Theme

Competitiveness of the EU and the US.

Summary

In recent decades the EU seems to have been lagging behind the US both economically and technologically. Identifying the key elements that underlie the differences in competitiveness has therefore become a matter of necessity. This paper addresses the competitiveness of the EU in comparison with that of the US, using the nine key performance indicators (KPIs) identified by the European Commission in its communication titled ‘Long-term competitiveness of the EU: looking beyond 2030’ as well as other complementary indicators. The analysis shows that: the EU is less dynamic in its trade in services (suggesting regulatory and administrative barriers in the single market); it has a higher level of private investment as a percentage of GDP, but its venture capital investment is much lower (limiting the development of cutting-edge companies); it falls slightly behind the US in public investment, although its fiscal sustainability is better; it spends less on R&D+i, which affects its potential for growth; it makes greater use of renewable energy, but its industrial energy costs are higher; it shows potential in material recycling, although there are areas for improvement; it lags behind the US in digitalisation, especially in small and medium-sized enterprises; it has a lower percentage of adults with advanced digital skills and IT specialists; and it has a greater share of global exports (although this has declined in recent decades). The analysis is supplemented by considerations concerning the differences in productivity, the quantity and complexity of the regulatory burden, company size and the efficiency of the public sector.

Analysis

1. Indicators of competitiveness

Competitiveness is a word that is frequently used but very poorly understood. In general terms, it may be defined as a company’s ability to position itself in a sustainable way, in a market activity or product, ahead of its competitors. And if there are few definitions, it is even less easy to find descriptions of its causes. In this context, the European Commission should be praised for striving to identify the factors that determine competitiveness in its communication ‘Long-term competitiveness of the EU: looking beyond 2030’ (COM/2023/168 final).

Figure 1. The nine drivers of competitiveness, according to the Commission

According to the European Commission, the EU’s economic growth model rests on four pillars: (a) sustainable competitiveness; (b) economic security; (c) open strategic autonomy; and (d) fair competition. The concept of competitiveness is used very frequently in economics, business and even daily conversation, and the idea that the EU no longer ranks as a competitive location, especially in comparison with the US, has gradually become an accepted notion. But defining competitiveness itself, and thus comparing the EU with other jurisdictions, is far from straightforward. Notwithstanding this, the European Commission has identified the following nine drivers of the EU’s competitiveness:

- The single market

- Access to private capital and investments

- Public investment and infrastructure

- Research and innovation

- Energy

- Circularity

- Digitalisation

- Education and skills

- Trade and open strategic autonomy

This paper will use concrete indicators to explore whether there is any foundation for the pessimism regarding the EU’s competitiveness compared with that of the US, and what the main areas for improvement might be. To do this, it uses the European Commission’s key performance indicators (KPIs), in addition to other indicators.

The need to study this phenomenon stems from a progressive divergence in per capita GDP between the EU and the US (which emerged from the last financial crisis earlier and better), and comes in addition to the relative loss of worldwide GDP share that both have suffered compared with other powers, such as China.

1.1. Single market

The European Commission uses three KPIs to gauge the situation and the progress made in this driver: (a) trade within the EU as a share of GDP; (b) the conformity deficit (in the sense of incorrectly transposed EU directives); and (c) the burden of national government regulation.

Despite the fact that the single market celebrated its 30th anniversary in 2023 and is considered one of the main sources of the European project’s prosperity, the trade in (intra-EU) services as a percentage of GDP is 30 points lower than the trade in goods (14.7% of GDP compared with 50%). Although there are inherent barriers to the trade in services, it seems clear that there are particular difficulties attached to the export of services within the EU, as compared with the export of goods, particularly when we bear in mind the share of EU GDP that derives from services. In the US, the trade in services accounts for just 6.3% of GDP, with a difference between that and goods somewhat lower than the EU’s (12.7 vs 15.2 percentage points).

Other indicators, such as the fact that only 25% of large businesses offer cross-border online sales within the EU (and fewer than 10% of SMEs), point to the existence of regulatory and administrative barriers that restrict the cross-border trade in services, with little progress being made in recent years (as the report on the single market drawn up by the former Italian Prime Minister, Enrico Letta, points out).

The conformity deficit in the transposition of directives fell from 1.3% in 2022 to 1.2% in 2023, although it still exceeds the European Commission target of 0.5%.

Lastly, the ease of regulatory compliance indicator assesses how companies perceive the ease or difficulty of complying with government regulations and standards, 1 representing great difficulty and 7 extreme ease. As shown in Figure 5, there is a significant variation between the various Member States and on a scale of 1 to 7, the EU average is 3.8 (with Spain, at 3.2, recording one of the worst results).

It is important to note that these KPIs seem insufficient for gauging the state of the single market. Indeed, state aid could be having a negative impact on the single market, creating an uneven playing field in terms of the Member States’ fiscal capabilities. An example of this is the most recent version of the Temporary Crisis and Transition Framework (TCTF), unveiled in March 2023, which allows EU Member States to support investment in the manufacture of products that are relevant to the transition towards a net-zero economy in order to prevent these investments being diverted outside the European Economic Area. Moreover, Member States can support such investments by allocating aid that matches foreign subsidies. These anti-offshoring provisions of the TCTF are already up and running: in January 2024 the European Commission approved a German plan to give €902 million in state aid to help Northvolt build a factory making batteries for electric vehicles. When notifying the state aid the Germans made it clear that, without the funding, Northvolt would have built the factory in the US, where funding was on offer under the Inflation Reduction Act (IRA). The fact that state aid is predominantly used by Member States of greater size and fiscal clout became evident with the previous Temporary Framework for State Aid, under which, according to European Commission figures, Germany and France accounted for almost 80% of all the state aid granted in the EU.

1.2. Access to private capital and investment

The European Commission uses two KPIs to measure the situation and progress in this driver: (a) private investment as a percentage of GDP; and (b) venture capital investment as a percentage of GDP.

The EU ranked almost two percentage points above the US in 2022 in private investment as a percentage of GDP (19.3% compared with 17.5%). Investment (or gross fixed capital formation) is key to increasing an economy’s growth potential. Private sector investment measures how much businesses and households contribute to the accumulation of capital to improve the output of goods and services in the future, with a positive impact on the income of the economy. However, despite the 2022 data, the EU faces a series of challenges:

- In the context of contractionary monetary policy, investment may stall due to the rising cost and tighter availability of credit for financing new projects. For some countries this situation is, however, offset by the possibility of accessing Next Generation EU funds until 2026, so it is unlikely that private investment as a percentage of total GDP will decline in the years ahead if these funds are tapped.

- There is considerable variation between EU Member States in private investment as a percentage of GDP, as shown in Figure 6, ranging from 10.1% in Greece to 22.8% in Hungary.

Investment in venture capital as a percentage of GDP is notably lower in the EU than in the US. Venture capital is particularly important to companies in their early stages, when they do not yet have a significant track record that would enable them to access more traditional sources of financing, such as banks. In 2021, investment in venture capital as a percentage of GDP in the US came in at over 0.7%, almost double the rate in Estonia, the EU country that devotes the largest share of its GDP to this type of investment, as shown in Figure 7.

This reduced investment in venture capital is one of the reasons for unicorns, in other words companies of a technological or innovative nature that begin as start-ups and end up with valuations in excess of €1 billion, being very thin on the ground in the EU. According to figures from Dealroom, more than half the 2,723 unicorns existing in the world in 2023 had their headquarters in the US. China was second with 348 unicorns followed by the UK with 147 and India with 87. Not until the fifth and eighth places is it possible to find EU countries, respectively Germany (64) and France (38).

In addition to these two KPIs identified by the European Commission, the source of financing for the private sector is also important.

Figure 8. Household financial assets (2015-21, % average)

| EU | US | |

|---|---|---|

| Shares | 21 | 31 |

| Investment funds | 9 | 16 |

| Debt securities | 2 | 4 |

| Pension and insurance funds | 33 | 33 |

| Cash and deposits | 32 | 13 |

| Other financial assets | 3 | 3 |

| Total | 100 | 100 |

Figure 9. Structure of capital markets

| Number of stock exchanges | Number of clearing houses | |

|---|---|---|

| EU | 41 | 18 |

| US | 16 | 1 |

As Figure 8 shows, household investment in capital markets is much higher in the US than in the EU. Between 2015 and 2021, EU households held 32% of their financial assets in cash and deposits, compared with 13% for US households, which by contrast kept almost 50% of their savings in shares (equity) and investment funds. This difference in the allocation of households’ financial assets may help to explain, at least in part, why capital markets in the EU are less developed than those in the US, thereby depriving the European private sector of alternative sources of financing. The relatively underdeveloped state of European capital markets may also be explicable in terms of their structure, which is much more fragmented than in the US, as shown in Figure 9.

Meanwhile, as shown in Figure , private credit originating from the banking sector as a percentage of GDP is 30 percentage points higher in the EU than in the US. The meagre volume of market financing as a share of business financing in the EU restricts possibilities of financial diversification for companies and makes it more difficult to absorb macroeconomic shocks.

This is compounded by the weak performance of the share prices of larger European banks compared with their US counterparts, if one looks at a longer timeframe (for example, since 2015), as shown in Figure , as well as their lower rates of profitability.

Despite this, the European banking sector showed its resilience during the US regional banking crisis of 2023. As Figure shows, the EURO STOXX bank index outperformed the KBW Nasdaq bank index between the March 2023-March 2024 financial strains, with a positive differential in favour of European banks’ share prices of almost 40%.

Moreover, since the implementation of the Single Supervisory Mechanism, the main banking financial ratios have improved: the CET1 solvency ratio of large institutions rose from 12.7% in the second half of 2015 to 15.6% in the third quarter of 2023, while the liquidity cover ratio ended the third quarter of 2023 at 159%, much higher than the minimum requirement of 100%. The default rate also fell notably, declining from 7.5% in the third quarter of 2015 to 1.8% in the third quarter of 2023.

Lastly, the results of the EU’s stress tests of the banking sector, published on 28 July 2023, confirmed the resilience of European banks. First, banks in the EU found themselves in a healthier state than in 2021, with higher levels of revenue, profitability and asset quality and lower ratios of bad debt. Secondly, European banks have enough capital to cope with an adverse scenario. In fact, in a severe crisis, the average CET1 would stand at 10.36% by 2025, almost 200 basis points above the minimum requirement of 8.5%. Third, both the base and the adverse scenario highlight the positive effect of the increase in the net margin of interest payments, mainly explicable by the increase in interest rates on loans. On the negative side, both scenarios make it necessary to account for an increase in operating costs with an impact of almost 1,000 basis points on capital consumption. Fourth, Greek and Spanish banks are the ones that would do best in the face of an adverse scenario, with reductions to their capital consumption figures that are virtually half the EU average, in contrast to their French and German counterparts, which are above the European average. Fifth, compared to the 2021 results, Cypriot, Greek and Italian banks record the most striking improvement. In particular, Cypriot and Greek banks’ capital consumption fell by half, with Italian institutions also recording a significant reduction. Spain and Portugal also recorded improvements in capital consumption compared with 2021, unlike German and French banks, where slight increases were recorded.

1.3. Public investment and infrastructure

The KPI that the European Commission uses for this driver is public investment as a share of GDP. The EU fares relatively poorly on this indicator compared with the US, with public investment as a share of GDP standing at 3.5% in the US in 2022 compared with 3.2% in the EU. The gap has been falling, however, as it was almost 1% in 2008, as shown in Figure.

The ability of the European Commission’s indicators to gauge the situation and progress in this driver appear somewhat limited. It is also important to measure the quality of infrastructure. In this dimension, according to the World Bank, the quality of transport-related infrastructure is better in the US than in the EU, although the differences have narrowed in recent years.

It would be useful to delve deeper into this indicator, distinguishing between types of infrastructure and their relationship with competitiveness.

As well as measuring public investment as a share of GDP or the quality of infrastructure, the sustainability of current levels of public investment is also important, because experience suggests that, in the event of a crisis, the first item to be sacrificed tends to be public investment. With regard to fiscal sustainability, the EU is better positioned than the US, with a public debt to GDP ratio almost 40 percentage points below the US. And far from improving, it is forecast that the US’s fiscal position will gradually deteriorate, with annual levels of public deficit exceeding 6% of GDP until 2033, according to the Congressional Budget Office. However, a fiscal crisis in the US would have global financial fallout.

1.4. Research and innovation

The European Commission’s suggested KPIs for this driver are: (a) R&D expenditure as a percentage of GDP; and (b) the number of patent applications per million inhabitants.

Spending on R&D is key for boosting an economy’s potential for growth, even more so in the context of a technology race and the need to get ahead in the green and digital transitions. Here, the EU is not well positioned in relative terms: R&D spending as a percentage of GDP in South Korea and the US is 2.2 and 1.5 times greater, respectively, than that of the EU, as shown in Figure.

In terms of number of patents per million inhabitants, the EU does not emerge badly compared with the US (the combined patents of the four main members of the EU exceed those of the US), but it is a long way behind the levels of South Korea and Japan, as shown in Figure . There is therefore scope for the EU to do more in terms of technology transfer, encouraging the transition from the laboratory to the factory.

1.5. Energy

The European Commission uses the following KPIs for this driver: (a) the share of energy from renewable sources; and (b) electricity prices for non-household consumers.

The EU is better positioned that the US in the relative use of renewable energies, and the gap is widening.

However, electricity costs are higher in the main EU countries than in the US. In the case of Germany, the Kw/hour price was almost double that of the US in June 2023, when the peak of high energy prices following the Russian invasion of Ukraine had already passed. In the context of a country so dependent on electricity-intensive industry as Germany, this difference in cost may prove highly damaging for the medium-term competitiveness of German industry.

Electricity is not the only source of industrial energy consumption. In 2022 natural gas accounted for 31% of EU industry’s final energy consumption (with a significant portion of this being imported from the US) and natural gas prices also constitute an important difference with respect to the US, especially since the Russian invasion of Ukraine.

1.6. Circularity

For this driver the European Commission uses only one KPI: the circular material use rate, where the Netherlands leads the way, as shown in Figure , which also shows the low rate of circularity in Spain. Given the shortage of fundamental raw materials in the EU, circularity looks set to play a key role.

As Figure shows, the EU already has great potential for recycling materials such as copper, zinc and aluminium, but very little or virtually none for other materials. Furthermore, recycling often proves highly complex owing to finished products’ lack of suitability for later recycling, and even inadequate labelling, which hampers the accurate identification of what materials a product is made from.

1.7. Digitalisation

The European Commission uses two KPIs for this driver: (a) digital intensity in SMEs; and (b) the adoption of digital technologies by companies.

The EU has set a goal of at least 90% of EU SMEs having a basic level of digital intensity by 2030. The EU average in 2023 stood at more than 30 percentage points below this target, as Figure 23 shows.

The adoption of digital technologies by European companies continues to fall well short of the Digital Decade targets, particularly in Artificial Intelligence (AI) and Big Data. Under the present scenario and assuming unchanged policies, the trajectory of the benchmark model predicts that only 66% of companies will use the cloud, 34% will use Big Data and 20% will use AI, far from the 75% target set for 2030.

Figure 23. 2022 and 2023 DESI scores for the EU and Spain in the digital transformation of businesses

| DESI 2022 | DESI 2022 | DESI 2023 | DESI 2023 | |

|---|---|---|---|---|

| Spain | EU | Spain | EU | |

| % of SMEs with a basic level of digital intensity | 60.0 | 54.9 | 67.5 | 69.1 |

| % of companies that share information by electronic media | 49.1 | 38.1 | 49.1 | 38.0 |

| % of companies using two or more social media | 39.3 | 29.3 | 39.3 | 29.3 |

| % of companies that use Big Data | 9.0 | 14.2 | 9.0 | 14.2 |

| % of companies using cloud computing services | 27.0 | 34.0 | 27.0 | 34.0 |

| % of companies using AI | 7.7 | 7.9 | 7.7 | 7.9 |

| % of companies using electronic invoicing | 32.8 | 32.2 | 32.8 | 32.2 |

| % of SMEs selling online | 25.4 | 18.5 | 29.0 | 19.1 |

| % of income originating from e-commerce | 9.1 | 11.6 | 10.2 | 11.3 |

| % of companies selling online across borders | 9.0 | 8.7 | 9.0 | 8.70 |

EU businesses look set to fall further behind their US competitors in this area. A study by the European Investment Bank found that companies with fewer than 50 workers and which are more than 10 years old have a greater probability of not digitalising.

Meanwhile, it is worth considering other indicators that reveal the divergence in digitalisation between the US and the EU, such as the nationality of the giant tech companies, the market share of providers of cloud computing services or the production of high-quality chips, as the following Figures indicate.

Figure 24. The top 10 global companies by market capitalisation (April 2024)

| Ranking | Company | Market capitalisation (US$ bn) | Country |

|---|---|---|---|

| 1 | Microsoft | 3,026 | US |

| 2 | Apple | 2,602 | US |

| 3 | NVIDIA | 2,006 | US |

| 4 | Alphabet (Google) | 1,969 | US |

| 5 | Saudi Aramco | 1,942 | Saudi Arabia |

| 6 | Amazon | 1,835 | US |

| 7 | Meta Platforms (Facebook) | 1,240 | US |

| 8 | Berkshire Hathaway | 872.95 | US |

| 9 | Eli Lilly | 695.12 | US |

| 10 | TSMC | 683.18 | Taiwan |

1.8. Education and skills

The European Commission uses three KPIs for this driver: (a) adult participation in education and training every year; (b) adult employment rate; and (c) ICT specialists.

Figure 28. Digital skills in the EU

| Skills | % |

|---|---|

| Use of the internet | 88.59 |

| Digital skills, basic level at least (% of people) | 53.92 |

| Digital skill above basic level (% of people) | 26.46 |

| Digital content creation skills, basic level at least (% of people) | 66.16 |

| ICT specialists (% of people in work aged 15-74) | 4.60 |

| Women ICT specialists (% of ICT specialists) | 18.90 |

| Companies that give ICT training (% of companies) | 22.40 |

| ICT qualifications (% of qualifications) | 4.20 |

It is worth drawing attention to the fact that the percentage of the working age population (aged 25 to 65) lacking secondary education is much lower in the US (8.2%) compared with the EU average (16.6%), where there are major differences between countries (while Portugal, Italy and Spain have rates of over 35%, the figures for Lithuania, Poland, Slovakia and the Czech Republic are less than 7%). Only just over 25% of the population have digital skills above a basic level. And only 4.6% of the working population aged 15 to 74 are ICT specialists.

1.9. Trade and open strategic autonomy

The European Commission uses trade with the rest of the world as a percentage of GDP as its KPI for this driver. The EU leads the US in terms of exports of goods, with shares of 14.6% and 10%, respectively. Furthermore, barring a brief interlude in 2022, the Eurozone current account is in the black, compared to America’s shortfall of 3% of GDP.

However, a significant surplus in the current account may work to the disadvantage of the Eurozone, to the extent that the single monetary area would be exporting its savings to other jurisdictions, thereby financing their consumption and investment, to the detriment of much-needed European investments.

The EU’s share of the world export market has fallen by five percentage points in the last 20 years, as shown in Figure , and the current geopolitical context is likely to lead to further decline. Indeed, in an increasingly hostile world, many of the traditional pillars of the EU’s trade policy are undergoing drastic changes. First, in terms of free trade agreements, while the EU has recently concluded successful deals with Chile, Kenya and New Zealand, it has seen talks break down with Australia and has failed to make substantial headway with MERCOSUR. The situation is even more fraught if the US attitude towards free trade is taken into account. While the US was once a traditional advocate of multilateralism, it shifted away from this position under the Trump Administration, and Biden has continued the trend of refusing to sign up to traditional free trade agreements.

Secondly, the EU has advocated multilateralism through the World Trade Organisation (WTO) in its three roles: creating regulations; negotiation; and resolving disputes. But the WTO finds itself in an increasingly awkward situation. Its governance structure, with more than 160 members arriving at decisions by consensus, is in need of an overhaul. China’s accession to the WTO in 2001 did not translate into genuine liberalisation, with the country continuing to classify itself as a developing economy (the WTO allows its members to classify themselves), thereby enabling it to benefit from a series of trade advantages. The WTO’s Appellate Body, an important element in the dispute-resolution system, is not currently operating, because its members have reached the ends of their mandates and the vacant posts have not been filled owing to the opposition of the US, both under the Trump and the Biden Administrations.

Third, some of the EU’s trade decisions are starting to be questioned even by some Member States. An example of this is the autonomous trade measures adopted with respect to Ukraine, which is benefitting from the suspension of import duties, quotas and trade defence measures. The EU took this step as a way of showing its implacable support for Ukraine amid Russia’s unjustified military aggression, but it has started to create tensions among EU farmers, who are protesting en masse, particularly in the eastern part of the EU.

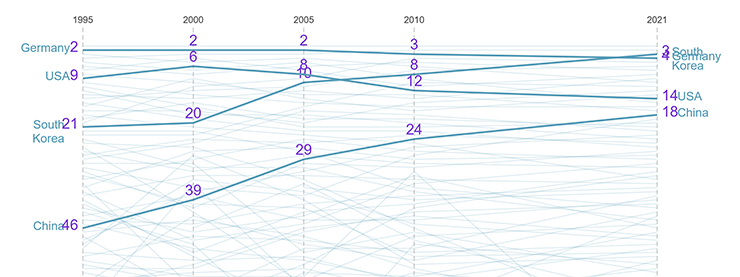

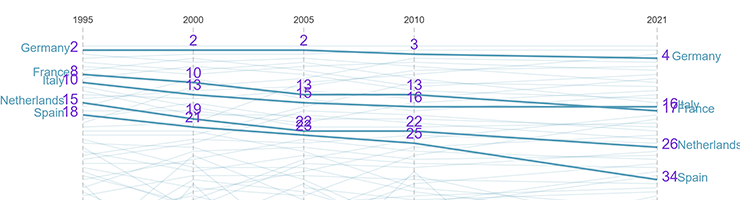

Another relevant indicator in this context is the Economic Complexity Index, shown in the Figures below, which suggests that products emanating from the EU have gradually been losing economic complexity in recent decades, by contrast with very pronounced improvements in countries such as South Korea and China.

Figure 32. Economic Complexity Index (Germany, the US, South Korea, China)

Figure 33. Economic Complexity Index (main EU countries)

2. Other indicators of competitiveness

2.1. Productivity

In 1997 the Nobel Prize-winner Paul Krugman said, ‘productivity isn’t everything, but in the long run, it’s almost everything’. Surprisingly, the Commission preferred not to include productivity measures as indicators of competitiveness, despite the fact that it is very difficult to maintain competitiveness over time without a decent productivity performance. In other words, although competitiveness may vary without productivity varying (a currency devaluation would be a good example), companies’ ability to remain in the market over the long run depends to a large extent on the efficient use of factors and technology, which is to say productivity.

The EU is not well placed on this measure: EU productivity per hour worked in the last two decades has been substantially inferior to the US’s, owing not so much to major differences in the capital per hour worked as lower total factor productivity.

The relationship between the sectoral composition of an economy and its competitiveness is neither direct nor determining. An economy’s competitiveness depends more on its general productivity, which may be high in any sector, not just the industrial sector. A study by the European Commission’s Joint Research Centre shows that the intensity of R&D and the capacity for innovation has a very significant impact on competitiveness, beyond the specific sectoral composition. Indeed, the competitiveness of the EU has improved thanks to policies that promote research and development, diversifying the economy and reducing dependency on the manufacturing sector. In the US, competitiveness has been preserved despite the relative decline of the industrial sector. This is attributable to heavy investment in sectors based on innovation and design, as well as the adoption of advanced technologies. Diversification and a capacity for adaptation have enabled the US economy to maintain its global competitiveness without relying exclusively on one sector alone.

2.2. European regulations

Among its indicators relating to the single market, the Commission is concerned about the national regulatory burden. However, it is important to remember that European regulations are superimposed on national ones, such that the EU ends up augmenting the bureaucratic burden of Member States.

Some studies highlight the role of excessive European regulation as the key element in the productivity gap with the US. In fact, the Commission is aware that its legislation represents a risk to its companies’ competitiveness and in its Green Deal Industrial Plan has already talked about the need for a ‘competitiveness check’ on all new regulations ‘to ensure that all potential competitiveness impacts are addressed and unnecessary burdens avoided’, stating that ‘a simple, predicable and clear regulatory environment is key to promoting investment’.

Although the EU’s regulatory burden is clearly greater than the US’s, the empirical evidence points not only to European failings but also to US successes: some studies show that US multinationals operating in Europe have significantly higher productivity than their European competitors in their use of ICT, despite facing the same regulatory environment (which may reflect more efficient corporate management and staff practices than their European counterparts). This suggests the need for deeper analysis of education and skills. Adopting ICT forces companies to institute complementary changes in their organisational structure in order to capitalise fully on productivity gains. Put another way: productivity requires both technological and human capital to harness it. An ECB investigation showed that fewer than 30% of companies (generally those closer to the technological frontier) manage to use digital technologies in a way that increases productivity over the long term.

2.3. Corporate size

The empirical evidence is also clear regarding the relationship between corporate size and productivity (although less so about the direction of causation). And it shows that large companies invest more in ICT, because the fixed costs related to the reorganisation of processes weigh especially heavily on small and medium enterprises.

As shown in Figure 36, the percentage of US companies with more than 49 employees is double that of the EU.

Figure 36. Companies classified by number of employees in the US and the EU, 2022 (%)

| Companies with | US | EU |

|---|---|---|

| 1-49 employees | 98.1 | 99.0 |

| 50-249 employees | 1.5 | 0.8 |

| More than 249 employees | 0.5 | 0.2 |

There are various kinds of limit to corporate growth in Europe compared with the US. Some are regulatory, such as the employment requirements that are only applicable once the 50-employee threshold has been passed (such as in France and Spain), which perhaps explains why US companies with more than 250 employees account for almost 60% of total employment, whereas in the Eurozone they only account for 12% to 37%. Some limits are financial: venture capital investments are much smaller in Europe than in the US, so that many innovative companies face financing restrictions when they enter their growth phase, which incentivises them to move to the US or the UK.

Figure 37. Size of exporting companies (%)

| Number of employees | US | EU | Spain | Germany | France | Italy | Netherlands |

|---|---|---|---|---|---|---|---|

| 0-9 | 13.3 | 7.4 | 11.0 | 4.1 | 5.1 | 5.9 | 12.1 |

| 10-49 | 5.4 | 10.1 | 13.6 | 6.0 | 6.3 | 17.6 | 17.0 |

| 50-250 | 9.6 | 19.5 | 22.2 | 12.8 | 10.6 | 29.7 | 34.8 |

| 250 and above | 71.7 | 59.1 | 51.2 | 73.6 | 77.2 | 45.7 | 36.1 |

| Not specified | 0.0 | 3.8 | 1.9 | 3.5 | 0.8 | 1.1 | 0.0 |

| Total | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

2.4. Size and efficiency of the public sector

This analysis needs to be complemented by other indicators relating to the size, operations and efficiency of public administrations, as well as their collaboration with the private sector. According to an analysis conducted by BBVA Research, the effect of the size of the government translates into a curve with the shape of an inverted U: the size of the public sector has a positive and significant impact on social well-being and GDP growth per capita when it is below 35% to 40% of GDP. Beyond this threshold, however, the impact reverts to being negative. The study also highlights that the quality of the public sector, productive expenditure and low levels of debt are more important for maximising social well-being than the size of the government per se. An efficient and well-governed public sector can increase the benefits of an optimal governmental size in terms of growth and well-being. The size of the public sector and its efficiency vary widely among the EU’s various Member States.

A clear example of the importance of the efficiency of public administrations is justice. There are studies with empirical evidence showing that judicial reform, especially reforms that improve the speed and quality of court proceedings, can increase companies’ productivity. This effect is due to greater confidence in the resolution of contractual disputes and in the protection of property rights, which in turn fosters a more favourable environment for investment and corporate growth. Other studies suggest that the quality of the judicial system, gauged by the rule of law and regulatory efficacy, has a significantly positive impact on attracting investment. An efficient judicial system reduces the risks perceived by investors and ensures that contracts are executed in a fair and timely fashion, enhancing an economy’s competitiveness. In general terms, the EU is viewed as a jurisdiction with a stable regulatory environment, but there are major differences between Member States as far as the efficiency of their judicial systems is concerned.

Conclusions

The data show a range of possible differentiating factors in the competitiveness of the EU compared with the US, some of them interrelated:

- A single market that operates less dynamically, especially in services

- Less access to venture capital (although private investment is greater)

- Less access to alternative sources of financing, with excessive dependence on bank financing

- Poorer bank share price performance (although their key solvency, liquidity and bad debt ratios, among others, continue to improve, and successfully withstood the financial turbulence precipitated in March 2023)

- Lower public investment (although the gap has been shrinking)

- Much lower spending on R&D

- The absence of major differences in the number of patents, albeit with reduced applicability to business activity

- Higher energy costs for companies, but with growing penetration by renewable energies

- Better circularity

- Relatively meagre digitalisation (non-physical capital is harnessed less)

- A lower employment rate (albeit with narrowing differences), higher unemployment and a larger percentage of the working population lacking secondary education

- Just over 25% of the population with digital skills above a basic level, and only 4.6% of the population aged 15 to 74 working as ICT specialists

- A larger, but declining, share of global exports, and a better current account balance

- A declining degree of economic complexity of the goods produced

- Lower total factor productivity

- More prolix and complex regulations

- A much smaller average company size

- Considerable variation between EU Member States in the size of the public sector

- And a stable regulatory environment, but with significant differences between Member States in the efficiency of their judicial systems.