Also available the Spanish version: Rectificando el desconocimiento mutuo: redescubrir Filipinas como puerta de entrada a la ASEAN.

Theme: The centre of Asian growth –ASEAN and East Asia– has strong commercial links with the EU, the US and Japan. But Philippines and Spain have shared four centuries of colonial experiences and this should have translated into a robust post-colonial relation. Paradoxically, the mutual ignorance of the business communities of the two countries has aggravated Spain’s retreat from the Philippines, culminating in an irrelevant economic relationship.

Summary: When confronted with Spain’s commercial irrelevance in Asia, pundits cite the following as impediments to an expanded Spanish presence: geographical distance, bureaucratic barriers, cultural differences and an abundance of opportunities in Europe. These beliefs continue to guide Spanish managers’ strategic actions, in spite of evidence to the contrary. Consequently, a commercial paradox has resulted whereby post-colonial economic relations have been marked by Spain’s irrelevance.

In this paper we attribute this commercial paradox to the mutual ignorance of Spanish and Filipino managers of their potential to work together. Consequently, managers pursue strategies that are incongruent to market realities and that imperil a venture’s viability. To reverse this sorry state we recommend three lines of action: (1) to focus on complementing strengths that create effective partnerships; (2) to create policy mechanisms that dismantle legal and administrative barriers to trade and investments; and (3) to deepen mutual understanding and capabilities through ASEAN-focused executive education and public-private sector forums.

Key words: Philippines, ASEAN, Strategy-Opportunities Framework.

Analysis: Asia’s stellar economic growth has attracted investments from global companies. While European firms tend to focus on China, global investors are fully aware of opportunities in ASEAN.[1] Dubbed the ‘sick man of Asia’, it is now the Philippines’ turn to surprise everyone. Buoyed by credit-rating upgrades, while Europe suffers downgrades, the Philippines have delivered 6% to 7.2% economic growth since 2008. Such a performance has come about from enhanced transparency and higher foreign currency and tourism inflows. By 2013, business process outsourcing (BPO) generated US$16 billion in revenues, while remittances from Filipinos abroad topped US$25 billion.

Spain’s four centuries of colonial experiences in the Philippines should place Spanish companies at a commercial advantage. However, after a century of post-colonial retreat that only intensified during the 20th century, Spanish economic influence is conspicuous for its irrelevance. Pundits on Philippine-Spanish economic relations attribute this absence to geographical distance, cultural differences and bureaucratic barriers.[2] Abundant domestic opportunities kept Spanish companies home. When the Great Recession hit Spain hard in 2008, many of these Euro-centric companies went bust.

Indeed, Spain’s commercial irrelevance contrast with the heights reached during its galleon-trade monopoly (1565-1815). Benito Legarda, in his book After the galleons: foreign trade, economic change, and entrepreneurship in the nineteenth century Philippines, noted that the Philippines were the Asian centre of the Seville-Acapulco-Manila trade route. Commodities such as spices, porcelain, ivory, lacquer and silk from China were exchanged for Mexican silver (as the currency of trade). Some estimate that a third of Mexico’s silver production, which was substantial, ended in Philippine coffers as payment for Spanish imports.

The galleon trade that Spain monopolised connected the Philippines to the imperial economy. Spain’s commercial dominance diminished with Mexico’s independence in 1815. To keep the lucrative trade afloat, private ships were allowed to ply the trade route. The agricultural potential of the Philippines was increasingly becoming recognised, with the cultivation of export crops transforming Manila from an Asian trading gateway into a source of agricultural supplies. British and American merchants saw this transition as an opportunity that led them to fund agricultural expansion. Ultimately, the Philippines became a major exporter of sugar, abaca, tobacco and coconut oil, whereby control of the economy shifted to Anglo-American interests. At this point, Spain’s grip on Philippine commerce was irreversibly lost.

Shared colonial experiences usually imply close economic and trade links between the former colonies and their coloniser. Pankaj Ghemwat put forward this hypothesis in the DHL-IESE Business School’s study on global connectedness. As an example, the Commonwealth of Nations provides the UK with a platform to assert influence while retaining commercial links to its former colonies. The projection of US power left a strong imprint on the socio-economic landscape of host countries, the Philippines being a classic example. Fifty years of tutelage implanted US political, legal, economic and social structures with a Filipino twist. While little is left of Spanish commercial influence, Christianity remains deeply embedded in Filipino customs and culture.

This brief historical context raises intriguing questions, whose answers have commercial relevance for business. Specifically:

- What caused Spain’s loss of influence and its eventual decline into commercial irrelevance in the Philippines and Asia?

- In contrast, why do specific Spanish brands prosper and are ubiquitous among Philippine and ASEAN consumers?

- Can Spain regain its commercial relevance, and how can it do it?

Spain’s diminished stature is greeted with a mixture of regrets or déjà vu. Moves to strengthen Spain’s ties to the Philippines and Asia are tentative. Often, initial enthusiasm is tempered by a sudden realisation that the terrain has become unfamiliar. However, deep-seated ‘managerial wisdom’ that is incongruent with market realities persists in guiding strategic actions. Specifically, note the following contradictions:

- Geographical distance is an insurmountable barrier. However, Spanish managers salivate at cracking China’s market of 1.3 billion people. Within three hours flight from Shanghai, the expatriates’ preferred city in China, Manila and the ASEAN capitals are considered distant unknowns.

- Bureaucratic barriers pose serious constraints to doing business in ASEAN economies. In contrast, Spanish managerial enthusiasm for Latin America is undiminished by sequestrations, expropriations and sovereign defaults.

- Cultural differences are pronounced and are compounded by differences in language and history. Ironically, common colonial experiences with the Philippines are a blur to Spanish managers.

These assertions became embedded as core beliefs for Spanish managers. Consequently, strategic actions became Ibero-centric. Selective international expansions tends to focus on the ‘familiar’ Latin American and ‘safe’ southern European markets.

Given these assumptions, how do these core beliefs impact on the strategic positioning of Spanish companies?

Latin American opportunities became available when waves of privatisation allowed Spanish businesses to acquire and control local companies. However, as the populist agenda regained acceptability, the ‘liberal’ economic approach pursued by Latin American governments converted into ‘protectionist’ populism. Brazil was the latest to re-affirm this policy shift.[3] In short order, foreign investments, previously seen as Latin America’s economic saviour, felt less welcome.

The European common market reinforced Spain’s Euro-centric commercial strategy. Clearly, the common market’s framework eased the entry of capital, goods, services and people. In turn, this facilitated the expansion of Spanish business into a ‘new European’ domestic market. With few exceptions, the projection of Spanish commercial interests in Europe was strongest in the ‘southern belt’ comprising Portugal, southern France and Italy. Notwithstanding this narrow regional bias, specific industries emerged as truly European and global in scope: construction (Ferrovial, Acciona), power (Iberdrola), communications (Telefonica) and financial services (Banco Santander and BBVA).

Most Spanish companies, however, remained homebound. Without a diversified market portfolio, they floundered when the 2008 Great Recession hit Europe hard. Euro-centric companies’ revenues declined sharply, resulting in mounting losses. Caught unprepared, Spanish managers belatedly scrambled to grasp Asia’s growth opportunities. After seven years of trying, Spanish managers have little to show for their efforts.

Spain’s commercial irrelevance is self-inflicted, largely arising from strategic miscalculations. We posit that these firm-specific factors are contributory:

- Opportunism replaced depth of strategic understanding to inform strategy.

- Presumptions passed for ‘unassailable truths’, hence reinforcing erroneous premises that guided strategic actions.

- ‘Sell-purchase’ transactions diminished the importance of relationships and commitments in sustaining partnerships.

To Spain’s credit, its accession to the EU transformed a middling income economy into an industrial nation. Spain’s economic progress was made manifest in its modern infrastructures and technological leadership in certain sectors. For instances, Spanish companies lead in renewable energy (Iberdrola and Acciona), waste technology (Masias), and environmental services (Ros Roca). In terms of scale, Spanish companies are in leading positions in a number of industries, such as banking, telecommunications, power, construction and infrastructures, consumer goods and tourism.

However, to a Filipino manager, Spanish companies are generally known for their vices and failures. This negative view is reinforced by news coverage, in which the Spanish economic crisis and corruption are staple offerings. Perhaps for this reason, Filipino managers are pleasantly surprised when they come across credible Spanish companies. This initial surprise turns to excitement at the prospect of profiting from commercial opportunities. This is reinforced when Filipino managers find specific Spanish goods, services or technologies that they can actually use. However, when the initial excitement dies down, Filipino managers struggle to reconcile Spain’s image with what Spanish companies can credibly offer.

Cautiously, Filipino managers seek tangible demonstrations of commitment and capabilities from Spanish companies. Unfortunately, Spanish managers find this disconcerting. Convinced of Spain’s ‘commercial advantage’, some Spanish managers presume that this is a known and accepted ‘fact’. At this point, the managers’ mutual ignorance becomes fatal. Much as some Spanish managers claim ‘commercial superiority’, they often remain unknown entities to Filipino and Asian managers. Worse, a number fail to live up to their hype, dashing the Filipino managers’ initial enthusiasm.

In this paper we offer a steady level perspective that differs from the pundits’ view of Spanish-Philippine (or Asian) commercial relations. We start by examining what Spanish companies are missing by strategically ignoring the Philippines and ASEAN. We identify feasible entry points to ASEAN opportunities, and how the Philippines can provide an ASEAN gateway for Spanish business. Throughout our analysis, we use our People–Opportunities–Place (POP) and Strategy-Opportunities Frameworks to develop a coherent and practical roadmap. We conclude by highlighting specific actions for the government and for companies. In embarking on this journey, managers can rediscover a 21st century galleon route that reconnects Spain to Asia (and vice versa) through the Philippines.

What Spain’s missing out from in ASEAN

A reversal of fortunes is occurring. Spain’s economic boom turned to bust, with recovery a painfully slow process since 2008. But the ‘sickly’ Philippines delivered its historic best in economic performance, outpacing its ASEAN peers. By ignoring the Philippines and ASEAN, Spanish managers failed to: (a) participate in the opportunities of high-growth markets that could be greater than Spain’s; (b) rebalance their portfolio of opportunities by shifting away from low-growth and high-political-risk markets; and (c) leverage on an internationally mobile talent pool to support their global expansion.

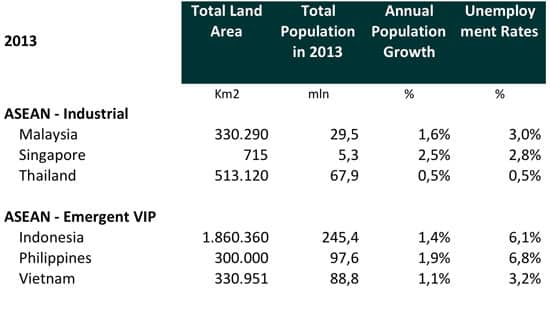

ASEAN’s population of 617.2 million earned a gross domestic product (GDP) of US$2,398 billion in current value as shown in Figure 1. The major ASEAN countries had 2013 per capita incomes that were significantly higher than India’s US$4,000. Malaysia and Thailand exceeded China’s US$9,800, with fast-growth Indonesia and Philippines closing the gap with China. Trade and investments were important pillars in sustaining growth and ensuring continued prosperity. Inflation rates were well within prudent ranges, implying a better capacity to improve purchasing power and preserve wealth. ASEAN’s shifting consumer needs and industrial structures, could offer ample opportunities for incorporating new technological inputs and services.

Figure 1. ASEAN economic and trade profile

The Philippines led in economic growth, while lagging in attracting foreign direct investments. Spain contributed an insignificant share, which investors attributed to the following structural constraints:

- Foreign ownership is legally limited to a maximum stake of 40%.

- Regulatory uncertainty is high given unpredictable changes in rules.

- Bureaucratic inefficiencies compound the country’s low ratings in terms of ‘ease of doing business’.

These factors are examined more closely under our People-Opportunities-Place (POP) framework. Suffice to say that the Philippines’ restrictive business and regulatory environments contrast with the ‘ease’ with which Spanish companies gained control of Latin American industries. However, this Spanish ‘managerial wisdom’ deserves to be questioned. The realities are: Bolivia[4] (Red Eléctrica and Iberdrola) expropriated, Argentina[5] (Repsol) sequestered and Venezuela[6] (Banco Santander) repurchased Spanish assets. Argentina is into its eighth sovereign default[7] over the past century.

The pundits cite low Philippine foreign direct investment inflows as evidence that support their ‘managerial wisdom’. Seen from a myopic legal perspective, a number of Spanish lawyers see foreign ownership limits as unsurmountable risks. As a result, lawyers turned economic principles on their head: they advised their clients to ‘invest as little as you can get away with, take as much of the profits as you can and bear no financial risks’.

This legalistic stance contrasts with what entrepreneurs do. They see the poor foreign direct investment performance as symptomatic of deeper inefficiencies. Reframed as arising from business constraints, two sets of opportunities can be identified:

- Companies could shape future opportunities by offering solutions to resolve the constraints.

- Companies could take early positions, hence giving them options to benefit from the financial returns of future opportunities.

Specifically, we observe that the Philippines’ weak industrial fabric, high power costs and poor infrastructures limited the investments that could provide attractive returns. However, instead of wringing their hands, successful investors capitalised on the strengths of the Philippines while seeking to resolve the constraints that impeded investments.

Perhaps not surprisingly, the pundits and their lawyers focus on finding reasons why they should not invest in the Philippines. Unfortunately for them, entrepreneurs saw a more immediate opportunity in the service sector and took action.

Plagued by these physical constraints, Filipino managers have worked with their foreign partners to transform the service sector by building up BPO capabilities. This approach leveraged on the more advanced communications infrastructures that benefited from prior market liberalisation. Combined with the Filipinos’ high language and professional proficiencies, BPO overcomes the Philippines’ weakness given the industry’s lower dependence on cheap power and superb infrastructures.

ASEAN’s economic dynamism, underpinned by entrepreneurial initiatives, contrasts with the lower growth potential of Europe and Latin America. Seen as portfolios of opportunities, Spanish companies are generally overweight in Europe and Latin America while short in high-growth ASEAN countries. This positioning portends a slow corporate recovery and rising political risks. A higher ASEAN weighting could rebalance the portfolios’ risks-payoffs.

Turning to Asia, Spanish managers are dazzled by China’s enormous size. Simplistic, but erroneous, calculations are employed to prioritise their presence in China. This is how the thought process goes: if only a fraction of China’s population consumes Spanish products it would be possible to exploit a demand larger even than Europe’s. But turning from fantasy to reality, the question is: why is this Chinese ‘consumer boom’ unrealised by Spanish business?

Let us consider a typical experience, in which a European wind-turbine manufacturer realised its miscalculation, much to its regret. As a pioneer in China, it supplied 85% of an emerging wind-turbine market under a ‘sell-purchase’ transaction. This involved the export to China of the existing turbine models that were being sold in Europe, with minimal after-sales services and financing and some form of local assembly.

Within five years, sales slumped to insignificant levels while the Chinese turbine market expanded. Three things occurred: (1) Chinese contractors learned fast and produced cheaper substitutes, thus becoming competitors; (2) competing technologies became better; and (3) late global entrants gained market share by offering integrated services, development capabilities and financing.

In the Philippines the company blamed its mixed fortunes on the lack of subsidies. This is curious since Philippine power prices were high and rising, making subsidies less important. In addition, the approved feed-in tariffs for Philippine wind farms were higher than most European subsidies. While the company’s managers were busy justifying their predicament, Denmark’s Vesta bagged their contract with the Philippine Energy Development Corporation (EDC). By the end of 2014, Asia’s largest wind-power project, a 150 MW wind farm, will be ready to operate commercially in the Philippines.

Where did our European wind-turbine manufacturer fail?

The company chose to use Singapore as its regional base with a small sales team for the Asia-Pacific region. With Singapore’s small land area and population, wind farms are least likely to flourish in such a market. Meanwhile, their sales team was too far away, in relation to competitors, from the major demand centres in the Philippines, Thailand and Indonesia in ASEAN, and from Australia and New Zealand. This locational decision resulted in insufficient customer coverage. Consequently, the company utterly failed to grasp the obsolescence of its technological offering and its outdated ‘sell-purchase’ approach.

By contrast, Inditex offers a success story. Through Zara and its affiliated brands, its Philippine franchisees are doing brisk business. Conversely, its Spanish competitors exporting similar goods floundered. The difference? Inditex established a physical presence through its franchisees’ shops, supported by marketing and logistics, thereby making their presence ubiquitous. Meanwhile, its competitors followed a variant of the ‘sell-purchase’ approach. In a market defined by fashion image, the combination of brand, logistics and marketing was essential to differentiating an offer. Hence, lower prices diminished as a fleeting (non-) advantage.

Financial services highlighted the success of Mapfre (the Spanish insurer), contrasting with a major Spanish bank’s exit during the 1997 Asian financial crisis. Awarded one of 10 full banking licences, the Spanish bank acquired local firms to expand its ASEAN stock-brokerage business. When losses mounted, the Spanish bank sold its Philippine operations to Banco de Oro, then a medium-sized Philippine bank. Fast-forwarding to the 21st century, Banco de Oro’s acquisitions and growth made it the largest Philippine universal bank.

Mapfre took an incremental approach. Recognising its limited market knowledge, it used its re-insurance business to gain expertise in the various insurance business segments. Over the years, Mapfre acquired Philippine insurance companies to gain market presence. Eventually, it merged its Philippine operations with Insular Life, a century-old market leader. As Mapfre evolved, it introduced new services such as its road and travel assistance through Ibero Asistencia and specialty insurance products.

By 2014 Mapfre had achieved market leadership in reinsurance as the only foreign firm with a local presence. It led as a major motor-vehicle insurer and ranked fifth in general insurance. Through its Philippine presence, Mapfre now services its ASEAN insurance and re-insurance business.

Entry points and the ASEAN Free Trade Area (FTA): demographic dividends and regional integration

Companies broadly reap ASEAN’s demographic dividends in two ways: (1) by offering goods and services that are appropriate to transitioning economies; and (2) by providing technological inputs that expand the local companies’ market offerings. The ASEAN Free Trade Area (AFTA) could propel convergence of standards and greater freedom in the flow of capital, goods, services and labour.

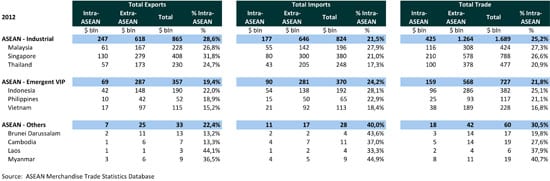

Figure 2. Intra-ASEAN Trade and Connectedness

Under this emerging economic liberalisation, aspiring gateways to ASEAN need to possess a minimum of these factors:

- The size of the domestic market. A credible presence is important in at least one of the major markets, identified as ‘Industrial’ or ‘Emergent VIP’ in Figure 1.

- The existence of a talent pool. Local talent is a source of competent managers and potential consumers.

- Market transparency and linkages. Market connectedness facilitates access to AFTA markets that allow tariff-exempt commerce from 2015.

Excepting financial services, which Singapore dominates, the ASEAN five meet these criteria. They are the emergent VIPs (Vietnam, Indonesia and the Philippines) and two industrial economies (Thailand and Malaysia), as shown in Figure 2. Myanmar is working on its political transition, presenting its own distinct opportunities and challenges.

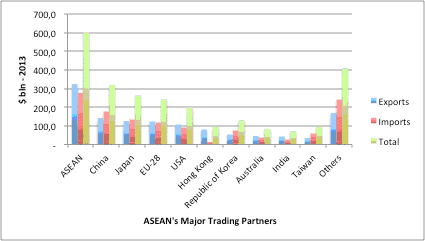

Regardless of the politicians’ preoccupation with protecting their local industries, ASEAN integration is further along than generally recognised. Industrial complementation in automotive, electronics and information technology is a reality, with Philippine and Thai factories relying on parts suppliers from Malaysia (or vice versa). This explains the high intra-regional trade shown in Figure 3. Increasingly, ASEAN supply and production chains are linked to the global logistics of multinational firms.

Figure 3. ASEAN Global Trade Flows

Source: ASEAN trade statistics.

Industrial complementation was brought to a transcontinental context. Alliance Global Group, a Philippine company, owns Emperador, the second most important global brand for brandy according to The Spirits Business. The company imports Spanish brandy distillates, which were Spain’s top export to the Philippines in 2013, for blending and local bottling into their best-selling Emperador Light. To secure their distillates supply, the company acquired a 1,000 hectare vineyard and distillery in Jerez de la Frontera, Spain. With this acquisition, Alliance Global Group became the largest Philippine investor in Spain.

Single-handedly the company re-acquainted Spain and the Philippines on how strategic complementation could create a strong international presence. While still half the size of top ranked Jinro, Global Alliance Group offered an example as to how Philippine companies could project their commercial interests. By 2013, the company sold 31.9 million cases of nine litres case, against Jinro’s 65.6 million cases.

Replicating their Spanish brandy success, Global Alliance Group acquired Whyte & MacKay from the UK’s United Distilleries of Scotland. While these are still early days, the whiskey venture has the makings to achieve a similar outcome as the brandy business.

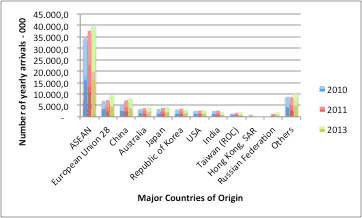

Figure 4. Tourism Arrivals to ASEAN

Source: ASEAN statistics.

Tourism follows similar patterns as those exhibited by trade, as shown in Figure 4. As a bloc, Europe tops tourist arrivals to ASEAN when intra-ASEAN flows are excluded. The degree of regional connectedness comes as no surprise, partly explained by administrative and economic factors.

Specific to the Philippines, Filipino tourists require at least a month to obtain Schengen visas to travel to Europe. With few exceptions, ASEAN nationals face similar constraints. Within ASEAN, visa-free travel for nationals contributed to the growth in intra-regional tourism. In recent months, Japan lifted visa restrictions for Filipinos, a move that propelled sharp growth in Filipino tourist arrivals to Japan.

The costs of travel represented an economic barrier for tourists from Europe to ASEAN destinations. However, administrative and non-economic barriers may account for the Philippines’ small share of the Spanish tourist market. A cursory review of Spanish travel agents’ advertising of Asian tours provides a clue. While Thailand is well advertised, the Philippine islands as a tourist destination hardly appear. Without this institutionalised link to the Spanish tourist trade, Spanish tourists often accidentally ‘discover’ the Philippines through friends, families or Filipino domestic staff.

While the constraints are real, mutual ignorance between Spanish and Filipino managers deters the expansion of their commercial interests. Consider the following:

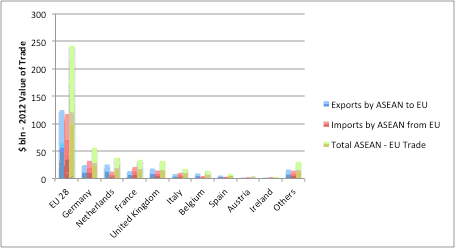

- The Intra-ASEAN trade shown in Figure 3 mimics the colonial trading links that connected the Philippines as the Spanish gateway to China, Japan and their neighbours as important trading partners.

- Replacing Spain in Figure 5, Europe’s dominance today mimics the positions of the colonial East India companies created by Dutch and British merchants, with the defunct Tabacalera (or Tabacos de Filipinas) as the closest Spanish equivalent.

Germany, the Netherlands and the UK have benefited from their companies’ long-established presence. In the Philippines, private companies such as Siemens, Royal Dutch Shell, Unilever, Philips and Lufthansa Teknik, to name a few, have replaced the East India companies. Notwithstanding the Philippines’ lower affinity for French products, French brands are ubiquitous in fashion (Yves Saint Laurent, Chanel), food (Danone), perfumery (Christian Dior) and luxury brands (Louis Vuitton), among others. Energy (Total) is a more recent entrant, once the energy market was liberalised.

Figure 5. EU trade with ASEAN

Source: ASEAN statistics.

The Netherlands’ dual taxation treaty with the Philippines reduced the fiscal burden that enhanced profits retention by investors and companies. Together with the UK, administrative efficiency eases financial settlements at lower costs. In contrast, Spanish and Philippine banks charged among the highest fees for international transactions. Unfortunately, they were also the least sophisticated in meeting international investors’ needs for financial services.

For investing or exporting, companies in Spain and the Philippines faced two choices when responding to these barriers: (1) abort the investment or trade; or (2) fund the transaction by employing banks operating from more administratively efficient jurisdictions. In the latter case, the already limited presence of Spanish companies in Asia was further undermined.

Philippines as ASEAN gateway: how viable?

Market entry strategies and the choice of entry points are examined here by using our People-Opportunities-Place (POP) framework. Through their dynamic interactions, business ideas can produce returns that investors can uniquely appropriate. Specifically:

- People provide the pool of consumers and talent that feed into a virtuous (or vicious) cycle. A young and growing population fuels economic opportunities.

- Opportunities are expanded when competition sharpens a firm’s response to technological, economic and market disruptions. Under such dynamic interactions, shifting market niches open up entry points for new product or service offerings.

- Place defines the market structures that influence their attractiveness. Secure legislation, regulation and transparency allow appropriating returns as just rewards for risk-taking.

We will now examine the Philippine case along these three strategic dimensions in relation to its ASEAN peers. We will focus on how Spain and the Philippines might rediscover a 21st century ‘Galleon route’ to mutual prosperity.

People: tapping into a talent pool and growing market

Overseas Filipino workers (OFWs) are ubiquitous in Europe, the Middle East and the US. They contribute to the wellbeing of their host families by providing care to the elderly and domestic services to households. In addition, the professional ranks in the service, marine and technical sectors are growing. For example, Filipino sailors account for a third of the maritime industry’s global manpower. Philippine entertainers are visible in Asian capitals, on New York’s Broadway, in London’s West End and on cruise liners.

Collectively, Filipinos abroad remitted in excess of US$25 billion in 2013 to their families, a sum that compensated the paltry US$4 billion in foreign direct investments. Remittances impact economic growth in a similar way to investments. Filipino households prioritise spending on education, shelter and consumption, with residual savings invested in entrepreneurial pursuits. As a result, remittances fuel expansion in real estate and construction, which in turn sustain growth in the consumption of durables as new households are formed. Fashion, food and entertainment follow global trends, given the mobility of Filipinos and their openness to experiment. Rising income leads to growing consumption that increases the demand for consumer goods and commercial floor space.

The Filipino households’ emphasis on education has created a cadre of talents that is globally mobile. Mobility has given rise to a managerial rank that is ubiquitous in Asian capitals, multilateral agencies and international bureaucracies such as the United Nations and its agencies. Closer to home, the Filipinos’ proficiency in English, information technology, engineering, accountancy and medical sciences, among others, provide a talent pool that support the rapid expansion of BPOs.

Complementing remittances, revenues from BPOs grew in excess of 20% annually over the past decade. As a result, the Philippines overtook India as the top provider of BPO services, earning US$16 billion in 2013 and employing 917,000 Filipinos. Philippine BPOs succeed largely because private initiatives are dominant, with the government merely playing a supportive role.

Given these success stories in deploying Filipino talent, why do managers see a skill shortage as a constraint to international expansion?

By default, Spanish and Filipino managers hire their own nationals for leadership roles. This approach heightens the limitations they face when expanding, such as: (a) linguistic deficiencies; and (b) inadequate expertise to operate in ASEAN or Europe. Understandably, managers cite a shortage of talent as a constraint to explain their predicament. However, this diagnosis can be erroneous: Spanish university graduates, half of whom cannot find employment at home, migrate to seek jobs abroad. In addition, top business schools such as IESE and ESADE have Filipino and Asian graduates every year who are recruited for senior leadership roles in global companies. Thus, while multinational enterprises routinely recruit top talents globally, Spanish and Filipino companies struggled to fill their executive vacancies with market-ready talent.

The difference? A meritocracy prevails in these global companies, which provide professionals with mobility, economic rewards and recognition for their achievements.

Given this context, some of the constraints are actually self-inflicted. With few exceptions, neither Spanish nor Filipino companies are fully equipped to hire, much less to delegate, managerial authority to non-nationals. Consequently, by failing to integrate local or internationally tested talents, market entry is constrained by a skills shortage. Worse, the ventures fail because of inadequate resourcing.

Opportunities: how can Spanish and Philippine firms mutually profit?

While BPOs and the consumer markets are flourishing, the industrial and agribusiness sectors are transitioning to achieve greater competitiveness under the AFTA. This implies a need to adapt production, supply chains, technologies and business strategies to ASEAN’s competitive realities.

In meeting these challenges, the needs of the Philippine companies have substantially changed. With copious corporate cash flows and a banking sector awash with liquidity, the need for equity investments has taken a lower priority. Instead, Philippine firms are in search of viable partnerships in the areas of technology, processing systems, automation, and access to global markets.

These market realities question the viability of the ‘sell-purchase’ model that managers are accustomed to. That is, Spanish exporters produce and sell while Philippine importers purchase and distribute in the Philippine market. This ‘sell-purchase’ transaction requires limited resource commitment while any marketing efforts are adjunct to home market initiatives. Increasingly, higher costs render this strategy untenable in the face of competition from well-placed global brands, or Asian and Philippine competitors.

At this point, geographical distance and costs discourage Spanish companies from pursuing Asian or Philippine opportunities. However, is this self-exclusion warranted?

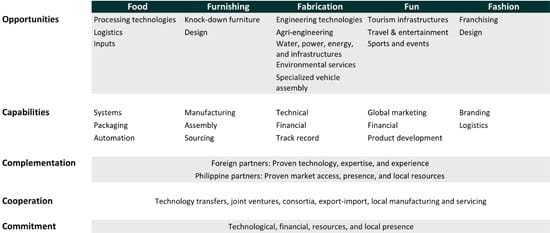

Figure 6. A strategy-opportunities framework

Our strategy-opportunities framework (Figure 6) offers an alternative to the ‘sell-purchase” approach. Premised on complementing capabilities and resources, Philippine companies benefit from technological inputs that improve design, efficiency and logistics. In return, Spanish firms potentially benefit from ready access to high-growth markets, while gaining a platform for ASEAN expansion. For partnerships of this nature to work, in-depth understanding of how the contracting companies could work together is essential.

Philippine opportunities are clustered into sector opportunities (the ‘five Fs’) that are undergoing structural transitions: food, furnishings, ‘fabrication’, fun and fashion. Specifically:

- Food processing and the agribusiness require advanced processing technologies to enhance yields. With high spoilage, returns could be enhanced through improved logistics and handling and a reconfiguration of supply chains.

- Furnishings benefit from rapid growth in residential and commercial construction. To meet higher demand, industrial scale production is needed to produce affordable, high-quality furniture and furnishings.

- ‘Fabrication’ requires technologies and know-how that improve efficiency, scale and scope. While Philippine firms are advanced in civil works, they rely on foreign technologies for structural and process engineering for infrastructures. Similar technology transfers are feasible in specialised vehicles (eg, ambulances and military applications), environmental services (eg, waste-to-cash) and specialised information technologies (eg, smart-metering and smart cities).

- Fun includes tourism, entertainment and sports, which benefit from rising incomes and closer integration within AFTA. The Philippines’ tourism potential, however, remains under-served given its limited integration in the global tourist markets. This contrasts with Spain’s highly successful tourism and sports programmes that continue to grow despite the economic crisis.

- Fashion demand shifts with rising incomes. The Philippines is a metropolitan market (especially Manila and Cebu) with income levels that are around three times the national average. Thanks to the spread of BPOs to regional markets, rising provincial incomes have broadened the fashion market.

Harbest AgriBusiness Corporation, a major agribusiness group, integrates foreign technologies and inputs into its agricultural modernisation approach. Starting out as specialists in seed marketing, Harbest and Taiwan’s Known You Seeds expanded their joint venture to include seed research and cultivation in the Philippines. Operating within an archipelago, poor logistics and infrastructure constrained agricultural growth. To address this problem, Harbest reconfigured the supply chain by encouraging farmers to grow food for their local markets. As a result, the need was reduced for inter-island shipping and cold storage. Subsequently, drip irrigation from Jain of India and Israel, hand tractors from Taiwan and agricultural inputs from Prathista of India were added to provide an integrated service to farmers. Ongoing farmers’ training was conducted with SM Foundation, while the farmers’ local produce was sold through SM Supermarkets. SM Group’s supermarkets possess the most extensive national shops network.

Learning from Harbest’s experiences, Spanish companies can employ our strategic framework (the ‘four Cs’), as shown in Figure 6, to guide their strategic actions. Specifically:

- Capabilities assessment starts with ‘knowing what you have’ that could complement a partner’s offerings. This requires a process of experimentation and validation.

- Complementation leverages on the strengths of Spanish companies in technology and process engineering, with market access provided by Philippine partners.

- Cooperation defines the structure and governance of the venture.

- Commitment is the litmus test on how commonly agreed strategic actions are supported with time, money and people.

To better understand how Spain’s commercial irrelevance came about, let us examine the scene:

- A Spanish agricultural company boasted of its ‘world-class’ products. In repeated field trials it came last, behind the other four competitors: one Indian, one Taiwanese and two Philippine suppliers. This was how it responded to its failures: (a) it considered the field trials flawed; (b) it required its prospective partner to purchase the inputs with limited marketing support; and (c) it refused to provide technical support because the market was too far. Unfortunately, these responses were common among companies pursuing a ‘sell-purchase’ approach to gaining markets.

- In contrast, competitors fully supported their product introductions with technical training, the education of farmers and extensive field trials. Thus, while Spanish managers were busy justifying their misfortunes, their competitors were reaping commercial success. The competition succeeded by helping to turn their Philippine partners into a market leader.

Food processing and football clinics provide contrary examples. Consider the following:

- Leche Pascual, a dairy-based food processor, tested a number of its solid yogurts in the Philippines. Its first attempts transplanted its Spanish offerings (flavours) and failed. The company analysed why its ‘superior’ yogurt failed, while competitors such as Yakult and Danone were succeeding. It discovered that Filipino palates were less familiar with yogurt and did not like the sour taste. To adapt to the Filipino’s sweet tooth, the recipe was sweetened by introducing Philippine mango-flavoured yogurt. Rich in calcium and other vital ingredients, yogurt was then positioned as a product that could enhance the healthy Filipino lifestyle. This switch in marketing strategy resulted in consumer acceptance. Within 18 months of re-introduction, Leche Pascual achieved a 30% market share.

- Football Club Barcelona (FCB, Barça) conducted football clinics in the Philippines and Singapore. While football was less popular than basketball, younger athletes were embracing the game. This growing popularity coincided with the acceptance of 11-year-old Sandro Reyes to the FCB Escola in Barcelona, Spain. FCB Escola is a highly selective football school that prepares young players for the Masía, the team’s training programme that produces football greats. Among the Escola’s alumni are Lionel Messi, Andrés Iniesta, Gerard Piqué, Carles Puyol and Cesc Fábregas, among others. This reconnection with the Philippines took 87 years to be achieved. Paulino Alcántara Riestá, a Spanish-Filipino set the record in 1927 as Barça’s highest goal scorer. His record stood until Lionel Messi surpassed Alcantara’s goal count in 2013. Meanwhile, Real Madrid and Sevilla partnered with Philippine companies to conduct football clinics. Real Club Deportivo Espanyol and other Spanish first division clubs are exploring similar football partnerships.

The Spanish success in food processing and football clinics is instructive: Leche Pascual and Barça learned to match their capabilities with what the Philippine market needed. Inditex and Mapfre’s successes highlight the validity of strategic complementation as an alternative to the ‘sell-purchase’ transactional model. They worked with Philippine partners where Spanish products, services and brands expanded the Philippine partners’ business offerings and scope. By complementing each other’s strengths, the time to monetise the business idea was substantially shortened. With appropriate resources committed, the ventures flourished.

Business education contributes to reversing the mutual ignorance that persists among managers. The Economist’s 2014 What MBA? ranked Spanish business schools highly, including IESE (5th globally) and ESADE (24th globally). Bloomberg Businessweek ranked IESE 8th, Instituto de Empresa 2nd and ESADE 19th among international business schools, while the Financial Times consistently placed IESE among the top three global providers of business education programmes. As a result, they are seen as viable European alternatives to an American business education. Each year, a growing number of Filipino managers graduate from their programmes. Such immersion is instrumental to building capabilities and mutual understanding. While Spanish business schools offer courses on Asian business in their curriculum, this area remains an under-served market with a significant growth potential. This is particularly the case with ASEAN-focused programmes catering for Spanish and European managers.

Place: rediscovering a 21st century galleon route

The third strategic pillar is the market place where opportunities and risks interact with legislation to determine a market’s attractiveness to investors. In this context, economic indicators provide the trends and size of markets. Institutional factors such as legal guarantees and property rights influence the investors’ capacity to appropriate returns as their just reward for risk-taking.

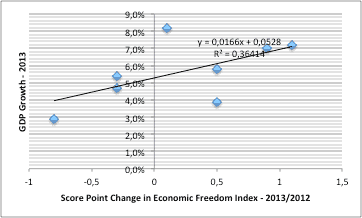

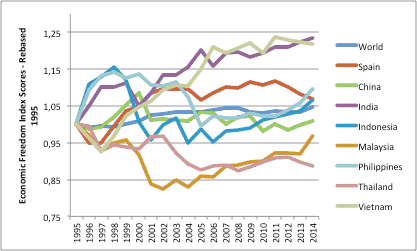

Heritage Foundation publishes an annual survey on economic freedom. This globally comprehensive index scores a country’s institutional performance. Markets that scored highly tend to achieve higher economic growth and attract greater capital flows. A smaller ASEAN sample replicated this relationship in Figure 7.

Figure 7. GDP growth and change in index score

Source: Heritage Foundation Economic Freedom Index, 2014.

While a single swallow does not usher in the spring, GDP performance in 2013 followed past relationships. ASEAN’s most improved countries in their economic freedom scores –The Philippines (1.1%) and Cambodia (0.9%)– also achieved the highest economic growth rates (7.2% and 7.0%, respectively). In contrast, Malaysia (-0.3), Thailand (-0.8) and Vietnam (-0.3) saw a deterioration in their scores. Their GDP growth rates were at the lower end of the ASEAN range: 4.7%, 2.9% and 5.4%, respectively.

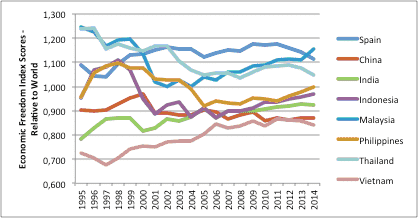

Figure 8. Index scores relative to World index

Source: Heritage Foundation Economic Freedom Index, 2014.

Since 1995 ASEAN’s economic freedom performance has been converging towards consistently improving World scores, as shown in Figure 8. By dividing country indices by the World Index, a ratio approaching 1 implies that a country’s performance approximates the World Index, with better country performances shown as above 1 (or vice versa).

Malaysia and Thailand continue to outperform the World index, with the Philippines doing slightly better. In contrast, China and India, which were among the preferred investment destinations of European companies, fell below the World and their Asian peers’ scores. This implies that prevailing institutional transparency was weaker.

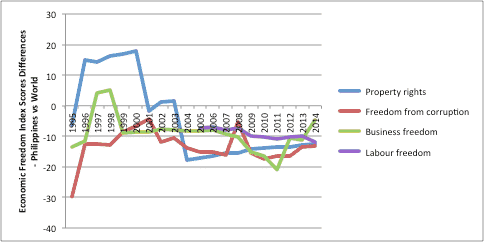

Momentum or rates of change in scores in Figure 9 indicate a market’s improvement (or vice versa). China’s performance at economic and institutional reforms has been slow and tentative, a phenomenon that was already impacting on slower GDP growth. In contrast, India and Vietnam, while starting from a low base, have outpaced their peers in terms of achieving improved economic and institutional transparency.

Figure 9. Index scores rate of change

Source: Heritage Foundation Economic Freedom Index, 2014.

Indonesia and the Philippines are two countries that warrant a closer examination. From 1995 to 1997 decisive policies aimed at reforming their economies significantly improved their institutional transparency and economic liberalisation. The Asian crisis in 1997 cut short this rising trend, with the Philippines’ domestic-oriented economy largely insulated from the adverse effects of the crisis.

While most analysts focus on present government policies, the Philippines’ economic dynamism resulted from cumulative effects of past reforms. As Figure 10 illustrates, growing technocratic influence in policy formulation contributed to creating a better business environment.

Former President Fidel V. Ramos liberalised strategic sectors of the Philippine economy. While his achievements were well recognised, some critics pointed out that the momentum of his reforms was short-lived. These critics cited that subsequent presidents failed to follow through on Ramos’s success. On closer examination, his critics may be proved wrong. In reality, each president’s legacies has provided a more coherent platform for growth than is generally perceived.

This observation pointing to greater policy coherence is counter-intuitive. Popular perceptions view a shambolic political process bereft of any continuity as more fitting to describe Philippine politics. We propose an alternative perspective in the discussion that follows.

Figure 10. Philippine presidents and their legacies

In a nutshell: the 1987 Philippine Constitution, despite its outdated economic provisions, restored and strengthened democratic institutions that 14 years of martial law had laid to waste. The Philippines was among the few countries operating under a market economy that restricted foreign ownership. In spite of expanding the list of exempt industries, where full foreign ownership is allowed, the perception of a restrictive business environment remained.

Figure 11. Philippine development areas and challenges

Source: Heritage Foundation Economic Freedom Index, 2014.

In succession, Fidel V. Ramos restored the power supply, political stability and capital flows. Despite having been impeached and convicted for plunder, Joseph E. Estrada made two significant contributions: He broke away from the failed policies on import substitutions and he re-oriented polices to agriculture and regional development. Recognising that regional growth is enhanced with strong linkages, Gloria Macapagal-Arroyo inter-connected the island markets through nautical highways and promoted BPOs. In the process, she strengthened the country’s fiscal base and the BPOs that achieved global leadership. These legacies resulted in subsequent sovereign credit rating upgrades. The current president Benigno S.C. Aquino’s single-minded pursuit in jailing erring politicians may deter corrupt practices in future governments.

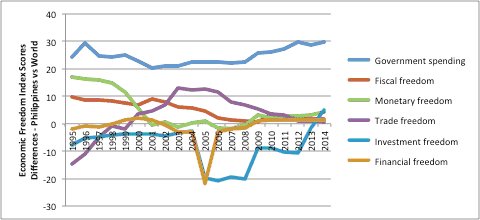

Generally perceived as a laggard, negative news such as corruption, the worst international airport and an incompetent bureaucracy dominated the headlines about Philippine business. However, the Philippines’ institutional performance, as shown in Figures 11 and 12, offer more promising prospects. While these factors contributed to four policy challenges identified in Figure 11, Business Freedom and Property Rights were improving, although they were still some way from achieving their 1995-1998 peaks.

Figure 12. Philippine areas of outperformance

Source: Heritage Foundation Economic Freedom Index, 2014.

Lost in the negative headlines were the progressive improvements in six areas of economic freedom, as highlighted in Figure 12. The Philippines outpaced their Asian peers in improving their scores on Government Spending, Investment and Financial Freedoms. Examined in these contexts, the Philippines’ economic and institutional performance followed a more sustained improvement than is generally perceived. For this reason, the strong economic performance observed since 2008 was actually building on the political stability restored by Fidel V. Ramos and sustained by the legacies of succeeding presidents.

Notwithstanding these achievements, the Philippines ranks low on ‘ease of doing business’ (or business freedom) criteria. Restrictive business and uncertain regulatory environments in the Philippines were cited as institutional weaknesses. To address these constraints, the government and global investors demonstrated pragmatism in confronting the challenges.

A number of Spanish lawyers, often unfamiliar with Philippine or US jurisprudence (which serves as the foundation for Philippine judicial practice), argued that their clients faced insurmountable risks. Investing as minority shareholders they would always be out-voted by their Philippine partners. From a strictly legalistic standpoint, this was arguably ‘sound’ legal advice if we neglect the protection that Philippine laws provide to minority interests. To extend this advice, some Spanish lawyers would insist on adopting a Spanish legal form to protect their investors’ interests. While the lawyers’ efforts were laudable, Spanish legal forms seldom fully comply with Philippine laws (or vice versa). As a result, when a myopic legal stance supersedes the venture’s economic and strategic logic, negotiations became arduous if not onerous for both parties. In short order, distrust sets in that unravels any carefully crafted agreements with a commercial rationale in mind.

Legal issues need to be addressed to facilitate, rather than impede, the entrepreneurial aspirations of the partners. For this reason, Philippine government pragmatism recognises ‘ownership constraints’. In order to confront this challenge, Philippine legislation allows segregating activities with foreign ownership limits from those that are unrestricted where full foreign ownership is permitted. Specifically:

- Restricted activities included utilities, concessions, natural resources and strategic industries. They are subject to a 40% foreign ownership limitation. These activities can be unbundled under a separate legal entity that can own the licence, certain assets and mineral reserves.

- Unrestricted activities, where no foreign ownership restrictions applied, such as services, operations and management are contracted with affiliates or third-party providers.

Such a legal compromise allows investors to reconcile their economic aspirations with foreign ownership restrictions. As a result, ventures are structured so that they are consistent with the just rewards criteria. That is, returns are appropriated as compensation for risk-taking. In this context, voting rights issues are evaluated on their economic effects on investors’ returns and risks.

To illustrate how these pragmatic approaches are applied, let us consider these examples:

- At the height of the power supply crisis in 1992, President Fidel V. Ramos adapted the build-operate-transfer (BOT) scheme to permit full foreign ownership of power generation. Through unbundling, power generation and supplies were classified as non-utilities businesses, hence allowing full foreign ownership. Transmission and distribution remained as utilities that were subject to a 40% foreign ownership limit. Through competitive tenders, investors from the US, Japan and Korea emerged as the dominant players. In parallel to this liberalisation, Philippine power groups such as Aboitiz Power, San Miguel Power and DMCI Power evolved as major power generators.

- Following a wave of market liberalisation, the Philippine Central Bank granted 10 licences to major foreign banks. This paved the way for foreign banks to fully own their Philippine banking businesses. A major Spanish bank was the first to successfully enter, but was equally quick to exit at the first sign of trouble. Hence, when the 1997 Asian crisis took hold, mounting losses led to the Spanish bank’s presence being unsustainable.

- The initial experiment with the 1992 banking liberalisation was followed by gradual dismantling of ownership restrictions. By 2014 full foreign ownership of Philippine banks was legislated. Subject to approving the rules and regulations for its implementation, the law is expected to take full effect by 2015.

- Water distribution was privatised under the Ramos presidency. To resolve the foreign ownership constraint, the government split the Manila Water and Sewerage Services (MWSS) into an asset owning and franchise holding entity and two service providers. The assets remained with state-owned MWSS, while an asset lease, service and operating contract were awarded to two newly created entities: Manila Water and Maynilad Water. The service companies were then privatised with the French water companies General des Eaux and Lyonnaise des Eaux leading the winning consortiums.

- Hydro power generation comprised two activities: (a) water extraction, that fell under the rules governing the exploitation of natural resources and thus reserved for Filipino nationals; and (b) power generation, that was unrestricted. Aboitiz Power and its Norwegian partner structured their Magat Hydro Power venture by forming SNAP to meet their commercial objectives. SNAP separated the water extraction licence and business, which are subject to a 40% foreign ownership limitation, from the power generation business. This approach allowed the allocation of economic interests and obligations according to the partners’ contributions. Similarly, K-Water followed SNAP’s approach for its Angat Hydro Power venture.

The BOT concept remained predominant, evolving into the public private partnership (PPP) espoused by President Benigno S.C. Aquino. To reinforce the government’s commitment to economic openness, Philippine Senate President Franklin Drilon committed to revisit all laws that restricted foreign ownership for possible amendments or revisions.

Regulatory certainty had become tantamount to investors expecting a ‘sovereign-like’ guarantee to secure their investment returns. In effect, the government was expected to cushion any adverse returns by providing fixed subsidies. Hence, by virtually taking very limited risks, investors reaped all the returns, which were often generous.

Such expectations were unrealistic given that returns were uniquely appropriated as a just reward for risk-taking. However, this flawed expectation persisted in certain circles, particularly among Spanish lawyers. Held up against these ‘regulatory certainty’ criteria, no regulatory regime would pass such a test nor should such ‘sovereign-like’ guarantees be used as the arbiter for regulatory soundness. Specifically, let us examine these realities:

- Subsidies, particularly for renewable energy, were seen as a sine qua non to committing capital. However, ‘secure’ European regulatory structures –Spain and Germany are examples– slashed subsidies when budgetary constraints made continuance politically impracticable. This policy shift resulted in extensive bankruptcies of subsidies-dependent renewable energy ventures. Now the question is: did regulatory uncertainty kill the green investors’ business or was the premise for investing a strategic miscalculation? Phrased differently, when subsidies became determinant to earning returns, were investors inadvertently engaged in subsidies collection rather than in generating green energy? If the former, the government’s shifting policy stance should be explicitly considered part of the investor’s risk management approach.

- Corruption and bureaucratic indecision go hand in hand in frustrating investors. While the Philippines suffered negative press over its Fraport dispute, repeated rulings by Philippine and Singapore courts and international arbitration bodies upheld the Philippine government’s case. Ironically, the Philippines’ reputation suffered when it sought to assert its rights against an erring German multinational that broke the law.

- Latin America’s pursuit of liberal economic policy is proving a fleeting phase in Argentina, Bolivia[8] and Venezuela.[9] Expropriation, sequestrations[10] and sovereign defaults[11] are again rearing their ugly heads to haunt Spanish businesses.

On a general note, managerial tolerance for political risks is a function of familiarity with the market and its dispute resolution mechanisms. On paper, Philippine legislation is supportive of a functioning market economy. Bureaucratic inefficiencies, however, challenge an investors’ ability to navigate the labyrinth of rules and regulations. Varying degrees of competencies make some Philippine government agencies more (or less) effective in supporting investments.

The Philippines has demonstrated its ability to adhere to the rule of international law. To a large extent, the Philippines was justifiably criticised for its over-emphasis on legal compliance that verged on technicalities rather than on applying the substance of the law. Hence, some foreign lawyers who were inexperienced in Philippine jurisprudence found it easy to blame the bureaucracy for their own inadequacies. Hence, the perception persisted that the Philippines remained a high-risk country among Spanish managers. In contrast, repeated experiences at the receiving end of Latin American expropriation, sequestration and defaults failed to diminish Spanish managers’ enthusiasm for the more ‘familiar’ Latin America.

The premises for Philippine corporate partnerships have changed over the years. Previously, capital, know-how and technology represented the contributions from foreign partners. This left little for Philippine partners to justify their 60% ownership of the ventures. As a result, uneven allocation of risks and returns planted ab initio the seeds for future discord.

The emergence of financially strong Philippine companies was coupled with strengthened technological capabilities. This changed the premises for foreign partnerships, where foreign capital diminished in importance. Increasingly, Philippine companies sought to complement their strengths with the technological inputs of foreign partners. Consequently, partnerships are now formed under an explicit understanding of what each party can contribute. This mutual understanding tends to sustain long-term commercial relationships.

The ability to navigate the Philippine bureaucratic labyrinth represents a local capability that is often under-estimated. Ironically, bureaucratic bottlenecks are resolved when investors spent time to understand how companies can comply with the rules. In many instances, the bureaucracy welcomes suggestions from businesses given that it recognises its own limitations. Approached on a collaborative basis, issues can be resolved more quickly while complying with Philippine and international laws.

With actual in-country experiences, foreign investors over time have learnt to value their Filipino partners’ worth. At this point, voting rights concerns are seen within the realities of each party’s contributions. As a result, Filipino-controlled partnerships are not uncommon, even in sectors where foreign ownership restrictions do not apply.

Conclusions

The way forward

Spain’s commercial irrelevance in the Philippines and Asia is a product of the mutual ignorance of Spanish and Filipino managers. Unaware of each other’s potential, capabilities and needs, strategic actions have been premised on erroneous perceptions that are incongruous with market realities. We posit that (a) geographical distance, (b) bureaucratic barriers and (c) cultural differences mask the underlying strategic miscalculations that managers make.

Using our POP and Strategy-Opportunities Frameworks, managers can leverage on their specific strengths. By combining technological capabilities with market access, the time to market in commercialising business opportunities is likely to be shortened. To achieve this, managers need to work together, committing time, resources and capital to build a viable market presence. Consequently, the ‘sell-purchase’ model that managers prefer is unlikely to succeed, much less be sustained.

Strategic responses to opportunities in ASEAN, therefore, can focus on three lines of action:

(1) Private initiatives

Commercial interactions are most effective when conducted through private initiatives. This recognises the specific nature of capabilities and resources that make complementation feasible. In this context, pursuing ASEAN opportunities would require a strategic approach where commitments to build long-term relations are equally important to success as deploying the appropriate resources. Hence, the opportunism that characterises a number of ‘marketing efforts’ may prove wasteful of corporate resources.

By adopting a complementation strategy, Spanish and Filipino managers would need to work together more closely. In building to complement their strengths, entry into ASEAN through the Philippines is viable through effective partnerships. Often, this becomes feasible when specific projects or opportunities are pursued.

Weak Philippine infrastructures offer opportunities for Spanish industrial companies. Philippine construction companies are experienced and skilled in civil works. However, they continue to rely on foreign expertise for structural engineering, design and advanced construction technologies. By complementing the Philippine companies’ capabilities, Spanish technology and know-how could allow to jointly pursue Philippine and ASEAN opportunities.

(2) A supportive economic diplomacy

State-sponsored actions are best focused at creating mechanisms that dismantle barriers to trade and investment. Specific areas for action are (a) easing visa restrictions, (b) lifting import quotas and (c) streamlining product standards and procedures for access to markets.

The Philippine Senate President’s commitment to revise laws that limit foreign ownership presents a specific opportunity for inter-parliamentary cooperation. This may take the form of: (a) exchanges of legislative experiences; (b) legislative support from multi-disciplinary experts; or (c) consultations with business leaders. Expertise from Spain and the Philippines could be drawn to support these legislative initiatives.

Public-private sector forums can complement the work of both governments. Formed as working groups, appropriate policy areas can be identified for action in order to facilitate commercial opportunities.

Weak Philippine bureaucracy offers opportunities for Spain and the Philippines to learn from each other. Spain’s success in transforming its economy within the EU provides valuable lessons for the Philippines. This exchange of experiences is achieved through two channels: (a) initiatives that enhance the Philippines’ policy framework through bilateral exchanges of experts, technocrats and policy-makers; and (b) actions that support private enterprises by easing taxation, pensions and social security frameworks and procedures, and aligning accreditation criteria and processes for technologies and standards.

(3) Developing leaders

Business education can reverse the mutual ignorance between Spanish and Filipino managers. Executive education programmes are instrumental in upgrading managerial capabilities and in transmitting skills and know-how to empower managers to seize ASEAN opportunities.

The executive programmes offered by leading business schools are effective channels for future ASEAN leaders to better appreciate the Spanish and European business culture. Spain is fortunate to host some of the top global business schools, such as IESE the Instituto de Empresa and ESADE.

A managerial reflection

In the final analysis, Spanish and Filipino managers hold the key to reversing the sorry state of Spanish-Philippine commercial relations. Expanding into Asia (or Europe) is fraught with ‘risks’ to an unfamiliar mind. Managers’ comfort with the ‘familiar’ limits their capacity to thrive, while making them inadvertently fail to grasp the threats of technological or business obsolescence. Hence, when inaction turns to inertia because deep-seated erroneous beliefs go unchallenged, business is destined to commercial irrelevance.

Hence, the next time around, when managers blame their commercial misfortunes on geography, bureaucrats and culture, they should think again. Perhaps, legitimate as the reasons may appear, the real causes are probably staring at them in the face!

Ricardo G. Barcelona

Managing Director, Barcino Advisers Limited, and PhD in Management, King’s College, London

Bernardo M. Villegas

Chair, Barcino Advisers Limited, and PhD in Economics, Harvard, Boston

[1] The Association of South East Asian Nations comprises Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Thailand, Singapore and Vietnam.

[2] These factors are variously identified in Manuel Varela Bellido (2008), ‘El Plan Asia-Pacífico: un balance económico’, p. 53-63, and in ‘Relaciones económicas y comerciales entre España y Asia en la última década’, p. 17-40, in Ministerio de Industria, Turismo y Comercio, España, España, Asia y el Banco Asiático de Desarrollo. Boletín Económico, 2937, 1-15/V/2008.

[3] See for example Rose Marie Boudeguer Yerkovic (2014), ‘Brasil: El desafío económico de Dilma Rousseff’, Expansión, 28/X/2014, and Nyshka Chandran (2014), ‘Watch out! Brazil markets slide after elections’, CNBC, 27/X/2014.

[4] Associated Press (2012). ‘Bolivia expropriates Spanish energy subsidiaries’, USA Today, 29/XII/2012.

[5] Wire Staff (2012), ‘Argentina, Spain at odds over oil company expropriation’, CNN, 17/IV/2012.

[6] Miles Johnson (2012), ‘Risks: seizures highlight pitfalls of Latin America’, Financial Times, 29/XI/2012.

[7] The Economist (2014), ‘Argentina defaults: eighth time unlucky’, The Economist, 2/VIII/2014.

[8] The Economist (2012), ‘Just when you thought it was safe: Evo Morales nationalizes a Spanish electric company’, The Economist, 5/V/2012.

[9] El Universal (2011), ‘Venezuela government has seized 988 companies’, El Universal, 29/VIII/2011.

[10] See for instance Agustino Fontevecchia (2012), ‘US condemns YPF expropriation as Spain-Argentina trade war nears’, Forbes, 18/IV/2012; and Lauren Frayer (2012), ‘Spain concerned by expropriation in Latin America’, NPR, 3/V/2012.

[11] Hans Humes (2014), ‘Who to blame for Argentina’s disastrous defaults? It’s lawyers, of course’, The Guardian, 20/VIII/2014.