Theme[1]

Can the Russian economy withstand Western sanctions?

Summary

Western sanctions could trigger a fall in Russia’s GDP of up to 15% and cause inflation to rise above 20%. This is going to be tough on the Russian people, but will it be enough to mobilise them against Putin? In all likelihood no –for the time being–. The rouble has recovered, the Russian financial system is clinging on and, in the wake of the 2014 sanctions, while the Russian economy became poorer it also became more resilient. If it really wants to weaken Putin, the EU is going to have to extend its sanctions to the energy sector, and even so it is likely that China and India will provide him with something of an escape route. But the pressure has to continue, because in the end only the Russian population can stop Putin. That said, this conflict may last much longer than expected and the EU must prepare for a long stand-off with the Russian nationalists, even if there is a ceasefire in Ukraine.

Analysis

Introduction

The economic sanctions imposed by the West –including the perennially neutral Switzerland, with some of the Asiatic allies such as Japan and Australia– on Russia following its invasion of Ukraine are unprecedented in modern times. Chad Bown, of the Peterson Institute in Washington, in an excellent timeline of the sanctions, divides them into five categories: (1) those imposed on the wealth of individuals such as Putin, the ‘oligarchs’ and close collaborators; (2) financial sanctions, which range from the expulsion of various Russian banks from the SWIFT interbank messaging system to the freezing of the Bank of Russia’s assets located in the West’s financial centres; (3) sanctions related to travel, such as the closure of European airspace to Russian airlines; (4) sanctions related to restrictions on exports to Russia, particularly dual-use technology (civilian and military); and (5) sanctions related to restricting or prohibiting imports, such as the US decision to ban Russian oil and gas.

If all these sanctions are applied strictly and for a long time, Russia will enter a state of quasi-isolation from the international economy and the macroeconomic effects will be severe. Analysts are estimating a fall in GDP for this year of 10%-15% (some think it could be even greater) and inflation of no less than 20% over the course of 2022, although it is currently difficult to make forecasts. The consequences over the long term are set to be highly damaging given that investment will fall and there will be (even greater) flight of human capital, while the international flows of fuel and other raw materials will be reconfigured. However, the question is whether the sanctions will inflict sufficient hardship on the Russian people that they will either take to the streets en masse to demand an end to the war or induce high-ranking members of the government and armed forces to organise a coup against Putin.

Can the Russian economy withstand the sanctions?

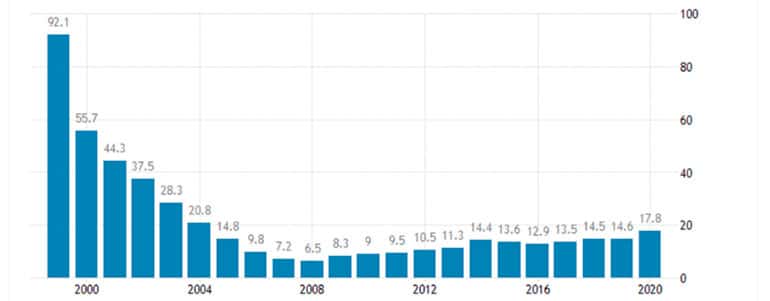

To try to answer this question it first helps to recall what befell Russia in 2014 when the West imposed sanctions for the invasion of Crimea. The sanctions then were understandably much less harsh, but they represent the most recent historical precedent and can serve as a benchmark, particularly because the reaction of the Bank of Russia was highly similar. In 2014 it raised interest rates from 5.5% to 17% in order to shore up the rouble and on this occasion it has hiked rates from 8.5% to 20%.

The fall in the value of the Russian currency has also been similar. Between February 2014 and February 2015 it went from a rate of 35 roubles to the dollar to 69, a fall of almost 50% of its value in the American currency, while on this occasion the Russian currency has gone from being worth 78 roubles per dollar on 23 February, one day prior to the start of the invasion, to 150 roubles on 7 March, the moment of its greatest weakness, a fall of almost half. Clearly the difference is that in 2014 the fall took place over the course of a year, whereas on this occasion it took less than 15 days. But the result for now is similar. The value of the rouble tumbled by almost 100%, reaching its floor, and from that point onwards has been recovering. At the time of writing on 24 March 2022 the exchange rate stands at 97 roubles to the dollar, which represents a recovery of 35% from its lowest point.

What accounts for this recovery? Various factors. The rise in interest rates clearly had an effect. Russian savers have seen their deposits attracting greater interest and have not on the whole tried to convert their roubles into dollars –so far–. Moreover, the Bank of Russia has capped exchanges of roubles into dollars and euros at a level of US$10,000. And it is extremely difficult to remove this money from the country. Russia has therefore applied a corralito-style asset freeze. Unlike countries such as Argentina and Venezuela however, the Bank of Russia still retains considerable credibility in the eyes of its citizens, and the capital flight has therefore been so far limited.

Moreover, the Russian authorities, just as in 2014, have forced the Russian energy companies to sell a considerable proportion (80%) of the dollars that they are paid for their exports; for the time being this means that the value of the rouble has been preserved and that it is the central bank itself that oversees these reserves, thereby offsetting the freezing of its foreign assets. This dynamic will only be strengthened now that Putin has announced that the sale of fossil fuels to Europe will take place in roubles: roubles that are of course issued by the Bank of Russia, meaning that virtually 100% of the reserves will end up under its control (without the intercession of the energy companies and their potentially corrupt and untrustworthy practices), thereby enabling it to exercise greater control over capital flight. It should also be borne in mind that the context is more propitious. In 2015 the price of a barrel of oil tumbled from US$100 to US$40, whereas currently it is worth well over US$100 and likely to rise. It is possible that the demand for more roubles and their greater circulation within the Russian economy will generate even more inflation, which will presumably force the Bank of Russia to counteract this effect. It remains to be seen whether it can do so effectively, as the Chinese Central Bank has done for years. It is something that requires extremely rigid control of the banking system.

Russia’s relative success in overcoming the 2014 sanctions can in large measure be attributed to the efficient management of Elvira Nabiullina, formerly Minister of Economic Development and subsequently Putin’s economic adviser, as the head of the Bank of Russia since June 2013 (and her possible departure stemming from her disagreement with the Ukraine invasion would be a severe blow to Putin). Although inflation in that crisis reached 15%, thanks to her rigid discipline, it fell back in subsequent years and remained close to the target of 4%. At the same time, Russian fiscal policy also remained on a tight leash. Unlike other oil-producing states, which spend in accordance with the receipts generated by their exports of crude oil, Russia has pegged its annual budgets to a conservative price of US$40 per barrel and the excess income, fruit of the enormous current account surplus, has been used to bulk up its reserves, which have reached US$630 billion (more than a third of its GDP), and to keep its level of government debt close to 20% of GDP, one of the lowest of the major economies.

However, this strategy of creating a ‘Russian fortress’ based on monetary and fiscal discipline meant that Russia emerged from the 2014 and 2015 sanctions and counter-sanctions with a more impoverished populace. Savings were imposed to balance the books and to prepare for a crisis such as the current one, at the expense of spending on education, healthcare and social policies, and an initial phase of de-internationalisation that is now gathering pace. This has triggered an approximate 10% fall in the purchasing power of salaries, but it has also meant a realignment of the economy towards self-sufficiency (the development of the domestic dairy industry being a perfect case in point) and increased trade with markets outside Europe, including Latin America, to procure foodstuffs at competitive prices. This has been tough on ordinary Russian citizens, but as Chris Miller points out, throughout these years, with the exception of protests in large cities like Moscow and St Petersburg in 2014 and 2015, the Russian public has not demonstrated en masse against the Kremlin; this has strengthened Putin, who has increased his popularity since the annexation of Crimea and is possibly hoping to do the same now in the lead up to the 2024 election (where he will presumably run again).

Could this change now with the current sanctions, which are of a much greater order of magnitude? Everything for now suggests not. The research that has been conducted into economic sanctions reveals that their impact tends to diminish if the state on the receiving end is strong, relatively stable in economic and political terms, rejects the international order and is autocratic. North Korea and especially Iran are the paradigmatic cases here, and the fact is that Russia displays many of the same characteristics. Sanctions, moreover, tend to have the perverse consequence of swelling patriotism in opposition to the ‘external enemy’ and are used by the regime as a propaganda weapon to accentuate national antipathy towards the foreign threat. Many have said that this is Putin’s war, but in fact some opinion polls show that the majority of Russians support the invasion and the number seems to have risen since the sanctions were imposed.

This might lead us to conclude that the sanctions are not tough enough. As Jean Pisani-Ferry points out, Russia is a ‘big gas station’ for the world, but it relies on foreign technology, finance, capital and consumer goods, and the reality is that, under the current sanctions regime, Europe continues buying energy from Russia (which is why it has not excluded all Russian banks from SWIFT, only seven), only some technologies can no longer be exported and it seems that very few Western companies have left Russia for good, even if they have paused their trading activities for the time being. This means that Russia is receiving close to €1 billion a day (although estimates vary and are difficult to verify) for its fuel exports and many Western companies are still paying rent on their premises and their workers’ salaries. For all these reasons, daily life in cities such as Moscow has not been unduly affected, according to their residents. It is true that there has been a certain shortage of sugar, pasta and flour, but this could owe more to compulsive stockpiling by some citizens than to a general scarcity.

Some analysts also thought that blocking VISA and Mastercard would cause chaos, but here too the Russian authorities had prepared for just such a contingency. After the invasion of Crimea in 2014, the Russian government introduced a domestic payments system known as MIR, which at first was an unnecessary expense for the majority of businesses, because nobody used it, but now it is proving a highly useful way of sidestepping the Western blockade. Many VISA and Mastercard cards already work with this system and if they do not, it seems to be very easy to use the MIR system to request a new card from the bank and receive it at home. Paradoxically, the people that cannot access their accounts are Russians who are currently abroad, because the suspension of VISA, Mastercard and American Express has been effective in the West. To alleviate this, it appears that various Russian banks are negotiating with Chinese counterparts to enable the UnionPay international payments system to be used (although this is not confirmed).

Here it should be pointed out that economic sanctions have less effect if the target economy is relatively closed, as in Russia’s case. Exports and imports of goods and services account for 47% of GDP, which is much more than the US (24%) and Japan (25%), but almost 10 percentage points less than the world average (56%) and considerably less than other oil-producing states such as Algeria (60%), Saudi Arabia (62%) and Norway (69%). Moreover, the ratio of imports to GDP stands at just 20%, lower even than Iran’s (22%). Since 2019 the Kremlin has also been testing the feasibility of cutting Russia off from the global Internet and operating a domestic version called Runet.

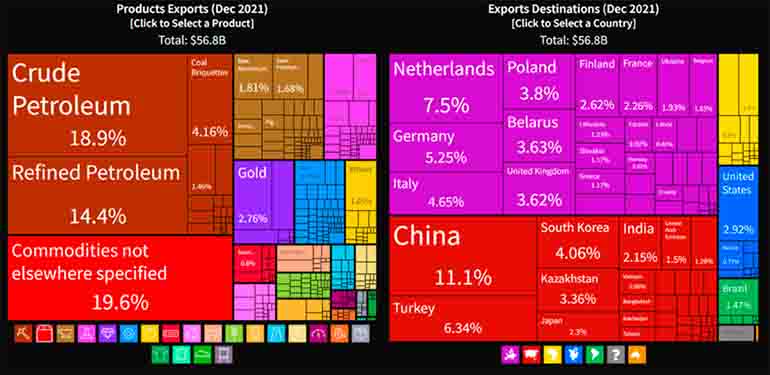

It is true that the complexity of the Russian economy is low, according to the index compiled by the OEC (Observatory of Economic Complexity), and this renders it vulnerable. It ranks in 45th position, a long way below Spain (in 36th place), but it is also true that it is on a par with India (44th) and above Portugal (48th) and Brazil (49th). Russia is also an exporter with systemic impact on a series of key raw materials for particular sectors. It supplies a major proportion of wheat to many African countries and Turkey, fertilisers to Brazil, China, the US and India and much of the industrial palladium, nickel and sapphires needed for semiconductors, which in turn are essential for making mobile phones, cars and aircraft worldwide. In other words, if exports of these materials are halted either because of the sanctions or a voluntary embargo, the international economy would fall into recession, with serious problems in developing countries resulting from dearer food prices.

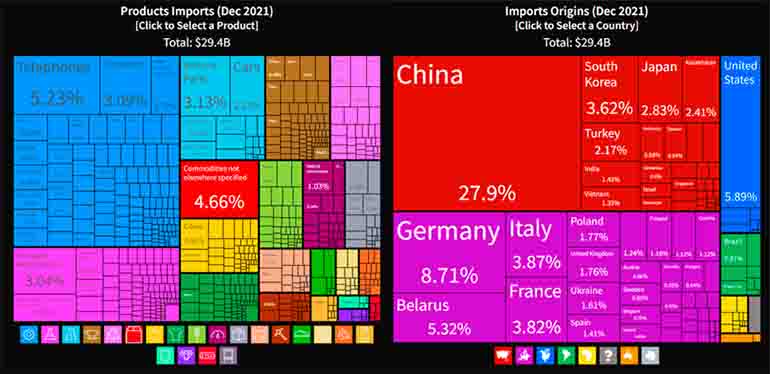

China is clearly a key foreign actor in the way the Russian economy evolves. It is the country that imports most from Russia, and the one that exports most to Russia. Not surprisingly, crude petroleum and timber feature prominently among Russian exports, but also nuclear reactors and their parts, while notable among Chinese exports are machinery and electronic devices, including computers and mobile phones, with a 40% market share taken by major Chinese brands such as Huawei, Xiaomi and Lenovo. China is also starting to export a large number of cars to Russia (in 2021 Russia was its third-largest market) and if Western manufacturers do withdraw it could represent the ‘chance of the century’ for companies such as Geely and Chery, in the view of many Chinese car industry analysts.

China has not yet made any open bid to save the Russian economy (although it is true that in the months leading up to the invasion its trade with Russia had grown steeply). Chinese banks and many of its companies fear doing business with their Russian counterparts and that the West, particularly the US, will impose secondary sanctions on them. Beijing is aware of the need to be highly cautious in its approach, conscious that it is under Western scrutiny and that if it openly takes Putin’s side it could lose (part of) its access to Western markets, which are of course more important to its economy than Russia. Nevertheless, the ability to exercise even greater domination of the Russian market, an indispensable strategic partner for China, as Bobo Lo of the French Institute of International Relations (IFRI) rightly argues, could be a huge temptation. Russia is, moreover, a strategic source of energy from the national security standpoint for China, and it is highly likely that it will continue offering the capital and technology needed for its extraction. Its participation in liquefied natural gas projects in the Arctic, ignoring the Western sanctions imposed after the annexation of Crimea, serve as a precedent.

There is increasing consensus among Western economists that in order to halt Putin’s war machine sanctions will need to be extended to the energy sector and the EU will have to stop buying Russian oil and gas. Adam Tooze offers a good summary of this debate from the standpoint of Germany, the key actor in the situation. Whereas some German economists calculate that renouncing Russian fossil fuels would entail a 2% fall in GDP, something that would be clearly manageable, the Ministry for Economic Affairs and Climate Action, led by Robert Habeck, estimates that the impact would be closer to 5%. In other words it would be even greater than the shock caused by the pandemic. The International Energy Agency compiles an excellent database on the dependency of EU countries on energy originating from Russia.

Olaf Scholz, the German Chancellor, has frequently emphasised that the social tensions this would trigger would be highly difficult to manage and with the support of Mark Rutte of the Netherlands he has for now ruled out such an option. Pressure from the US and certain Eastern European countries persists however, and many economists have put forwards various ways of using energy to ‘punish’ Putin without having to suddenly renounce Russian fossil fuels by introducing, for example, taxes, as suggested by Ricardo Hausmann, gradual taxation, as suggested by Charney, Gollier and Philippon and also gradually sanctioning different types of fossil fuel with payments being made into escrow accounts, an idea put forward by Rachel and Schularick. Two Russian economists, Gurijew and Itskhoki, have also written that the best way of stopping the war in Ukraine is to stop buying Russian energy, arguing that Putin has few alternative buyers to the EU due to a lack of infrastructure.

While this argument is valid for gas (70% of exports travel through gas pipelines, and there is no gas pipeline with China), it is less so for oil (70% of which travels by sea and there is an oil pipeline to China) or for liquefied natural gas, which is also transported by ship. India, for example, has already hastened to take advantage of the situation and has bought Russian oil at cheaper prices, despite the condemnation of the US and the UK. It is highly likely that both India and China, which abstained in the UN General Assembly vote deploring the Russian invasion of Ukraine, will continue doing business with Russia. And the same applies to countries such as the United Arab Emirates and Saudi Arabia. The fact is that the vast majority of the world’s countries have not imposed sanctions on Russia.

To get round Western sanctions it is possible that many countries will use their own currencies or even use bartering systems. The US Federal Reserve is capable of monitoring any transaction in the world conducted in US dollars (it should be borne in mind that the bulk of dollars in circulation are digital, something that facilitates tracking), but if the transactions are denominated in roubles, yuan or rupees, this weapon is lost. Perhaps Putin’s insistence on being paid in roubles for the fuel sold to the West is to preserve the value of the Russian currency and thereby make it more attractive to the Indians and Chinese. Many of these countries have been saying for years that they want to de-dollarise their economies and it is significant that Saudi Arabia is mulling the possibility of not only being paid but also setting the price of the oil that it sells to China in yuan.

The Chinese-Russian border stretches for thousands of miles, making it extremely difficult for the West to ascertain whether an increase in trade between the two neighbours is really taking place. One of the largest categories included in Russian export statistics is precisely commodities not specified elsewhere (see Figure 3, although it normally refers to gas). It should also be noted that both Mongolia and Kazakhstan could serve as a bridge between the two powers, and indeed both abstained in the United Nations vote.

As a last resort, if pressure from the West increases, China could even treat Russia in the same way it has already been treating North Korea. Officially it could declare that it respects and even endorses the West’s sanctions, but by a back-door route it could try to supply the help needed to ensure the survival of the Putin regime. It would not be the first time that a country sanctioned by the West continued selling its oil by what are known as ‘leakages’. This involves oil tankers transferring their cargoes on the high seas with their transponders turned off so that the ultimate source of the oil remains unknown.

Conclusions: Despite all these possible escape routes, the US and the EU must keep up the pressure on Putin. If the invasion continues or intensifies, the EU will be left with no other option than to impose sanctions on Russian fuel too. This will cause prices to climb even further in Europe and bring social tensions (something that is already occurring), but also exert enormous pressure on the Russian people and make it more difficult for Russia to finance a war that is liable to drag on. This is a game of who can last the longest and it is important to prepare for the worst. Twenty-five per cent of the Russian population lives in the countryside (10 percentage points higher than in Spain, for example) in what is virtually a subsistence economy. They will be hit indirectly by the sanctions and their capacity for hardship (and resistance) tends to be greater. There are millions more Russians on modest salaries living in cities who similarly tend not to buy foreign products on a daily basis and will therefore be affected less by the inflation arising on this account (although of course they will suffer from generalised inflation). The most affected will be the urban middle classes who consume imported products and travel abroad. But it remains to be seen whether they will mobilise against the war. For now the prevailing view among many Russians is that life is not nearly as bad as in the 1990s, when the economy collapsed and life expectancy fell by six years.

Erica Chenoweth and Maria Stephan have studied hundreds of popular uprisings and have devised the 3.5% rule. What does the rule state? That if 3.5% of a population mobilises against its government in a peaceful manner, the government falls. In the case of Russia, with a population of 145 million, this translates into five million people. For the time being we are a long way from such numbers. Many opponents of the government are fearful of repression and, in conversations conducted with Muscovites for this paper, some residents said that many provincial and rural Russians rejoiced in the fact that their Westernised compatriots living in large cities would have to endure hardship. Organising a popular movement of such a size will not be easy, especially because many anti-Putin Russians will be leaving the country in the coming weeks and months. Another exodus.

For all these reasons the war may drag on, even if there is a ceasefire in Ukraine, and European leaders need to be aware of this fact. Consequently, there will be a need to devote more resources to defence and intelligence, but also to protect the most vulnerable in our societies. To achieve this, the creation of an EU fund for the war financed by joint debt seems inevitable. Ultimately, if this does become a test of who can hold out longest, the West, and specifically the EU, has more resources, more technology and more human capital to resist. The important thing is to show the same determination as the Russian nationalists, and to support as much as possible those who disagree with them and are prepared to fight for a free Russia.

[1] The author is grateful to Federico Steinberg, Enrique Feás and José Juan Ruiz for their comments and suggestions on an earlier version of this ARI.

Image: Lock on the Russian flag. Photo: FLY:D