Theme: The paradigm of international development is currently shifting and this could be triggering a ‘clash of civilisations’ between the development community and the financial industry.

Summary: This policy brief is directed at development finance institutions supporting private companies in developing countries and reviews what can be considered the three main debates or challenges of the role of the private sector in development cooperation. First it looks at the major debate on how to ensure the development effects of donor-supported domestic investment in developing countries. Then it considers the concept of private sector additionality in promoting development. In a third section, it looks at how to institutionalise the contribution of private companies to socio-economic development. A final section presents some conclusions.

Analysis: In the last couple of years the global development community has witnessed the proliferation of working papers, policy briefs, seminars, workshops and official documents on the role of the private sector in development cooperation. More precisely, besides the more general debate on whether private profit and public good are compatible, the development community is showing its concern regarding the ability of the financial private sector and the development financial institutions (DFIs) to correctly manage funds with a development approach.

Some of them emphasise the potential role of private (domestic or transnational) companies in improving living conditions in developing communities, notably through labour creation.

Others insist on the risk of privatising development cooperation and of a new shift in the paradigm of international cooperation to economic growth, leaving aside the basic needs of the populations in partner countries.

These two positions are antagonistic that there could even be said to be a ‘clash of civilisations’. This ‘tribal’ division has always existed but the confrontation now seems stronger as a paradigm shift appears to be underway, leaving the era of Millennium Development Goals (MDGs) behind and moving into something new, although what that may be is not yet clear.

To put it simply, these two tribes have opposite views on almost everything regarding the private sector and development: (1) its definition; (2) the roles of the State and the market in promoting development; (3) the effects of the private sector on development; (4) the private companies’ added value in promoting development; and (5) the institutional architecture of the private sector’s contribution to development.

For part of the development community, development can only mean human –social, gender equal and sustainable– development, largely as defined in the Millennium Declaration and the MDGs. For development to be achieved, an active and efficient State is needed; as it is expected to accomplished tasks that cannot be transferred to the private sector –cash transfers and the improvement of the network of public primary schools, for instance–. Actually, the private sector can hinder development, as more room for the market can lead to greater inequalities and exclusion. In this context, the private sector can hardly add anything to the cooperation system and therefore the private and public sectors must be kept apart in the development community –meaning that the private sector should be excluded, as far as possible, from the cooperation system–.

From a totally opposite view, for the white-collar workers of development, the definition of development is economic growth. They assume that the latter will trickle down –thanks to market mechanisms– in a fairly equal fashion to the entire population. Therefore, the main objective for both the Administration and companies, as regards the private sector, is to maximise profitability. A higher profitability means more growth and well-being for all. So, support from the public to the private sector must be unconditional –companies will always do good in development terms–.

On the basis of previous studies,[1] we believe that there is actually a case for a more active role of the private business sector in development cooperation. However, for the potential beneficial effects to turn into a real impact, it is essential to acknowledge both the limitations of the private sector in promoting human development and the conditions under which foreign or local investment can have an impact on development.

This paper concludes a research project on the development effects of domestic investment initiatives promoted by development finance institutions (DFIs). The initiative, funded by the Spanish Agency for International Development Cooperation (AECID, its initials in Spanish)[2] has attempted to track the effects on development of a selection of Colombian private companies –all supported by different DFIs–. The case studies were conducted on the basis of a theoretical framework on the impact of investment on development.

We share the idea that economic development and social well-being are actually linked and can reinforce each other. For this to be true, a wider, more complex definition of economic development must be adopted. Rather than limiting it to economic growth, it is necessary to take into account the impact of economic activity on structural change, balance of payments equilibrium, the provision of both basic and non basic goods and the labour structure. For most of the cases, to ensure these effects, both public and private sectors will be needed.

Policy recommendations are addressed to DFIs and are focused on their investment projects in private companies, which are often channelled through financial intermediaries. They are specially meant for AECID, whose recently created fund FONPRODE allows it to support the private sector in developing countries through different financial vehicles, a tool that already exists in all other DFIs.

This policy brief reviews what can be considered the three main debates or challenges concerning the role of the private sector in development cooperation. We shall now see the ways there are to ensure the development effects of donor-supported domestic investment in developing countries. In a subsequent section we shall deal with the concept of the private sector’s additionality in promoting development. The third section will review the ways to institutionalise the contribution of private companies to socio-economic development. In the last section we present some conclusions.

Development Outcomes

- As a DFI, choose your development objectives in supporting the private sector.

- Define your strategy on the basis of the private sector’s development mechanisms.

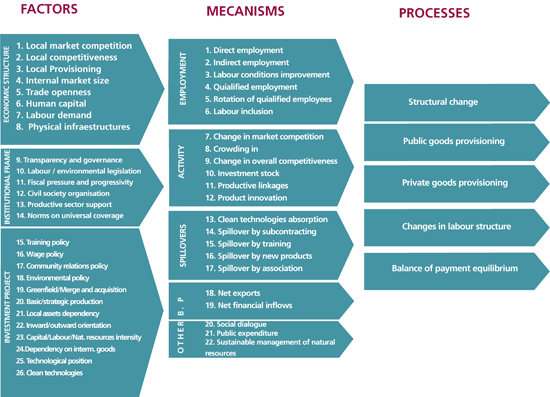

The analytical framework (Olivié et al., 2012) mentioned above can indeed be a tool for defining donors’ strategies and identifying specific programmes or projects for supporting development-friendly domestic investment. There are 22 ‘development mechanisms’ which are the result of different combinations of the host country’s features (economic and institutional) and those specific to the investment projects. These mechanisms derive into five types of development results (structural change, balance of payments equilibrium, the provision of both basic and non basic goods and the labour structure) and can be grouped into four types of mechanisms: labour, economic activity, technological and balance-of-payments.

Chart 1. Analytical framework for identifying development outcomes of local investment

- Choose the development targets according to your own strategy and the development needs and priorities of the partner country or region.

The Estrategia Nacional de Cooperación Internacional (ENCI), the document containing the strategic framework for international donors in Colombia, sets among others the objective of overcoming the productivity deficit in the primary sector, specifically in the agriculture and fisheries branch, that records a very low competitiveness and a high contribution to the GDP. For DFIs to align with partner countries’ priorities, for the Colombian case, they should target technological and economic activity mechanisms.

Moreover, the DFI’s target can be, as in the case of Spanish cooperation, to promote inclusive growth. If this is the case, the target of structural change should be complemented with a pro-poor focus, choosing to support domestic investments that actually promote competitiveness and productivity among the ‘left aside’.

- Chose your tool according to your geographical coverage and your target.

Obviously, different geographic contexts mean different needs. For the case of Colombia, in general terms, it can be said that the financial industry for development-friendly investment projects has flourished in the last few years. In this context, simply promoting the abundance of financial tools may not be an adequate target; that may seem more suitable for other (perhaps Subsaharan) regions.

Therefore, different contexts and objectives may also mean different investment tools (ie, seed funds, hedge funds or growth funds).

- Are there enough development-friendly investments to support? Establish second- and third-level priorities.

One of the reasons DFIs have targeted the mere appearance of a financial industry of the financially-excluded domestic companies in developing countries is that there are not so many of those that, additionally, can guarantee a development impact in terms of structural change, balance of payments equilibrium, the provision of basic or non-basic goods or the creation of quality employment. If we take this more narrow definition of effect on development, there might be more refundable assistance by DFIs than projects to be supported.

Moreover, among them, the DFI might choose only those that would mean a contribution to both the host country development strategy and the donor’s priorities. In these cases, it is advisable to select second- and third-level priorities. Going back to the Spain-Colombia example mentioned above, Spanish cooperation might establish the promotion of Colombia’s exports as a secondary priority for private sector development in Colombia.

- Refine your monitoring and evaluation systems.

- Take into account the role of financial intermediaries (that will be a key element of the short-term impact on development).

One thing that distinguishes refundable assistance from grants is that, in most of the cases, support to the private sector goes through intermediaries. DFIs transfer to investment funds that then support productive initiatives. This is a key element in the correct design of the whole decision-making process, from identification to ex-post evaluation. The ex-ante evaluation tool must not only take into account the features of the investment project it supports at the end of the chain (ie, whether it contributes or not to increasing exports). It also has to be based on the idea that there is an intermediate decision maker that can influence the development outcome.

- Complete ex ante evaluation tools with development outcomes indicators.

There are several ex-ante evaluation tools for DFIs. GPR (Geschäftspolitisches Projektrating) and DOTS (Development Outcome Tracking System) are two examples. As already argued (Buendía, 2012;[3] Olivié et al., 2012), they usually take a ‘do no harm’ approach by trying to avoid side effects such as environmental damages or child labour. Moreover, these tools usually include profitability indicators as a measure of development outcomes. Although necessary, profitability only reflects the investment project’s sustainability. Therefore, a more comprehensive vision of development is needed. On the basis of the above-mentioned analytical framework, we recommend the inclusion of ‘pro-development’ objectives such as labour creation or technological upgrading.

- Build your monitoring and ex-post evaluation tools on the basis of a more complete ex-ante evaluation tool.

Another advantage of setting a more demanding identification toolkit (in terms of development outcomes) is that the monitoring process and the ex-post evaluation system can be designed on that same basis. If the tool works, there should be no big surprises when it comes to evaluating the development results.

Additionality

- Base your investment decisions on measureable additionality criteria.

Additionality of DFIs has traditionally been assessed within the financial industry. From this approach, a DFI intervention is considered additional when it takes place in underserved financial markets, playing a pioneer role that commercial banks and private investors are not willing to play. More recently, due to the increase of this type of aid, civil society analysts have tracked these flows and due to the size, sector and fiscal domicile of many of the firms targeted by DFI, they have questioned the added value of such investments for local communities. From this point of view, additionality would entail a higher development impact from companies supported by DFIs in comparison to other companies. Finally, under aid effectiveness criteria, a DFI is expected to specialise according to a rational labour division between donors and, therefore, its additionality also depends on the added value of its home country in comparison to other international donors (see recommendation 1).

All three meanings of additionality should form part of a set of measurable criteria orienting investment decisions and facilitating reporting and evaluation. FONPRODE, in fact, has already integrated the third one in its ex-ante evaluation tool.

Institutional Issues

- Integrate capacities from the financial industry and the development community.

- Scale up your business support activities by means of financial intermediaries.

International donors willing to support development-friendly investments and aiming to reach a relevant number of beneficiaries need to work in partnership with other actors, especially if they aim to reach small-medium enterprises (SME). According to the Busan principles, these interventions should mobilise other financial flows and innovative financial mechanisms must be developed. Obviously, the knowledge and human resources needed for such a task can be found in the financial industry. Commercial banks, private equity funds, microfinance institutions and second-level financial institutions are needed as new local counterparts for international cooperation agencies.

- Reinforce professional capacities with knowledge on economic development.

Financial industry professionals are focused on financial techniques. DFI guidelines often do not question private sector impact on development. Experts from the development community are used to analyse interventions in terms of development impact but usually have a greater interest in social and legal issues. At some point business outcomes have to be assessed from a development approach and adequate professional capacities are needed. The impact investing community is already raising awareness on the fight against poverty among members of the financial industry.

- Ensure transparency all along the aid chain.

Channelling aid through different levels of intermediaries makes monitoring and reporting more difficult. When such intermediaries are private companies they might be more concerned about keeping commercial information secure than reporting to citizens. The international consensus on aid effectiveness, including accountability requirements, must be met whenever aid is being managed, no matter who the manager is. The recommendations in this document will not be effective if policy makers do not receive feedback on their progress due to the opacity of financial intermediaries.

- There is no reason to keep private-sector support and reimbursable aid apart from donor coordination activities.

Financial institutions managing development funds as well as multilateral banks have been operating officially as development actors for years. However, in the case of Colombia, they do not form part of any coordinating body led by the Presidential Cooperation Agency and there is no exchange of information between DFIs and traditional cooperation agencies. At a higher level, the OECD Development Aid Committee has trouble in completing its ODA statistics with information on these activities. There is no reason to keep private sector support and reimbursable aid apart from donor coordination activities and Spain can become an example of how aid effectiveness improves when integrating different tools in a single agency with a single strategy.

- Take advantage of partnership opportunities.

Defining a clear strategy as explained in point 1 will also help development actors like AECID to identify strategic partnerships for more effective support to the private sector. For Spain and other bilateral donors, some of the potential partners could be the multilateral banks of which they are members, since they have a longer experience in financial markets and direct dialogue with national financial authorities; national development banks; second-level institutions reaching commercial banks and investment funds; the impact investment community, disseminating pro-development investment approaches among investors and financial intermediaries; and multinational companies, especially from the financial sector, willing to join public agencies as co-investors for the development of regions and sectors of their interest.

Conclusions: The Busan declaration advocates strategic partnerships of different kinds so that development cooperation can be scaled up with contributions from non-traditional cooperation actors, including private companies, which play a central role in ‘advancing innovation, creating wealth, income and jobs, mobilising domestic resources and in turn contributing to poverty reduction’. This is an appeal to overcome cultural differences and build strategic partnerships between development and financial institutions.

Spain has already made progress in this field by integrating in its main cooperation agency, AECID, an investment tool addressed at private companies in partner countries. In order to improve the tool’s effectiveness, different challenges have to be overcome. Although the private sector’s potential contribution to development is clear in general terms, a better understanding of the development outcome from private companies at the micro level is needed to improve strategic planning, decision making and monitoring and evaluation. Additionality criteria also need to be refined in order to maximise each actor’s contribution to development. Finally, institutional capacities have to be adapted to manage private sector support activities with a development approach.

Although these are pending issues for most international donors, ODA and other public flows to the private sector are increasing significantly and DFI are becoming more important actors in development cooperation. Spain, with a commitment to aligning private sector support to the development agenda, can face these challenges as an individual donor but also lead efforts at the international level. A Busan building-block might be the adequate initiative to concentrate such efforts.

Iliana Olivié

Senior Analyst for International Cooperation and Development, Elcano Royal Institute

Aitor Pérez

Project Coordinator, Foreign Investment and Development, Elcano Royal Institute

[1] Iliana Olivié & Aitor Pérez (2012), ‘Los efectos en desarrollo de la ayuda reembolsable al sector privado: estudio de caso en Colombia’, DT nr 18/2012, Elcano Royal Institute, December; and Iliana Olivié, Aitor Pérez & Carlos Macías (2012), ‘Inversión local, cooperación financiera y desarrollo: reflexiones sobre el FONPRODE’, DT nr 4/2012, Elcano Royal Institute, March.

[2] Funding provided through Convocatoria Abierta y Permanente (CAP), reference 11-CAP1-0186.

[3] Luis Buendía (2012), ‘Metodologías para la evaluación de impacto en desarrollo de la ayuda reembolsable: la experiencia europea’, document presented at the I Congress of Development Studies – REEDES, Santander, 14-16/XI/2012.