Theme

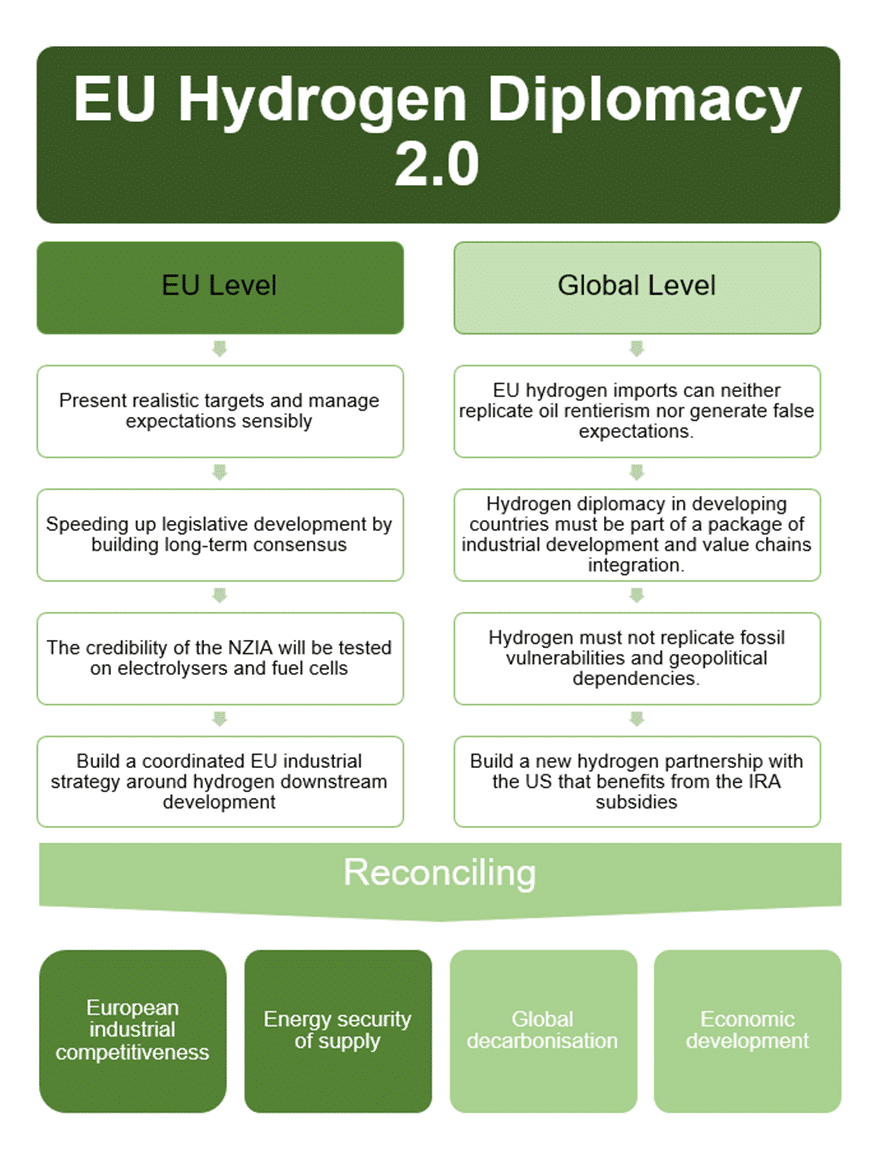

This analysis evaluates the EU’s H2 diplomacy and suggests an alternative pathway that is realistic, agile and that reconciles global decarbonisation and economic development with European industrial competitiveness and the security of energy supply.

Summary

Since the publication of the EU Hydrogen Strategy in July 2020, hydrogen has enjoyed a prominent position in the EU’s decarbonisation, infrastructure development, industrial policy and energy security debates. The EU aims to position itself as a global standard setter, technology developer and importer of hydrogen, while hydrogen has been identified as a central piece in the Net Zero Industry Act and in the search for open strategic autonomy. The objective of this paper is to evaluate the key elements of the EU’s hydrogen diplomacy thus far and propose a novel approach around four aspects regarding its domestic scope and another four at the international level, reconciling global decarbonisation and economic development with European industrial competitiveness and the security of energy supply.

Figure 1. EU hydrogen diplomacy 2.0

Analysis

Ever since the EU Hydrogen Strategy was unveiled in July 2020, hydrogen has occupied a pivotal role in the EU’s discussions on decarbonisation, infrastructure development, industrial policy and energy security. The EU’s ambition is to establish itself as a global leader in setting standards, fostering technology development and becoming a significant actor in the future hydrogen-related trade. Renewable hydrogen, both domestic production and potential future imports, has been targeted as a potential substitute of Russian natural gas in REPowerEU. Simultaneously, hydrogen has emerged as the backbone in the implementation of the Net Zero Industry Act and in the pursuit of strategic autonomy. Since the EU’s hydrogen policy has thrived in a crisis environment -the COVID-19 pandemic and the war in Ukraine-, it is now time to rethink the role of hydrogen in the context of its main purpose: providing a decarbonisation pathway for hard-to-electrify sectors on the road to net-zero. The EU needs to abandon the paradigm of the miracle gas, to move towards a more realistic and nuanced strategy that suits the true potential and limitations of renewable hydrogen.

Previous discussions on the EU’s nascent hydrogen diplomacy have excessively focused on the future of imports, an issue that concerns a limited number of Member States, but falsely disguised as a common priority. The EU must develop a diplomacy that incorporates other interests and agendas, enriching with new perspectives a hitherto overly narrow import-based strategy. Hydrogen diplomacy must expand its focus of engagement, prioritising the development of supply chains with geopolitically aligned countries, avoiding presenting hydrogen as a new decarbonised commodity with little added value. The EU’s hydrogen diplomacy must be based on win-win formulas, away from neo-colonial narratives, conducive to the economic development of third countries and the geopolitical resilience of the EU. The aim of this analysis is to propose, in four points at two different levels -domestic and external-, a hydrogen diplomacy that aligns Europe’s interests in increasing the competitiveness of its decarbonised industry and its energy security with the global objectives of decarbonisation and sustainable economic development.

(1) Building synergies between the EU’s hydrogen domestic policy and diplomacy

The paper begins by reviewing the EU’s domestic hydrogen policy around four main points that have a direct impact on its hydrogen diplomacy: (1) it argues that the Commission’s hydrogen targets (imports and domestic production) should be reconsidered based on realistic criteria that do not unreasonably raise expectations at home and abroad; (2) it further analyses the excessively slow legislative development of hydrogen in the EU, proposing consensus building with negotiations focused on minimalist agreements that maintain Brussels’ status as the standard setter; (3) it continues identifying electrolysers and fuel cells as key elements of the Net Zero Industry Act (NZIA), proposing reinforced support for these technologies; and (4) it closes with a reflection on the need to reorganise not only hydrogen flows within the EU but also the most energy-intensive activities of the industrial supply chain.

(1.1) Present realistic targets and manage expectations sensibly

With the objective of enhancing energy security through the acceleration of the decarbonisation process, REPowerEU stands as one of the most ambitious plans within the EU concerning energy transition goals. It was formulated in the aftermath of Russia’s invasion of Ukraine and during the peak of Europe’s energy crisis. It should be noted that at the time of the publication of the REPowerEU, ammonia production in the EU, one of the main grey hydrogen consuming industries (see Figure 2), had shut down 70% of its production, while the refining sector, the other big hydrogen off-taker suffered from a complex supply disruption.

The primary purpose of the REPowerEU document was to update the Fit-for-55 targets to the new geopolitical reality and provide a strategic plan for the energy and industrial sectors, which were severely impacted by the crisis. However, given the geopolitical context, it can be argued that REPowerEU was also intended to boost morale among European citizens fearful of potential energy shortages and economic downturns. The prevailing enthusiasm surrounding hydrogen since 2020 further contributed to an environment conducive to a significant increase in targets related to renewable hydrogen in REPowerEU (see Figure 2).

While the Fit-for-55 targets for 2030 had originally established a very ambitious goal of 5.6 million tonnes of renewable hydrogen consumption by 2030, the new REPowerEU strategy raised the target to 20 million tonnes (see Figure 2), half of which would be imported, with the aspiration of substituting 27 bcm of Russian gas by the end of the decade. These objectives have faced substantial criticism due to the lack of a robust modelling foundation and incoherence with (provisional) REDIII targets.[1] One of its weaknesses is to estimate a very aggressive growth of renewable hydrogen demand in 2030 in unconsolidated end-uses, against a relatively slow decarbonisation of existing consumption in refining, ammonia and methanol (42% as per REDIII targets with multiple exceptions).

Managing expectations seems particularly important in the case of hydrogen. Analysing the history of hydrogen, the technology has suffered from many false-starts and its emergence has followed politically-driven hype cycle trends. The enormous versatility of applications of the hydrogen molecule makes it susceptible to overestimation. However, renewable hydrogen must be conceived as a scarce and expensive commodity whose priority uses must be as industrial feedstock, reducing agent for metallurgy and in those applications whose electrification is not feasible (long-haul aviation, shipping and certain high temperature industrial processes). It is important to maintain a realistic hydrogen narrative that does not divert investments in decarbonisation away from more efficient uses. The Commission may have to re-examine its hydrogen targets, in particular its green import ones, and reassess the feasibility and cost of achieving them. Presenting realistic targets[2] is essential to send the right signals to the domestic market and not weaken the EU’s credibility as an international energy and climate actor. It also seems more reasonable to prioritise domestic hydrogen production over imports, with the Hydrogen Bank exclusively subsidising European projects, at least during this decade.

(1.2) Speeding up legislative development by building a long-term consensus

If the REPowerEU presented overly ambitious and unrealistic targets for an eight-year timeframe (2022-30), the European hydrogen industry has suffered from regulatory uncertainty over sectoral targets, the definition of renewable hydrogen and its GHG life-cycle assessment. The legislative development concerning renewable hydrogen has suffered from political meddling, affecting other key legislative packages. As a result, during the Swedish Presidency, the adoption of the Renewable Energy Directive III (REDIII) was postponed because several Member States supported low-carbon hydrogen produced from nuclear energy to be deducted from the bloc's renewable energy targets.

Among the heterogeneous hydrogen sector, there was unanimity on the urgency of finalising the Delegated Acts (DAs) setting the rules to produce Renewable Fuels of Non-Biological Origin (RFNBOs). The definition of renewable hydrogen, a necessary step to provide regulatory clarity for investors, producers and consumers, took almost two years from the publication of the EU Hydrogen Strategy and almost five years since the European Commission was first given the task to create a rulebook on the use of renewable energy in electrolysers, halting the execution of key investments. Finally, in February 2023 the Commission adopted two delegated regulations: one defining rules on renewable hydrogen production and clarifying the additionality criteria for renewable electricity; and another setting out a methodology to calculate lifecycle GHG emissions. Despite the importance of its adoption, the Parliament and the Council decided to have four months instead of two months to raise objections, further delaying its entry into force. The delay in defining renewable hydrogen has caused the EU to lose much of its early-mover momentum, retarding for months the final investment decision (FID) of many projects in the pipeline. While the US Department of Energy (DOE) is also experiencing delays in establishing the requirements governing the definition of renewable hydrogen within agreed timeframes, the Inflation Reduction Act (IRA), with a decarbonised hydrogen subsidy package of up to US$3/kg tax credit for clean hydrogen, seemed to pass against a backdrop of EU legislative paralysis.

The role of low-carbon (mainly nuclear) hydrogen has been identified as the main source of disagreement, with pro-nuclear Member States defending hydrogen from nuclear energy to be (partially) deducted from the bloc’s renewable energy targets. Other issues of disagreement have been the conditions of additionality, temporal and spatial correlation, as well as the requirements for hydrogen imports. It is essential that given the backlog in the development of hydrogen legislation and the Member States’ right to decide their energy mix, durable and consensual agreements are reached as soon as possible. This implies accepting the different decarbonisation pathways chosen by the Member States and supporting competition between low-emission technologies within the EU. This framework should ensure low emissions within the hydrogen supply chain but refrain from further impeding the development of a sector identified as a strategic priority. Considering the urgency to increase the supply of low-carbon hydrogen in the EU and the political commitment of several Member States to sustain their nuclear industry, it is imperative to accommodate all types of low-emission electrolytic hydrogen production, even if only as a transitional measure in the current context of crisis.

In parallel, the requirements for imported hydrogen and its derivatives also remain to be defined more precisely, in particular, regarding hydrogen produced under the IRA support schemes and additionality rules excluding subsidised electricity as renewable. The Commission Delegated Regulation (EU) 2023/1184 states in Article 5 (b) on Additionality that subsidised electricity generation does not account as renewable. The EU Commission still needs to clarify the details in the application of this rule for hydrogen and its derivatives imports. In particular, if electricity under the support of the IRA would make US hydrogen not eligible for renewable targets under REDIII. If the legislative process continues to be slowed down, the EU risks eroding one of its main geopolitical competitive advantages: its soft power capacities as a standard setter.

(1.3) The credibility of the NZIA will be tested on electrolysers and fuel cells

The EU Net Zero Industry Act identifies a group of eight strategic technologies on which the Commission set a non-binding common benchmark target for EU domestic manufacturing self-sufficiency of at least 40%. The list includes solar technologies, onshore wind and offshore renewables, batteries, heat pumps and geothermal, electrolysers and fuel cells, biogas and biomethane, carbon capture and storage (CCS), and grid technologies.

This list is problematic, since it disregards the different realities of the R&D and business ecosystem of each technology, as well as the relative position of the EU in the global value chains. It seems more sensible to favour a strategy differentiated by technology. Promoting self-sufficiency in particular technologies better positioned to succeed, while benefiting from cheaper imports in other consolidated technologies with higher barriers to entry (such as solar PV), could be an approach that is more aligned with the concept of open strategic autonomy.

Europe has a robust presence of electrolyser manufacturers who possess expertise in various types of electrolysis technology, coupled with the existence of well-equipped research facilities in the region. These actors comprise both prominent industrial players (John Cockerill, Thyssenkrupp, Siemens, Nel, Ceres, ITM, McPhy, Sunfire, etc) as well as smaller companies that specialise in niche yet promising technologies. Electrolysers offer a few advantages for EU technological success: they are design intensive, benefiting domestic companies’ acquired advantage, but with a certain degree of customisation for each project, incentivising manufacturing close to production sites, with the potential to export to near markets such as North Africa and the Gulf.

The EU renewable industry is still recovering from the painful collapse of its solar PV industry a decade ago. Now, it is again confronting intense competition from China to establish global leadership in batteries, electric vehicles and wind power technology. In this challenging landscape, securing European leadership in electrolysers could serve as a significant confidence boost to European low-carbon innovation capacities. In the pursuit of efficiency, the EU should prioritise technologies with strong strategic positioning, and electrolysers and fuel cells are one such technology deserving of attention from the NZIA and the EU’s new industrial policy. The EU must confront the low-cost competition from Asia in the electrolyser manufacturing sector by enabling its domestic electrolysis suppliers to scale up, learn by doing and swiftly reduce production costs while maintaining R&D activities. The EU, the European Hydrogen Bank (EHB) and its Member States should promote WTO-compatible sustainability requirements such as recycling obligations and limits on the CO2 footprint of electrolyser manufacturing facilities in the design of grants or subsidy schemes.

(1.4) Build a coordinated EU industrial strategy around hydrogen downstream development

Uncoordinated hydrogen industrial policies could negatively affect EU economies and synergies scale, undermining the level playing field across Europe. While the €3 billion hydrogen bank may serve as a common vehicle for ramping up green hydrogen production, since the adoption of the Temporary Crisis and Transition State aid Framework (TCTF) public financial support for low-carbon hydrogen industrial applications is coming mainly from Member States’ regular budgets, which risks jeopardising the single market’s cohesion. A supranational budget and hydrogen-related industrial policy would mitigate the kinds of distortions that national state aid would bring, as the latter is correlated with national fiscal resources that favour richer Member States. This risk might materialise quickly if countries with more fiscal leeway execute their plans to create their own green industrial policy packages, such as Germany’s industrial carbon contracts-for-difference (CfD) or the Berlin-led H2Global double auction import subsidy scheme. France’s intention of implementing a Green Industry Bill and Hydrogen CfD, that includes substantial tax credits, represents the risk of a potential subsidy race between Member States. On hydrogen-related industrial policy, the EU needs to build a credible governance framework that avoids fragmentation, brings coordination and limits the risk of spending money inefficiently. Delivering these subsidies at the EU level would protect the single market and its scale by harnessing EU-wide synergies and regional relative competitive advantages.

Building on this approach, high-emission and easily transportable products can be partially relocated to the EU’s sun- and wind-rich regions. Downstream hydrogen sectors, such as steel and chemical, are energy-intensive industries subject to strong international competition even under the enforcement of CBAM. The ‘renewables pull’ effect can lead to relocation, especially for renewable-energy intensive and easily tradable goods within the single market. For those Member States with competitive advantages for hydrogen production, a package of developing downstream activities and value-chain integration is more attractive than one of mere production and export of the molecule. Likewise, the renewable pull will not necessarily lead to a relocation of entire industrial sectors, but of those stages of the value chain that have a relatively higher energy intensity. This is a process already happening in the German steel industry, with plans for the relocation of the most energy-intensive steps from the interior to the coastal cities near the offshore wind resources of the North Sea. Salzgitter AG is studying whether to move the direct reduced iron (DRI) steel making step from the current inland site at Salzgitter to the coastal site at Wilhelmshaven and ArcelorMittal has announced plans to transport part of the sponge iron produced at its DRI Hamburg plant to its steel plant in Duisburg for further processing.

Although this might become a politically complicated topic for EU regions with renewable hydrogen potential deficit, it is not a new phenomenon within the processes of intra-European outsourcing of value chains based on comparative advantage specialisation. In addition, the EU has created a range of funding options for regions under industrial restructuring processes, such as the €20 billion Just Transition Fund. With an EU-level coordinated approach, industrial relocation could be shaped pro-actively, building low-carbon industrial partnerships among European regions through IPCEI initiatives[3] that lead to secure and robust low-carbon supply chains. This proposal is not intended to reject the transport of hydrogen within Europe by pipeline, but to broaden a debate dominated by the creation of a Hydrogen Backbone in Europe.

This approach is in line with the EU’s commitment to strategic autonomy, reindustrialisation and the reduction of intra-European economic imbalances. Promoting industrial relocation within the single market would prevent carbon leakage and the loss of European jobs, strengthening strategic autonomy by keeping value chains on European soil. Furthermore, it offers opportunities for regional development where renewable resources are more abundant. Successful implementation of this industrial relocation model to areas rich in renewable resources would serve as a compelling narrative supporting the energy transition, effectively dismantling prevalent anti-renewables discourses by showcasing the potential for wealth and job creation. This would increase the credibility of the EU hydrogen diplomacy with third countries, demonstrating the benefits associated with hydrogen development in partnership with Brussels.

(2) A resilient hydrogen diplomacy to serve decarbonisation and global development

Further on the global dimension, the analysis explores several risks and opportunities arising from the international dimension of the EU’s hydrogen diplomacy and its development thus far. The document reformulates four major elements: (1) hydrogen cannot replicate the rent-seeking behaviour of oil exporting countries, nor can it generate misleading expectations that delay political system reform; (2) hydrogen diplomacy must be aligned with the EU’s industrial development policy and the integration of value chains; (3) hydrogen must not replace current fossil-related geopolitical vulnerabilities with new ones, even if low-carbon; and (4) a new hydrogen partnership with the US that benefits from IRA subsidies is proposed.

(2.1) EU hydrogen imports can neither replicate oil rentierism nor generate false expectations

From 2021 many oil and gas exporting countries have identified decarbonised hydrogen as a potential export commodity that substitutes fossil fuels in the long-term. These countries have presented strategies to export blue hydrogen,[4] renewable hydrogen and hydrogen by-products in the search of their place in the post-fossil fuels world economy. Meanwhile, the EU has identified hydrogen as an attractive solution to go beyond its initial natural gas diplomacy in the context of the energy crisis. In response to Russia’s invasion of Ukraine, Commission Vice-President Timmermans introduced natural gas diversification agreements involving countries such as Egypt, Algeria and Qatar as a stepping stone to a broader strategy that envisaged integrating these countries into a comprehensive global framework around the production and use of low-carbon hydrogen.

The climate logic behind this strategy remains to be proved. First, it relies heavily on blue hydrogen agreements. Germany’s recent shift to blue hydrogen, changing its initial 2020 strategy, has led to new hydrogen/energy parternships with Saudi Arabia, the UAE and Algeria. This poses a problem because the feasibility and long-term environmental benefits of the steam methane reforming and carbon capture pathway are still uncertain on a large-scale production level.[5] Secondly, the future capacity of these countries to produce low-carbon hydrogen while simultaneously decarbonising their own energy systems remains challenging. Despite being the world region with the lowest penetration of renewable energies, a recent analysis of Global Energy Monitor shows that more than 60% of the renewable projects in the Middle East and North African regions are specifically designated to hydrogen production and exports. Third, it is uncertain whether there is a future case for the use of LNG terminals with renewable or low carbon energy carriers, which poses a risk for them to become stranded assets in the medium term. There is a lack of sufficient knowledge and expertise regarding the technical requirements and associated costs involved in converting LNG terminals for ammonia or alternative carriers, as well as the techno-economics of cracking these molecules back into hydrogen at destination. Meanwhile, carbon capture is still far from guaranteeing CO2 capture in the long term and with sufficient reservoirs for mass scalability at a competitive cost.

While international climate policy must also listen to fossil-fuel exporting countries’ interests to keep them on track with global climate ambitions, it is dangerous to create false expectations that delay structural reforms. Hydrogen trade revenues will hardly substitute those associated with fossil fuels, since international trade will be based on regional cost-differentials, meaning competition will be naturally high while prices will tend to be low. In contrast to oil and gas, which are limited in supply due to their geological availability and geopolitical distortions such as OPEC and international sanctions, green hydrogen production depends on access to renewable electricity, which is more widely distributed and abundant elsewhere on the planet.

It is urgent to reformulate the EU’s hydrogen diplomacy with oil and gas exporting countries, prioritising local decarbonisation over mega-projects designed to export energy. The EU needs to rethink if linking natural gas diversification efforts to an import-based hydrogen diplomacy creates positive synergies or represents a risk of delaying needed economic (and political) reform among fossil-fuel producing countries. Masking negotiations centred on natural gas with an uncertain transition to decarbonised hydrogen benefits neither the EU’s position nor that of hydrocarbon exporting societies, obstructing their genuine sustainable development.

(2.2) Hydrogen diplomacy in developing countries must be part of a package of industrial development and value-chain integration

The net effect that hydrogen exports can have on developing countries is ambiguous and could, in certain cases, even be negative, with further analysis needed. In real-life conditions, the capacity to deploy renewables is limited by the grid, manpower, access to capital, bureaucracy and logistics. Therefore, devoting part of the renewable deployment in developing countries to hydrogen production could be a barrier to true leapfrogging from fossil or preindustrial fuels (wood, manure, etc) directly to clean renewable energy. The rationale behind exporting energy at a time of energy insecurity -for the first time in decades, the number of people without access to electricity increased in 2022- is still complex to articulate. Hydrogen imports cannot, in any case, be used to offshore the externalities, such as social acceptability issues in Europe, associated with the deployment of renewable energy sources and electricity grids.

Moreover, as with renewables, in hydrogen production the value that is eventually added to the exporting economy is dubious, as its production becomes a largely automated business once development is completed. Hence, the potential benefits and spillovers at the local level would be conditional on the existence of local off-takers, a skilled workforce or strong institutions that enable a fair distribution of hydrogen production cash-flows throughout the economy. The challenge is further aggravated by the fact that developing countries often rely on foreign infrastructure, materials, know-how and technology. The EU must essay striking a complex balance between promoting imports and energy security, respecting local autonomy and avoiding negative dependencies that replicate fossil rentierism to the detriment of the societies of the exporting nations.[6] A more extensive definition of the concept of additionality is therefore needed to prevent export-driven hydrogen production projects from delaying or cannibalising the deployment of decarbonised technology –including power grids– for local use.

The starting point of an sustainable EU import strategy must be local decarbonisation and development, supporting developing countries’ capacities. EU hydrogen imports must ensure added value for supplier countries beyond the revenue generated, promoting other dimensions of sustainable development. Providing added value to supplier countries is a difficult task that requires solid policies and regulations by their countries to support the funding and effective administration of affordable, secure and environmentally friendly energy. It also implies the establishment of physical and digital infrastructure catering to industrial areas and transport logistics, stimulation of investments in professional and industrial services, enhancement of workforce training, facilitation of investment agreements, streamlining of bureaucratic processes, assurance of legal clarity and the establishment of robust institutional frameworks.

Strategic partnerships for green steel, advanced e-fuels or fertilisers seem to complement or substitute hydrogen trade with third countries in a more efficient way. They should be developed on the basis of new Just Energy Transition Partnerships (JTEPs) with like-minded European countries aligned with its geostrategic priorities and values. Building on initiatives such as the Global Gateway, European hydrogen diplomacy should focus on developing the associated industrial chain wherever there is a competitive renewable resource, including the development of trade corridors. However, the development of Global Gateway has so far been disappointing, requiring a new approach that improves its governance mechanisms, demonstrates its impact on the development of recipient countries, reduces the ownership deficit on the part of local stakeholders, and substantially improves its communication and credibility.[7]

(2.3) Hydrogen must not replicate fossil vulnerabilities and geopolitical dependencies

European hydrogen diplomacy was born in a context of geopolitical energy conflict and must overcome the vulnerabilities and dependencies of fossil geopolitics. Strict geopolitical alignment criteria must be applied to future renewable hydrogen suppliers, analysing partnership quality, the nature of the political systems of major supplier countries and vulnerability exposure by market share. Hydrogen partnerships need to be analysed in order to find allies that will guarantee the robustness of the relationship in the long term. Now, as the hydrogen market is at its early stages of development, the EU can seek to form partnerships with actors with whom cooperation can generate the greatest spill-over effects at the lowest geopolitical risk. This implies reaching agreements preferentially with countries with comparable public policies, democratic participation systems and markets open to foreign investment. Preferably, the EU should continue to work towards broader cooperation packages that include critical minerals, investment in renewables, energy efficiency and clean industries, as well as scientific cooperation. The recent agreements with Uruguay, Argentina and Chile follow this approach, although their capacity to deliver actual results remain to be proved.

These types of partnerships offer win-win formulas, such as in the case of steel. H2-based Direct Reduced Iron (DRI) steelmaking[8] is considered the most efficient route to decarbonising steel production but requires huge amounts of renewable hydrogen to produce (green) sponge iron. Therefore, hydrogen-importing countries with steel production can partially offshore the transformation of iron into renewable-rich countries, domestically retaining the most complex and remaining steel finishing processes, accountable for most of the value added.[9] Offshoring part of the production of green raw materials (ammonia, sponge iron, methanol, e-fuels, etc) can even be conceptualised as a hedging strategy against both volatility in prices and potential shortages in the supply of low-carbon hydrogen.

Building partnerships that incorporate downstream industrial development increases interdependencies and reduces the vulnerability of importers. From the point of view of energy security, solid or liquid goods are usually easier to store and transport than gaseous ones. In contrast, trade in gaseous products often relies on inflexible logistics (pipelines) and long-term supply contracts that can further increase dependence by locking partners into long-term trade relations and reducing options for alternative supplies.

(2.4) Build a new hydrogen partnership with the US that benefits from IRA subsidies

If agreements with hydrogen-exporting countries are to be established, those with a high level of decarbonisation, similar political systems and geographical proximity should be prioritised. The US, with the IRA, presents itself as a preferential partner to deliver hydrogen and its derivatives to the EU at an extremely competitive price. The US is a prospective strategic hydrogen partner that does not encounter the challenges outlined in section (2.1) related to nations reliant on hydrocarbon revenues, the dilemmas associated with developing countries mentioned in section (2.2) or the risks arising from emerging geopolitical vulnerabilities discussed in section (2.3).

The best way to benefit from the IRA would be to capture US subsidies, creating synergies between the transformation of the US into the world’s clean hydrogen superpower and European competitiveness. This approach would transform initial tensions between the EU and the US related to hydrogen in the release of the IRA, creating opportunities for European utilities with transatlantic businesses. Despite the recent spike in US energy exports (LNG, diesel and crude oil), recent data reveal that transatlantic trade relations remain highly favourable to the EU, with a robust trade surplus of high value-added products. This experience could be replicated with hydrogen trade, increasing the scope of EU-US energy cooperation towards decarbonised goods -including steel- and creating incentives for more ambitious climate policies in Washington. In contrast to certain approaches that call for imposing anti-dumping measures on US exports of hydrogen and its derivatives, the EU has an opportunity to cover part of its renewable hydrogen deficit at the expense of US taxpayers. This would make it unnecessary to establish the announced external leg of the Hydrogen Bank for production outside the EU, devoting the funds to the promotion of these projects in the Member States.

However, on the EU side more regulatory clarity is needed. The EU Commission must publish clear and specific guidelines describing how imports will qualify as a green fuel to promote policy certainty for international project developers and suppliers. The EU hydrogen Delegated Acts allow for a transition period that exempts from the additionality requirement until 2038 for installations commissioned before 2028. In order to benefit from this transitional period, hydrogen project developers in the US must secure contracts with EU off-takers and make FIDs on large projects now, so that there is a nascent transatlantic renewable hydrogen and derivatives market by the end of the decade. Fortunately, the time for cooperation is now, when the DOE is in the process of defining the IRA 45V Tax Credit Definition criteria, which regulate the level of subsidy for low-carbon hydrogen produced in the US. The current discussion bears a resemblance to recent debates in the EU, centring around the concepts of additionality and time correlation requirements. An EU-US deal similar to the Canada-Germany Hydrogen Alliance, that targets policy harmonisation and secure hydrogen supply chains, could be the first step in this direction.

Conclusions

The EU hydrogen strategy was built during two historical crises –the COVID-19 pandemic and the Russian invasion of Ukraine- affecting its priorities and long-term projection. Now it is time to rethink the EU hydrogen narrative and diplomacy, learning after three years of development (2020-23) and aligning it with the EU’s interests domestically and abroad.

This analysis has attempted to propose a new approach that strengthens the EU’s domestic hydrogen dimension by rethinking production and import targets, speeding up the legislative process, reinforcing the technology dimension and reformulating the European industrial hydrogen strategy. It has further tried to review the international dimension of the EU’s hydrogen diplomacy, identifying three risks: (1) replicating formulas of oil rentierism; (2) building energy relations that reproduce underdevelopment in the Global South; and (3) generating new low-carbon geopolitical vulnerabilities and dependencies. Finally, the document identifies the opportunity of articulating a new hydrogen partnership with the US that benefits from IRA subsidies and helps decarbonise transatlantic trade flows.

Despite the interest of several Member States in developing an import-based hydrogen diplomacy, it must be integrated into a broader strategy, which includes the interests of the EU as a whole and the global objectives of development and decarbonisation. There is an urgent need to reshape the EU’s hydrogen diplomacy, aligning Europe’s interests in increasing the competitiveness of its decarbonised industry and its energy security at times of crisis with the global objectives of decarbonisation and sustainable economic development.

[1] REDIII provisional agreement provides that by 2030, 42% of the hydrogen used in industry should come from renewable fuels of non-biological origin (RFNBOs). Considering that in 2021 in the EU, around 8.7 Mt of hydrogen were consumed, REDIII targets for hydrogen consumption in existing industries would represent 3.7 Mt in 2030, without considering expected declining demand in the refining sector, accountable for 50% of the current demand for hydrogen. REDIII sets diffuse targets for hydrogen on transport, more difficult to calculate, with a minimum requirement of 1% of RFNBOs in the share of renewable energies supplied to the transport sector in 2030. REDIII does not include targets for new uses such as steel, industrial heat or power generation. However, even including the most optimistic projections, demand would fall short of the 20 Mt envisioned in REPowerEU for 2030.

[2] For a more realistic approach to the future hydrogen demand in the EU refer to Agora Energiewende (2023), ‘Breaking free from fossil gas. A new path to a climate-neutral Europe’.

[3] Important Projects of Common European Interest (IPCEIs) are cross-border, integrated projects, important due to their contribution to EU objectives while limiting potential competition distortions and ensuring positive spill-over effects for the internal market and the Union.

[4] Hydrogen from Steam Methane Reforming and carbon capture and storage of CO2.

[5] M. Riemer & V. Duscha (2023), ‘Carbon capture in blue hydrogen production is not where it is supposed to be. Evaluating the gap between practical experience and literature estimates’, Applied Energy, nr 349, 121622.

[6] For further analysis on this topic see D. Ansari & J.M. Pepe (2023), ‘Toward a hydrogen import strategy for Germany and the EU: priorities, countries, and multilateral frameworks’, SWP, Working Paper, nr 01, June.

[7] I. Olivié & M. Santillán (2023), ‘Ayuda al desarrollo y geopolítica: la iniciativa Global Gateway’, Policy Paper, Elcano Royal Institute.

[8] Hydrogen-DRI (Direct Reduced Iron) Steelmaking is a steel production process that uses hydrogen as a reducing agent instead of carbon-based sources, significantly reducing carbon. Hydrogen gas is used to remove oxygen from iron ore, producing high-quality iron pellets that can be further processed into steel, enabling a transition towards a low-carbon and sustainable steel industry.

[9] Agora Industry and Wuppertal Institute (2023), ‘15 insights on the global steel transformation’.