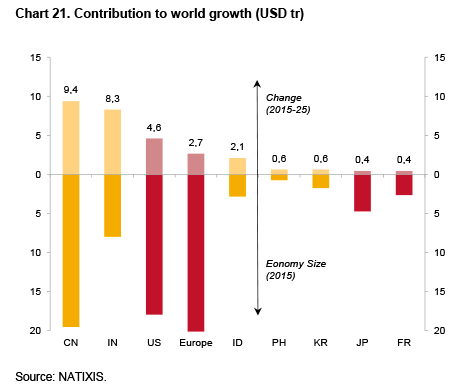

Abe advocated the success of Abenomics during the election campaign. However, without meaningful structural reforms, the Japanese economy will continue to be highly sensitive to global economic developments and have an increasingly gloomy long-term outlook. As for Abe’s idea that ‘Japan is back’, it should be borne in mind that Japan is a much smaller economy than it used to be, contributing less to global growth than other Asian peers, including not only Indonesia but also Korea.

Analysis

Accelerating Abenomics further?

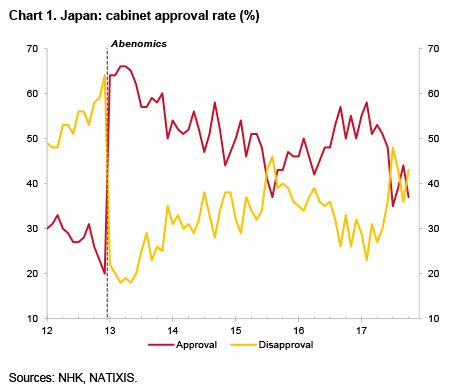

Prime Minister Shinzō Abe unexpectedly decided to dissolve the Lower House of the Japanese parliament and call an election for 22 October. After he had been accused of helping Kake Gakuen, an educational institution headed by a long-time friend of the Prime Minister, win approval for a veterinary school in a special economic zone, the cabinet’s approval rate took on a downward trend (see Chart 1).

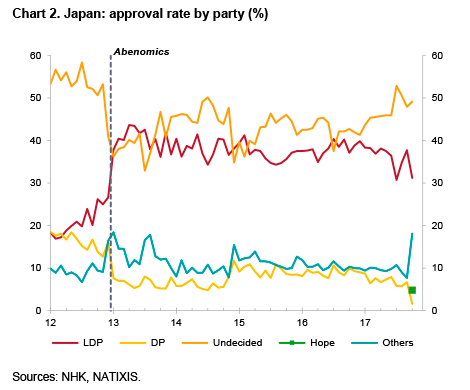

Given this scenario, not only was his intention to dissolve parliament a surprise, but also the election’s purpose. Abe was seeking the confidence to increase expenditure on education by JPY1 trillion (around 1% of the fiscal budget) instead of making progress on fiscal consolidation after the consumption tax hike in October 2019, which is likely to meet limited opposition. Therefore, his real intention could arguably have been to paper over the scandal and win a majority before his term in the Lower House ended in December 2018. In fact, although the approval rate of Abe’s Liberal Democratic Party (LDP) was as low as 31.2% in October, it was still well above the newly established Party of Hope (Hope) of Tokyo governor Koikei, at 4.8% (see Chart 2). Abe’s nationalism was also expected to help him, given the heightened geopolitical risk in the Korean peninsula.

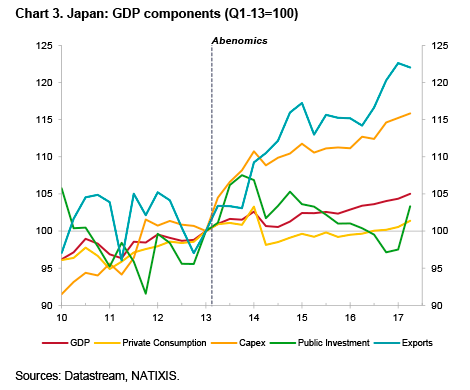

More importantly, the recent positive surprise in economic development clearly provided a strong to Abe’s LDP. In fact, GDP accelerated by +0.6% QoQ (+2.5% annualised) in the second quarter of 2017, the sixth consecutive quarterly increase (see Chart 3). Given this positive background, Abenomics have arguably had some success, as their primary objective was to restore the ailing Japanese economy. During the election campaign, Abe emphasised these achievements and asked for additional support to accelerate his programme further. Therefore, with political developments having reached a turning point, it is worthwhile reassessing the achievement of Abenomics and their possible evolution.

Positive drivers of Abenomics

Japan is enjoying an economic uptrend and this positive momentum is expected to continue to the end of 2017. The main engine of growth is the JPY28.1 trillion (5.3% of GDP) fiscal package announced last year. This stimulus package has finally begun to kick in, with public investments accelerating by +6.0% QoQ in the second quarter of 2017. The second driver is the pick-up in the global economic cycle, which has lifted the exports of goods. As the capacity utilisation rate rises towards its long-term average with current profits surging by +22.6% YoY in the second quarter, business investments are anticipated to gradually increase, making a positive contribution to economic growth.

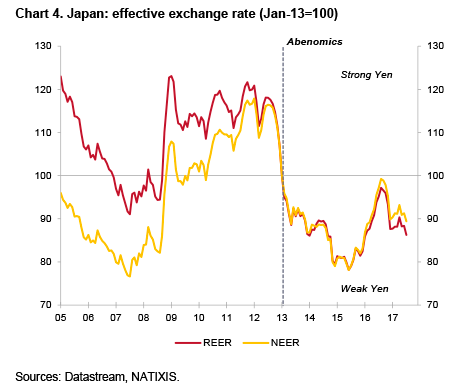

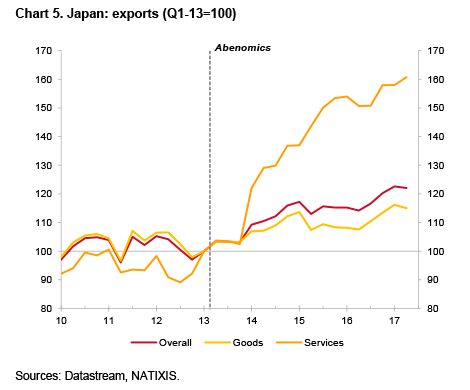

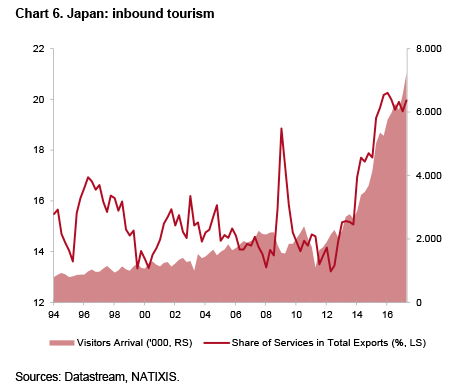

For the medium-term, tourism is clearly a bright spot for Abenomics. As the yen depreciated on the back of the Bank of Japan’s Quantitative and Qualitative Easing (QQE) launched in April 2013 (see Chart 4), exports of services, which are largely tourism, responded favourably (see Chart 5). As a result, the number of overseas visitors –especially from China– increased by 187% from 2012 to 2016 and the number continues to break records, stimulating the domestic tourism industry (see Chart 6). This positive development is expected to continue in the medium-term on the back of a growing middle class in China. As income grows, Chinese households are expected to move up the Maslow hierarchy of needs, switching consumption from essential goods such as food to discretionary items such as tourism.

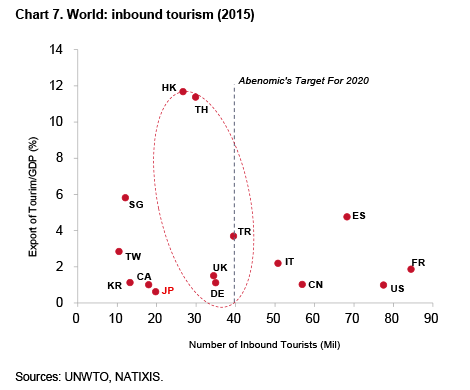

Nevertheless, tourism will still be negligible for the size of the Japanese economy. Although the goal to attract 20 million annual visitors was easily met in 2015, the share of export of tourism was limited to 0.6% of GDP (see Chart 7). On the back of the growing number of tourists from China, the government became more ambitious, doubling the target to 40 million in 2020. However, given the size of the economy, the share is likely to be limited to around 1.2%, which is clearly smaller than for Thailand and Turkey, well know destinations for tourists, but similar to the figure for Germany. Therefore, because tourism is unlikely to be sufficiently large to be a major driver of the economy, Japan would need to search for alternative sources of growth.

The broken third ‘arrow’ of Abenomics?

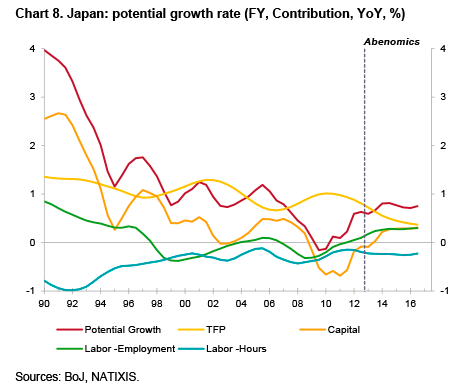

The flip side of the recent positive developments is a stagnant private domestic demand, which is a bottleneck for sustainable economic recovery. The problem is that meaningful structural reforms from the third ‘arrow’ of Abenomics, which is essential to lift the potential growth rate, has not been implemented. As total factor productivity (TFP) slowed down, the improvement in the potential growth rate has been limited (see Chart 8), restricting wage growth and private consumption. Furthermore, immigration has clearly not been large enough to increase the country’s total population, which is ageing. As a consequence, the economy remains highly sensitive to global economic developments. As Abe delays progress on structural reform, the Bank of Japan and the government are arguably depleting policy ammunition, which could be used to counterbalance the negative side-effects of implementing those reforms. Because meaningful reforms could have adverse effects in the short term through higher unemployment, Japan is losing a golden opportunity to push through labour market reforms and deregulation, which raise the potential growth rate in the long run.

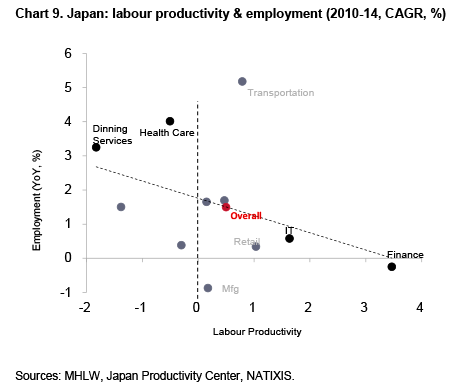

In the labour market, little progress has been made to reform the life-time employment system, which has arguably been a bottleneck of the Japanese economy. In fact, employees under permanent employment contracts are highly protected by law and their wages are based on seniority and length of service. While the system established employment stability, it has limited efficient resource allocation through labour mobility, which is essential for an economy undergoing structural change such as Japan’s. For instance, even when Japanese manufacturers shift their production sites overseas, their permanent staffs do not have much incentive to seek employment opportunities outside their organisations. The other side of the coin is that the job market for those in mid-career has still not been well established. Furthermore, because on-the-job training is a common practice, opportunities for professional training to rebuild careers, such as business schools, are underdeveloped in Japan. While low-productive positions are growing faster than high ones (see Chart 9), the underdevelopment of the job market and educational system for those in mid-career poses challenges to reverse this negative relationship, limiting improvements in potential growth.

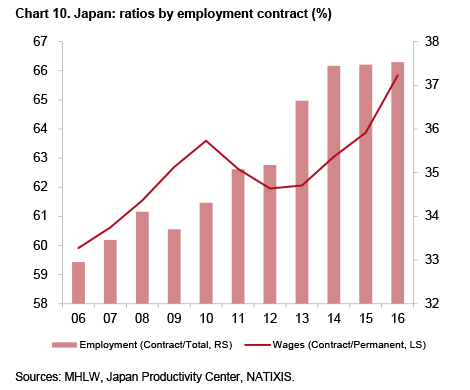

The permanent employment system has also increased the burden on workers outside the system. As the economy stagnated over the past few decades, companies increased employment through a larger number of contract workers with limited legal protection and opportunities for on-the-job training, which in turn restricted the improvement in the potential growth rate (see Chart 10). Their wages were more than 30% below those of permanent workers, creating disincentives to switch careers and reducing labour mobility. These developments have contributed to subdued wage growth despite the unemployment rate falling to 2.8% in July, the lowest level since the early 1990s. Although the government is promoting the principle of equal pay for equal work, companies would need to restructure the life-time employment system, which would require changes in employment laws to limit the protection that permanent contract workers enjoy. Because the main motivation to increase contract workers was to improve profitability, these labour market reform measures could reduce overall wages in the short run.

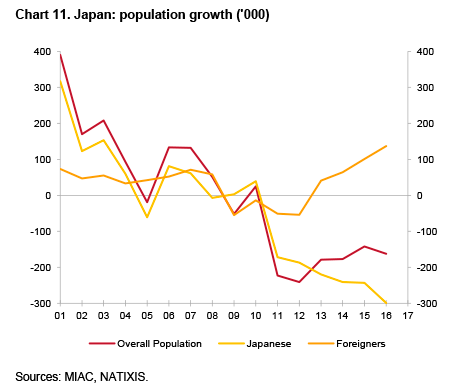

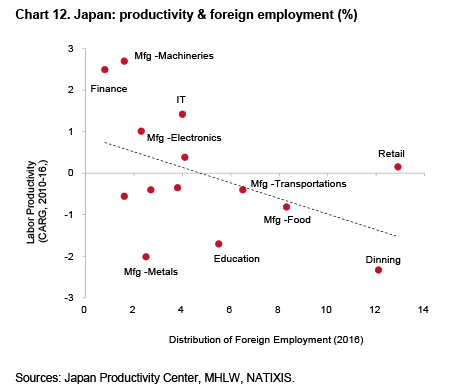

As regards the shrinking labour force, the country’s immigration policy has had very limited success in reversing the problem of an aging population. While Japan has made some progress in increasing its immigration largely from neighbouring Asian countries, this has been insufficient to increase the overall population (see Chart 11). Furthermore, a large portion of foreigners work in low-productive sectors such as dining and retail, filling in for the absence of young Japanese (see Chart 12). On the other hand, the share with professional employment visas is limited to 18.5%, with less than 10% of foreigners working in high-productive sectors such as finance and IT. Because Japan is losing opportunities to attract highly skilled professionals to lift economic productivity, the government would need to further relax the requirements to obtain employment visas. Nevertheless, Japan would still face an intensifying global war for talent, especially with Hong Kong and Singapore, which have favourable income-tax rates and social systems similar to those in the West.

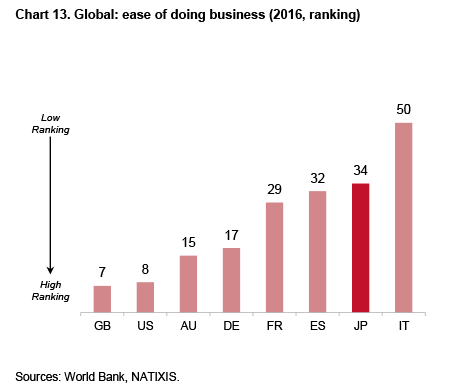

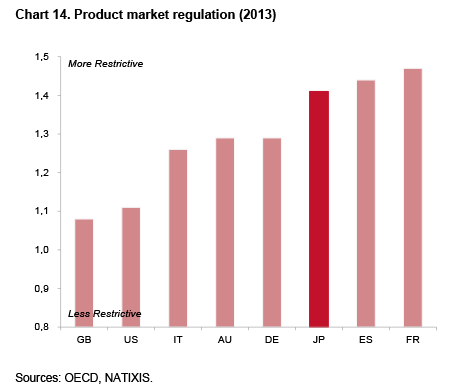

The second shortcoming of Abenomics is insufficient deregulation. The Japanese economy is generally known to be highly regulated, with only limited market competition, and reality has not changed much following the launch of Abenomics. The ranking of ease of doing business is well below the position of the US and similar to the levels of France and Spain (see Chart 13). High market regulation, especially in professional services, the telecommunications and energy sectors, has played a significant role, raising the barriers to entering the market (see Chart 14). As a result, regulations have not only discouraged investments but also limited market competition, thereby lowering TFP (see Chart 8). Because the working-age population is shrinking on the back of an ageing population, it is essential to implement deregulation measures to raise the potential growth rate.

The first two ‘arrows’ of Abenomics lose strength

Although the implementation of the third ‘arrow’ of Abenomics is essential to improve the economy’s long-term prospects, it will have adverse effect on the economy through job losses, especially in the short term. Hence, the Bank of Japan and the government should ideally have plenty of ammunition to counterbalance these negative effects. However, in reality, the first two ‘arrows’ of Abenomics are losing strength, which arguably makes it even more difficult to implement important structural reforms.

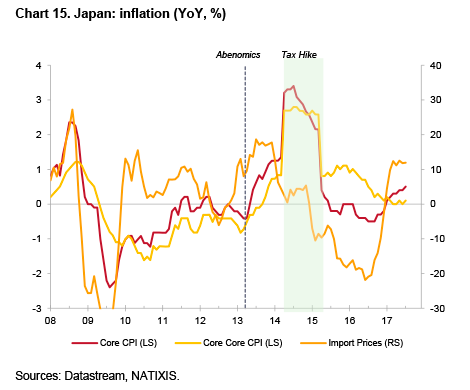

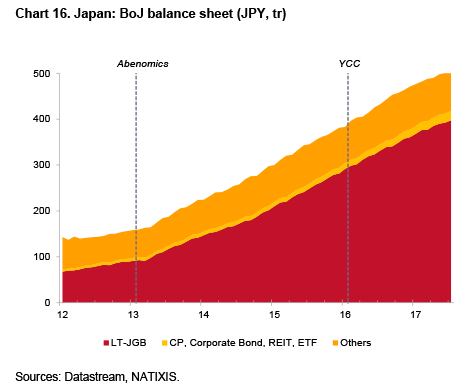

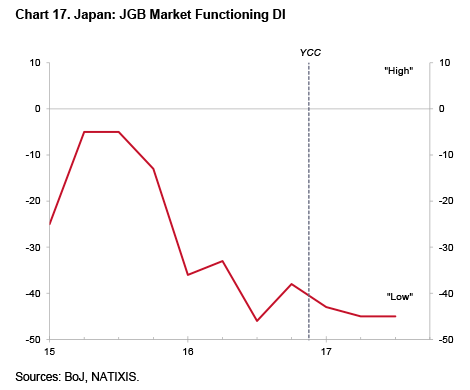

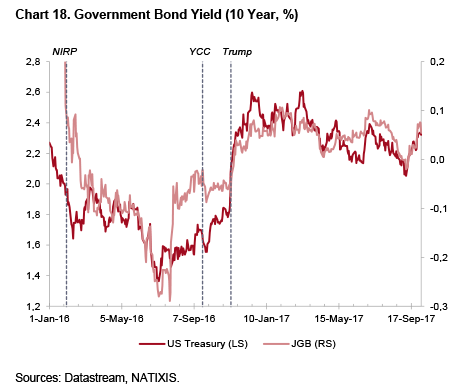

After launching the QQE in April 2013 to achieve the 2% inflation target in two years, the Bank of Japan is still far behind, with core CPI at +0.5% YoY in July (see Chart 15). As the Bank of Japan trebled its balance sheet through a massive Japanese Government Bond (JGB) purchase (see Chart 16), it become the largest holder with a share of outstanding JGBs of 39.5% in the first quarter of 2017. As a consequence, market liquidity has dried up (see Chart 17), providing limited scope for additional JGB purchases to meet the inflation target. With these developments, in September 2016 the Bank of Japan switched its operational target from the quantity of money through asset purchases to 10-year JGB yields at 0% under Yield Curve Control (YCC). However, because long-term bond yields are highly influenced by global market developments (see Chart 18), the Bank of Japan will have less control over its monetary policy as the Fed normalises. If the Bank of Japan lets the JGB yield deviate from the 0% target once again without a clear explanation, its credibility could be further penalised.

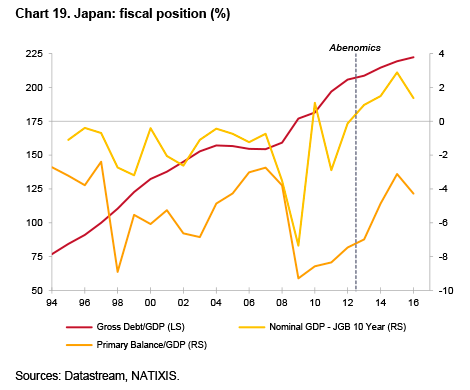

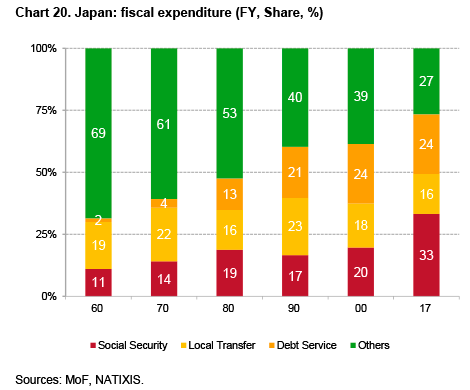

Fiscal manoeuvrability has also become increasingly limited. While Japan already has the largest debt level among developed economies, its fiscal situation is hardly improving. Although the positive difference between economic growth and bond yield is a constructive development, the large deficit on the primary balance, at -4.3% of GDP in 2016, makes debt stability challenging (see Chart 19). In fact, the fiscal situation will deteriorate further, as social security expenditure, which already made up 33% of the total budget (see Chart 20), will continue to increase by around JPY1 trillion (1% of total expenditure) per year on the back of an aging population. With fiscal budget constraint tightening every year, the government will face serious challenges to organise a large stimulus package to support the economy.

Conclusions

Is Japan really back?

Abenomics has arguably had some success. The economy has recently surprised on the upside, with GDP growth expanding for the sixth consecutive quarter and the unemployment rate falling to the lowest level since the early 1990s. The pick-up in tourism is also a good example of a bright spot. In addition to these positive economic developments, Abe’s nationalism at a time of extreme tension with North Korea has helped him win the Lower House election on 22 October.

However, the ongoing economic uptrend is clearly cyclical, supported by fiscal stimulus and the pickup in the global economy. Even if Japan achieves the goal of doubling the number of overseas visitors, the impact on the economy will still be negligible in relation to the size of the Japanese economy.

The flipside of these developments is stagnant private domestic demand, which is a bottleneck for sustainable economic recovery. Structural reforms in the labour market and deregulation, the third ‘arrow’ of Abenomics, have been held back, limiting improvements in the potential growth rate. While structural reforms could initially have adverse effects such as job losses, the Bank of Japan and the government are depleting their resources to counterbalance these negative effects. Therefore, meaningful implementation of the third ‘arrow’ has become even more unlikely.

Abe advocated the success of Abenomics during the election campaign. However, without meaningful structural reform, the Japanese economy will continue to be highly sensitive to global economic developments and the long-term outlook is less upbeat. While Abe may claim that ‘Japan is back’, the country’s contribution to global economic growth is expected to become less significant, smaller than that of its neighbouring Asian economies (see Chart 21).

Alicia Garcia Herrero

Non-resident Senior Research Fellow at Real Instituto Elcano, Chief Economist for Asia Pacific at NATIXS and Senior Research Follow at Bruegel | @Aligarciaherrer

Kohei Iwahara

Senior Economist, NATIXIS

References

International Monetary Fund (2017), ‘2017 Article IV Consultation – Press Release; Staff Report; and Statement by the Executive Director for Japan’, IMF Country Report nr 17/242, July.

International Monetary Fund (2017), ‘Why Isn’t Private Investment Higher in Japan?’, IMF Country Report nr 17/243, July.