This text first appeared in the report “Chinese Investment in Europe: A Country-Level Approach” by the European Think-tank Network on China (ETNC)

Theme

Reluctance to Chinese investments in Spain may grow if the its volume increases significantly and begins to penetrate more “strategic” or high-tech sectors.

Summary

As in many other European countries, Chinese investments in Spain have increased spectacularly over that past years. Nonetheless, there has not been a public or political debate around the topic, and even less a thorough reflection by the government, the media and the academic community at large about the implications of these investments. One reason for the lack of interest in this topic is that, until 2016, the stock of Chinese investments was rather low and there have been no major acquisitions in strategically sensitive sectors. However, this could change in the years to come, considering what is happening in neighboring countries and the intensification and diversification of Chinese investments in Spain in the past few years.

Overall, for the moment, the perception of the Spanish government, the public administration at large and the media regarding Chinese investments is broadly positive. This contrasts with the view of Spanish public opinion, which looks with more suspicion on the capital coming from China than from other sources of foreign direct investment (FDI) such as the US, France, Germany, and even Japan.

Analysis

A late and modest destination for Chinese investment

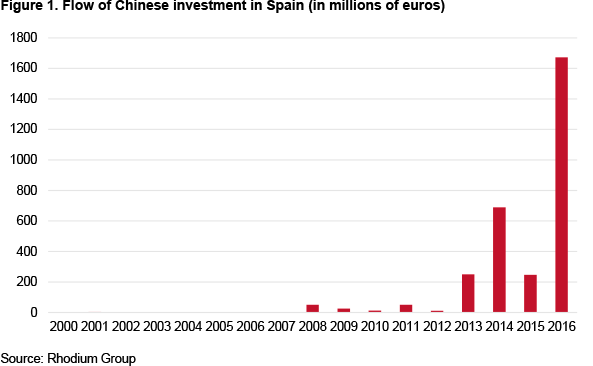

Up to 2008, Spain received hardly any Chinese investment. In the last eight years, however, the total volume of Chinese direct investment flows to Spain has mounted to EUR 4 billion, according to the Ministry of Economics of Spain, and EUR 3 billion if one takes the figures provided by the Rhodium Group.1 Two factors mainly explain this discrepancy: investment in real estate by individual investors and in the energy sector by China Three Gorges through Energias de Portugal (EDP) and by Gingko Tree Investment in Madrileña Red de Gas through an international consortium.2 Either way, this is quite a modest figure compared with the EUR 10 billion of assets that Chinese firms have acquired from Spanish companies in Latin America.3

The amount of Chinese investment in Spain is quite ordinary also when compared with Chinese investment in other European countries and with the foreign direct investment received by Spain from other countries. According to the Rhodium Group figures, Spain is the ninth most important target country for Chinese direct investments in Europe, and the statistics offered by the Spanish Ministry of Economics make China the tenth largest investor in Spain, with a 2.65 percent share of Spain´s stock of inward foreign direct investment (IFDI) as of 31 December 2015.

This means that, although Spain is the fourth largest economy in the Eurozone, and the seventh country in the EU by stock of IFDI, it is not one of the priority destinations for Chinese investors in Europe – so far.

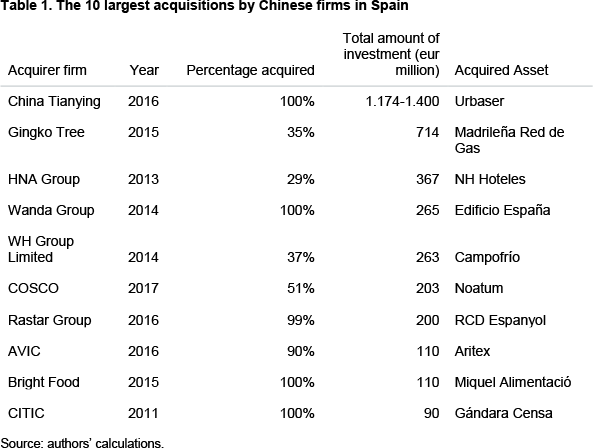

Looking at the investment trend, caution is advised of making too much of the massive spike in Chinese investment in Spain in 2016 (see figure below), since the purchase of Urbaser (a branch of the infrastructure giant ACS specialized in environmental services) by China Tianying for EUR 1.2 – 1.4 billion accounts for ¾ of total Chinese direct investment in Spain for that year. This single operation also distorts the industry breakdown for Chinese investment in Spain.

Unlike in other Southern European countries, Beijing did not purchase any strategic assets in Spain during the Eurozone debt crisis.4 Nevertheless, State Grid did attempt to buy the electric company Red Eléctrica de España, Fosun was after the public insurance firm CESCE, specialised in corporate risk, and the China Investment Corporation showed an interest in Repsol (energy), Canal de Isabel II (water), and the above-mentioned Red Eléctrica.

At the same time, one needs to note that, indirectly, China has already penetrated the strategically important energy market of Spain. By buying Energias de Portugal (EDP) in 2011, the Chinese state-owned company China Three Gorges became the main shareholder of EDP Spain and invested the sizable sum of EUR 600 million in EDP Spain from 2012 to 2016. Moreover, Gingko Tree Investment acquired for EUR 714 million a 35 percent share of Madrileña Red de Gas in 2015, which was sold to an international consortium formed by Gingko Tree, the Dutch pension fund PGGM, and the French electricity group EDF (see table below). In June 2017, however, EDP sold its gas distribution business in Spain to an international consortium for EUR 2.6 billion, which essentially means that China Three Gorges now only operates a Spanish electricity distribution business through a company called EDP HC Energia. Hence, the presence of Chinese actors in the Spanish energy market is still rather small.

Other sectors that have attracted significant amounts of Chinese money are the real estate and hospitality sector, with EUR 900 million – the most significant acquisitions being the EUR 367 million invested in the NH Hotel Group by the HNA Group (2013), the EUR 265 million investment by Wanda Group in the skyscraper Edificio España (2014), the EUR 50 million sale of Hotel Santiago in Tenerife to Chongqing Kangde Industrial (2015)and the EUR 48 million that the Jiangsu Group paid for Hotel Valparaiso in Palma de Mallorca (2014).

A large amount of Chinese money has also arrived in Spain through the Golden Visa program, which grants permanent residency to foreign investors who buy real estate assets for EUR 500,000 or more. Indeed, the official figures for this program show that one-third of the golden visas issued by the Spanish authorities have gone to 702 Chinese investors who have spent a total of EUR 489 million.

Apart from infrastructure and real estate and hospitality, other important sectors include agriculture products and food and beverages, which received around EUR 525 million according to the Rhodium Group. In the European context, agriculture in Spain is a comparatively important target for Chinese investors. Chinese companies are interested in the reputation and production techniques of Spanish food companies, since Chinese consumers are spending increasing amounts on food products due to their rising purchasing power and to food safety concerns. Among the biggest acquisitions in this field are the purchase of Miquel Alimentació by Bright Food; Hijos de Albo by Shanghai Kaichuang (for EUR 61 million); 75 percent of the winery Marqués de Atrio by Changyu Pioneer Wine (for EUR 35 million) and 20 percent of the giant Osborne by Fosun.

Another sector that attracts a considerable amount of Chinese investment is soccer. Three La Liga clubs have Chinese shareholders. Espanyol and Granada were purchased by Rastar Group and Desport, respectively, while Wanda Group is now in possession of 20 percent of the shares of Atlético Madrid, one of the biggest teams in Spain and Europe. In total, Chinese investment in Spanish football amounts to EUR 281 million so far.

Finally, although the technology sector has not been targeted by Chinese investors as much as in other countries, it is significant that the two biggest acquisitions in this sector happened in 2016: Aritex and Eptisa, two engineering firms, were bought by AVIC and JSTI for EUR 110 million and 16 million, respectively.

Is Chinese investment well received in Spain?

There is a clear difference between the perceptions and attitudes towards Chinese investments by the government and the media, and by the public opinion at large. Both the governments of the Spanish Socialists (PSOE), in power from 2004 until 2011, and the center-right Popular Party (PP), in power now, have tried to attract Chinese investments, especially in the aftermath of the global financial crisis in 2008. From the Spanish government’s point of view, when it comes to Chinese investments in Spain the attitude is: “the more investment, the better”.

With this purpose in mind, the Spanish government has developed a series of concrete actions. For example, during every visit of senior Spanish officials to China, apart from seeing their Chinese counterparts, there is also a meeting with potential Chinese investors interested in Spain. Consistent with this strategy is also the fact that, according to the Spanish trade promotion office, ICEX, between 2014 and 2016 China is the place where Spanish officials have given the most briefings on Spain’s Golden Visa program. This promotion of Spanish assets for Chinese investors also applies to the technology sector. ICEX has organized commercial missions of Spanish aerospace companies to contact with the Commercial Aircraft Corporation of China and that facilitated the acquisition of ARITEX by ARIC (see table above).

Although the government has not undertaken a thorough and exhaustive analysis of all Chinese investments in Spain, the general feeling in the administration is that with the 126 Chinese firms that are based in the country, the experience so far has been positive or even very positive. This is particularly true with firms that have generated an important amount of jobs5 or have helped Spanish firms to penetrate the Chinese market in the fields of agriculture, food and beverages, and distribution.

By contrast, there are a few, but well-known negative cases, such as the purchase of the Edificio España skyscraper by Wanda Group, which was not able to get its renovation project approved by the City Council in Madrid and eventually sold the building to a Spanish group. Another example is the dismissal from the board of the NH Hotel Group of two HNA Group executives, despite HNA being the largest shareholder, due to a conflict of interest once this Chinese company purchased Carlson Hotels. In addition, the opening of an ICBC office in Madrid has also been problematic due to its alleged involvement in illicit activities, such as money laundering. A Spanish court is investigating this issue involving not only ICBC Spain, but also ICBC Luxembourg, ICBC´s European unit. These cases have damaged the image of Spain as a destination of Chinese direct investment, and also the image of Chinese investment in Spain.

Other significant divestments by Chinese companies in Spain, such as the sales of Campofrío, Naturgas Energía, or a 20 percent stake in the Osborne Group by WH Group Limited, China Three Gorges, and Fosun respectively, do not necessarily imply a negative assessment by these Chinese firms of their experience in Spain, but should be understood in a wider framework of corporate strategy.

Despite these negative experiences, the Spanish media share the Spanish authorities’ generally positive assessment on Chinese investment. A content analysis of news published on this topic from 2013 to 2016 by eight important newspapers in Spain, shows that the attitudes towards Chinese investments are similar in the media as in government. Usually, the coverage is positive (this is the case for ABC, Cinco Días, El País and La Vanguardia), moderately positive (for El Mundo and Expansión) or neutral (which is the case for La Voz de Galicia and Público). In other words, none of the most-read newspapers with national coverage, nor the two most circulated economic newspapers in Spain, have a hostile attitude towards Chinese investments.

On the one side are two most cited arguments in favor of Chinese investments. First is the complimentarity between the availability of Chinese capital and the financial needs of Spanish firms, particularly during the Eurozone crisis. Second are the synergies that potentailly emerge when the Chinese partner facilitates access to the Chinese consumer market. On the other side, concerns expressed usually focus on the lack of knowledge that the Chinese investors have of the Spanish legal system and the lack of transparency in their firms.

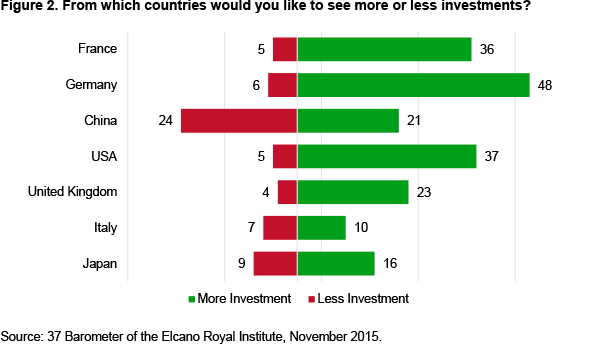

However, despite the strong consensus in favor of Chinese investments that exists among government and media actors, Spanish public opinion has a different view. A poll conducted by the Elcano Royal Institute6 in 2015 shows that most Spanish citizens perceive Chinese investment with hesitation, especially when compared with investment from other countries such as Germany, the United States and France. In order to capture the perceptions of the Spanish public, the poll asked the participants to respond to the following question:

Spain receives investments from different countries. Arguably, it is better for Spain to increase the investment that it receives from a number of countries and reduce that coming from others. In your view, from which countries should Spain receive more investment and from which less?

The results were the following:

As can be observed, Spaniards are generally in favor of inward foreign direct investment, especially if it comes from Germany, the United States and France. However, the attitude is different vis-à-vis China. One quarter of those interviewed think that China’s investments in Spain should be reduced. This is a striking figure given that the country that generates the second most negative sentiment, Japan, was only viewed as such by 9 percent of interviewees.

These numbers are more easily understood when one looks to another survey, also conducted by the Elcano Royal Institute,7 which shows that a large percentage of Spaniards (concretely 34 percent) believe that China is the biggest investor in Spain, while only 17 percent think it is Germany, 10 percent France and 8 percent the United States. In reality, China is only the tenth biggest investor in Spain.

What then explains this desire for proportionally less Chinese investment? This is not about people just focusing on recent IFDI flows, since China has never been one of the five main origins of Spain´s IFDI and is far behind the flows from many OECD countries. More research needs to be done on this topic, but two plausible explanations are that companies from non-OECD countries generate less trust in Spain than OECD companies; and the envy and rejection generated in some sectors of the Spanish society by the economic success of the Chinese community in the context of the deep economic crisis that the country has gone through from 2009 until 2014.

What is Spain’s position regarding Chinese investments in Europe?

At the moment, the European Commission is focused on two aspects when it comes to Chinese investments in Europe. One is the negotiation of a bilateral investment agreement, and the other is the implementation of an IFDI screening mechanism for strategic sectors on the grounds of security and public order. On these matters, the position of Spain is as follows. On the one hand, Spain is in favor of an investment agreement that would facilitate greater access of European service industries to the Chinese market. This emphasis on market access is no surprise given the weight of the services sector in the Spanish economy. Spanish banking and telecommunication firms, for example, are confronted with many restrictions to penetrate the Chinese market.

Regarding the IFDI screening mechanism, Spain is not as worried as the countries that signed the February 2017 petition to the European Commission (Germany, France and Italy) about the strategic implications of Chinese investments in Spanish companies. First, Spain already has a working screening mechanism for IFDI. Second, Chinese investment on Spanish technological firms and critical infrastructure is quite limited. Besides that, Spain is satisfied with the idea to allow the Commission to give a recommendation, but not make a binding decision. The final word should remain with the member state receiving the investment, since the Spanish authorities do not want this mechanism to behave as an undercover protectionist mechanism in the hands of the Commission.

Nonetheless, this does not mean that this laid-back attitude will continue in the future. Most probably, the worries will increase as Chinese investors buy more high-tech, infrastructure and energy firms. This has already happened in 2016 with the acquisitions of Aritex and Eptisa (see above) and also the purchase by COSCO of a 51 percent stake of Noatum, the biggest Spanish port terminal operator.

Conclusions

Chinese direct investment in Spain has arrived later and in lesser volumes compared to other European countries. However, it is very likely that it will increase in the near future, especially if we consider the trend in the past few years and the business opportunities that exist in Spain in sectors such as agriculture products, food and beverages, real estate, tourism, manufacturing, engineering, and logistics.

In contrast to Spanish public opinion, which is generally reluctant to see more Chinese investments, the Spanish elites, in government, business and the media, are welcoming Chinese capital and tend to highlight the positive aspects that it brings. However, reluctance may grow if the volume of Chinese investments increases significantly and begins to penetrate more “strategic” or high-tech sectors. So far, when it comes to large scale operations in strategic sectors, the Spanish government has not been supportive of Chinese companies becoming the sole owner of large Spanish firms.

Mario Esteban

Senior analyst, Elcano Royal Institute | @wizma9

Miguel Otero-Iglesias

Senior analyst, Elcano Royal Institute | @miotei

1 In this chapter, we will use both the data from the Ministry of the Economy of Spain and those from the Rhodium Group.

2 On the contrary, Rhodium groups reports much more Chinese investment in agriculture and food than the Spanish Ministry of Economy. The frequent reports of Chinese investment in this sector that finally do not materialize could explain this discrepancy.

3 Mario Esteban (ed.), China in Latin America: Repercussions for Spain, Madrid: Elcano Royal Institute, 2015, p. 55-59.

4 Although China has not bought strategic assets in Spain during the Eurozone crisis, as in other Southern European countries, it bought a sizable amount of public debt. See Miguel Otero-Iglesias, “The Euro for China: Too Big to Fail and Too Hard to Rescue”, ARI, Real Instituto Elcano, 13 October 2014; Miguel Otero-Iglesias, “How Much Spanish Debt Does China Hold?”, Real Instituto Elcano, 17 December 2014.

5 The Ministry of the Economy of Spain claims that total Chinese direct investment in Spain generates only 2,661 direct jobs (1,000 by Huawei), while Spanish direct investment in China generates 30,674.

6 37 Barometer of the Elcano Royal Institute. The representative survey by the Elcano Royal Institute consisted of 1,003 interviews conducted by phone across the country and was undertaken in November 2015.

7 34 Barometer of the Elcano Royal Institute. This survey was undertaken in November-December 2013.